CNG Vehicles Market Synopsis:

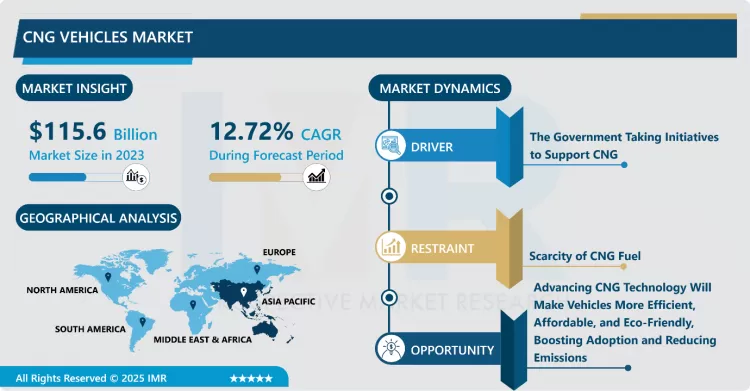

CNG Vehicles Market Size Was Valued at USD 115.6 Billion in 2023 and is Projected to Reach USD 339.60 Billion by 2032, Growing at a CAGR of 12.72% From 2024-2032.

Compressed Natural Gas (CNG) is Clean Energy for Vehicles. The use of natural gas in the transport sector has contributed primarily to containing the pollution due to vehicular exhaust emissions. CNG is an eco-friendly green fuel and emits less pollutants. Apart from this, natural gas as CNG has been able to replace high-priced hydrocarbon commodities like petrol and diesel. It is an economical than other conventional fuels. It has no evaporation leaks and fuel spills, both during refueling and feeding of the vehicles.

Natural Gas sold under compression (CNG) maintains rapid market growth due to it serves as an eco-friendly substitute to traditional hydrocarbon fuels including gasoline and diesel. Both personal consumers and corporate transportation services find promise in using CNG to tackle rising environmental pollution alongside greenhouse gases and fuel expenses. This alternative fuel finds growth in popularity due to it has multiple useful characteristics that include efficient combustion affordable maintenance and extensive natural reservoirs.

CNG serves sustainability and environmental practice goals by providing affordable carbon footprint reductions through its accessible and practical operation. The modern concern for environmental stewardship combined with energy security demands makes CNG a compelling solution for future transportation systems that are greener and sustainable. Governments as well as business sectors together with environmentally conscious consumers now acknowledge CNG due to its ability to reduce air contamination and minimize greenhouse gas generation while producing enduring cost reductions.

CNG Vehicles Market Growth and Trend Analysis:

The Government Taking Initiatives to Support CNG

- The use of Compressed Natural Gas (CNG) as fuel represents a compelling alternative due to its lower fuel expenses when compared to gasoline or diesel. The lower unit pricing of CNG allows vehicle owners along with fleet operators to save substantially for the long run.

- CNG vehicle fuel comes in at cheaper price levels of gasoline or diesel when assessed depending on geographic regions and market pricing dynamics. The low production expenses of CNG stem from the large availability of natural gas sources and straightforward compression methods needed during production.

- CNG vehicles need reduced maintenance compared to other models since they run on natural gas. Due to, CNG producing clean emissions it causes less degradation of engine parts which minimizes replacement and repair expenses for vehicle owners. The vehicle naturally accumulates substantial financial savings throughout its entire operational period. Looking ahead, several initiatives and plans are underway to further expand the CNG fueling infrastructure. Government agencies, energy companies, and private investors are collaborating to expand the CNG Fuel stations.

- For instance, in the U.S. the Biden administration has awarded over USD105 million to support compressed natural gas (CNG) bus transit projects across the U.S. through the Federal Transit Administration’s Low- and No-Emission Grant Program for Fiscal Year 2024. This funding will help transit agencies replace aging diesel buses with cleaner CNG alternatives, along with investments in fueling infrastructure and facility upgrades.

Scarcity of CNG Fuel

- Limited availability of fueling stations, and scarcity of CNG fuel for individual consumers is a primary impediment for the widespread adoption of CNG vehicles. Moreover, the upfront costs of these vehicles, including necessary equipment installation or conversion costs make lifetime expenses for CNGs higher compared to traditional petroleum and electric vehicles. Likewise, repairs for a natural gas engine require specialized maintenance that most localized mechanics lack the capacity and training for. Additionally, many CNG vehicles have range limitations and poor fuel economy than gasoline-powered vehicles and diesel vehicles, often requiring more frequent refueling compared to traditional options.

Advancing CNG Technology Will Make Vehicles More Efficient, Affordable, and Eco-Friendly, Boosting Adoption and Reducing Emissions

- As CNG research and development advances, CNG vehicles are expected to become more efficient and affordable, making them a viable option for a wider range of individual consumers and fleet vehicles. The continued adoption of natural gas trucks, buses, and other long-range CNG vehicles should ostensibly continue to spur investment and research into a wider range of options for natural gas vehicle types. As their use becomes more widespread, and economies of scale bring down costs per gallon, CNG vehicles’ role in reducing greenhouse gas emissions is likely to increase, solidifying their importance in the global transportation landscape.

CNG Vehicles Market Segment Analysis:

CNG Vehicles Market is segmented based on Product type, application, Kit Type, and region

By Product Type, Car modification segment is expected to dominate the market during the forecast period

- CNG is generally more affordable than traditional fuels like gasoline or diesel, leading vehicle owners to convert their existing vehicles to CNG to reduce fuel expense. Compressed Natural Gas (CNG) is often more affordable than traditional fuels like gasoline or diesel, prompting many vehicle owners to consider converting their vehicles to CNG to reduce fuel expenses.

- For instance, in November 2024, Nigeria turned to natural gas as transport prices soared after petrol subsidies were removed. Transportation costs skyrocketed as the price of petrol more than tripled in the months that followed last year’s decision, resulting in the country’s worst cost-of-living crisis in a generation. The government aims to convert 1 million of Nigeria’s over 11 million vehicles in the next three years

By Application, Personal use segment held the largest share in 2023

- The growth of urban areas together with improved economic status creates increased demand for sedans along with SUVs. The increase in passengers in mobility markets has prompted manufacturers to create wide CNG-powered model lines. The user-friendliness of CNG in private vehicles improved due to Original Equipment Manufacturer's efforts in matching their gasoline performance metrics.

- The low cost of buying and operating CNG vehicles makes personal driving with this fuel source highly appealing to car owners. The overall worth of CNG vehicles rises due to both maintenance costs and insurance fees cost less than what diesel owners pay. Tax benefits provide further reduction to the ownership expenses. The increasing number of households purchasing CNG cars due to convenience and affordable ownership leads to fast market growth within the segment.

CNG Vehicles Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Globally, the Asia Pacific countries represent the top-ranked region for gas penetration in the transport sector. China is by far the world’s top market for natural gas vehicles, accounting for around half of the total gas consumed globally by the transport sector.

- Many governments are implementing policies aimed at decarbonizing transport industries. Such policies have already proven to encourage the increased use of natural gas and are expected to continue to be favorable to the gas industry

- The countries like China, India, South Korea, and Thailand have the largest share of the market in the region. China is the largest market in the region due to its government policies to support the adoption of low-emission fuel vehicles and the low cost of vehicle conversions. Rising fuel prices and growing environmental concerns are driving interest in alternative fuel vehicles in India. Petrol and diesel costs have surged dramatically over the past decade, putting pressure on consumers and businesses relying on traditional internal combustion engine vehicles

- For instance, In the fiscal year 2024, the compressed natural gas (CNG) vehicle market has experienced a significant uptick, with sales soaring by 38% to a staggering 940,000 units. This surge in demand is attributed to various factors, including a sharp rise in the popularity of CNG-powered three-wheelers, passenger vehicles, goods carriers, and buses. With the prospect of continued growth and favorable market conditions, the CNG vehicle industry is poised for a promising future, and will continue dominating the market in the forecasted period.

CNG Vehicles Market Active Players:

- Bajaj Auto Ltd. (India)

- Fiat Chrysler Automobiles (Italy/USA)

- Ford Motor Company (USA)

- General Motors Company (USA)

- Honda Motor Co., Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- Isuzu Motors Ltd. (Japan)

- Kia Corporation (South Korea)

- Mahindra & Mahindra Ltd. (India)

- Mercedes-Benz Group (Germany)

- Mitsubishi Motors Corporation (Japan)

- Nissan Motor Company Ltd. (Japan)

- Peugeot S.A. (Stellantis Group) (France)

- Renault SA (France)

- Suzuki Motor Corporation (Japan)

- Tata Motors Ltd. (India)

- Toyota Motor Corporation (Japan)

- Volkswagen Group (Germany)

- Other Active Players

Key Industry Developments in the CNG Vehicles Market:

- In September 2024, Tata Motors, India’s leading manufacturer of cars and SUVs, announced the launch of the Nexon iCNG, and additions to the Nexon EV range with a new 45 kWh battery pack and the flagship Red Hot DARK edition. These additions make India’s bestselling SUV, the Tata Nexon, India’s first and only vehicle to be available in 4 distinct powertrains – petrol, diesel, CNG and electric

- In July 2024, Bajaj Auto launched the world’s first CNG-powered bike. The Bajaj Freedom CNG motorcycle offers significant fuel cost savings, potentially reducing expenses by around 50% compared to petrol motorcycles

|

Global CNG Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 115.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.72 % |

Market Size in 2032: |

USD 339.60 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Kit Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: CNG Vehicles Market by By Product Type (2018-2032)

4.1 CNG Vehicles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 OEM

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Car Modification

Chapter 5: CNG Vehicles Market by By Application (2018-2032)

5.1 CNG Vehicles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Personal Use

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Use

Chapter 6: CNG Vehicles Market by By Kit Type (2018-2032)

6.1 CNG Vehicles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retro Fitment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Venturi

6.5 sequential

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 CNG Vehicles Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAJAJ AUTO LTD. (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FIAT CHRYSLER AUTOMOBILES (ITALY/USA)

7.4 FORD MOTOR COMPANY (USA)

7.5 GENERAL MOTORS COMPANY (USA)

7.6 HONDA MOTOR COLTD. (JAPAN)

7.7 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

7.8 ISUZU MOTORS LTD. (JAPAN)

7.9 KIA CORPORATION (SOUTH KOREA)

7.10 MAHINDRA & MAHINDRA LTD. (INDIA)

7.11 MERCEDES-BENZ GROUP (GERMANY)

7.12 MITSUBISHI MOTORS CORPORATION (JAPAN)

7.13 NISSAN MOTOR COMPANY LTD. (JAPAN)

7.14 PEUGEOT S.A. (STELLANTIS GROUP) (FRANCE)

7.15 RENAULT SA (FRANCE)

7.16 SUZUKI MOTOR CORPORATION (JAPAN)

7.17 TATA MOTORS LTD. (INDIA)

7.18 TOYOTA MOTOR CORPORATION (JAPAN)

7.19 VOLKSWAGEN GROUP (GERMANY)

7.20

Chapter 8: Global CNG Vehicles Market By Region

8.1 Overview

8.2. North America CNG Vehicles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 OEM

8.2.4.2 Car Modification

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Personal Use

8.2.5.2 Commercial Use

8.2.6 Historic and Forecasted Market Size By By Kit Type

8.2.6.1 Retro Fitment

8.2.6.2 Venturi

8.2.6.3 sequential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe CNG Vehicles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 OEM

8.3.4.2 Car Modification

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Personal Use

8.3.5.2 Commercial Use

8.3.6 Historic and Forecasted Market Size By By Kit Type

8.3.6.1 Retro Fitment

8.3.6.2 Venturi

8.3.6.3 sequential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe CNG Vehicles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 OEM

8.4.4.2 Car Modification

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Personal Use

8.4.5.2 Commercial Use

8.4.6 Historic and Forecasted Market Size By By Kit Type

8.4.6.1 Retro Fitment

8.4.6.2 Venturi

8.4.6.3 sequential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific CNG Vehicles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 OEM

8.5.4.2 Car Modification

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Personal Use

8.5.5.2 Commercial Use

8.5.6 Historic and Forecasted Market Size By By Kit Type

8.5.6.1 Retro Fitment

8.5.6.2 Venturi

8.5.6.3 sequential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa CNG Vehicles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 OEM

8.6.4.2 Car Modification

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Personal Use

8.6.5.2 Commercial Use

8.6.6 Historic and Forecasted Market Size By By Kit Type

8.6.6.1 Retro Fitment

8.6.6.2 Venturi

8.6.6.3 sequential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America CNG Vehicles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 OEM

8.7.4.2 Car Modification

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Personal Use

8.7.5.2 Commercial Use

8.7.6 Historic and Forecasted Market Size By By Kit Type

8.7.6.1 Retro Fitment

8.7.6.2 Venturi

8.7.6.3 sequential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global CNG Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 115.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.72 % |

Market Size in 2032: |

USD 339.60 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Kit Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the CNG Vehicles Market research report is 2024-2032.

Hyundai Motor Company (South Korea), Honda Motor Co., Ltd. (Japan), Suzuki Motor Corporation (Japan), Volkswagen Group (Germany), Ford Motor Company (USA), Fiat Chrysler Automobiles (Italy/USA), Mitsubishi Motors Corporation (Japan), Mercedes-Benz Group (Germany), Nissan Motor Company Ltd. (Japan), General Motors Company (USA), Tata Motors Ltd. (India), Mahindra & Mahindra Ltd. (India), Renault SA (France), Peugeot S.A. (Stellantis Group) (France), Kia Corporation (South Korea), Toyota Motor Corporation (Japan), Isuzu Motors Ltd. (Japan), Bajaj Auto Ltd. (India), and Other Active Players.

The CNG Vehicles Market is segmented into Product type, application, Kit Type, and Region. By Product Type, the market is categorized into OEM and Car Modification, By Application it is categorized into Personal Use and Commercial Use. By Kit Type, it is categorized into Retro Fitment, Venturi, and sequential By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Compressed Natural Gas (CNG) is Clean Energy for Vehicles. The use of natural gas in the transport sector has contributed largely to containing the pollution due to vehicular exhaust emissions. CNG is an eco-friendly green fuel and emits less pollutants. Apart from this, natural gas as CNG has been able to replace high-priced hydrocarbon commodities like petrol and diesel. It is an economical than other conventional fuels. It has no evaporation leaks and fuel spills, both during refueling and feeding of the vehicles.

CNG Vehicles Market Size Was Valued at USD 115.6 Billion in 2023 and is Projected to Reach USD 339.60 Billion by 2032, Growing at a CAGR of 12.72% From 2024-2032.