Construction Equipment Market Synopsis

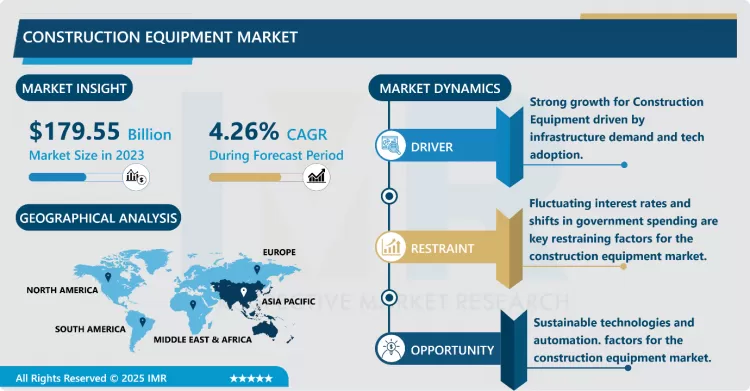

Construction Equipment Market Size Was Valued at USD 179.55 Billion in 2023, and is Projected to Reach USD 261.36 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.

Construction equipment refers to heavy-duty vehicles specially planned for accomplishing construction tasks, most frequently involving earthwork operations The basic operations involved in the construction of any Project are Excavation, digging of large quantities of earth, Moving them to reasonably long distances, Placement, Compacting, Leveling, Dozing, Grading, Hauling, etc.

Cutting edge innovations and other desirable enhancement in construction equipment are expected to provide profitable growth opportunities for players that operate in the market. For instance, in September 2024, Caterpillar’s advanced mining vision, Cat Precision Mining was designed to improved and integrate every step of the mining process, from extraction to processing, bringing mine-to-mill theory into reality.

Construction equipment plays an important role in the construction industry. From heavy machinery to functional tools, this equipment is essential for completing construction projects efficiently and effectively. They not only help with tasks that would be otherwise impossible or time-consuming to carry out manually but also contribute to improving worker safety and project outcomes.

Construction Equipment Market Growth and Trend Analysis:

Rapid Urbanization, Industrialization, and Increased Investments in Automation and Research to Improve Efficiency and Productivity.

- The worldwide construction equipment market is majorly propelled by factors including rapid industrialization, rapid urbanization, rising government investments in the development of infrastructure, and expansion and growth activities of real estate and construction companies across the world.

- The increased investments by the market players in the research and developmental activities to develop new automated equipment to replace traditional construction equipment is projected to boost the market growth in the upcoming future. The construction equipment manufacturers are constantly engaged in securing the supply chains to enhance efficiency that will increase the productivity of the construction industry.

- The implementation of advanced technologies is reshaping the landscape of construction machinery. From artificial intelligence to robotics and automation, emerging trends are redefining the construction equipment designing, operations, and management The construction equipment technology landscape has been substantially revolutionized by the incorporation of the Internet of Things (IoT) and telematics. IoT establishes connections among different devices and systems, facilitating real-time data collection and transmission from construction equipment. Specifically, telematics systems offer crucial information on equipment performance, maintenance requirements, fuel usage, and location tracking.

Strong advancement for Construction Equipment driven by infrastructure demand and tech adoption.

- The improved speed of implementation of infrastructure projects in the pipeline, along with the awarding of a record number of new projects emerged in a significant rise in demand for construction equipment, and was the primary factor behind the growth, along with an increase in the construction activity in other sectors, including urban development, rural sector, airports and ports, and an upswing in mining activity.

- The overall position of the Construction Equipment industry remains robust in the long term, owing to several growth drivers for the construction equipment industry. The sustained emphasis of the Government on Infrastructure and increasing budgetary allocations for infrastructure sector is expected to continue also to support demand for Construction Equipment. The adoption of the latest technologies by industry players, incorporating advanced safety features, alternate fuels, the interconnectivity of machines, and sustainability components in processes and products is also opening new markets for state-of-the-art, eco-friendly machines have resulted in significant growth in the global construction industry.

Fluctuating interest rates and shifts in government spending are key restraining factors for the construction equipment market.

- As construction companies reduce their operations and delay investments in new equipment, this decline in construction activities inevitably will have an impact on the construction equipment renting industry. In addition, the success of the construction equipment rental industry might be impacted by variables including shifting government expenditures on regulatory changes, infrastructure projects, and interest rate fluctuations. However, the construction industry's resilience and rental companies' adaptability are such that they are able to weather economic downturns and increase during the recovery periods.

Sustainable technologies and automation.

- Advanced construction equipment’s now offers technological features that improve efficiency, lowers fuel consumption, and reduce environmental impact. For example, the adoption of hybrid and electric-powered equipment has increased, driven by stricter emissions regulations and a growing emphasis on sustainability. Innovations including automated and semi-automated machinery have revolutionised the construction industry. These technologies enhance precision, lowers labour costs, and speed up project timelines. Automated equipment, such as robotic loaders and autonomous excavators, are increasingly being utilised in construction projects, from tunnelling to high-rise building.

- For instance, in December 2024, Greaves Retail, a division of Greaves Cotton Limited, launched its new range of electric light construction equipment at bauma CONEXPO India 2024. The company continues to focus on providing sustainable, zero-emission solutions that enhance performance while reducing operational costs. The entry of such key players into the construction equipment sector is part of its diversification approach, focusing on increasing its multi-product and multi-fuel offerings to enhance its position in various industries.

Construction Equipment Market Segment Analysis:

Construction Equipment Market is Segmented on the basis of equipment type, application, end-users, and region

By Equipment Type, Earthmoving segment is expected to dominate the market during the forecast period

- The earth moving equipment market is driven by the rising trade and demand for core earth minerals due to their numerous applications in various industries. earth-moving equipment are ubiquitous across applications in the Construction Equipment industry. They are used for a wide range of earthworks including laying foundations, grading soil, removing dirt and rocks, digging trenches, demolition works, etc.

- The increasing global population caused the higher demand for building properties like residential, commercial, and industrial building that driving the demand for the Construction Equipment industry. The rising Construction Equipment operations globally results in the higher demand for earthmoving equipment for the operation and challenging tasks and other heavy loaded operations. The increasing investment in the real-estate industry and industrial development also boosted the demand for the Construction Equipment industry that anticipated to drive the demand for the earthmoving equipment market.

By Application, Excavation and Demolition segment held the largest share in the projected timeframe

- Excavation and Demolition are fundamental to the Construction Equipment industry. These processes make room for new infrastructure, buildings, and developments, often revolutionizing landscapes to fit the needs of growing cities and communities. As the world moves into a more technology-driven era, the future of demolition and excavation is being shaped by advancements in technology. These innovations promise to make these processes more efficient, safer, and environmentally friendly.

- Technological advancements are a prominent trend shaping the excavation and demolition sector. Companies are integrating innovative technologies to fortify their market position. For instance, in August 2022, Rod Radar introduced Live Dig Radar technology, combining ground penetrating radar (GPR) with an excavator's digging bucket. This technology detects underground utilities during excavation in real time, overcoming existing limitations. The Live Dig Radar Excavate operates with standard excavator attachments, providing operators with real-time data on potential underground hazards while digging.

Construction Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Construction output continues to gain momentum across Asia Pacific as economic growth accelerated in 2024. GDP growth in APAC is expected to hit 4.6% this year and remain at 4.4% in 2025, driven by high levels of private investment and public infrastructure spending, especially in the regional powerhouse of India.

- Construction growth across the region has proved volatile to the struggles of the broader global economy. Activity is fuelled by heavy investment in infrastructure, renewable energy, cutting-edge manufacturing and data centres. India again leads the way, while Malaysia and Singapore are also projected to perform strongly over the next three years.

- The Indian government’s resourceful infrastructure projects, including smart cities, highways, and urban transit systems, have substantially propelled demand for earthmoving equipment. Initiatives like the Bharatmala Pariyojana and the Smart Cities Mission are driving construction activity across the country. The attention on building and upgrading road networks, bridges, and public transport systems has led to a surge in demand.

- For instance, the latest report from ICEMA unviels the Indian construction equipment market has witnessed a substantial surge in sales, marking a 26 per cent increase to 1,35,650 units in the fiscal year 2023-24. This achievement as a significant leap from the previous year's sales of 1,07,779 units. The industry’s strong performance is reflective of heightened demand across both domestic and international markets, with sales up by 24 per cent and 49 per cent, respectively.

Construction Equipment Market Active Players:

- Atlas Copco (Sweden)

- Case Construction Equipment (United States)

- Caterpillar Inc. (United States)

- CNH Industrial (United Kingdom)

- Doosan Bobcat (United State)

- Doosan Infracore (South Korea)

- Hitachi Construction Machinery (Japan)

- Hyundai Construction Equipment (South Korea)

- JCB (United Kingdom)

- Kobelco Construction Machinery (Japan)

- Komatsu Ltd. (Japan)

- Liebherr Group (Germany)

- Manitou Group (France)

- Mitsubishi Heavy Industries (Japan)

- SANY Group (China)

- Terex Corporation (United States)

- Volvo Construction Equipment (Sweden)

- Wirtgen Group (John Deere) (Germany)

- XCMG (China)

- Zoomlion Heavy Industry Science & Technology (China)

- Other Active Players

Key Industry Developments in the Construction Equipment Market:

- In January 2025, CASE India introduced seven new construction equipment models and a telematics application. The launch includes two vibratory compactors, the 952 NX and 450 NX, along with five models upgraded to meet the BS CEV V emission standards.

- In December 2024, Mahindra Construction Equipment Division (MCE), a part of the Mahindra Group, today launched the new CEV5 range of Construction Equipment at Bauma ConExpo 2024, offering advanced features and compliance with the latest industry norms.

|

Construction Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 179.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.26% |

Market Size in 2032: |

USD 261.36 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Atlas Copco (Sweden), Case Construction Equipment (United States), Caterpillar Inc. (United States), CNH Industrial (United Kingdom), Doosan Bobcat (United States), and Other Active Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Construction Equipment Market by By Equipment Type (2018-2032)

4.1 Construction Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Earthmoving

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Material Handling

4.5 Heavy Construction Equipment Vehicles

4.6 Others

Chapter 5: Construction Equipment Market by By Application (2018-2032)

5.1 Construction Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Excavation and Demolition

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tunneling

5.5 Heavy Lifting

5.6 Material Handling

5.7 Recycling and Waste Management

Chapter 6: Construction Equipment Market by By End-User (2018-2032)

6.1 Construction Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Infrastructure

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Construction Equipment

6.5 Mining

6.6 Oil and Gas

6.7 Manufacturing

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Construction Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ATLAS COPCO (SWEDEN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CASE CONSTRUCTION EQUIPMENT (UNITED STATES)

7.4 CATERPILLAR INC. (UNITED STATES)

7.5 CNH INDUSTRIAL (UNITED KINGDOM/NETHERLANDS)

7.6 DOOSAN BOBCAT (UNITED STATES/SOUTH KOREA)

7.7 DOOSAN INFRACORE (SOUTH KOREA)

7.8 HITACHI CONSTRUCTION MACHINERY (JAPAN)

7.9 HYUNDAI CONSTRUCTION EQUIPMENT (SOUTH KOREA)

7.10 JCB (UNITED KINGDOM)

7.11 KOBELCO CONSTRUCTION MACHINERY (JAPAN)

7.12 KOMATSU LTD. (JAPAN)

7.13 LIEBHERR GROUP (GERMANY)

7.14 MANITOU GROUP (FRANCE)

7.15 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

7.16 SANY GROUP (CHINA)

7.17 TEREX CORPORATION (UNITED STATES)

7.18 VOLVO CONSTRUCTION EQUIPMENT (SWEDEN)

7.19 WIRTGEN GROUP (JOHN DEERE) (GERMANY)

7.20 XCMG (CHINA)

7.21 ZOOMLION HEAVY INDUSTRY SCIENCE & TECHNOLOGY (CHINA)

7.22 OTHER ACTIVE PLAYERS.

Chapter 8: Global Construction Equipment Market By Region

8.1 Overview

8.2. North America Construction Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Equipment Type

8.2.4.1 Earthmoving

8.2.4.2 Material Handling

8.2.4.3 Heavy Construction Equipment Vehicles

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Excavation and Demolition

8.2.5.2 Tunneling

8.2.5.3 Heavy Lifting

8.2.5.4 Material Handling

8.2.5.5 Recycling and Waste Management

8.2.6 Historic and Forecasted Market Size By By End-User

8.2.6.1 Infrastructure

8.2.6.2 Construction Equipment

8.2.6.3 Mining

8.2.6.4 Oil and Gas

8.2.6.5 Manufacturing

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Construction Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Equipment Type

8.3.4.1 Earthmoving

8.3.4.2 Material Handling

8.3.4.3 Heavy Construction Equipment Vehicles

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Excavation and Demolition

8.3.5.2 Tunneling

8.3.5.3 Heavy Lifting

8.3.5.4 Material Handling

8.3.5.5 Recycling and Waste Management

8.3.6 Historic and Forecasted Market Size By By End-User

8.3.6.1 Infrastructure

8.3.6.2 Construction Equipment

8.3.6.3 Mining

8.3.6.4 Oil and Gas

8.3.6.5 Manufacturing

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Construction Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Equipment Type

8.4.4.1 Earthmoving

8.4.4.2 Material Handling

8.4.4.3 Heavy Construction Equipment Vehicles

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Excavation and Demolition

8.4.5.2 Tunneling

8.4.5.3 Heavy Lifting

8.4.5.4 Material Handling

8.4.5.5 Recycling and Waste Management

8.4.6 Historic and Forecasted Market Size By By End-User

8.4.6.1 Infrastructure

8.4.6.2 Construction Equipment

8.4.6.3 Mining

8.4.6.4 Oil and Gas

8.4.6.5 Manufacturing

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Construction Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Equipment Type

8.5.4.1 Earthmoving

8.5.4.2 Material Handling

8.5.4.3 Heavy Construction Equipment Vehicles

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Excavation and Demolition

8.5.5.2 Tunneling

8.5.5.3 Heavy Lifting

8.5.5.4 Material Handling

8.5.5.5 Recycling and Waste Management

8.5.6 Historic and Forecasted Market Size By By End-User

8.5.6.1 Infrastructure

8.5.6.2 Construction Equipment

8.5.6.3 Mining

8.5.6.4 Oil and Gas

8.5.6.5 Manufacturing

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Construction Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Equipment Type

8.6.4.1 Earthmoving

8.6.4.2 Material Handling

8.6.4.3 Heavy Construction Equipment Vehicles

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Excavation and Demolition

8.6.5.2 Tunneling

8.6.5.3 Heavy Lifting

8.6.5.4 Material Handling

8.6.5.5 Recycling and Waste Management

8.6.6 Historic and Forecasted Market Size By By End-User

8.6.6.1 Infrastructure

8.6.6.2 Construction Equipment

8.6.6.3 Mining

8.6.6.4 Oil and Gas

8.6.6.5 Manufacturing

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Construction Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Equipment Type

8.7.4.1 Earthmoving

8.7.4.2 Material Handling

8.7.4.3 Heavy Construction Equipment Vehicles

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Excavation and Demolition

8.7.5.2 Tunneling

8.7.5.3 Heavy Lifting

8.7.5.4 Material Handling

8.7.5.5 Recycling and Waste Management

8.7.6 Historic and Forecasted Market Size By By End-User

8.7.6.1 Infrastructure

8.7.6.2 Construction Equipment

8.7.6.3 Mining

8.7.6.4 Oil and Gas

8.7.6.5 Manufacturing

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Construction Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 179.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.26% |

Market Size in 2032: |

USD 261.36 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Atlas Copco (Sweden), Case Construction Equipment (United States), Caterpillar Inc. (United States), CNH Industrial (United Kingdom), Doosan Bobcat (United States), and Other Active Players. |

||

Frequently Asked Questions :

The forecast period in the Construction Equipment Market research report is 2024-2032.

Atlas Copco (Sweden), Case Construction Equipment (United States), Caterpillar Inc. (United States), CNH Industrial (United Kingdom/Netherlands), Doosan Bobcat (United States/South Korea), Doosan Infracore (South Korea), Hitachi Construction Machinery (Japan), Hyundai Construction Equipment (South Korea), JCB (United Kingdom), Kobelco Construction Machinery (Japan), Komatsu Ltd. (Japan), Liebherr Group (Germany), Manitou Group (France), Mitsubishi Heavy Industries (Japan), SANY Group (China), Terex Corporation (United States), Volvo Construction Equipment (Sweden), Wirtgen Group (John Deere) (Germany), XCMG (China), Zoomlion Heavy Industry Science & Technology (China), and Other Active Players.

The Construction Equipment Market is segmented into Equipment Type, Application, End-User, and Region. By Equipment Type the market is categorized into Earthmoving, Material Handling, Heavy Construction Equipment Vehicles, and Others, By Application the market is categorized into Excavation and Demolition, Tunneling, Heavy Lifting, Material Handling, Recycling and Waste Management. By End-User the market is categorized into Infrastructure, Construction Equipment, Mining, Oil and Gas, Manufacturing, and Others By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Construction equipment refers to heavy-duty vehicles specially designed for executing construction tasks, most frequently involving earthwork operations The basic operations involved in the construction of any Project are Excavation, Digging of large quantities of earth, Moving them to reasonably long distances, Placement, Compacting, Leveling, Dozing, Grading, Hauling, etc.

Construction Equipment Market Size Was Valued at USD 179.55 Billion in 2023, and is Projected to Reach USD 261.36 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.