Commercial Electric Vehicle Market Synopsis

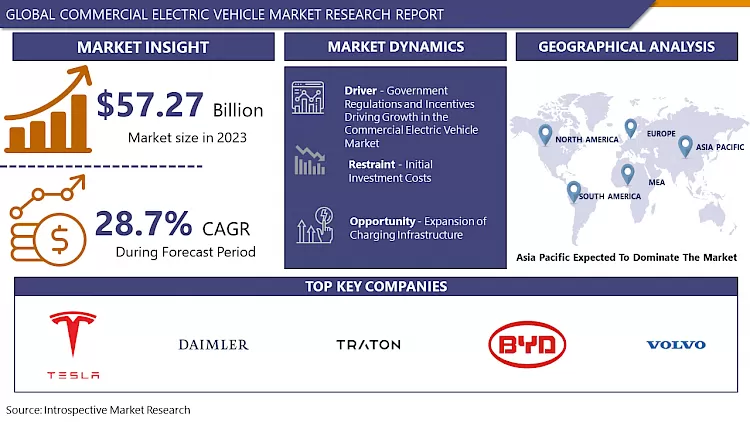

Commercial Electric Vehicle Market Size Was Valued at USD 57.27 Billion in 2023 and is Projected to Reach USD 391.21 Billion by 2032, Growing at a CAGR of 28.7% From 2024-2032.

A commercial electric vehicle (EV) is a type of vehicle that is powered by electricity and designed for commercial purposes such as transporting goods, passengers, or performing specific tasks. These vehicles can include electric trucks, vans, buses, delivery vehicles, and specialized vehicles for various industries such as construction, agriculture, and logistics. Commercial EVs offer benefits such as lower operating costs, reduced emissions, and quieter operation compared to traditional internal combustion engine vehicles, making them increasingly popular for businesses looking to reduce their environmental footprint and operating expenses.

- The commercial electric vehicle market has experienced remarkable growth driven by a combination of factors including increasing environmental awareness, government incentives promoting clean energy initiatives, and advancements in battery technology. As businesses and governments seek to reduce carbon emissions and operational costs, there's been a significant shift towards electric alternatives in sectors such as delivery, logistics, and public transportation. Companies like Tesla, Rivian, and established automakers have been investing heavily in developing electric vans, trucks, and buses tailored to commercial use, offering enhanced efficiency and lower maintenance costs over their traditional counterparts. With expanding infrastructure for charging stations and ongoing innovations in battery technology to extend range and improve performance, the commercial electric vehicle market is poised for continued expansion and innovation in the years ahead.

- The environmental concerns and technological advancements, shifting consumer preferences and regulatory changes have also played a crucial role in driving the growth of the commercial electric vehicle market. Businesses are increasingly recognizing the value of adopting sustainable practices not only to meet consumer expectations but also to comply with stricter emissions regulations imposed by governments worldwide.

- The total cost of ownership for electric vehicles, including lower fuel and maintenance expenses, is becoming increasingly competitive compared to traditional fossil fuel-powered vehicles. This financial incentive, coupled with the long-term sustainability benefits, is further incentivizing businesses to make the switch to electric fleets. As the commercial electric vehicle market continues to evolve, collaborations between automakers, energy companies, and policymakers will be essential to overcome challenges such as range anxiety, charging infrastructure expansion, and the integration of renewable energy sources for sustainable fleet operations. Through collaborative efforts and ongoing innovation, the commercial electric vehicle sector is poised to revolutionize transportation and contribute significantly to global efforts to combat climate change.

Commercial Electric Vehicle Market Trend Analysis:

Increasing Adoption of Battery Swapping Technology

- Battery swapping technology is poised to revolutionize the commercial electric vehicle (EV) market due to its potential to address key challenges such as range anxiety, long charging times, and infrastructure limitations. This technology allows EV operators to quickly exchange depleted batteries for fully charged ones, significantly reducing downtime compared to traditional charging methods. As governments worldwide push for decarbonization and stricter emission regulations, businesses are increasingly turning to electric fleets to meet sustainability goals. Battery swapping offers a compelling solution for fleet operators, particularly in sectors like logistics, where minimizing vehicle downtime is crucial for maintaining efficient operations.

- Moreover, the scalability and flexibility of battery swapping stations make them adaptable to various locations, including urban centers and remote areas, further driving adoption across diverse market segments. With advancements in battery technology and infrastructure development, battery swapping is poised to play a pivotal role in accelerating the transition towards sustainable transportation and shaping the future of the commercial EV market.

Expansion of Charging Infrastructure

- The expansion of charging infrastructure is pivotal for the burgeoning commercial electric vehicle (EV) market. As businesses increasingly embrace sustainability goals and governments enact stricter emissions regulations, the demand for electric commercial vehicles is on the rise. However, the widespread adoption of these vehicles hinges on the availability of robust charging infrastructure capable of supporting their operational needs. Establishing an extensive network of charging stations across key transportation routes, urban centers, and industrial hubs is essential to alleviate range anxiety among commercial fleet operators and encourage the transition to electric.

- Moreover, investing in fast-charging technologies and smart grid solutions can optimize charging efficiency and minimize downtime for commercial EVs, enhancing their competitiveness against traditional fossil fuel vehicles. Collaboration between governments, businesses, and utilities is critical to overcoming the financial, logistical, and regulatory challenges associated with scaling up charging infrastructure. Ultimately, a comprehensive and accessible charging ecosystem will not only accelerate the electrification of commercial fleets but also contribute significantly to reducing greenhouse gas emissions and mitigating the impacts of climate change.

Commercial Electric Vehicle Market Segment Analysis:

Commercial Electric Vehicle Market Segmented based on Vehicle Type, Propulsion and End Users.

By Vehicle Type, Vans segment is expected to dominate the market during the forecast period

- Bus: Electric buses are gaining popularity, especially in urban areas, due to their lower operating costs, reduced emissions, and government incentives. Municipalities and private operators are increasingly investing in electric buses to modernize their fleets and meet sustainability goals.

- Trucks: Electric trucks, including delivery trucks, freight trucks, and refuse trucks, are becoming more prevalent as advancements in battery technology extend their range and improve their hauling capabilities. Companies are attracted to electric trucks for their potential long-term cost savings and environmental benefits.

- Pick-up Trucks: Electric pick-up trucks are seeing growing interest, particularly in the consumer market, driven by the success of models like the Tesla Cybertruck and Rivian R1T. However, commercial applications, such as utility companies and construction firms, are also exploring electric pick-up trucks for their fleets, attracted by their versatility and lower operating costs.

- Vans: Electric vans are increasingly being used for urban delivery and last-mile logistics. With the rise of e-commerce and demand for quick deliveries, businesses are turning to electric vans to reduce their carbon footprint and comply with emissions regulations in city centers.

By Propulsion, Battery Electric Vehicles (BEVs) segment held the largest share of XX% in 2023

- Battery Electric Vehicles (BEVs):BEVs are powered solely by electricity stored in onboard batteries. They produce zero tailpipe emissions. They have gained significant popularity due to advancements in battery technology, offering longer ranges and faster charging times.In the commercial sector, BEVs are commonly used for last-mile delivery vehicles, city buses, and light-duty trucks.

- Plug-in Hybrid Electric Vehicles (PHEVs):PHEVs combine an internal combustion engine (ICE) with an electric motor and a battery. They can be charged via an external power source and also use regenerative braking to recharge the battery.PHEVs offer both electric and hybrid driving modes, providing flexibility and extended range compared to BEVs.In the commercial sector, PHEVs are suitable for applications where longer ranges are necessary, such as delivery routes that extend beyond typical electric vehicle ranges.

- Fuel Cell Electric Vehicles (FCEVs):FCEVs use hydrogen as fuel and employ fuel cells to generate electricity, which powers the vehicle's electric motor. The only emission from FCEVs is water vapor.FCEVs offer longer ranges and shorter refueling times compared to battery-electric vehicles.In the commercial sector, FCEVs are gaining traction in applications like heavy-duty trucks and buses, where long ranges and quick refueling are essential.

Commercial Electric Vehicle market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is poised to assert its dominance in the commercial electric vehicle (EV) market over the forecast period. This momentum can be attributed to several key factors. Firstly, the region's growing urbanization and industrialization are driving demand for cleaner and more sustainable transportation solutions, prompting businesses to adopt electric vehicles to meet regulatory standards and reduce carbon emissions. Additionally, governments across Asia-Pacific are implementing supportive policies and incentives to encourage the adoption of electric vehicles, such as subsidies, tax breaks, and infrastructure investments, further fueling market growth.

- Moreover, the presence of established EV manufacturers, innovative startups, and robust supply chains in countries like China, Japan, and South Korea positions the region as a hub for electric vehicle production and innovation. With favorable market conditions and a strong commitment to sustainability, the Asia-Pacific region is expected to lead the commercial electric vehicle market in the foreseeable future, driving innovation and shaping the global transition towards electrification in the transportation sector.

Active Key Players in the Commercial Electric Vehicle market

- Traton SE(Germany)

- AB Volvo(Sweden)

- BYD Auto Co. Ltd(China)

- Daimler AG(Germany)

- Zhongtong Bus Holding (China)

- Anhui Ankai Automobile Co. LTD(China)

- Proterra Inc. (US)

- Rivian(US)

- Tata Motors Limited(India)

- Tesla Inc.(US)

- Ford Motor Company(US)

- Navistar International Corporation (US)

- Alexander Dennis Limited (UK)

- MAN Truck & Bus SE (Germany)

- Hyundai Motor Company (South Korea)

- King Long United Automotive Industry Co., Ltd. (China)

- Ashok Leyland (India)

- Gillig LLC (US)

- Blue Bird Corporation (US)

- Iveco S.p.A. (Italy)

- Nikola Corporation (US)

- NFI Group Inc (Canada), Other Key Players

Key Industry Developments in the Commercial Electric Vehicle market

- In June 2023, Volkswagen Commercial Vehicles is expected to conduct autonomous driving testing using the self-driving all-electric Volkswagen ID. The testing program has already been launched in Texas, United States, at Volkswagen Group of America (VWGoA) alongside European centers. The company aims to expand commercially available transport services and the Volkswagen Group's mobility options.

- In May 2024, Mullen Automotive, Inc. an electric vehicle (“EV”) manufacturer, announced a European purchase order for 40 Mullen-GO urban delivery vehicles with Antidote SA, a commercial upfitter based in Switzerland. Antidoto SA primarily serves on-demand food delivery companies. The purchase order, valued at USD 440,000, marked a significant step in Mullen’s expansion into the European market. The order highlighted the growing demand for Mullen’s EV solutions in the commercial sector, particularly in urban delivery applications, aligning with the company's strategic focus on sustainable transportation.

|

Global Commercial Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 57.27 Bn. |

|

Forecast Period 2024–32 CAGR: |

28.7% |

Market Size in 2032: |

USD 391.21 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Propulsion |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Commercial Electric Vehicle Market by By Vehicle Type (2018-2032)

4.1 Commercial Electric Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bus

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Trucks

4.5 Pick-up Trucks

4.6 Vans

Chapter 5: Commercial Electric Vehicle Market by By Propulsion (2018-2032)

5.1 Commercial Electric Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Battery-electric vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plug-in Hybrid Electric Vehicles

5.5 Fuel Cell Electric Vehicles

Chapter 6: Commercial Electric Vehicle Market by By End Users (2018-2032)

6.1 Commercial Electric Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Last-mile delivery

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Distribution Services

6.5 Transportation

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Commercial Electric Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LANXESS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TENCATE

7.4 CELANESE

7.5 POLYSTRAND

7.6 TRI-MACK

7.7 AXIA MATERIALS

7.8 US LINER

7.9 AONIX

7.10 LINGOL

7.11 NINGBO HUAYE MATERIAL

7.12 QIYI TECH

7.13 ZHEJIANG DOUBLE FISH PLASTICS

7.14 GUANGZHOU KINGFA CARBON FIBER

7.15 SGL CARBON

7.16 TEIJIN LIMITED

7.17 TORAY INDUSTRIES

7.18 MITSUBISHI CHEMICAL ADVANCED MATERIALS

7.19 SABIC

7.20 OTHER KEY PLAYERS

Chapter 8: Global Commercial Electric Vehicle Market By Region

8.1 Overview

8.2. North America Commercial Electric Vehicle Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Vehicle Type

8.2.4.1 Bus

8.2.4.2 Trucks

8.2.4.3 Pick-up Trucks

8.2.4.4 Vans

8.2.5 Historic and Forecasted Market Size By By Propulsion

8.2.5.1 Battery-electric vehicles

8.2.5.2 Plug-in Hybrid Electric Vehicles

8.2.5.3 Fuel Cell Electric Vehicles

8.2.6 Historic and Forecasted Market Size By By End Users

8.2.6.1 Last-mile delivery

8.2.6.2 Distribution Services

8.2.6.3 Transportation

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Commercial Electric Vehicle Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Vehicle Type

8.3.4.1 Bus

8.3.4.2 Trucks

8.3.4.3 Pick-up Trucks

8.3.4.4 Vans

8.3.5 Historic and Forecasted Market Size By By Propulsion

8.3.5.1 Battery-electric vehicles

8.3.5.2 Plug-in Hybrid Electric Vehicles

8.3.5.3 Fuel Cell Electric Vehicles

8.3.6 Historic and Forecasted Market Size By By End Users

8.3.6.1 Last-mile delivery

8.3.6.2 Distribution Services

8.3.6.3 Transportation

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Commercial Electric Vehicle Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Vehicle Type

8.4.4.1 Bus

8.4.4.2 Trucks

8.4.4.3 Pick-up Trucks

8.4.4.4 Vans

8.4.5 Historic and Forecasted Market Size By By Propulsion

8.4.5.1 Battery-electric vehicles

8.4.5.2 Plug-in Hybrid Electric Vehicles

8.4.5.3 Fuel Cell Electric Vehicles

8.4.6 Historic and Forecasted Market Size By By End Users

8.4.6.1 Last-mile delivery

8.4.6.2 Distribution Services

8.4.6.3 Transportation

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Commercial Electric Vehicle Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Vehicle Type

8.5.4.1 Bus

8.5.4.2 Trucks

8.5.4.3 Pick-up Trucks

8.5.4.4 Vans

8.5.5 Historic and Forecasted Market Size By By Propulsion

8.5.5.1 Battery-electric vehicles

8.5.5.2 Plug-in Hybrid Electric Vehicles

8.5.5.3 Fuel Cell Electric Vehicles

8.5.6 Historic and Forecasted Market Size By By End Users

8.5.6.1 Last-mile delivery

8.5.6.2 Distribution Services

8.5.6.3 Transportation

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Commercial Electric Vehicle Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Vehicle Type

8.6.4.1 Bus

8.6.4.2 Trucks

8.6.4.3 Pick-up Trucks

8.6.4.4 Vans

8.6.5 Historic and Forecasted Market Size By By Propulsion

8.6.5.1 Battery-electric vehicles

8.6.5.2 Plug-in Hybrid Electric Vehicles

8.6.5.3 Fuel Cell Electric Vehicles

8.6.6 Historic and Forecasted Market Size By By End Users

8.6.6.1 Last-mile delivery

8.6.6.2 Distribution Services

8.6.6.3 Transportation

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Commercial Electric Vehicle Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Vehicle Type

8.7.4.1 Bus

8.7.4.2 Trucks

8.7.4.3 Pick-up Trucks

8.7.4.4 Vans

8.7.5 Historic and Forecasted Market Size By By Propulsion

8.7.5.1 Battery-electric vehicles

8.7.5.2 Plug-in Hybrid Electric Vehicles

8.7.5.3 Fuel Cell Electric Vehicles

8.7.6 Historic and Forecasted Market Size By By End Users

8.7.6.1 Last-mile delivery

8.7.6.2 Distribution Services

8.7.6.3 Transportation

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Commercial Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 57.27 Bn. |

|

Forecast Period 2024–32 CAGR: |

28.7% |

Market Size in 2032: |

USD 391.21 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Propulsion |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Commercial Electric Vehicle Market research report is 2024-2032.

Traton SE(Germany),AB Volvo(Sweden),BYD Auto Co. Ltd(China),Daimler AG(Germany),Zhongtong Bus Holding (China),Anhui Ankai Automobile Co. LTD(China),Proterra Inc. (US),Rivian(US),Tata Motors Limited(India),Tesla Inc.(US),Ford Motor Company(US),Navistar International Corporation (US),Alexander Dennis Limited (UK),MAN Truck & Bus SE (Germany),Hyundai Motor Company (South Korea),King Long United Automotive Industry Co., Ltd. (China),Ashok Leyland (India),Gillig LLC (US),Blue Bird Corporation (US),Iveco S.p.A. (Italy),Nikola Corporation (US),NFI Group Inc (Canada), Other Key Players

The Commercial Electric Vehicle Market is segmented into Vehicle Type, Propulsion, End User and Region. By Vehicle Type, the market is categorized into buses, Trucks, Pick-up Trucks, and Vans. By Propulsion, the market is categorized into Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles. By End Users, the market is categorized into Last Mile Delivery, Distribution Services, Transportation, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A commercial electric vehicle (EV) is a type of vehicle that is powered by electricity and designed for commercial purposes such as transporting goods, passengers, or performing specific tasks. These vehicles can include electric trucks, vans, buses, delivery vehicles, and specialized vehicles for various industries such as construction, agriculture, and logistics. Commercial EVs offer benefits such as lower operating costs, reduced emissions, and quieter operation compared to traditional internal combustion engine vehicles, making them increasingly popular for businesses looking to reduce their environmental footprint and operating expenses.

Commercial Electric Vehicle Market Size Was Valued at USD 57.27 Billion in 2023 and is Projected to Reach USD 391.21 Billion by 2032, Growing at a CAGR of 28.7% From 2024-2032.