Continuous Peripheral Nerve Block Catheter Market Synopsis:

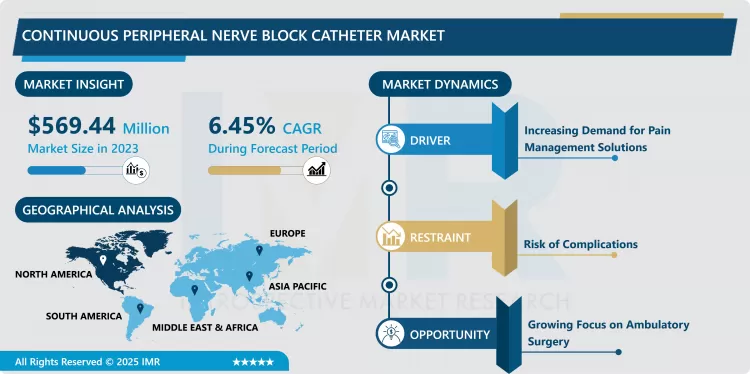

Continuous Peripheral Nerve Block Catheter Market Size Was Valued at USD 569.44 Million in 2023, and is Projected to Reach USD 999.45 Million by 2032, Growing at a CAGR of 6.45% From 2024-2032

The Continuous Peripheral Nerve Block (CPNB) Catheter market discussing the medical devices that are inserted into the human body to deliver local anaesthetic agents that swim around a particular nerve for pain control after surgery or trauma. These catheters cause nerve blockage, which helps in the prolongation of pain relief hence reducing the use of pulmonary analgesics such as opioids. Market includes catheter type, technique of insertion and the related technologies which are used in hospitals, ambulatory surgical centers and various pain management clinics. A rising need for efficient pain management after surgical procedures, product development, and the growing consciousness of the availability of opioid-free catheters form the key drivers to continuing growth in this market.

The Continuous Peripheral Nerve Block (CPNB) Catheter market has the potential to grow significantly in the global market, due to the rising use of advanced anesthetic techniques for the management of post-surgical pain, and because of the shift towards the utilization of catheters for perineural analgesia. Surgical applications of CPNB catheters include postoperative peripheral nerve blocks through which long-lasting local anesthesia is administered directly to the affected region by the surgery including, orthopedic, vascular, and plastic surgeries. This minimize opioids use which is considered to have many side effects and risks of addiction to the substance. Increased disposable surgeries; especially among elder people likely to undergo joint replacement surgeries or people dealing with chronic pains among other factors have immensely contributed to the growth of the market. On a similar note, development of new generation catheters, use of ultrasound for locating CPNB catheters has enhanced its accuracy hence recommending it for use in healthcare facilities.

From the geographical point of view, North America holds the largest market share in the Continuous Peripheral Nerve Block Catheter market mainly owing to its higher surgery rate, effective healthcare facilities, and quicker acceptance towards innovative technologies. Europe is next, which has gained from raised consciousness over the use of opioid avoidance methods and the right policies on healthcare. During the forecast period, the Asia-Pacific region is projected to grow at the highest rate because of increasing healthcare costs, a growing number of surgical operations, and the rising incidence of chronic pain diseases. Latin American and Middle Eastern and African markets are also expected to show a steady future growth due to the subsequent extension of health care accessibility and infrastructure. The it global CPNB catheter market is fragmented and the leading players are likely to emphasize on product differentiation, mergers, and acquisitions, and increase their geographical presence.

Continuous Peripheral Nerve Block Catheter Market Trend Analysis

Advancements and Trends in the Continuous Peripheral Nerve Block (CPNB) Catheter Market

- Catheter market is the increasing rate of regional anesthesia over general anesthesia especially in surgical & trauma procedures. Evidently, regional anesthesia like the nerve blocks is safer, specific complications, minimal opioids and faster postoperative recovery. These advantages are extended by CPNB catheters because they can deliver a steady, regulated concentration of anaesthetics for a long duration and for this reason offer more effective pain relief in contrast to single shot nerve blocks. As such, CPNB catheters have become very popular in surgeries like orthopedic, obstetric deliveries and trauma surgeries where adequate analgesia is very important for the speedy recovery of the patient.

- Another factor that is driving demand in the catheter market is development in the products themselves and these include features such as in multi-port catheters that allow uniform dispersion of the anaesthetic making the whole process easier for the patient. These catheters not only improve the endurance span of the nerve block but also improve quality of life and decrease the necessity for dosage change. These advanced and enzyme-triggered, easier-on-the-patient designs are making CPNB catheters a product of choice for clinicians who are interested in administering better analgesia with less adverse outcomes, which is making them applicable across a wider surgery spectrum.

Growing Demand for Continuous Peripheral Nerve Block Catheters Driven by Aging Population and Technological Advancements

- Due to an increase in the proportion of the elderly, the number of operations performed worldwide increases, especially among orthopedic and general surgeons. This type of operations has seen an increasing trend due to pressure created by patient needs; therefore, the need to ensure that there is adequate post-operative pain management. Fixed peripheral nerve block (FPNB) catheters are becoming more popular because they offer substantially better relief for extended periods and obviate the use of opioids. The transition away from opioids due to side effects and dependency that are commonly associated with them have placed CPNB catheters as a superior solution. With the higher awareness of the opioid complication in various parts of the world, more and more healthcare providers have turn to use CPNB catheters to enhance patient surgical results and reduce opioid consumption.

- Additionally, there is an emergence of value added features in catheters, that not only allows easy usage but are also very strong. These innovations are a solution to the previous difficulties seen in healthcare personnel, for instance complicationsderive from catheter deployment and problems pertaining to durability. In addition to increasing the overall effectiveness of pain management, an improved ease of use of the device also further extends the versatility of the CPNB catheters for use in a wider range of medical procedures. What’s more, these technological developments are expected to reach new levels and stimulate market growth and a greater use of the CPNB catheters across the globe.

Continuous Peripheral Nerve Block Catheter Market Segment Analysis:

Continuous Peripheral Nerve Block Catheter Market Segmented on the basis of Insertion Technique, Indication, End Use, and Region

By Insertion Technique, Ultrasound segment is expected to dominate the market during the forecast period

- Ultrasound-guided insertion has remained popular in recent years because it increases both accuracy and safety in numerous procedures. Known as 3D, this approach provides pictures of the nerves and the encompassing tissue in real time with the use of high-frequency sound waves. The authors have noted that this type of visualization is most useful when performing nerve blocks or administering regional anesthesia because it allows one to selectively aim for a particular nerve but avoid other equally sensitive structures. Influenced by the minimally invasive aspect of this technique, ultrasound exposes less risk of touch damage to nerve or accidental puncture to blood vessels, thus choose by clinicians in both hospital-and-external clinic environments.

- Apart from safety and accuracy, which are offered by ultrasound guided techniques, its noninvasive procedures explain why it is preferred by most surgeons and why it improves patients’ comfort and surgical results. There is less pain for the patient during procedures because this approach reduces the frequent use of invasive approaches. Stated shorter recovery periods are usually mentioned, which allow patients with the conditions to get back to their regular lives quickly. Consequently, the addition of ultrasound guidance to regional anesthesia practices not only improves the process outcomes but also adds up to the trends towards patient-centredness. This is becoming popular and is expected to progress further because new in ultrasound technology is enhancing the utility and functionality of this crucial imaging technique in healthcare practice.

By End Use, Hospitals segment expected to held the largest share

- Hospitals are the largest consumers of regional anesthesia techniques mostly because they present a diverse spectrum of surgical procedures that need pain management solutions. This is more so especially the use of ultrasonic and nerve stimulating instruments, common more often in hospitals with a large surgery workload. Through the use of regional anesthesia, the total wellbeing of the patient during surgeries may be greatly improved and the postoperative period made far more comfortable. Apart from minimizing the requirement of general anesthesia, this approach will help to ensure less time for recovery and decreased length of stay right after the surgery thus cutting healthcare expenses.

- While most hospitals are competing to stay among the top surgical facilities and to offer their clients the best quality services, they consequently contribute to training and purchasing relevant equipment for successful implementation of such approaches. The use of regional anesthesia correlates with another trend associated with improving patients’ outcomes and satisfaction in surgical departments. Educating the staff about the trends and advances, as well as using state of the art ultrasound and nerve stimulations equipment, hospitals can expand their surgical capabilities and provide only the best for their patients. This dedication to outstanding pain management and streamlined procedure makes certain the importance of regional anesthetic in current medicine.

Continuous Peripheral Nerve Block Catheter Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Moreover, the Continuous Peripheral Nerve Block (CPNB) Catheter Market in North America is set for dominance owing to the developed healthcare facilities and increased demand for delivering opioid-free pain management procedures. These include a high number of surgical procedures with many procedures being surgical for instance joint replacements and spinal. These procedures require optimal postoperative pain management and that is why increasing numbers of centres turn to CPNB catheters. The largest market in the region has been the United States, and there has been increase in the use these catheters to control pain since there is enhanced awareness concerning the need to avoid use of opioids. Besides, there is a constant improvement of catheter technology and better placement through ultrasound, all of which play a role for the increase of CPNB catheters use in the U.S.

- The other primary driver of market growth in North America is the sound reimbursement framework for the procedures related to pain management. The incorporation of CPNB catheters into insurance packages act as a driving force for acquiring these techniques by hospitals or surgical centers in that they save costs while promoting better results for the patients. Continuing opioid usage problem in the United States has also put more emphasis in reduction of opioid usage, resulting in a rise in the demand for other pain management devices such as CPNB catheters. This, added to high annual number of surgical procedures and the growing pool of people requiring joint replacements and other operations in North America, makes it one of the most promising regions for future growth of the market.

Active Key Players in the Continuous Peripheral Nerve Block Catheter Market:

- B. Braun SE

- Teleflex Incorporated

- PAJUNK

- Ace-medical

- Vygon SAS

- AVNS

- ICU Medical, Inc.

- Scilex Holding

- Henan Tuoren Medical Device Co., Ltd.

- Solo-Dex, Inc.

- Other Active Players

Key Industry Developments in the Continuous Peripheral Nerve Block Catheter Market:

- In July 2023, Solo-Dex, the U.S.-based industry player, formed a master distribution agreement with Farouk, Maamoun Tamer & Co, and CH Trading Group LLC for distributing its Fascile products in North Africa and Middle East markets. The Fascile products include continuous peripheral nerve block catheters.

- In May 2023, Epimed International, Inc., a provider of nerve block products, introduced the product line named Epimed Essentials, which includes Epidural Nerve Block Needles and Epidural Needles.

|

Continuous Peripheral Nerve Block Catheter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 569.44 Million |

|

Forecast Period 2024-32 CAGR: |

6.45% |

Market Size in 2032: |

USD 999.45 Million |

|

Segments Covered: |

By Insertion Technique |

|

|

|

By Indication |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Continuous Peripheral Nerve Block Catheter Market by By Insertion Technique (2018-2032)

4.1 Continuous Peripheral Nerve Block Catheter Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ultrasound

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nerve Stimulation

4.5 Both

Chapter 5: Continuous Peripheral Nerve Block Catheter Market by By Indication (2018-2032)

5.1 Continuous Peripheral Nerve Block Catheter Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Upper Extremity Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lower Extremity Surgery

Chapter 6: Continuous Peripheral Nerve Block Catheter Market by By End Use (2018-2032)

6.1 Continuous Peripheral Nerve Block Catheter Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Continuous Peripheral Nerve Block Catheter Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 B. BRAUN SE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TELEFLEX INCORPORATED

7.4 PAJUNK

7.5 ACE-MEDICAL

7.6 VYGON SAS

7.7 AVNS

7.8 ICU MEDICAL INC.

7.9 SCILEX HOLDING

7.10 HENAN TUOREN MEDICAL DEVICE CO. LTD.

7.11 SOLO-DEX INC.

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Continuous Peripheral Nerve Block Catheter Market By Region

8.1 Overview

8.2. North America Continuous Peripheral Nerve Block Catheter Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Insertion Technique

8.2.4.1 Ultrasound

8.2.4.2 Nerve Stimulation

8.2.4.3 Both

8.2.5 Historic and Forecasted Market Size By By Indication

8.2.5.1 Upper Extremity Surgery

8.2.5.2 Lower Extremity Surgery

8.2.6 Historic and Forecasted Market Size By By End Use

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Continuous Peripheral Nerve Block Catheter Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Insertion Technique

8.3.4.1 Ultrasound

8.3.4.2 Nerve Stimulation

8.3.4.3 Both

8.3.5 Historic and Forecasted Market Size By By Indication

8.3.5.1 Upper Extremity Surgery

8.3.5.2 Lower Extremity Surgery

8.3.6 Historic and Forecasted Market Size By By End Use

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Continuous Peripheral Nerve Block Catheter Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Insertion Technique

8.4.4.1 Ultrasound

8.4.4.2 Nerve Stimulation

8.4.4.3 Both

8.4.5 Historic and Forecasted Market Size By By Indication

8.4.5.1 Upper Extremity Surgery

8.4.5.2 Lower Extremity Surgery

8.4.6 Historic and Forecasted Market Size By By End Use

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Continuous Peripheral Nerve Block Catheter Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Insertion Technique

8.5.4.1 Ultrasound

8.5.4.2 Nerve Stimulation

8.5.4.3 Both

8.5.5 Historic and Forecasted Market Size By By Indication

8.5.5.1 Upper Extremity Surgery

8.5.5.2 Lower Extremity Surgery

8.5.6 Historic and Forecasted Market Size By By End Use

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Continuous Peripheral Nerve Block Catheter Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Insertion Technique

8.6.4.1 Ultrasound

8.6.4.2 Nerve Stimulation

8.6.4.3 Both

8.6.5 Historic and Forecasted Market Size By By Indication

8.6.5.1 Upper Extremity Surgery

8.6.5.2 Lower Extremity Surgery

8.6.6 Historic and Forecasted Market Size By By End Use

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Continuous Peripheral Nerve Block Catheter Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Insertion Technique

8.7.4.1 Ultrasound

8.7.4.2 Nerve Stimulation

8.7.4.3 Both

8.7.5 Historic and Forecasted Market Size By By Indication

8.7.5.1 Upper Extremity Surgery

8.7.5.2 Lower Extremity Surgery

8.7.6 Historic and Forecasted Market Size By By End Use

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Continuous Peripheral Nerve Block Catheter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 569.44 Million |

|

Forecast Period 2024-32 CAGR: |

6.45% |

Market Size in 2032: |

USD 999.45 Million |

|

Segments Covered: |

By Insertion Technique |

|

|

|

By Indication |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Continuous Peripheral Nerve Block Catheter Market research report is 2024-2032.

B. Braun SE, Teleflex Incorporated., PAJUNK, Ace-medical, Vygon SAS, AVNS.,ICU Medical, Inc, Scilex Holding, Henan Tuoren Medical Device Co., Ltd., Solo-Dex, Inc. and Other Active Players.

The Continuous Peripheral Nerve Block Catheter Market is segmented into By Insertion Technique, By Indication, By End Use and region. By Insertion, the market is categorized into Ultrasound, Nerve Stimulation and Both. By Indication, the market is categorized into Upper Extremity Surgery and Lower Extremity Surgery. By End Use, the market is categorized into Hospitals Ambulatory Surgical Centers .By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Continuous Peripheral Nerve Block (CPNB) Catheter market refers to the segment of medical devices used to deliver local anesthetics continuously around specific nerves, primarily for pain management following surgery or injury. These catheters enable prolonged analgesia by blocking nerve signals, thus minimizing the need for systemic pain medications like opioids. The market encompasses various catheter types, insertion techniques, and associated technologies, catering to hospitals, ambulatory surgical centers, and pain management clinics. Increasing demand for effective post-operative pain management, advancements in catheter designs, and growing awareness of opioid alternatives are driving growth in this market.

Continuous Peripheral Nerve Block Catheter Market Size Was Valued at USD 569.44 Million in 2023, and is Projected to Reach USD 999.45 Million by 2032, Growing at a CAGR of 6.45% From 2024-2032