Clinical Chemistry Analyzers Market Synopsis:

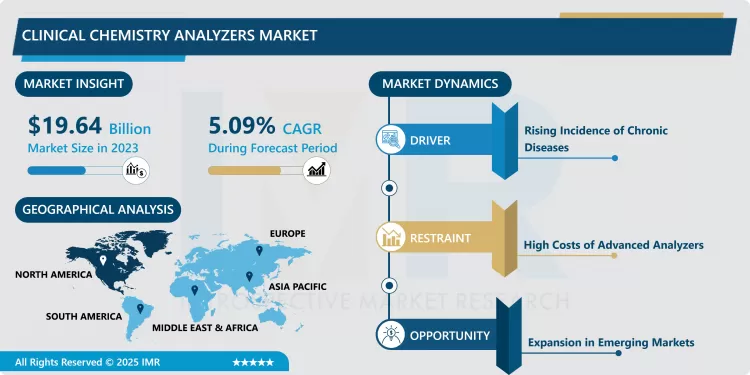

Clinical Chemistry Analyzers Market Size Was Valued at USD 19.64 Billion in 2023, and is Projected to Reach USD 30.70 Billion by 2032, Growing at a CAGR of 5.09% From 2024-2032.

Clinical chemistry analyzers are laboratory equipment used to analyze biological fluids such as blood and urine with the objective of finding the different chemical components that may exist. These analyzers are essential in the diagnostic process and the monitoring of diseases due to their rapid and accurate biochemical results about glucose levels, cholesterol levels, electrolytes, and tests for liver and kidney function.

This market is a crucial segment of the medical diagnostics industry, comprising a number of analyzers that attempt to analyze biochemical compounds in biological samples. These analyzers make it possible to detect and quantify several substances that could be used in the diagnosis and monitoring of diseases. Modern advancements have enabled clinical chemistry analyzers to be more automatic, efficient, and accurate, thus enhancing patient outcomes. The market is increasingly motivated by the prevalence of chronic diseases, an aging population, and point-of-care testing.

The market consists of several different product types namely automated, semi-automated, and manual analyzers bound to the requirements and capacity of the laboratory. The automated analyzers dominate the market mainly due to their high throughput and low human intervention, hence reducing the error potential. Such analyzers are used in various fields of medicals, from the management of diabetes, diagnosis of cardiac disorders, up to testing of kidney functions. In addition, future improvement and activity of research will be used to enhance the capabilities of clinical chemistry analyzers, which will play a major role in ensuring the boost of the market growth and maintain this equipment in relevance in contemporary health care.

Clinical Chemistry Analyzers Market Trend Analysis:

Increasing Automation in Clinical Chemistry Analyzers

- One of the major trends in the clinical chemistry analyzers market is an increased level of automation within diagnostic processes. It improves the effectiveness and speed of laboratory work flows so that healthcare professionals can process a much larger volume of tests inside an even shorter time. This is especially important in high-throughput laboratories, where timely results are an essential factor for patient management. Due to these reasons, automated analyzers have become the most preferred choice of hospitals and diagnostic labs, which are rising in terms of adoption.

- Moreover, automation rules out the possibilities of human errors, hence test results are absolutely accurate. Reliability in this context is important for carrying out potential therapeutic interventions and enhancing the care of the patients. Implementing advanced technologies like artificial intelligence and machine learning in automated systems enhances the capability of analyzers and ensures effective forecasting and dealing with data. Hence, the same trend is believed to maintain the tremendous growth in clinical chemistry analyzers during the next years.

Expansion in Emerging Markets

- One of the major opportunities in the clinical chemistry analyzers market would be expansion to emerging markets. Economic growth at a very fast pace, increasing investment in healthcare as well as improvement in the health infrastructure across Asia-Pacific and Latin America, hold promise in good opportunities for the producers of these machines. The absolute prevalence of chronic diseases is increasing here with greater demand for diagnostic services. Companies that venture into such markets should strategically do so to acquire more sales and a greater market share, exploiting the untapped opportunity.

- Moreover, collaborations and partnerships with health-care providers at local levels can help in getting access to market and brand awareness in such markets. The rising awareness among health care professionals and patients of advanced diagnostic technologies will look to enhance their demand for clinical chemistry analyzers, making it an ideal moment in time for companies looking to increase their footprint in such markets.

Clinical Chemistry Analyzers Market Segment Analysis:

Clinical Chemistry Analyzers Market is Segmented on the basis of Product type, Technology, Application, End User, and Region

By Product Type, Automated Analyzers segment is expected to dominate the market during the forecast period

- Clinical chemistry analyzers come in three primary product types- automated analyzers, semi-automated analyzers, and manual analyzers. Automated analyzers have a higher share because of the efficiency with which they process large volumes of samples with minimal human intervention. What makes systems like this essentially necessary for high throughput laboratories is that they bring about fast turnaround times for test results. Increased demand for automated analysers nowadays is above all stimulated by the necessity of timely diagnostics, with increased focus on patient-centered care.

- Semi-automated and manual analyzers are still used in smaller laboratories or facilities with lower volumes of testing. Although they are not as efficient and require much more human effort than automatic models, these systems are often cheaper at the point of sale, so they solve the problem for facilities whose budgetary limitations do not let them invest in fully automatic models. However, overall, the market landscape of laboratory analyzers is remodeling itself according to a tendency to automation as more and more laboratories look for efficiency in their operations and performances in diagnostics.

By Application, Diabetes segment expected to held the largest share

- Various application fields, including diabetes management, cardiac disorders, hepatic disorders, renal disorders, and many more, use these clinical chemistry analyzers. The diabetes segment is relatively more critical in view of an increased prevalence of diabetes in the global scenario, hence a regular monitoring of blood glucose levels is very crucial for health care professionals to develop proper treatment strategies based on accurate biochemical data.

- Cardiac and renal disorders are also areas of significant application, as early detection followed by continuous monitoring remains the key to management of patients in these areas. Increasing incidences of heart diseases and renal failures have accelerated the need for accurate diagnostic tests in these segments. Very importantly, clinical chemistry analyzers must, for this purpose of improvement in patient outcomes in critical areas, provide prompt and accurate results.

Clinical Chemistry Analyzers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America currently leads the market for clinical chemistry analyzers, primarily due to superior healthcare structures and excellent adoption rates for innovative diagnostic technologies. Established healthcare systems coupled with high investments in medical research have meant that the majority of hospitals and laboratories use clinical chemistry analyzers in the region. In addition, with its presence of leading manufacturers and continuous technological advancements, this region further adds strength to its market position.

- The chronic diseases are highly prevalent in North America, thus proving to be a major demand area for effective diagnostic agents. Increasing preventive healthcare awareness coupled with an aging population will encourage service providers to put more clinical chemistry analyzers to work during patient care. Thus, North America would be the leading region in the overall space of clinical chemistry analyzers.

Active Key Players in the Clinical Chemistry Analyzers Market:

- Abbott Laboratories (USA)

- Siemens Healthineers (Germany)

- Roche Diagnostics (Switzerland)

- Beckman Coulter, Inc. (USA)

- Thermo Fisher Scientific (USA)

- Ortho Clinical Diagnostics (USA)

- Sysmex Corporation (Japan)

- Mindray Medical International Limited (China)

- Horiba Ltd. (Japan)

- Danaher Corporation (USA)

- Fujifilm Holdings Corporation (Japan)

- Agilent Technologies, Inc. (USA)

- Other Active Players

Key Industry Developments in the Clinical Chemistry Analyzers Market:

- In July 2023, Beckman Coulter Diagnostics receives FDA clearance for the DxC 500 AU Chemistry Analyzer, an automated system designed for small-to-medium-sized laboratories. The analyzer, featuring standardized assays, enhances clinical decision-making and patient outcomes with proven Six Sigma performance, supporting efficiency and reliability in diagnostic testing

- In March 2023, Thermo Fisher Scientific has completed the acquisition of The Binding Site Group for £2.3 billion (USD 2.8 billion). The addition of The Binding Site expands Thermo Fisher's Specialty Diagnostics segment, particularly in oncology testing for multiple myeloma

- In May 2023, Siemens Healthineers introduces the Atellica HEMA 570 and 580 Analyzers for high-volume hematology testing. These solutions feature intuitive interfaces, multi-analyzer automation connectivity, and rules-based testing to streamline workflows and provide fast and reliable results for physicians and patients.

|

Clinical Chemistry Analyzers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.64 Billion |

|

Forecast Period 2024-32 CAGR: |

5.09% |

Market Size in 2032: |

USD 30.70 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Application |

|

||

|

Bu Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clinical Chemistry Analyzers Market by By Product Type (2018-2032)

4.1 Clinical Chemistry Analyzers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Automated Analyzers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Semi-Automated Analyzers

4.5 Manual Analyzers

Chapter 5: Clinical Chemistry Analyzers Market by By End User (2018-2032)

5.1 Clinical Chemistry Analyzers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diagnostic Laboratories

5.5 Academic & Research Institutions

5.6 Point-of-Care Testing (POCT)

Chapter 6: Clinical Chemistry Analyzers Market by By Application (2018-2032)

6.1 Clinical Chemistry Analyzers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diabetes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cardiac Disorders

6.5 Hepatic Disorders

6.6 Renal Disorders

6.7 Others

6.8 Bu Technology

6.9 Colorimetric

6.10 Immunoassay

6.11 Enzymatic

6.12 Electrochemical

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Clinical Chemistry Analyzers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS HEALTHINEERS (GERMANY)

7.4 ROCHE DIAGNOSTICS (SWITZERLAND)

7.5 BECKMAN COULTER INC. (USA)

7.6 THERMO FISHER SCIENTIFIC (USA)

7.7 ORTHO CLINICAL DIAGNOSTICS (USA)

7.8 SYSMEX CORPORATION (JAPAN)

7.9 MINDRAY MEDICAL INTERNATIONAL LIMITED (CHINA)

7.10 OTHER ACTIVE PLAYERS

Chapter 8: Global Clinical Chemistry Analyzers Market By Region

8.1 Overview

8.2. North America Clinical Chemistry Analyzers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Automated Analyzers

8.2.4.2 Semi-Automated Analyzers

8.2.4.3 Manual Analyzers

8.2.5 Historic and Forecasted Market Size By By End User

8.2.5.1 Hospitals

8.2.5.2 Diagnostic Laboratories

8.2.5.3 Academic & Research Institutions

8.2.5.4 Point-of-Care Testing (POCT)

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Diabetes

8.2.6.2 Cardiac Disorders

8.2.6.3 Hepatic Disorders

8.2.6.4 Renal Disorders

8.2.6.5 Others

8.2.6.6 Bu Technology

8.2.6.7 Colorimetric

8.2.6.8 Immunoassay

8.2.6.9 Enzymatic

8.2.6.10 Electrochemical

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Clinical Chemistry Analyzers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Automated Analyzers

8.3.4.2 Semi-Automated Analyzers

8.3.4.3 Manual Analyzers

8.3.5 Historic and Forecasted Market Size By By End User

8.3.5.1 Hospitals

8.3.5.2 Diagnostic Laboratories

8.3.5.3 Academic & Research Institutions

8.3.5.4 Point-of-Care Testing (POCT)

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Diabetes

8.3.6.2 Cardiac Disorders

8.3.6.3 Hepatic Disorders

8.3.6.4 Renal Disorders

8.3.6.5 Others

8.3.6.6 Bu Technology

8.3.6.7 Colorimetric

8.3.6.8 Immunoassay

8.3.6.9 Enzymatic

8.3.6.10 Electrochemical

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Clinical Chemistry Analyzers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Automated Analyzers

8.4.4.2 Semi-Automated Analyzers

8.4.4.3 Manual Analyzers

8.4.5 Historic and Forecasted Market Size By By End User

8.4.5.1 Hospitals

8.4.5.2 Diagnostic Laboratories

8.4.5.3 Academic & Research Institutions

8.4.5.4 Point-of-Care Testing (POCT)

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Diabetes

8.4.6.2 Cardiac Disorders

8.4.6.3 Hepatic Disorders

8.4.6.4 Renal Disorders

8.4.6.5 Others

8.4.6.6 Bu Technology

8.4.6.7 Colorimetric

8.4.6.8 Immunoassay

8.4.6.9 Enzymatic

8.4.6.10 Electrochemical

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Clinical Chemistry Analyzers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Automated Analyzers

8.5.4.2 Semi-Automated Analyzers

8.5.4.3 Manual Analyzers

8.5.5 Historic and Forecasted Market Size By By End User

8.5.5.1 Hospitals

8.5.5.2 Diagnostic Laboratories

8.5.5.3 Academic & Research Institutions

8.5.5.4 Point-of-Care Testing (POCT)

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Diabetes

8.5.6.2 Cardiac Disorders

8.5.6.3 Hepatic Disorders

8.5.6.4 Renal Disorders

8.5.6.5 Others

8.5.6.6 Bu Technology

8.5.6.7 Colorimetric

8.5.6.8 Immunoassay

8.5.6.9 Enzymatic

8.5.6.10 Electrochemical

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Clinical Chemistry Analyzers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Automated Analyzers

8.6.4.2 Semi-Automated Analyzers

8.6.4.3 Manual Analyzers

8.6.5 Historic and Forecasted Market Size By By End User

8.6.5.1 Hospitals

8.6.5.2 Diagnostic Laboratories

8.6.5.3 Academic & Research Institutions

8.6.5.4 Point-of-Care Testing (POCT)

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Diabetes

8.6.6.2 Cardiac Disorders

8.6.6.3 Hepatic Disorders

8.6.6.4 Renal Disorders

8.6.6.5 Others

8.6.6.6 Bu Technology

8.6.6.7 Colorimetric

8.6.6.8 Immunoassay

8.6.6.9 Enzymatic

8.6.6.10 Electrochemical

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Clinical Chemistry Analyzers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Automated Analyzers

8.7.4.2 Semi-Automated Analyzers

8.7.4.3 Manual Analyzers

8.7.5 Historic and Forecasted Market Size By By End User

8.7.5.1 Hospitals

8.7.5.2 Diagnostic Laboratories

8.7.5.3 Academic & Research Institutions

8.7.5.4 Point-of-Care Testing (POCT)

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Diabetes

8.7.6.2 Cardiac Disorders

8.7.6.3 Hepatic Disorders

8.7.6.4 Renal Disorders

8.7.6.5 Others

8.7.6.6 Bu Technology

8.7.6.7 Colorimetric

8.7.6.8 Immunoassay

8.7.6.9 Enzymatic

8.7.6.10 Electrochemical

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Clinical Chemistry Analyzers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.64 Billion |

|

Forecast Period 2024-32 CAGR: |

5.09% |

Market Size in 2032: |

USD 30.70 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Application |

|

||

|

Bu Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Clinical Chemistry Analyzers Market research report is 2024-2032.

Abbott Laboratories (USA), Siemens Healthineers (Germany), Roche Diagnostics (Switzerland), Beckman Coulter, Inc. (USA), Thermo Fisher Scientific (USA), Ortho Clinical Diagnostics (USA), Sysmex Corporation (Japan), Mindray Medical International Limited (China), and Other Active Players.

The Clinical Chemistry Analyzers Market is segmented into Product Type, Application, End User, Technology and region. By Product Type, the market is categorized into Automated Analyzers, Semi-Automated Analyzers, Manual Analyzers. By End User, the market is categorized into Hospitals, Diagnostic Laboratories, Academic & Research Institutions, Point-of-Care Testing (POCT). By Application, the market is categorized into Diabetes, Cardiac Disorders, Hepatic Disorders, Renal Disorders, Others. By Technology, the market is categorized into Colorimetric, Immunoassay, Enzymatic, and Electrochemical. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Clinical chemistry analyzers are laboratory equipment used to analyze biological fluids such as blood and urine with the objective of finding the different chemical components that may exist. These analyzers are essential in the diagnostic process and the monitoring of diseases due to their rapid and accurate biochemical results about glucose levels, cholesterol levels, electrolytes, and tests for liver and kidney function.

Clinical Chemistry Analyzers Market Size Was Valued at USD 19.64 Billion in 2023, and is Projected to Reach USD 30.70 Billion by 2032, Growing at a CAGR of 5.09% From 2024-2032.