Colorectal Cancer Screening Market Synopsis:

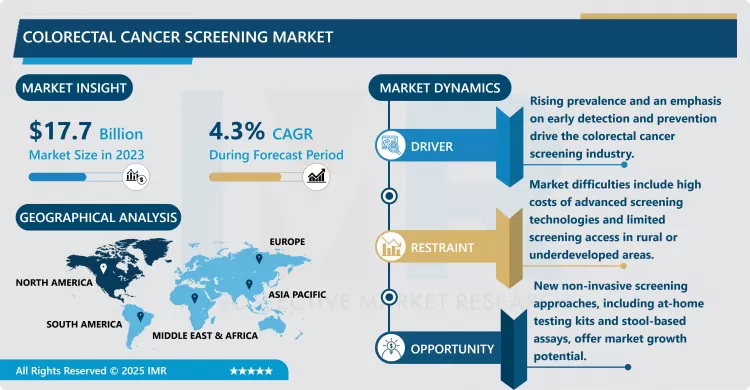

Colorectal Cancer Screening Market Size Was Valued at USD 17.7 Billion in 2023, and is Projected to Reach USD 25.9 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

The colorectal cancer screening market is growing gradually owing to high incidence rates of colorectal cancer (CRC) across the world and higher awareness about screening. Colorectal cancer has ranked high among the globally leading cancer-related deaths, and screening serves a useful function in minimizing the mortality rate by I identified prevention, and treatment at early stages. Market growth is also evident by coming up with enhanced screening tools including non invasive tests, liquid biopsies, and Stool DNA tests compared to conventional colonoscopies and sigmoidoscopies with precision enhancements.

Another factor which nudges the growth of the colorectal cancer screening market is the rise in population based screening programs across many countries.. These programs are intended to identify abnormal cells or carcinomas that have not yet disseminated when the patients have no symptoms; they often begin at the age of fifty, or earlier, in cases where the client is at risk. Besides the conventional approaches, there is new features like home-based screening tools through a kit to check for colorectal cancer, which are accepted especially in the developed countries. Such innovations have made it easier to have minimal screening hitches, enhanced participation and generally manipulated screening program efficiency.• However, there is still room for difficulty: imperfections in the availability for screening programs still prevail in this sphere, particularly in LMICs, as well as high prices for new diagnostic methods.with no symptoms, typically starting at age 50 or earlier for those at higher risk. In addition to traditional methods, novel approaches like at-home testing kits, which allow individuals to screen for colorectal cancer privately, have gained traction, especially in developed markets. Such innovations have helped to reduce screening barriers, increase participation rates, and improve the overall efficacy of screening programs.

Despite the positive outlook, challenges in the colorectal cancer screening market remain, including disparities in access to screening programs, particularly in low- and middle-income countries, and the high costs associated with advanced diagnostic tests. Still, the growing emphasis on new research for better and cheaper screening methods should make the market for Mammography equipment grow manifold in the future. There are likely to be higher subsequent government actions, more feverish awareness crusades, and much more development in diagnostic equipments to make early CRC detection reachable to a larger populace.

Colorectal Cancer Screening Market Trend Analysis:

Rising Popularity of Non-Invasive Screening Methods

- A major trend of the colorectal cancer screening industry is the shift towards non-invasive techniques of screening.. This is because technologies like stool-based test (for instance the, Fecal Immunochemical tests, FIT) as well as liquid biopsies are considered to be more invasive than traditional approaches like Colonoscopes. Unlike these traditional tests that involve invasive procedures like endoscopy, colonoscopy or sigmoidoscopy that require a protracted stay in the hospital, these tests are simpler since they identify special biomarkers or DNA modifications relating to colorectal cancer; and through enhancing and promoting more complicated participation in screening programs since they are less painful or embarrassing for patients; hence boosting early detection and prevention.

Growing Use of At-Home Testing Kits

- Another growing development is consumer-based fecal occult blood test or home-based colorectal cancer tests.. These tests allow people to self-administer collection of samples from home and post it for analysis decreasing the barriers to screening. As more people get to understand the disease and test developers improve on the accuracy of the test, at home kits are considered as a better option than clinic based methods among those who are shy to undergo invasive procedures and those in areas that doctors and good equipment are hard to come by. The increasing accessibility and reliability of these home-based tests are thought to enhance the demand for overall colorectal cancer screening.

Colorectal Cancer Screening Market Segment Analysis:

Colorectal Cancer Screening Market is Segmented on the basis of Screening Tests, End User, and Region

By Screening Tests, Stool-based Tests segment is expected to dominate the market during the forecast period

- By types of screening tests, colorectal cancer screening market comprises of stool-based tests like fecal occult blood tests, guaiac fecal occult tests, and sigmoidoscopy, colonoscopy, CT colonography, other flexible sigmoidoscopy, and other tests.. Fecal tests including the FIT and FOBT are non invasive, specific and relatively cheaper that makes them ideal for initial screening. Colonoscopy remains the most effective method of colorectal cancer screening as well as the only method allowing for both diagnosis and polypectomy. CT colonography or virtual colonoscopy is an emerging, less invasive technique compared to traditional colonoscopy and is accepted due to its accuracy in detecting lesion formation. Flexible sigmoidoscopy, in which the colonoscopist examines only the lower part of the colon, is less invasive but equally efficient and frequently employed as the first step of screening in combination with fecal tests. There also several other forms of screening such as genetic and molecular screening which are also being developed as other methods to add in the form of screening and improve the early detection manners. These carcinoma screening tests have their own benefits and this may have led to enhancement of usage of colorectal cancer screening in various patient groups.

By End User, Hospitals segment expected to held the largest share

- In the colorectal cancer screening market, the end-user segment distribution is mainly between hospital, specialist clinics and other medical. Hospitals are the largest end-user segment because they use innovative diagnostic technologies and treat a large population of patients who require a variety of screening techniques such as colonoscopies or other imaging test. Another facet in the market is affiliated specialty clinics that have direct access to the patient population to offer preventive and screening services for high-risk populations in a more specialty centric setup. The “Others” is comprised of diagnostic laboratories, at- home testing services, and other suitable settings where colorectal cancer screening can be performed also adding to the increase of non invasive and home-based testing. All these end-user segments have been identified to be experiencing a constant rise in its demand for early detection of colorectal cancer.

Colorectal Cancer Screening Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to hold the largest share in the colorectal cancer screening market due to high awareness, better healthcare facilities and government affirmative measures for screening.. Colorectal cancer screening programs, therefore, have elaborate guidelines on when people should begin screening in the United States and many other countries, due to the rising rates of participation among people below the previous recommended age of 50. Also, aspiring to leadership is the ready availability in the region of modern methods of screening, including the liquid biopsy and self-collected tests. North America is better prepared due to its strong and efficient healthcare facilities, high insurance penetration, and ongoing crusade against CRC mortality predicting a continuing dominance in the global market over the forecast period.

Active Key Players in the Colorectal Cancer Screening Market:

- Polymedco Inc. (USA),

- Eiken Chemical Co. Ltd. (Japan),

- Sysmex Corporation (Japan),

- Siemens Healthineers AG (Germany),

- Quidel Corporation (USA),

- Novigenix SA (Switzerland),

- Hemosure Inc. (USA),

- Exact Sciences Corp. (USA),

- Epigenomics Inc. (USA),

- Olympus Corporation (Japan),

- Clinical Genomics Technologies Pty Ltd. (Australia),

- Exact Sciences Corporation (USA),

- Clinical Genomics (Australia),

- Guardant Health, Inc. (USA),

- Hemosure Inc. (USA),

- Geneoscopy, Inc. (USA)

- Other Active Players

|

Colorectal Cancer Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.7 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 25.9 Billion |

|

Segments Covered: |

By Screening Tests |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Colorectal Cancer Screening Market by By Screening Tests (2018-2032)

4.1 Colorectal Cancer Screening Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stool-based Tests

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Colonoscopy

4.5 CT Colonography

4.6 Flexible Sigmoidoscopy

4.7 Others

Chapter 5: Colorectal Cancer Screening Market by By End User (2018-2032)

5.1 Colorectal Cancer Screening Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Specialty Clinics

5.5 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Colorectal Cancer Screening Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 POLYMEDCO INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EIKEN CHEMICAL CO. LTD. (JAPAN)

6.4 SYSMEX CORPORATION (JAPAN)

6.5 SIEMENS HEALTHINEERS AG (GERMANY)

6.6 QUIDEL CORPORATION (USA)

6.7 NOVIGENIX SA (SWITZERLAND)

6.8 HEMOSURE INC. (USA)

6.9 EXACT SCIENCES CORP. (USA)

6.10 EPIGENOMICS INC. (USA)

6.11 OLYMPUS CORPORATION (JAPAN)

6.12 CLINICAL GENOMICS TECHNOLOGIES PTY LTD. (AUSTRALIA)

6.13 EXACT SCIENCES CORPORATION (USA)

6.14 CLINICAL GENOMICS (AUSTRALIA)

6.15 GUARDANT HEALTH INC. (USA)

6.16 HEMOSURE INC. (USA)

6.17 GENEOSCOPY INC. (USA)

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Colorectal Cancer Screening Market By Region

7.1 Overview

7.2. North America Colorectal Cancer Screening Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Screening Tests

7.2.4.1 Stool-based Tests

7.2.4.2 Colonoscopy

7.2.4.3 CT Colonography

7.2.4.4 Flexible Sigmoidoscopy

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size By By End User

7.2.5.1 Hospitals

7.2.5.2 Specialty Clinics

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Colorectal Cancer Screening Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Screening Tests

7.3.4.1 Stool-based Tests

7.3.4.2 Colonoscopy

7.3.4.3 CT Colonography

7.3.4.4 Flexible Sigmoidoscopy

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size By By End User

7.3.5.1 Hospitals

7.3.5.2 Specialty Clinics

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Colorectal Cancer Screening Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Screening Tests

7.4.4.1 Stool-based Tests

7.4.4.2 Colonoscopy

7.4.4.3 CT Colonography

7.4.4.4 Flexible Sigmoidoscopy

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size By By End User

7.4.5.1 Hospitals

7.4.5.2 Specialty Clinics

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Colorectal Cancer Screening Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Screening Tests

7.5.4.1 Stool-based Tests

7.5.4.2 Colonoscopy

7.5.4.3 CT Colonography

7.5.4.4 Flexible Sigmoidoscopy

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size By By End User

7.5.5.1 Hospitals

7.5.5.2 Specialty Clinics

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Colorectal Cancer Screening Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Screening Tests

7.6.4.1 Stool-based Tests

7.6.4.2 Colonoscopy

7.6.4.3 CT Colonography

7.6.4.4 Flexible Sigmoidoscopy

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size By By End User

7.6.5.1 Hospitals

7.6.5.2 Specialty Clinics

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Colorectal Cancer Screening Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Screening Tests

7.7.4.1 Stool-based Tests

7.7.4.2 Colonoscopy

7.7.4.3 CT Colonography

7.7.4.4 Flexible Sigmoidoscopy

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size By By End User

7.7.5.1 Hospitals

7.7.5.2 Specialty Clinics

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Colorectal Cancer Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.7 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 25.9 Billion |

|

Segments Covered: |

By Screening Tests |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Colorectal Cancer Screening Market research report is 2024-2032.

Polymedco Inc. (USA), Eiken Chemical Co. Ltd. (Japan), Sysmex Corporation (Japan), Siemens Healthineers AG (Germany), Quidel Corporation (USA), Novigenix SA (Switzerland), Hemosure Inc. (USA), Exact Sciences Corp. (USA), Epigenomics Inc. (USA), Olympus Corporation (Japan), Clinical Genomics Technologies Pty Ltd. (Australia), Exact Sciences Corporation (USA), Clinical Genomics (Australia), Guardant Health, Inc. (USA), Hemosure Inc. (USA), Geneoscopy, Inc. (USA), and Other Active Players.

The Colorectal Cancer Screening Market is segmented into By Screening Tests, End User and region. By Screening Tests (Stool-based Tests, Colonoscopy, CT Colonography , Flexible Sigmoidoscopy, Others), By End User (Hospitals, Specialty Clinics, Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Colorectal cancer screening refers to the process of testing individuals for signs of colorectal cancer (CRC) or precancerous conditions, often before symptoms appear, to enable early detection and prevention. It includes various methods such as fecal occult blood tests (FOBT), fecal immunochemical tests (FIT), colonoscopy, sigmoidoscopy, and more recently, non-invasive tests like stool DNA tests and liquid biopsies. Screening aims to identify abnormalities in the colon and rectum, such as polyps or early-stage cancers, which can be treated more effectively when detected early. Regular screening is recommended, particularly for individuals over 50 years of age or those at higher risk, as early detection significantly reduces mortality rates from CRC.

Colorectal Cancer Screening Market Size Was Valued at USD 17.7 Billion in 2023, and is Projected to Reach USD 25.9 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.