Cling Films Market Synopsis:

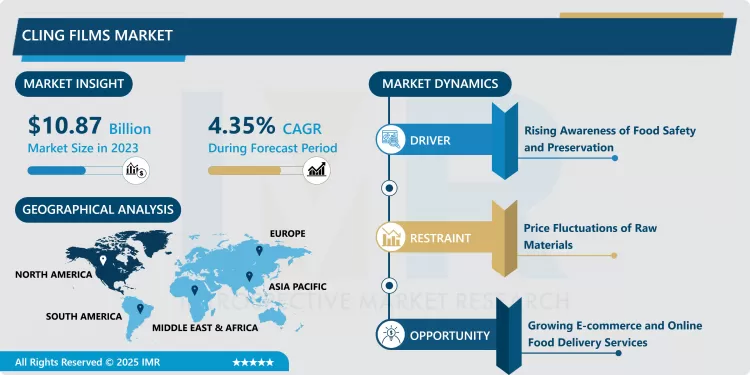

Cling Films Market Size Was Valued at USD 10.87 Billion in 2023, and is Projected to Reach USD 15.94 Billion by 2032, Growing at a CAGR of 4.35% From 2024-2032.

The cling film industry is the segment that is associated with the manufacturing and marketing of cling films that are thin, clear plastic materials used in packaging food and other goods. Cling films are also referred to as plastic wrap, food wrap, saran wrap, and stretch film.

The cling films market is growing on a global level at an impressive pace due to the rising demand of these films across such sectors as food and beverages, health care and consumer goods. The most famous varieties of stretch films include cling films which are valued for their practical usability, and outstanding protective characteristics. Cling films as such are widely used in the food industry to cover the perishable foods and to ensure that they remain fresh, hygienically packed and have a longer shelf life. Increased consumer consciousness towards the quality of foods being consumed and need to minimize food waste have also boosted growth of the market. Other factors that have boosted the market are the growing size of the population living in urban areas, changes in diet and a constantly developing e-commerce market that requires more protective packages. Cling films are gradually used by supermarkets, grocery stores, and other household users as an important packaging material.

But environmental issues regarding plastic material and the increasing trend of sustainable products are the driving forces of the cling films market. The regulatory bodies and the government of different countries around the world are making tough rules to minimize the use of plastics, and to produce the recyclable plastics, manufacturers are trying to explore new ways to create the biodegradable plastics. This has therefore shifted researchers to work on developing cling films that will be sourced from more natural sources such as plant derived materials and bio-polymers. Sustainable technologies are also being developed in recycling as manufacturers aim to catch up with the new trends in consumer consumption of sustainable products. Nevertheless, demand for cling films remains steady mainly because many foods across the globe are packaged, especially in North America and Europe. Currently, Asia-Pacific region is experiencing rapid market growth as a result of urbanization, population growth and a rising disposable income, thus remain an attractive market for cling filmmakers in the future.

Cling Films Market Trend Analysis:

Growing Preference for Eco-Friendly and Biodegradable Cling Films

- Use of environmentally friendly and biodegradable cling films is on the rise because of the negative impacts attributed to the use of plastic products. Old-fashioned shrink wraps, mainly constitute of materials such as PVC or LDPE, significantly contribute to the count of plastics which can degrade at a very slow pace, which in turn creates a massive amount of littering up the landfills and oceans. This has created a push from both consumer and the regulatory authority for environmentally friendly packaging. As a result, manufacturers are looking into other materials like the biopolymers which are got from sources like cornstarch or sugarcane, which are easier to degrade in composting environments. These are biodegradable cling films which give the necessary protection for packing and at the same time, avoids the harming of our environment; due to this, these films will be very suitable for those consumers and business people who are friendly to the environment.

- In addition, the global governments and organizations are coming up with even more stringent restrictions on single-use plastics, which puts pressure on industries to prop up their efficiencies in eliminating non-recyclable elements. This regulatory force combined with growing consumer preference for a sustainable product is forcing manufactures to create cling films with reduced emissions. Some companies are looking for reusable models or Cretan films that consist of recyclable as well as biodegradable products, solutions that are based on circular economy. There is an increasing demand of these films by different industries such as food and beverage, retail and healthcare as these try to incorporate ‘’green’’ elements into their every day practices. The trend is impacting on the packaging industry while at the same time improving brand image of companies that have embraced the change as a long-term market strategy.

Rising Demand for Food Safety and Sustainable Packaging in the Cling Films Market

- The first major opportunity in the cling films market can be derived from the increasing interest of the public on food hygiene and safety as the market becomes global and as the number of conscious consumers increases. This change in consumers’ behaviour needs packaging techniques that can act as a barrier against adverse factors that include, bacteria, air, and moisture, which would affect the food products. Uses of cling films include food preservation, increase shelf-life, and reduction in the incidence of food borne diseases. These factors have cultivated greater concern for health and safety that has in turn encouraged the use of cling films in homes, restaurants and the food services all over the world. These changes create great opportunities for manufacturers to take advantage and increase the barrier properties of their products standing for the concerns of consumers that their food will not get spoiled or become unhygienically contaminated.

- Besides the pressure from the increasing concern of food hygiene standards, the trend of using sustainable and bio-degradable materials, including plastic cling films, is also in high demand. There is an indication that governments across the globe are tightening their environmental standards especially in Europe and North America where there is a rising war against the use of plastics. This move is making manufacturers look for new ways of providing suitable products such as biodegradable and compostable cling films containing plant products. These are some of the sustainable packaging options which if some organization implements it is not only is in a position to meet the standards of the environment but it also gets tremendously matched with the market which is now moving towards those products which are more environmental friendly. It is evident that sustainability is a critical buying point for consumers and benefits businesses that embrace eco-friendly packaging leading to better market share prospects, enhance the growth prospects of manufacturers headquartered in areas where sustainability is valued.

Cling Films Market Segment Analysis:

Cling Films Market is Segmented on the basis of Material Type, Thickness, End-use, and Region

By Material Type, PE (LDPE) segment is expected to dominate the market during the forecast period

- The largest material type segment is the Polyethylene (PE) segment and is expected to play the most important role in the market since this type of packaging material has various applications in industries. This paper demonstrated that the flexible, durable, and low-cost aspects offered by PE makes it a favourite among both manufacturers and users. Another reason for PE domination is flexibility in its application that is used for packaging of all types of food products as well as various non-food items. Among these, Low-Density Polyethylene (LDPE) is one of the most prominent types, which combines an impressive set of properties that may include moisture protection, transparency, and ease of sealing, making LDPE suitable for packing fridge- and freezer-born goods, as well as easily-tossable mass consumption items. LDPE retains the keen factor on the market due to the capability to create a thin film, which is hugely significant in the food industry for the cover to be both supple and robust to sustain food freshness as well as serve its purpose of prolonging food preservation.

- Additionally, by the demands of Green Chemistry, LDPE has a greater market share because it is easier to recycle than many other types of plastics. Its capability for forming a barrier decreases the needfor other materials that can result in stuffy sustainability while decreasing costs for manufacturers. The low density of the material also means that there are lower levels of transportation costs and thus lower levels of carbon emissions. This consolidates LDPE’s market leadership in proportions where cost per unit of packaging performance is paramount. Apart from food packaging, LDPE is also used in consumer goods packaging for example in the form of films and bags and due to its widespread use the demand for it is still increasing in all facets of industries.

By Thickness, 9 to 12 Microns segment expected to held the largest share

- The greatest share of 9 to 12 microns thickness segment is due to optimal characteristics such as strength, flexibility, and adaptability of its use, which causes demand in a wide range of packaging industries. Such a thickness is enough to ensure adequate protection of products, at the same time, the films are pliant enough to be manipulated easily and sealed. This is specially so in the food industry whereby the packaging required has to preserve the freshness of products such as meat, and seafood, baked good and dairy products, it also needs to withstand handling and transportation. In addition to providing excellent barrier properties for gas and moisture, and preventing contamination from external sources, the films within this thickness range also have the added advantage of the increase shelf life of perishable food products. The films made are also lightweight, so it makes the expenses on transporting them to their intended destinations cheaper, which makes the films economical for manufactures and retailers.

- Besides food industry, thickness range of 9 to 12 microns has various uses in medical, personal use and industrial field. For example, packaging for medical devices and pharmaceuticals in healthcare requires strong but elastic materials to provide the product reliability and manufacturability. The strength offered by films in this range also usefully positions them for consumer goods packaging, most notably in cases such as ‘wrap’ films and bags where both protection of contents and convenience of usage are key. Indeed, thickness within this range is useful in industrial processes because these films have the adequate stiffness to shield components during transportation or storage, without the added disadvantage of excess mass. The segment spanning a range of 9 to 12 microns thickness is therefore a powerful player that spans several sectors.

Cling Films Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America specifically, the current market for cling films has been recording impressive growth due to a growing concern for food preservation among consumers. Since people are starting to become more aware about the need to preserve the quality of food, these films are very useful specifically in covering and preserving perishable foods and products. Consumer attitudes towards food also change with emerging trends in convenient foods mainly due to increased working rates reducing time required in food preparation hence need for foods that can be packaged and stored easily. The convenience food sector that is made from ready to eat meals, snack items, frozen foods etc needs good packs that will increase the shelf life of the product. Therefore, cling films have emerged as vital products for the manufacturers and retailers who want to satisfy the requirements of the contemporary customers who want to get food products that are easy to prepare and can be stored for a long period.

- Furthermore, the rise on the buying or ordering groceries online has affected the demand on cling films in North American countries as well. Since more customers prefer buying groceries online, there has been the need for better packaging that safeguards the products during the shipping process. Pouches also fit well here though cling films offer a far better protection against moisture, air and contaminants so foods delivered retain their quality. To me, consumer demand and environmental or ecological issues remain two forces that have compelled major manufacturers to purpose innovation in their product development. This was an umbrella for proper organizational biodegradable & Recyclable cling films to meet the environmentally conscious customers who embraced proper packaging materials. These companies are; Developing and implementing the use of environmentally friendly materials and manufacturing techniques to gain market share while dealing with increased concern in the region about the effects of plastics on the environment.

Active Key Players in the Cling Films Market:

- Berry Global Group, Inc.;

- Intertape Polymer Group (IPG);

- Gruppo Fabbri Vignola S.p.A;

- Kalan SAS;

- Fine Vantage Limited;

- Rotofresh - Rotochef s.r.l.;

- Manuli Stretch S.p.A.;

- Klöckner Pentaplast;

- Adex S.r.l.;

- MOLCO GmbH;

- CeDo Ltd; Prowrap Group (Wrapex Limited);

- 3M Company; Benkai Co., Ltd.;

- Multi Wrap (PTY) LTD;

- Anchor Packaging;

- Anhui Jumei Biological Technology Co., Ltd;

- Pragya Flexifilm Industries;

- Reynolds Consumer Products Inc.

- Other Active Players

|

Cling Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.87 Billion |

|

Forecast Period 2024-32 CAGR: |

4.35% |

Market Size in 2032: |

USD 15.94 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Thickness

|

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cling Films Market by By Material Type (2018-2032)

4.1 Cling Films Market Snapshot and Growth Engine

4.2 Market Overview

4.3 PE

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LDPE

4.5 LLDPE

4.6 HDPE

4.7 BOPP

4.8 PVC

4.9 PVDC

4.10 Others

Chapter 5: Cling Films Market by By Thickness (2018-2032)

5.1 Cling Films Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Up to 9 Microns

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 9 to 12 Microns

5.5 Above 12 Microns

Chapter 6: Cling Films Market by By End-use (2018-2032)

6.1 Cling Films Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Food

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Meat

6.5 Seafood

6.6 Baked Foods

6.7 Dairy Products

6.8 Fruits & Vegetables

6.9 Ready to Eat Meals

6.10 Others

6.11 Healthcare

6.12 Consumer Goods

6.13 Industrial

6.14 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cling Films Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BERRY GLOBAL GROUP INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTERTAPE POLYMER GROUP (IPG)

7.4 GRUPPO FABBRI VIGNOLA S.P.A

7.5 KALAN SAS

7.6 FINE VANTAGE LIMITED

7.7 ROTOFRESH - ROTOCHEF S.R.L.

7.8 MANULI STRETCH S.P.A.

7.9 KLÖCKNER PENTAPLAST

7.10 ADEX S.R.L.

7.11 MOLCO GMBH

7.12 CEDO LTD

7.13 PROWRAP GROUP (WRAPEX LIMITED)

7.14 3M COMPANY

7.15 BENKAI CO. LTD.

7.16 MULTI WRAP (PTY) LTD

7.17 ANCHOR PACKAGING

7.18 ANHUI JUMEI BIOLOGICAL TECHNOLOGY CO. LTD

7.19 PRAGYA FLEXIFILM INDUSTRIES

7.20 REYNOLDS CONSUMER PRODUCTS INC

7.21 OTHER ACTIVE PLAYERS

Chapter 8: Global Cling Films Market By Region

8.1 Overview

8.2. North America Cling Films Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Material Type

8.2.4.1 PE

8.2.4.2 LDPE

8.2.4.3 LLDPE

8.2.4.4 HDPE

8.2.4.5 BOPP

8.2.4.6 PVC

8.2.4.7 PVDC

8.2.4.8 Others

8.2.5 Historic and Forecasted Market Size By By Thickness

8.2.5.1 Up to 9 Microns

8.2.5.2 9 to 12 Microns

8.2.5.3 Above 12 Microns

8.2.6 Historic and Forecasted Market Size By By End-use

8.2.6.1 Food

8.2.6.2 Meat

8.2.6.3 Seafood

8.2.6.4 Baked Foods

8.2.6.5 Dairy Products

8.2.6.6 Fruits & Vegetables

8.2.6.7 Ready to Eat Meals

8.2.6.8 Others

8.2.6.9 Healthcare

8.2.6.10 Consumer Goods

8.2.6.11 Industrial

8.2.6.12 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cling Films Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Material Type

8.3.4.1 PE

8.3.4.2 LDPE

8.3.4.3 LLDPE

8.3.4.4 HDPE

8.3.4.5 BOPP

8.3.4.6 PVC

8.3.4.7 PVDC

8.3.4.8 Others

8.3.5 Historic and Forecasted Market Size By By Thickness

8.3.5.1 Up to 9 Microns

8.3.5.2 9 to 12 Microns

8.3.5.3 Above 12 Microns

8.3.6 Historic and Forecasted Market Size By By End-use

8.3.6.1 Food

8.3.6.2 Meat

8.3.6.3 Seafood

8.3.6.4 Baked Foods

8.3.6.5 Dairy Products

8.3.6.6 Fruits & Vegetables

8.3.6.7 Ready to Eat Meals

8.3.6.8 Others

8.3.6.9 Healthcare

8.3.6.10 Consumer Goods

8.3.6.11 Industrial

8.3.6.12 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cling Films Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Material Type

8.4.4.1 PE

8.4.4.2 LDPE

8.4.4.3 LLDPE

8.4.4.4 HDPE

8.4.4.5 BOPP

8.4.4.6 PVC

8.4.4.7 PVDC

8.4.4.8 Others

8.4.5 Historic and Forecasted Market Size By By Thickness

8.4.5.1 Up to 9 Microns

8.4.5.2 9 to 12 Microns

8.4.5.3 Above 12 Microns

8.4.6 Historic and Forecasted Market Size By By End-use

8.4.6.1 Food

8.4.6.2 Meat

8.4.6.3 Seafood

8.4.6.4 Baked Foods

8.4.6.5 Dairy Products

8.4.6.6 Fruits & Vegetables

8.4.6.7 Ready to Eat Meals

8.4.6.8 Others

8.4.6.9 Healthcare

8.4.6.10 Consumer Goods

8.4.6.11 Industrial

8.4.6.12 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cling Films Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Material Type

8.5.4.1 PE

8.5.4.2 LDPE

8.5.4.3 LLDPE

8.5.4.4 HDPE

8.5.4.5 BOPP

8.5.4.6 PVC

8.5.4.7 PVDC

8.5.4.8 Others

8.5.5 Historic and Forecasted Market Size By By Thickness

8.5.5.1 Up to 9 Microns

8.5.5.2 9 to 12 Microns

8.5.5.3 Above 12 Microns

8.5.6 Historic and Forecasted Market Size By By End-use

8.5.6.1 Food

8.5.6.2 Meat

8.5.6.3 Seafood

8.5.6.4 Baked Foods

8.5.6.5 Dairy Products

8.5.6.6 Fruits & Vegetables

8.5.6.7 Ready to Eat Meals

8.5.6.8 Others

8.5.6.9 Healthcare

8.5.6.10 Consumer Goods

8.5.6.11 Industrial

8.5.6.12 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cling Films Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Material Type

8.6.4.1 PE

8.6.4.2 LDPE

8.6.4.3 LLDPE

8.6.4.4 HDPE

8.6.4.5 BOPP

8.6.4.6 PVC

8.6.4.7 PVDC

8.6.4.8 Others

8.6.5 Historic and Forecasted Market Size By By Thickness

8.6.5.1 Up to 9 Microns

8.6.5.2 9 to 12 Microns

8.6.5.3 Above 12 Microns

8.6.6 Historic and Forecasted Market Size By By End-use

8.6.6.1 Food

8.6.6.2 Meat

8.6.6.3 Seafood

8.6.6.4 Baked Foods

8.6.6.5 Dairy Products

8.6.6.6 Fruits & Vegetables

8.6.6.7 Ready to Eat Meals

8.6.6.8 Others

8.6.6.9 Healthcare

8.6.6.10 Consumer Goods

8.6.6.11 Industrial

8.6.6.12 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cling Films Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Material Type

8.7.4.1 PE

8.7.4.2 LDPE

8.7.4.3 LLDPE

8.7.4.4 HDPE

8.7.4.5 BOPP

8.7.4.6 PVC

8.7.4.7 PVDC

8.7.4.8 Others

8.7.5 Historic and Forecasted Market Size By By Thickness

8.7.5.1 Up to 9 Microns

8.7.5.2 9 to 12 Microns

8.7.5.3 Above 12 Microns

8.7.6 Historic and Forecasted Market Size By By End-use

8.7.6.1 Food

8.7.6.2 Meat

8.7.6.3 Seafood

8.7.6.4 Baked Foods

8.7.6.5 Dairy Products

8.7.6.6 Fruits & Vegetables

8.7.6.7 Ready to Eat Meals

8.7.6.8 Others

8.7.6.9 Healthcare

8.7.6.10 Consumer Goods

8.7.6.11 Industrial

8.7.6.12 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cling Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.87 Billion |

|

Forecast Period 2024-32 CAGR: |

4.35% |

Market Size in 2032: |

USD 15.94 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Thickness

|

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cling Films Market research report is 2024-2032.

Berry Global Group, Inc., Intertape Polymer Group (IPG), Gruppo Fabbri Vignola S.p.A, Kalan SAS, Fine Vantage Limited, Rotofresh - Rotochef s.r.l., Manuli Stretch S.p.A., Klöckner Pentaplast, Adex S.r.l., MOLCO GmbH, CeDo Ltd, Prowrap Group (Wrapex Limited), 3M Company, Benkai Co., Ltd., Multi Wrap (PTY) LTD, Anchor Packaging, Anhui Jumei Biological Technology Co., Ltd., Pragya Flexifilm Industries, Reynolds Consumer Products Inc., and Other Active Players.

The Cling Films Market is segmented into By Material Type, By Thickness, By End-use and region. By Material Type, the market is categorized into PE, BOPP, PVC, PVDC and Others. By Thickness, the market is categorized into Up to 9 Microns, 9 to 12 Microns and Above 12 Microns. By End-use, the market is categorized into Food, Healthcare, Consumer Goods, Industrial and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The cling film market is the industry that involves the production and sale of cling films, which are thin, transparent plastic films used to wrap food and other items. Cling films are also known as plastic wrap, food wrap, saran wrap, and stretch film.

Cling Films Market Size Was Valued at USD 10.87 Billion in 2023, and is Projected to Reach USD 15.94 Billion by 2032, Growing at a CAGR of 4.35% From 2024-2032.