Cocoa & Chocolate Market Synopsis

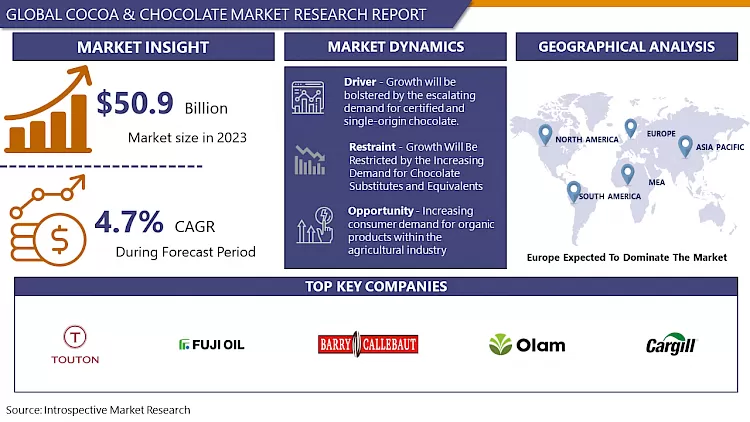

Cocoa & Chocolate Market Size Was Valued at USD 50.9 Billion in 2023, and is Projected to Reach USD 77.0 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.

Chocolate is cocoa, and cocoa is chocolate, but natural chocolate is cocoa with contamination. They said that cocoa is gotten from cocoa pod same way chocolates are produced. Although, cocoa butter is not obtained from chocolate. In this regard, the chocolate acquires the velvety, glamorous feeling from cocoa butter.

Following cocoa butter extraction, a part of the fragments of the roasted beans is milled into cocoa mass or powder. Most products that involve cocoa processing employ cocoa powder such as beverage production, confectionery fillings, ice creams and the like. While cocoa powder can of course, be usually bought in any store. Chocolate in a solid form is confectioned by putting together cocoa butter, cocoa fluid and sugar. The classification of chocolate depends on the proportion of cocoa liquor included in the chocolate recipe. Chocolate has a very high caloric, fat, and sugar content, which is most due to cocoa butter. Different forms of chocolates include the unsweetened, the semisweet or the sweet, dark, milk, white as well as the compound chocolates. There are many types of chocolate including, and not limited to bars, tiny beads, liquid and powder. The growth of cocoa and chocolate industry is fuelled by the higher volume during holiday seasons, increased use of chocolate as functional food, and increasing use of dark and ruby chocolate. Chocolates are now being given commonly as holiday gifts, and this has to a great extent led to a rise in chocolate sales. The innumerable variety of chocolates of different taste and affordable price ranges makes chocolate celebrations popular as gifts in the modern world.

- Cocoa is a product obtained from cocoa tree seeds. Cocoa originated mainly from Asia and Oceania but has now grown to cover nearly all the tropical areas in the world, including the West and the Central Africa and the Africa. The cocoa seeds are used to process a number of products such as cocoa liquor, cocoa butter and cocoa flour.

- The market for chocolate confectionery in the global market has continuously growing thanks to its sustainable growth path. The proportion of the global grindings has significantly grown and boosted the use of cocoa ingredients around the globe.

- Also some novelties as the new products penetrating to different segments in the culinary business act as catalysts for increasing the consumers’ demand on cocoa and chocolates. In the beverage, confectionery and confectionery industries, the flavor of chocolate has gone on to remain the most introduced. Further, it remains a common product in confectionery and beverage markets up to the present time. Based on this trend, it can be forecasted that the market growth in this industry should continue indefinitely.

Cocoa & Chocolate Market Trend Analysis

Increased demand for chocolate confections will propel market expansion.

- The worldwide market for cocoa and chocolate is predominantly driven by the rising demand for chocolate confectionery. In recent years, emerging economies have witnessed an increase in the demand for chocolate confectioneries, which can be attributed to increasing consumer spending on indulgent confectionery products, particularly chocolate confectioneries. It is anticipated that the increasing desire for molded and countline chocolates in developed economies will have a positive impact on the chocolate confectionery industry.

- The development of this industry is anticipated to be facilitated by the addition of new chocolate varieties to the portfolios of key manufacturers, including dark chocolate and ruby chocolate. Additionally, the increasing practice of bestowing chocolates as gifts during the holiday season is anticipated to significantly contribute to the chocolate confectionery market's expansion over the forecast period.

Supportive Demand for Specialty Chocolate Products to Encourage Progress and Innovation

- In recent years, there has been a noticeable surge in the desire for a premium or specialty chocolates, particularly in developed nations such as the United States, France, Belgium, and Germany. It is anticipated that there will be a progressive increase in the forthcoming years. A chief motivator is the growing inclination of consumers to ascertain the provenance of every ingredient utilized in chocolate products. It can be caused by a variety of factors, including vegan preferences and lactose intolerance of specific components. Additionally, products crafted from organic cocoa seeds are in high demand. These elements are anticipated to promote the expansion of specialty chocolates.

- The growing preference for organic and clean-label products as a means to promote holistic health and well-being has resulted in an elevated need for dark and sugar-free chocolates. In the coming years, the growing consciousness surrounding labor welfare is anticipated to contribute to the continued surge in demand for fair-traded cocoa.

Cocoa & Chocolate Market Segment Analysis:

Cocoa & Chocolate Market Segmented based on type, product, nature, applications, and distribution channels.

By product, the traditional segment is expected to dominate the market during the forecast period

- The market is anticipated to be dominated by the traditional segment throughout the forecast period. White chocolate, milk chocolate, and dark chocolate are included. The increased accessibility, popularity, and market penetration of cocoa in comparison to carob, the raw material utilized in artificial chocolate, account for this phenomenon. Given its early entry into the market, milk chocolate is the prevailing variety among the diverse range of traditional chocolates.

- The CAGR for artificial chocolate is anticipated to be the highest during the forecast period. The exponential expansion can be ascribed to the absence of caffeine in carob candies, which renders them appropriate for individuals who are sensitive to caffeine. Furthermore, carob contains nearly three times as much calcium as cocoa. This contributes to its widespread appeal, especially among women and individuals suffering from calcium deficiencies.

By application, the Food and beverages segment held the largest share in 2023

- The demand for cocoa and chocolate is anticipated to increase in tandem with rising consumer health consciousness and rising consumption of confectionary items such as chocolate-infused cookies, doughnuts, cupcakes, rolls, sweet rolls, cakes, pies, and coffee cakes.

- Increasing demand within the beverage industry is also anticipated to contribute to the expansion of the market. The demand is predominantly determined by consumer preference in beverage selection, which is significantly impacted by the flavor profile of the beverage. Diverse product offerings, including chocolate syrups and chocolate-infused alcoholic beverages, are expanding the market's selection of cocoa-based beverages, thereby contributing to the segment's expansion. This, in conjunction with increasing the cocoa content to decrease the sugar content of a beverage, enables previously untapped consumer segments to prefer chocolate beverages to those sweetened artificially.

Cocoa & Chocolate Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- The European market is the greatest producer of chocolate on a global scale and one of the largest importers of cocoa. Increasing consumer preference for chocolates over other delicacies for celebrations and health-conscious consumption, as well as a rising consumer trend toward niche chocolates such as the bean-to-bar concept of chocolates from a singular origin, are driving market expansion. This, coupled with the availability of a wide variety of cocoa yields in Europe, has encouraged chocolate manufacturers to enter the premium chocolate sector and develop specialized products.

- It is expected that Europe will experience a rise in the demand for cocoa and chocolate due to the existence of established market participants. Additionally, Europe is a significant cacao producer. This is anticipated to stimulate the expansion of the regional market.

- The market is anticipated to be dominated by North America throughout the forecast period. The increasing demand for chocolate in North America is concurrently propelling the expansion of cocoa in the area, given that cocoa serves as the primary basic material in the chocolate manufacturing process. Furthermore, the escalating consumer demand for chocolate generates a corresponding need for cocoa butter, which imparts the chocolate with its delectable texture.

Active Key Players in the Cocoa & Chocolate Market

- Barry Callebaut, AG (Switzerland)

- Cargill, Inc. (U.S.)

- Olam International (Singapore)

- Fuji Oil Company Ltd. (Japan)

- ECOM Agroindustrial Corporation Ltd. (Switzerland)

- Cocoa Processing Co. Ltd. (Ghana)

- Touton S.A. (France)

- Niche Cocoa Industry Ltd. (Ghana)

- BD Associates Ghana Ltd. (Ghana)

- Mars, Inc. (USA)

- Mondelez International (USA)

- Nestlé S.A. (Switzerland)

- Hershey Company (USA)

- Ferrero Group (Italy)

- PLOT Enterprise Ghana Limited (Ghana), and Other Key Players

Key Industry Developments in the Cocoa & Chocolate Market:

- In April 2024, Cargill's alternative cocoa collaboration took off as cocoa prices climbed. Partnering with Voyage Foods, Cargill aimed to scale up alternatives to cocoa-based products to satisfy consumers' indulgence needs. This commercial partnership also provided food manufacturers with nut spreads formulated without nut or dairy allergens.

- In March 2024, PROBAT acquired Royal Duyvis Wiener, significantly strengthening its position in the cocoa and chocolate sector. With the integration of Royal Duyvis Wiener, PROBAT bolstered its stance in product and process innovation, expanding its technological lead in the food processing sector. The technology transfer between the individual group members was significantly intensified to exploit synergies and create integrated solutions for cross-segment projects. The aim was to further increase market share in the global cocoa and chocolate sector.

|

Global Cocoa & Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 50.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 77.0 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Nature |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cocoa & Chocolate Market by By Type (2018-2032)

4.1 Cocoa & Chocolate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cocoa Butter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cocoa Powder

4.5 Cocoa Liquor

Chapter 5: Cocoa & Chocolate Market by By Product (2018-2032)

5.1 Cocoa & Chocolate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Traditional

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Artificial

Chapter 6: Cocoa & Chocolate Market by By Nature (2018-2032)

6.1 Cocoa & Chocolate Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Organic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Conventional

Chapter 7: Cocoa & Chocolate Market by By Application (2018-2032)

7.1 Cocoa & Chocolate Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Confectionery

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Food and beverages

7.5 Bakery

7.6 Pharma

7.7 Animal Feed

7.8 Others

Chapter 8: Cocoa & Chocolate Market by By Distribution Channel (2018-2032)

8.1 Cocoa & Chocolate Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarket & Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Convenience Stores

8.5 Online

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Cocoa & Chocolate Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ENERGY STAR (U.S)

9.4

9.5

9.6 FAGOR (U.S)

9.7

9.8

9.9 HOBART (U.S)

9.10

9.11

9.12 INSINGER (U.S)

9.13

9.14

9.15 JACKSON U.S)

9.16

9.17

9.18 KATOM RESTAURANT SUPPLY (U.S)

9.19

9.20

9.21 KNIGHT (U.S)

9.22

9.23

9.24 COSTCO WHOLESALE CANADA LTD (CANADA)

9.25

9.26

9.27 MIELE (GERMANY)

9.28

9.29

9.30 TEIKOS (ITALY)

9.31

9.32

9.33 EASICOOK (AUSTRIA)

9.34

9.35

9.36 AVENTUS GROUP LTD (LITHUANIA)

9.37

9.38

9.39 ELECTROLUX (SWEDEN)

9.40

9.41

9.42 CLASSEQ (U.K)

9.43

9.44

9.45 CMA (U.K)

9.46

9.47

9.48 JLA (U.K)

9.49

9.50

9.51 MEIKO (JAPAN)

9.52

9.53

9.54 WASHTECH (AUSTRALIA)

9.55

Chapter 10: Global Cocoa & Chocolate Market By Region

10.1 Overview

10.2. North America Cocoa & Chocolate Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Cocoa Butter

10.2.4.2 Cocoa Powder

10.2.4.3 Cocoa Liquor

10.2.5 Historic and Forecasted Market Size By By Product

10.2.5.1 Traditional

10.2.5.2 Artificial

10.2.6 Historic and Forecasted Market Size By By Nature

10.2.6.1 Organic

10.2.6.2 Conventional

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Confectionery

10.2.7.2 Food and beverages

10.2.7.3 Bakery

10.2.7.4 Pharma

10.2.7.5 Animal Feed

10.2.7.6 Others

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Supermarket & Hypermarkets

10.2.8.2 Convenience Stores

10.2.8.3 Online

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Cocoa & Chocolate Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Cocoa Butter

10.3.4.2 Cocoa Powder

10.3.4.3 Cocoa Liquor

10.3.5 Historic and Forecasted Market Size By By Product

10.3.5.1 Traditional

10.3.5.2 Artificial

10.3.6 Historic and Forecasted Market Size By By Nature

10.3.6.1 Organic

10.3.6.2 Conventional

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Confectionery

10.3.7.2 Food and beverages

10.3.7.3 Bakery

10.3.7.4 Pharma

10.3.7.5 Animal Feed

10.3.7.6 Others

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Supermarket & Hypermarkets

10.3.8.2 Convenience Stores

10.3.8.3 Online

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Cocoa & Chocolate Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Cocoa Butter

10.4.4.2 Cocoa Powder

10.4.4.3 Cocoa Liquor

10.4.5 Historic and Forecasted Market Size By By Product

10.4.5.1 Traditional

10.4.5.2 Artificial

10.4.6 Historic and Forecasted Market Size By By Nature

10.4.6.1 Organic

10.4.6.2 Conventional

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Confectionery

10.4.7.2 Food and beverages

10.4.7.3 Bakery

10.4.7.4 Pharma

10.4.7.5 Animal Feed

10.4.7.6 Others

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Supermarket & Hypermarkets

10.4.8.2 Convenience Stores

10.4.8.3 Online

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Cocoa & Chocolate Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Cocoa Butter

10.5.4.2 Cocoa Powder

10.5.4.3 Cocoa Liquor

10.5.5 Historic and Forecasted Market Size By By Product

10.5.5.1 Traditional

10.5.5.2 Artificial

10.5.6 Historic and Forecasted Market Size By By Nature

10.5.6.1 Organic

10.5.6.2 Conventional

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Confectionery

10.5.7.2 Food and beverages

10.5.7.3 Bakery

10.5.7.4 Pharma

10.5.7.5 Animal Feed

10.5.7.6 Others

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Supermarket & Hypermarkets

10.5.8.2 Convenience Stores

10.5.8.3 Online

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Cocoa & Chocolate Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Cocoa Butter

10.6.4.2 Cocoa Powder

10.6.4.3 Cocoa Liquor

10.6.5 Historic and Forecasted Market Size By By Product

10.6.5.1 Traditional

10.6.5.2 Artificial

10.6.6 Historic and Forecasted Market Size By By Nature

10.6.6.1 Organic

10.6.6.2 Conventional

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Confectionery

10.6.7.2 Food and beverages

10.6.7.3 Bakery

10.6.7.4 Pharma

10.6.7.5 Animal Feed

10.6.7.6 Others

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Supermarket & Hypermarkets

10.6.8.2 Convenience Stores

10.6.8.3 Online

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Cocoa & Chocolate Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Cocoa Butter

10.7.4.2 Cocoa Powder

10.7.4.3 Cocoa Liquor

10.7.5 Historic and Forecasted Market Size By By Product

10.7.5.1 Traditional

10.7.5.2 Artificial

10.7.6 Historic and Forecasted Market Size By By Nature

10.7.6.1 Organic

10.7.6.2 Conventional

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Confectionery

10.7.7.2 Food and beverages

10.7.7.3 Bakery

10.7.7.4 Pharma

10.7.7.5 Animal Feed

10.7.7.6 Others

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Supermarket & Hypermarkets

10.7.8.2 Convenience Stores

10.7.8.3 Online

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Cocoa & Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 50.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 77.0 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Nature |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cocoa & Chocolate Market research report is 2024-2032.

Barry Callebaut, AG (Switzerland) Cargill, Inc. (U.S.) Olam International (Singapore) Fuji Oil Company Ltd. (Japan) ECOM Agroindustrial Corporation Ltd. (Switzerland) Cocoa Processing Co. Ltd. (Ghana) Touton S.A. (France) Niche Cocoa Industry Ltd. (Ghana) BD Associates Ghana Ltd. (Ghana) PLOT Enterprise Ghana Limited (Ghana), and Other Major Players.

The Cocoa & Chocolate Market is segmented into type, product, nature, applications, distribution channels, and region. By type, the market is categorized into Cocoa Butter, Cocoa Powder, and Cocoa Liquor. By product, the market is categorized into Traditional and Artificial. By nature, the market is categorized into Organic and Conventional. By applications, the market is categorized into Confectionery, Food and beverages, Bakery, Pharma, Animal Feed, and Others. By distribution channels, the market is categorized into Supermarket & Hypermarkets, Convenience Stores, and Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cocoa is a pure and unaltered variety of chocolate. Chocolate, which is produced from cocoa seeds, undergoes the same manufacturing process as cocoa. Nevertheless, cocoa butter remains in chocolate. Cocoa butter enhances the velvety and opulent texture of chocolate.

The Cocoa & Chocolate Market Size Was Valued at USD 50.9 Billion in 2023, and is Projected to Reach USD 77.0 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.