Continuous Glucose Monitoring Device Market Synopsis:

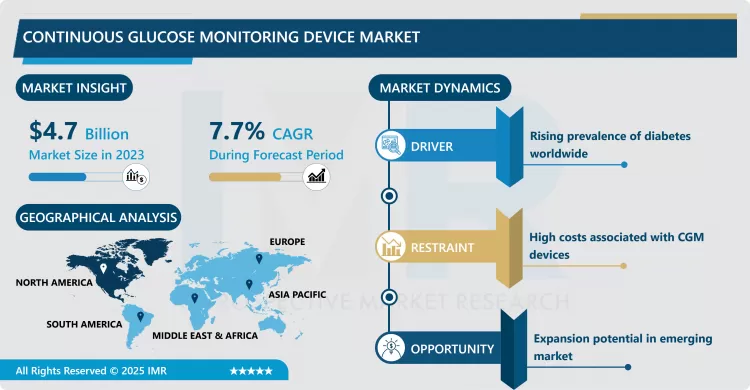

Continuous Glucose Monitoring Device Market Size Was Valued at USD 4.7 Billion in 2023, and is Projected to Reach USD 9.1 Billion by 2032, Growing at a CAGR of 7.7% From 2024-2032.

The Continuous Glucose Monitoring (CGM) Device Market relates to the market encompassing devices which offer real time, ongoing monitoring of glucose levels in a patient, patients with diabetes or other conditions that impact blood sugar stability. These devices, which are used on body, are capable of measuring it often without using the finger-prick test to allow better diabetes management by providing finer details of the bodily glucose levels.

The market for the CGM device is relatively new and has been growing recently due to rising cases of diabetes and focus on patient-centred care. Such devices are important among patients with type 1 and type 2 diabetes who repeatedly experience high blood glucose levels and allow for better glycemic control. There is a rising knowledge of the necessity of managing diabetes together with advances in healthcare technology that are making patients and health care practitioners to embrace CGM devices over glucose meters. Thirdly, healthcare providers and insurers are extending their appreciation of the prospect of using CGM products as long-term investment tools for cutting future healthcare expenses due to diabetes complications and expanding the market for such products.

Factors driving demand for CGM devices include better, miniaturized, and cheaper sensors, better control over devices, and improvements in the technology such as longer battery life. These devices can now be synchronized with App and cloud technology; where users can monitor, store, and share their glucose levels conveniently. This ability to monitor without going for frequent follow-ups has major benefits not only to patients but pediatric patients and elderly individuals who need help in monitoring their Glucose levels. With the ongoing COVID-19 pandemic continuing to increase the popularity of remote glucose monitoring, CGM devices will be even more important in diabetes care and patient safety.

Continuous Glucose Monitoring Device Market Trend Analysis:

Rising Demand for Remote Patient Monitoring in CGM

- Telemedicine, especially RPM, is already an emerging focus in the CGM Device Market since the COVID-19 pandemic and beyond. Due to the COVID-19 pandemic, RPM technologies have become popular because people can convey their glucose levels from the comfort of their homes while sparing offices clinical visits. Such a shift is important for diabetes patients who, in addition to avoiding exposure to clinical facilities, gain the autonomy to regulate their diseases. Bluetooth technology in conjunction with cloud-based data systems of CGM devices has been useful in RPM’s progress since patients are able to send real-time data to physicians for response and directions.

Rising Adoption of CGM in Developing Markets

- The blood sugar level monitoring device market has a high growth in the developing countries where the new cases of diabetes are increasing as a result of the increase incidences of diseases and unhealthy diets. They would be CGM devices because different from Europe and North America, Asian, Latin American and Middle Eastern countries are witnessing a definite upsurge in type 2 diabetes cases but are not adequately empowered with these advanced products. The demand for innovative solutions to confront the diabetes challenge in these regions increases as healthcare providers continue to incorporate newer technology into practice a good opportunity for manufacturers of the CGM device. Furthermore, obesity index, the high incidence of diabetes, government policies and initiatives for increasing the awareness of the diabetes across these regions, upcoming integrated healthcare infrastructure in these growing economies thereby catalyzing the demand of the CGMs solutions in the global market over the coming years.

Continuous Glucose Monitoring Device Market Segment Analysis:

Continuous Glucose Monitoring Device Market is Segmented on the basis of Component, Connectivity, End Use, and Region

By Component, Transmitters segment is expected to dominate the market during the forecast period

- CGM transmitters remain the largest segment in the CGM Device Market because the devices are critical for transmitting real-time glucose data from sensors to display devices, including smartphones or separate receivers. Transmitters are instrumental in making sure that there is steady flow of data transmission hence afford patients true and real time glucose levels. Transmitter’s design improvement due to technological innovation improvements such as miniaturization and longer battery life has improved the performance of this segment leading to its dominance.

- Second, we learned that it is possible for CGM devices to integrate with digital health platforms, which has led to improvement in transmitters’ efficiency; therefore, there has been a reduced rate of data loss or data inaccuracy. Principle manufacturers are now dedicating resources to research and development to enhance its transmitter performance to meet the standards of a medical device. The overall Transmission Type Market in the CGM Device Market has developed a segment of transmitters that has continued to be critical in the revenue generation throughout the forecast period.

By Connectivity, Bluetooth segment expected to held the largest share

- Out of all connectivity types in the CGM Device Market, Bluetooth is expected to dominate this segment because of its compatibility with mobile devices and ease of use. A CGM system that incorporates Bluetooth capabilities eliminates data transfer from glucose sensors to the patients’ smartphones and provides them with constant information about glucose levels via an application. Bluetooth connectivity has continued to enjoy widespread usage due to its utility in offering real-time monitoring information for health care givers and physicians.

- This particular market focus on the inclusion of Bluetooth technology is also motivated by the likelihood of increased patient compliancy and participation given the more convenient way Bluetooth-enabled CGM devices display data. Therefore, Bluetooth is anticipated to continue dominating the connectivity techniques found in CGM devices due its success ratio that offers perfect ease of use, compatibility, and safety to the users.

Continuous Glucose Monitoring Device Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- With the increasing rate of diabetes, the high health care awareness, well-equipped medical facilities, and the supportive government policies towards the management of diabetes in North America have demonstrated the largest market share in the CGM Device Market in 2023. The region occupies a middle position by capturing the market share with a 40% share in the total CGM market because of the increased usage of diabetes care solutions and high spending capacity per capita. These include patients’ awareness, better reimbursement policies for CGMS and robust R&D activities have firmly placed North America at the leader’s position. The concentration of key CGM manufacturers and partnerships with health technologies companies also solidify the region’s leadership position to drive the future advancement and commercialization of CGM technology.

Active Key Players in the Continuous Glucose Monitoring Device Market:

- Abbott Laboratories (USA)

- Ascensia Diabetes Care (Switzerland)

- Dexcom, Inc. (USA)

- Echo Therapeutics, Inc. (USA)

- Eversense Inc. (USA)

- GlySens Incorporated (USA)

- GlucoMe (Israel)

- Insulet Corporation (USA)

- Medtronic plc (Ireland)

- Nemaura Medical Inc. (UK)

- Senseonics Holdings, Inc. (USA)

- Tandem Diabetes Care, Inc. (USA)

- Ypsomed AG (Switzerland)

- Zhor-Tech (France)

- Other Active Players

|

Continuous Glucose Monitoring Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.7 Billion |

|

Forecast Period 2024-32 CAGR: |

7.7% |

Market Size in 2032: |

USD 9.1 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Connectivity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Continuous Glucose Monitoring Device Market by By Component (2018-2032)

4.1 Continuous Glucose Monitoring Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transmitters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sensors

4.5 Receivers

Chapter 5: Continuous Glucose Monitoring Device Market by By Connectivity (2018-2032)

5.1 Continuous Glucose Monitoring Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bluetooth

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 4G

Chapter 6: Continuous Glucose Monitoring Device Market by By End User (2018-2032)

6.1 Continuous Glucose Monitoring Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare Settings

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Continuous Glucose Monitoring Device Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASCENSIA DIABETES CARE (SWITZERLAND)

7.4 DEXCOM INC. (USA)

7.5 ECHO THERAPEUTICS INC. (USA)

7.6 EVERSENSE INC. (USA)

7.7 GLYSENS INCORPORATED (USA)

7.8 GLUCOME (ISRAEL)

7.9 INSULET CORPORATION (USA)

7.10 MEDTRONIC PLC (IRELAND)

7.11 NEMAURA MEDICAL INC. (UK)

7.12 SENSEONICS HOLDINGS INC. (USA)

7.13 TANDEM DIABETES CARE INC. (USA)

7.14 YPSOMED AG (SWITZERLAND)

7.15 ZHOR-TECH (FRANCE)

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Continuous Glucose Monitoring Device Market By Region

8.1 Overview

8.2. North America Continuous Glucose Monitoring Device Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Component

8.2.4.1 Transmitters

8.2.4.2 Sensors

8.2.4.3 Receivers

8.2.5 Historic and Forecasted Market Size By By Connectivity

8.2.5.1 Bluetooth

8.2.5.2 4G

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Homecare Settings

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Continuous Glucose Monitoring Device Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Component

8.3.4.1 Transmitters

8.3.4.2 Sensors

8.3.4.3 Receivers

8.3.5 Historic and Forecasted Market Size By By Connectivity

8.3.5.1 Bluetooth

8.3.5.2 4G

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Homecare Settings

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Continuous Glucose Monitoring Device Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Component

8.4.4.1 Transmitters

8.4.4.2 Sensors

8.4.4.3 Receivers

8.4.5 Historic and Forecasted Market Size By By Connectivity

8.4.5.1 Bluetooth

8.4.5.2 4G

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Homecare Settings

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Continuous Glucose Monitoring Device Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Component

8.5.4.1 Transmitters

8.5.4.2 Sensors

8.5.4.3 Receivers

8.5.5 Historic and Forecasted Market Size By By Connectivity

8.5.5.1 Bluetooth

8.5.5.2 4G

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Homecare Settings

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Continuous Glucose Monitoring Device Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Component

8.6.4.1 Transmitters

8.6.4.2 Sensors

8.6.4.3 Receivers

8.6.5 Historic and Forecasted Market Size By By Connectivity

8.6.5.1 Bluetooth

8.6.5.2 4G

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Homecare Settings

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Continuous Glucose Monitoring Device Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Component

8.7.4.1 Transmitters

8.7.4.2 Sensors

8.7.4.3 Receivers

8.7.5 Historic and Forecasted Market Size By By Connectivity

8.7.5.1 Bluetooth

8.7.5.2 4G

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Homecare Settings

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Continuous Glucose Monitoring Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.7 Billion |

|

Forecast Period 2024-32 CAGR: |

7.7% |

Market Size in 2032: |

USD 9.1 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Connectivity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Continuous Glucose Monitoring Device Market research report is 2024-2032.

Abbott Laboratories (USA), Ascensia Diabetes Care (Switzerland), Dexcom, Inc. (USA), Echo Therapeutics, Inc. (USA), Eversense Inc. (USA), GlySens Incorporated (USA), GlucoMe (Israel), Insulet Corporation (USA), Medtronic plc (Ireland), Nemaura Medical Inc. (UK), Senseonics Holdings, Inc. (USA), Tandem Diabetes Care, Inc. (USA), Ypsomed AG (Switzerland), Zhor-Tech (France), and Other Active Players.

The Continuous Glucose Monitoring Device Market is segmented into Component, Connectivity, End Use and region. By Component, the market is categorized into Transmitters, Sensors, Receivers. By Connectivity, the market is categorized into Bluetooth, 4G. By End Use, the market is categorized into Hospitals, Homecare Settings, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Continuous Glucose Monitoring (CGM) Device Market relates to the market encompassing devices which offer real time, ongoing monitoring of glucose levels in a patient, patients with diabetes or other conditions that impact blood sugar stability. These devices, which are used on body, are capable of measuring it often without using the finger-prick test to allow better diabetes management by providing finer details of the bodily glucose levels.

Continuous Glucose Monitoring Device Market Size Was Valued at USD 4.7 Billion in 2023, and is Projected to Reach USD 9.1 Billion by 2032, Growing at a CAGR of 7.7% From 2024-2032.