Clinical Decision and Support System Market Synopsis:

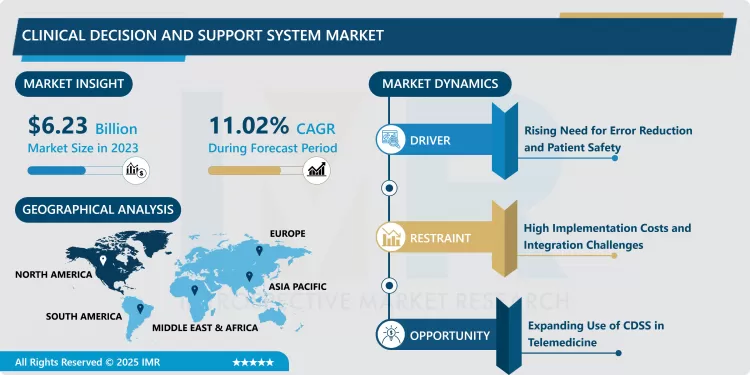

Clinical Decision and Support System Market Size Was Valued at USD 6.23 Billion in 2023, and is Projected to Reach USD 15.96 Billion by 2032, Growing at a CAGR of 11.02% From 2024-2032.

Clinical Decision and Support Systems serve in healthcare as health information technologies for the support of healthcare providers when making data-driven clinical decisions. CDSS is implemented as health information technology to give clinicians specific patient assessments or recommendations about large sets of clinical data, medical knowledge, and best practices. CDSS enhances clinical workflows through the use of real-time alerts, reminders, diagnostic assistance, and treatment recommendations-all to reduce errors and increase better healthcare outcomes.

The CDSS market is in the fast lane as health care systems around the world move towards a model of value-based care, concentrating more on the delivery of better patient outcomes, minimizing errors and optimizing efficiency. CDSS is fundamentally used in standardizing decision-making through evidence-based information to aid clinicians in diagnosis, treatment, and patient care management. With the rise in the implementation of EHRs, CPOE systems, and other healthcare IT solutions, CDSS is gradually developing as one of the key elements of modern healthcare systems.

Healthcare organizations increasingly opt for CDSS solutions as such helps minimize clinical errors, optimize workflow, and improves compliance with standardized care guidelines. These systems help physicians not only to diagnose a condition, but also offer treatment suggestions. In addition, drug-drug interactions, allergic sensitivity, and dosing errors bring timely alerts. As providers of healthcare have been under growing pressure to provide high-quality care to patients at a lower cost and elevated safety, CDSS is found to be a strong tool to assist in guiding decisions within an increasingly complex environment.

The progress of AI and ML to support CDSS also promotes the growth of big data analytics, which enables these systems to be even more accurate, predictive, and personalized in their recommendations. Thus, through increasing capabilities that are being used to accomplish with AI, market growth with CDSS is further impelled. North America is the leader of the market driven by advanced healthcare infrastructure, wide applications of healthcare IT, and strong regulatory support for health information technology. Other markets, including Europe and Asia-Pacific, however are emerging rapidly driven by higher investments in digital health care solutions and government efforts to modernize the services provided.

Clinical Decision and Support System Market Trend Analysis:

AI and Machine Learning in CDSS

- One of the most prevalent trends evident in the health systems of the world is the inclusion of AI and ML in CDSS. These AI-powered CDSS tools may be said to analyze tens of millions of clinical data assets in real-time, bringing recommendations more accurate, personalized, and predictive to the healthcare provider. These smart systems are further away from simple rule-based alerts, providing insights based on historical patient data, clinical outcomes, and predictive algorithms, which enables clinicians to make more informed decisions in diagnosis, treatment, and management of patients.

- With advances in AI and ML, the development of CDSS systems is becoming increasingly sophisticated. For instance, an AI-driven CDSS would be able to identify patterns in patient data that could predict the probability of sepsis or heart failure even before symptoms begin to show, which would enable early interventions that improve patient outcomes and lower readmissions to the hospital. The growing use of AI through CDSS presents an enormous opportunity for precision medicine and overall quality of care improvements in health care delivery.

Expanding Use of CDSS in Telemedicine

- The rising level of telemedicine usage promises enormous scope for the expansion of CDSS. With additional services being rendered through distant locations, the need for CDSS tools will rise to complement the efforts of physicians in virtual settings. When clinicians are not physically present with their patients, a telemedicine platform with integrated CDSS can render a diagnosis in real time, with treatment recommendations and even risk warnings regarding possible drug interaction.

- It is even more important for settings in which many patients reside in rural or underserved areas, where access to subspecialized care providers may be limited. CDSS will help bridge such gaps by enabling health care professionals with remote access to expert advice and clinical direction thereby ensuring timely and appropriate management for patients. Further, use of CDSS in telemedicine is just in keeping with the trend of digital transformation in health and shall become a potentially promising area in the short term

Clinical Decision and Support System Market Segment Analysis:

Clinical Decision and Support System Market is Segmented on the basis of Product, application, Delivery Mode, Component, and Region

By Product, Standalone CDSS segment is expected to dominate the market during the forecast period

- The CDSS market can be categorized into standalone CDSS, integrated CPOE with CDSS, integrated EHR with CDSS, and integrated CDSS with CPOE & EHR. Standalone CDSS solutions have independent decision support that does not rely on other systems. These provide clinicians with evidence-based recommendations in different aspects of care. However, these standalone systems are nowadays being replaced by integrated solutions because they offer more comprehensive functionality. Integrated CDSS with CPOE and EHR are the most advanced and allow seamless communication between a variety of health IT systems.

- Integrated systems are in vogue nowadays for the reason of efficiently working in clinical workflows and optimizing work flow. Additionally, through the integration of CDSS with EHR and CPOE, all the real-time patient data, order entries, and decision support tools are in a single, integrated platform. This maintains simple, easy-to-make decisions with low error opportunities and is thus the most preferred option for greater healthcare organizations.

By Application, Drug-drug interactions segment expected to held the largest share

- Application of CDSS includes drug-drug interactions, drug allergy alerts, clinical reminders, clinical guidelines, drug dosing support, among others. Among the above, a drug-drug interaction and a drug-allergic alert are major enablers for preventing adverse drug events, such as drug interaction-related medical errors. A CDSS system that provides timely alerts regarding potential drug interactions or allergic conditions avoids the chances of prescription errors and increases patient safety for clinicians.

- Other critical applications of CDSS are in clinical alerts and advice, which would facilitate consistency in following care guidelines from healthcare providers. The functionalities aid clinicians in tracking and executing required patient care activities, for instance, vaccination-related or examination-related work, as well as follow-up actions so that necessary preventive care is provided to the patients. Drug dosage support aids patient safety by being able to provide appropriate dosing taking into consideration the age and weight of the patient as well as other relevant factors.

Clinical Decision and Support System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North America region currently leads the CDSS market, with its developed healthcare infrastructure, high adoption of healthcare IT solutions, and strong regulatory support for health information technology. Improving healthcare quality, reducing medical errors, and enhancing patient safety have become a focus area for the region, and the adoption has happened in almost all sectors, especially in the United States. The leadership in healthcare IT companies and high investments in digital health technologies are some factors that have contributed to the dominant market in that particular region.

- The government is also supporting initiatives to improve the usage of health IT systems, like the HITECH Act that provides incentives in terms of EHRs, other health information technologies, and value-based care models. This further supports North America's position in the CDSS market.

Active Key Players in the Clinical Decision and Support System Market

- Cerner Corporation (United States)

- Epic Systems Corporation (United States)

- Allscripts Healthcare Solutions, Inc. (United States)

- IBM Watson Health (United States)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- GE Healthcare (United States)

- McKesson Corporation (United States)

- Meditech (United States)

- Wolters Kluwer Health (Netherlands)

- Change Healthcare (United States)

- Zynx Health (United States)

- Other Active Players

Key Industry Developments in the Clinical Decision and Support System Market:

- In October 2023, Wolters Kluwer Health launched AI Labs, a collective resource to integrate generative AI with UpToDate, its CDS solution, enabling medical professionals to make better-informed decisions

- In August 2023, GE HealthCare launched CardioVisio for Atrial Fibrillation, a patient-centric, digital CDS tool to allow precision care

- In February 2023, EBSCO Information Services launched new features in DynaMedex Mobile App to improve clinical decision support. These enhancements improve the mobile experience for users by enabling clinicians to deliver evidence-based patient care efficiently

|

Clinical Decision and Support System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.23 Billion |

|

Forecast Period 2024-32 CAGR: |

11.02% |

Market Size in 2032: |

USD 15.96 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Delivery Mode |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clinical Decision and Support System Market by By Product (2018-2032)

4.1 Clinical Decision and Support System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Standalone CDSS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Integrated CPOE with CDSS

4.5 Integrated EHR with CDSS

4.6 Integrated CDSS with CPOE & EHR

Chapter 5: Clinical Decision and Support System Market by By Application (2018-2032)

5.1 Clinical Decision and Support System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drug-drug interactions

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drug allergy alerts

5.5 Clinical reminders

5.6 Clinical guidelines

5.7 Drug dosing support

5.8 Others

Chapter 6: Clinical Decision and Support System Market by By Delivery Mode (2018-2032)

6.1 Clinical Decision and Support System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Web-based Systems

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud-based Systems

6.5 On -premise Systems

Chapter 7: Clinical Decision and Support System Market by By Component (2018-2032)

7.1 Clinical Decision and Support System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hardware

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Software

7.5 Services

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Clinical Decision and Support System Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CERNER CORPORATION (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EPIC SYSTEMS CORPORATION (UNITED STATES)

8.4 ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (UNITED STATES)

8.5 IBM WATSON HEALTH (UNITED STATES)

8.6 PHILIPS HEALTHCARE (NETHERLANDS)

8.7 SIEMENS HEALTHINEERS (GERMANY)

8.8 GE HEALTHCARE (UNITED STATES)

8.9 OTHER ACTIVE PLAYERS

Chapter 9: Global Clinical Decision and Support System Market By Region

9.1 Overview

9.2. North America Clinical Decision and Support System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product

9.2.4.1 Standalone CDSS

9.2.4.2 Integrated CPOE with CDSS

9.2.4.3 Integrated EHR with CDSS

9.2.4.4 Integrated CDSS with CPOE & EHR

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Drug-drug interactions

9.2.5.2 Drug allergy alerts

9.2.5.3 Clinical reminders

9.2.5.4 Clinical guidelines

9.2.5.5 Drug dosing support

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size By By Delivery Mode

9.2.6.1 Web-based Systems

9.2.6.2 Cloud-based Systems

9.2.6.3 On -premise Systems

9.2.7 Historic and Forecasted Market Size By By Component

9.2.7.1 Hardware

9.2.7.2 Software

9.2.7.3 Services

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Clinical Decision and Support System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product

9.3.4.1 Standalone CDSS

9.3.4.2 Integrated CPOE with CDSS

9.3.4.3 Integrated EHR with CDSS

9.3.4.4 Integrated CDSS with CPOE & EHR

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Drug-drug interactions

9.3.5.2 Drug allergy alerts

9.3.5.3 Clinical reminders

9.3.5.4 Clinical guidelines

9.3.5.5 Drug dosing support

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size By By Delivery Mode

9.3.6.1 Web-based Systems

9.3.6.2 Cloud-based Systems

9.3.6.3 On -premise Systems

9.3.7 Historic and Forecasted Market Size By By Component

9.3.7.1 Hardware

9.3.7.2 Software

9.3.7.3 Services

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Clinical Decision and Support System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product

9.4.4.1 Standalone CDSS

9.4.4.2 Integrated CPOE with CDSS

9.4.4.3 Integrated EHR with CDSS

9.4.4.4 Integrated CDSS with CPOE & EHR

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Drug-drug interactions

9.4.5.2 Drug allergy alerts

9.4.5.3 Clinical reminders

9.4.5.4 Clinical guidelines

9.4.5.5 Drug dosing support

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size By By Delivery Mode

9.4.6.1 Web-based Systems

9.4.6.2 Cloud-based Systems

9.4.6.3 On -premise Systems

9.4.7 Historic and Forecasted Market Size By By Component

9.4.7.1 Hardware

9.4.7.2 Software

9.4.7.3 Services

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Clinical Decision and Support System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product

9.5.4.1 Standalone CDSS

9.5.4.2 Integrated CPOE with CDSS

9.5.4.3 Integrated EHR with CDSS

9.5.4.4 Integrated CDSS with CPOE & EHR

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Drug-drug interactions

9.5.5.2 Drug allergy alerts

9.5.5.3 Clinical reminders

9.5.5.4 Clinical guidelines

9.5.5.5 Drug dosing support

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size By By Delivery Mode

9.5.6.1 Web-based Systems

9.5.6.2 Cloud-based Systems

9.5.6.3 On -premise Systems

9.5.7 Historic and Forecasted Market Size By By Component

9.5.7.1 Hardware

9.5.7.2 Software

9.5.7.3 Services

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Clinical Decision and Support System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product

9.6.4.1 Standalone CDSS

9.6.4.2 Integrated CPOE with CDSS

9.6.4.3 Integrated EHR with CDSS

9.6.4.4 Integrated CDSS with CPOE & EHR

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Drug-drug interactions

9.6.5.2 Drug allergy alerts

9.6.5.3 Clinical reminders

9.6.5.4 Clinical guidelines

9.6.5.5 Drug dosing support

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size By By Delivery Mode

9.6.6.1 Web-based Systems

9.6.6.2 Cloud-based Systems

9.6.6.3 On -premise Systems

9.6.7 Historic and Forecasted Market Size By By Component

9.6.7.1 Hardware

9.6.7.2 Software

9.6.7.3 Services

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Clinical Decision and Support System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product

9.7.4.1 Standalone CDSS

9.7.4.2 Integrated CPOE with CDSS

9.7.4.3 Integrated EHR with CDSS

9.7.4.4 Integrated CDSS with CPOE & EHR

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Drug-drug interactions

9.7.5.2 Drug allergy alerts

9.7.5.3 Clinical reminders

9.7.5.4 Clinical guidelines

9.7.5.5 Drug dosing support

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size By By Delivery Mode

9.7.6.1 Web-based Systems

9.7.6.2 Cloud-based Systems

9.7.6.3 On -premise Systems

9.7.7 Historic and Forecasted Market Size By By Component

9.7.7.1 Hardware

9.7.7.2 Software

9.7.7.3 Services

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Clinical Decision and Support System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.23 Billion |

|

Forecast Period 2024-32 CAGR: |

11.02% |

Market Size in 2032: |

USD 15.96 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Delivery Mode |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Clinical Decision and Support System Market research report is 2024-2032.

Cerner Corporation (United States), Epic Systems Corporation (United States), Allscripts Healthcare Solutions, Inc. (United States), IBM Watson Health (United States), Philips Healthcare (Netherlands), Siemens Healthineers (Germany), GE Healthcare (United States), McKesson Corporation (United States), Meditech (United States), Wolters Kluwer Health (Netherlands), Change Healthcare (United States), Zynx Health (United States), and Other Active Players.

The Clinical Decision and Support System Market is segmented into Product , Application, Delivery Mode ,Component and region. By Product, the market is categorized into Standalone CDSS, Integrated CPOE with CDSS, Integrated EHR with CDSS, Integrated CDSS with CPOE & HER. By Application, the market is categorized into Drug-drug interactions, Drug allergy alerts, Clinical reminders, Clinical guidelines, Drug dosing support, Others. By Delivery Mode, the market is categorized into Web-based Systems, Cloud-based Systems, On -premise Systems. By Component, the market is categorized into Hardware, Software, Services. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Clinical Decision and Support Systems serve in healthcare as health information technologies for the support of healthcare providers when making data-driven clinical decisions. CDSS is implemented as health information technology to give clinicians specific patient assessments or recommendations about large sets of clinical data, medical knowledge, and best practices. CDSS enhances clinical workflows through the use of real-time alerts, reminders, diagnostic assistance, and treatment recommendations-all to reduce errors and increase better healthcare outcomes.

Clinical Decision and Support System Market Size Was Valued at USD 6.23 Billion in 2023, and is Projected to Reach USD 15.96 Billion by 2032, Growing at a CAGR of 11.02% From 2024-2032.