Coal to Liquid Market Synopsis

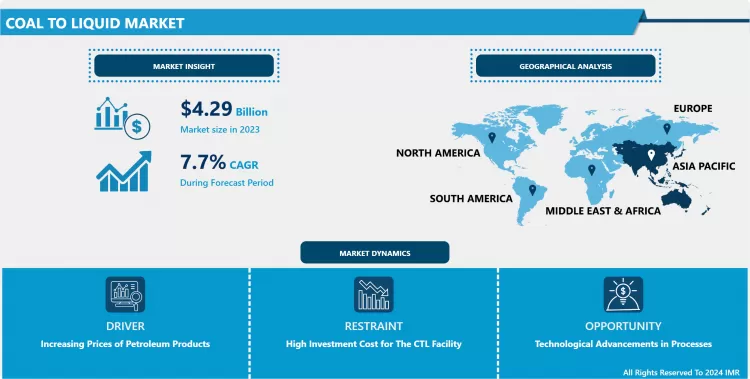

The Coal To Liquid Market was valued at USD 4.29 Billion in 2023 and is projected to reach USD 8.36 Billion by 2032, growing at a CAGR of 7.7% from 2024 to 2032.

Coal is an important fuel utilized worldwide to generate electricity, while petroleum fuels are commonly utilized in vehicles. Coal and petroleum fuels both majorly possess carbon, which makes the conversion of coal to liquid fuel more feasible.

- The production of liquid fuel from coal is also known as coal-to-liquid (CTL) technology or coal liquefaction. In this process, the produced liquid is a high-grade, clean fuel suitable for use in transport. Coal liquefaction provides various benefits. In terms of power generation, coal liquefaction is considered less expensive. Infrastructure and logistical requirements for processing and transportation of coal are lower than those for other fossil fuels such as oil and gas.

- Coal to liquid fuel process is also known as coal liquefaction. Coal liquefaction is any process of turning coal into liquid products resembling crude oil. The two procedures that have been most extensively evaluated are carbonization heating coal in the absence of air, and hydrogenation causing coal to react with hydrogen at high pressures, usually in the presence of a catalyst.

The Coal to Liquid Market Trend Analysis

Increasing Prices of Petroleum Products

- As the prices of traditional petroleum products like gasoline, diesel, and jet fuel rise, CTL can become economically competitive. When the price of oil is high, CTL may offer a more stable and potentially cost-effective alternative for producing liquid hydrocarbon fuels from coal. This price competitiveness can drive investment in CTL projects.

- Rising petroleum product prices can heighten concerns about energy security. Countries heavily reliant on imported oil may seek to diversify their energy sources by developing CTL facilities. CTL provides a way to use domestic coal reserves to produce liquid fuels, reducing dependence on volatile international oil markets.

- CTL production can provide a degree of price stability for liquid fuels. Because coal prices tend to be more stable than oil prices, countries with abundant coal resources may use CTL to ensure a consistent supply of fuels at predictable prices. The increasing prices of petroleum products can motivate governments to invest in CTL infrastructure as part of a broader strategy to achieve national energy independence. This can be particularly important for countries with significant coal reserves but limited domestic oil production.

- The transportation sector relies heavily on petroleum-based fuels. As prices rise, industries like aviation, shipping, and long-haul trucking may seek alternative fuel sources, and CTL can provide a bridge between coal and liquid hydrocarbon fuels in these sectors. Rising oil prices can lead to increased interest in diversifying fuel sources. CTL is one of the options available to achieve this diversification and reduce exposure to oil market volatility.

Technological Advancements in Processes

- Technological innovations can increase the overall efficiency of the CTL conversion process. Enhanced gasification techniques, reactor designs, and catalyst developments can lead to higher yields and reduced energy consumption.

- Advancements in CTL technology can lower the capital and operational costs associated with building and operating CTL plants. This can make CTL more economically competitive with other fuel production methods, especially as economies of scale are achieved. Developing and implementing cleaner CTL technologies can help reduce the environmental footprint of CTL production. Carbon capture and storage (CCS) systems, as well as improved emissions controls, can mitigate the release of greenhouse gases and pollutants.

- Integrating biomass into the CTL process can create bio-CTL, which offers potential environmental benefits. Combining coal and biomass feedstocks can lead to lower carbon emissions and may be eligible for renewable fuel credits and incentives. Innovative CTL processes can utilize waste materials, such as municipal solid waste or biomass residues, as feedstock. This not only provides a sustainable source of feedstock but also contributes to waste management solutions.

Coal to Liquid Market Segment Analysis:

The Coal to Liquid market is segmented into Liquefaction Process, Product. By Liquefaction Process, the Direct Coal Liquefaction segment is Anticipated to Dominate the Market Over the Forecast period.

- Technological innovations can increase the overall efficiency of the CTL conversion process. Enhanced gasification techniques, reactor designs, and catalyst developments can lead to higher yields and reduced energy consumption.

- Advancements in CTL technology can lower the capital and operational costs associated with building and operating CTL plants. This can make CTL more economically competitive with other fuel production methods, especially as economies of scale are achieved.

- Developing and implementing cleaner CTL technologies can help reduce the environmental footprint of CTL production. Carbon capture and storage (CCS) systems, as well as improved emissions controls, can mitigate the release of greenhouse gases and pollutants.

- Integrating biomass into the CTL process can create bio-CTL, which offers potential environmental benefits. Combining coal and biomass feedstocks can lead to lower carbon emissions and may be eligible for renewable fuel credits and incentives.

- Innovative CTL processes can utilize waste materials, such as municipal solid waste or biomass residues, as feedstock. This not only provides a sustainable source of feedstock but also contributes to waste management solutions.

Coal to Liquid Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- Asia Pacific, particularly countries like China and India, possesses vast coal reserves. This abundance of coal feedstock makes it feasible for these countries to invest in CTL technologies to produce liquid hydrocarbon fuels, which helps reduce dependence on imported oil.

- Many Asian countries have historically been reliant on imported oil to meet their energy needs. CTL provides a means to enhance energy security by utilizing domestic coal resources, thereby reducing vulnerability to oil price fluctuations and supply disruptions.

- Rapid economic growth in Asia Pacific has led to increased energy demand. CTL can be seen to meet this growing demand for liquid fuels while simultaneously boosting domestic industries and job creation.

- Governments in the Asia Pacific region have provided strong support for CTL projects through policies, subsidies, and incentives. This support has encouraged investment and technological development in the CTL sector.

- Some Asian countries, notably China, have made significant strides in commercializing CTL technologies. China has several large-scale CTL plants in operation, and ongoing research and development have led to improvements in the efficiency and environmental performance of these facilities.

Coal to Liquid Market Key Players:

- TransGas Development Systems (USA)

- Headwaters, Inc. (USA)

- Eastman Chemical Company (USA)

- Calera Corporation (USA)

- Global Energy Inc. (USA)

- DKRW Energy (USA)

- Rentech (USA)

- Giga Watt (USA)

- Carbon Clean Solutions Limited (United Kingdom)

- Shenhua Group (China)

- Synfuels China (China)

- Yankuang Group (China)

- Shanxi Lu'an Group (China)

- Huaneng Group (China)

- Baofeng Energy Group (China)

- Jinmei Group (China)

- Shandong Energy Group (China)

- Anshan Iron and Steel Group (China)

- China Kingho Group (China)

- Linc Energy (Australia)

- PetroSA (South Africa)

- Sasol (South Africa)

- Cinkarna Celje (Slovenia)

- Neste (Finland), and Other Major Players.

Key Industry Developments in the Coal to Liquid Market

- In May 2023, Botswana has to develop a USD 2.5 billion facility to convert coal into liquid fuels in the diamond-rich A state oil company official told a mining conference that the Southern African country is looking to minimize its dependency on foreign gasoline.

|

Coal to Liquid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.29 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.7 % |

Market Size in 2032: |

USD 8.36 Bn. |

|

Segments Covered: |

By Liquefaction Process |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Coal to Liquid Market by By Liquefaction Process (2018-2032)

4.1 Coal to Liquid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Direct Coal Liquefaction

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Indirect Coal Liquefaction

Chapter 5: Coal to Liquid Market by By Product (2018-2032)

5.1 Coal to Liquid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diesel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gasoline

5.5 Other Fuels

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Coal to Liquid Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 FROSCH INTERNATIONAL TRAVELINC. (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EXPEDIA GROUP INC. (US)

6.4 BLACK KITE TOUR PLC (US)

6.5 GONDWANA ECOTOURS (US)

6.6 DISCOVER CORPS (US)

6.7 ROW ADVENTURES (US)

6.8 NATURAL HABITAT ADVENTURES (US)

6.9 CHEESEMANS’ ECOLOGY SAFARIS (US)

6.10 KIND TRAVELER (US)

6.11 TRAVEL LEADERS GROUP LLC (NEW YORK)

6.12 G ADVENTURES (CANADA)

6.13 RESPONSIBLE TRAVEL (UK)

6.14 STEPPES DISCOVERY (UK)

6.15 UNDISCOVERED MOUNTAINS LTD (UK)

6.16 ADVENTURE ALTERNATIVE (UK)

6.17 INTREPID GROUP LIMITED (AUSTRALIA)

6.18 SMALL WORLD JOURNEYS PTY LTD (AUSTRALIA)

6.19 KIPEPEO (INDIA)

6.20 SPITI ECOSPHERE (INDIA)

6.21 ANDBEYOND (SOUTH AFRICA)

6.22 ARACARI TRAVEL (PERU)

6.23 RICKSHAW TRAVEL GROUP (TANZANIA)

6.24 BCD TRAVEL (NETHERLANDS)

Chapter 7: Global Coal to Liquid Market By Region

7.1 Overview

7.2. North America Coal to Liquid Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Liquefaction Process

7.2.4.1 Direct Coal Liquefaction

7.2.4.2 Indirect Coal Liquefaction

7.2.5 Historic and Forecasted Market Size By By Product

7.2.5.1 Diesel

7.2.5.2 Gasoline

7.2.5.3 Other Fuels

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Coal to Liquid Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Liquefaction Process

7.3.4.1 Direct Coal Liquefaction

7.3.4.2 Indirect Coal Liquefaction

7.3.5 Historic and Forecasted Market Size By By Product

7.3.5.1 Diesel

7.3.5.2 Gasoline

7.3.5.3 Other Fuels

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Coal to Liquid Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Liquefaction Process

7.4.4.1 Direct Coal Liquefaction

7.4.4.2 Indirect Coal Liquefaction

7.4.5 Historic and Forecasted Market Size By By Product

7.4.5.1 Diesel

7.4.5.2 Gasoline

7.4.5.3 Other Fuels

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Coal to Liquid Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Liquefaction Process

7.5.4.1 Direct Coal Liquefaction

7.5.4.2 Indirect Coal Liquefaction

7.5.5 Historic and Forecasted Market Size By By Product

7.5.5.1 Diesel

7.5.5.2 Gasoline

7.5.5.3 Other Fuels

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Coal to Liquid Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Liquefaction Process

7.6.4.1 Direct Coal Liquefaction

7.6.4.2 Indirect Coal Liquefaction

7.6.5 Historic and Forecasted Market Size By By Product

7.6.5.1 Diesel

7.6.5.2 Gasoline

7.6.5.3 Other Fuels

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Coal to Liquid Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Liquefaction Process

7.7.4.1 Direct Coal Liquefaction

7.7.4.2 Indirect Coal Liquefaction

7.7.5 Historic and Forecasted Market Size By By Product

7.7.5.1 Diesel

7.7.5.2 Gasoline

7.7.5.3 Other Fuels

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Coal to Liquid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.29 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.7 % |

Market Size in 2032: |

USD 8.36 Bn. |

|

Segments Covered: |

By Liquefaction Process |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Coal to Liquid Market research report is 2024-2032.

Sasol (South Africa), Shenhua Group (China), Synfuels China (China), PetroSA (South Africa), Yankuang Group (China), DKRW Energy (USA), Shanxi Lu'an Group (China), Cinkarna Celje (Slovenia), TransGas Development Systems (USA), Huaneng Group (China), Baofeng Energy Group (China), Jinmei Group (China), Giga Watt (USA), Linc Energy (Australia), Rentech (USA), Shandong Energy Group (China), DKRW Advanced Fuels (USA), Anshan Iron and Steel Group (China), Headwaters, Inc. (USA), Eastman Chemical Company (USA), Calera Corporation (USA), Global Energy Inc. (USA), Carbon Clean Solutions Limited (United Kingdom), China Kingho Group (China), Neste (Finland), and Other Major Players.

The Coal to Liquid Market is segmented into Liquefaction Process, Product, and region. By Liquefaction Process, the market is categorized into Direct Coal Liquefaction, Indirect Coal Liquefaction. By Product, the market is categorized into Diesel, Gasoline, Other Fuels. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Coal is an important fuel utilized worldwide to generate electricity, while petroleum fuels are commonly utilized in vehicles. Coal and petroleum fuels both majorly possess carbon, which makes the conversion of coal to liquid fuel more feasible. The production of liquid fuel from coal is also known as coal-to-liquid (CTL) technology or coal liquefaction. In this process, the produced liquid is a high-grade, clean fuel suitable for use in transport.

The Coal To Liquid Market was valued at USD 4.29 Billion in 2023 and is projected to reach USD 8.36 Billion by 2032, growing at a CAGR of 7.7% from 2024 to 2032.