Core Materials for Composites Market Synopsis:

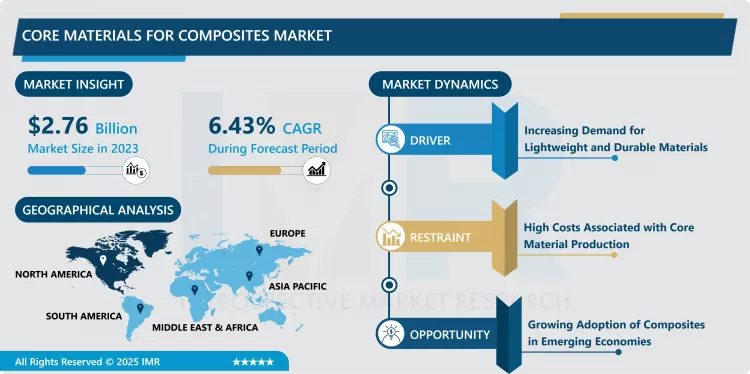

Core Materials for Composites Market Size Was Valued at USD 2.76 Billion in 2023, and is Projected to Reach USD 4.84 Billion by 2032, Growing at a CAGR of 6.43% From 2024-2032

The Core Materials for Composites Market pertains to a specific niche of the overall materials sector in demand for lightweight, high strength and high performance core materials for composite structures. A lot of these materials for instance foam cores, honeycomb cores, and balsa wood are vital in the improvement of mechanical features, rigidity and strength in composite products. They are widely used in aerospace applications, marine, wind energy, automotive, and construction to guarantee high performance and minimum weigh.

On this basis, the market for core materials for polymer-matrix composites has shown substantial growth in recent years due to the growing demand for lightweight and high-strength materials. Composite core materials play an important role in decreasing the mass of the parts without compromising on the strength and thus, cannot be eliminated for industries like aviation and automobile. This growing popularity of these materials to manufacture wind turbine blades in the wind energy segment augments the business growth due to the worldwide demand for green energy utilization.

In the aerospace and defense industry, advanced material for fuel efficiency and durability have pulled the desire of core materials utilized for making aircraft and spaceships forward. Moreover, escalating infrastructure spending and the ongoing tendency toward constructing environmentally friendly structures have the potential to boost the use of composite core materials in architecture further. With industries focusing on sustainability, there would be increased market for recyclable and environment friendly core materials consequently improving the market prospects for new players.

Core Materials for Composites Market Trend Analysis:

Growing Demand for Lightweight Materials in Renewable Energy

- The increasing trends in sustainability energy solutions have greatly increased the demand of core material specifically in renewable energy particularly in wind energy. Foams and honeycomb are necessities for forming wind turbine blades since less weight is directly proportional to more efficiency and lesser expenses. With a growing number of nations attempting to increase their reliance on renewable energy sources the installation of wind turbines is steadily increasing world wide. The latest development of larger and more efficient turbines will only put a further premium on developments in improved core body materials, particularly advanced materials that can meet the conditions arising from high stress and fatigue.

Emerging Markets in Asia-Pacific Driving Demand

- The Asia-Pacific area can be operated as the best opportunity for the core material for composites market due to the increasing speed of industrialization and infrastructural development and also, increasing interest in renewable power projects. With emerging economies such as China, India investing in power generation through wind energy generators and aerospace manufacturing demanding the cores, the demand could be considered robust. Further, the automotive and construction industries in these continents are expanding their use base for lightweight and high-strength composite materials for higher performance and reduced environmental impact. This increasing demand in turn, combined with availability of cheap and effective material and human resource, is predicted to compel major stakeholders to increase operation in Asia-Pacific, which is considered the region of future.

Core Materials for Composites Market Segment Analysis:

Core Materials for Composites Market is Segmented on the basis of Type, End Use Industry, and Region

By Type, Foam Core segment is expected to dominate the market during the forecast period

- The existing core materials shown to have the highest potential in the light of foam cores for composites market based on factors like strength to weight ratio, ease of manufacturing and manufacturing cost. These cores are incorporated in parts that need high durability and relatively low density such as aircraft parts, windmills and automobile parts. Foam cores can be modified in density and produced in materials such as PVC, PET and polyurethane, making it a favourite with manufactures.

- Besides, improvements in foam core production such as using the recyclable and bio-based foam cores are adding on to the use of foam cores. The ongoing market demands for sustainability for the industrial processes to adhere with the properties present in Foams cores, which also help the market to dominate the forecast period.

By End Use Industry, Aerospace and Defense segment expected to held the largest share

- Out of all the end use industries, aerospace and defense is predicted to occupy the largest share in Core Materials for Composites Market. This dominancy can be explained that automotive sector particularly aerospace requires light weight, long life, and high performance materials for fuel efficiency, safety, and performance of aircrafts and defense equipments. The base materials are mainly used in producing aircraft interior compartments, structural parts, and UAVs: where lightweighting equates to less fuel burnt, and less money spent.

- As defense budgets are increasing and air industry is developing around the world, the need for higher-class core materials in this segment will be great. The application resins in extensive applications like hypersonic vehicle and advanced drones make core materials relevant in aerospace and defense sectors thereby guaranteeing business continuity in this segment.

Core Materials for Composites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America held the largest market share of Core Materials for Composites Market in 2023 due to strengthened industries of aerospace, wind and marine for composites. The US is one of the major producers due to well-developed manufacturing industry, high investment into renewable power generation projects, and large demand for lightweight materials in defense and aerospace industries. Interestingly in 2023, North America is shown to cover about 35 % of the market share, in line with its advanced embrace of technology and innovation. Established participants in addition to a heavy emphasis placed on research and development are certain to maintain this region’s commanding position in this market.

Active Key Players in the Core Materials for Composites Market:

- 3A Composites (Switzerland)

- Airborne International (Netherlands)

- Carbon-Core Corporation (USA)

- Chongqing Polycomp International Corporation (China)

- Diab Group (Sweden)

- Evonik Industries AG (Germany)

- Gurit Holding AG (Switzerland)

- Hexcel Corporation (USA)

- Matrix Composite Materials Company (UK)

- Mitsubishi Chemical Corporation (Japan)

- Plascore Incorporated (USA)

- SABIC (Saudi Arabia)

- Schweiter Technologies (Switzerland)

- The Gill Corporation (USA)

- Toray Industries, Inc. (Japan)

- Other Active Players

|

Core Materials for Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.76 Billion |

|

Forecast Period 2024-32 CAGR: |

6.43% |

Market Size in 2032: |

USD 4.84 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Core Materials for Composites Market by By Type (2018-2032)

4.1 Core Materials for Composites Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Foam Core

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 HoneyComb

4.5 Wood

Chapter 5: Core Materials for Composites Market by By End Use Industry (2018-2032)

5.1 Core Materials for Composites Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aerospace and Defense

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Marine

5.5 Construction

5.6 Wind Energy

5.7 Automotive

5.8 Consumer Goods

5.9 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Core Materials for Composites Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3A COMPOSITES (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AIRBORNE INTERNATIONAL (NETHERLANDS)

6.4 CARBON-CORE CORPORATION (USA)

6.5 CHONGQING POLYCOMP INTERNATIONAL CORPORATION (CHINA)

6.6 DIAB GROUP (SWEDEN)

6.7 EVONIK INDUSTRIES AG (GERMANY)

6.8 GURIT HOLDING AG (SWITZERLAND)

6.9 HEXCEL CORPORATION (USA)

6.10 MATRIX COMPOSITE MATERIALS COMPANY (UK)

6.11 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

6.12 PLASCORE INCORPORATED (USA)

6.13 SABIC (SAUDI ARABIA)

6.14 SCHWEITER TECHNOLOGIES (SWITZERLAND)

6.15 THE GILL CORPORATION (USA)

6.16 TORAY INDUSTRIES INC. (JAPAN)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Core Materials for Composites Market By Region

7.1 Overview

7.2. North America Core Materials for Composites Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Foam Core

7.2.4.2 HoneyComb

7.2.4.3 Wood

7.2.5 Historic and Forecasted Market Size By By End Use Industry

7.2.5.1 Aerospace and Defense

7.2.5.2 Marine

7.2.5.3 Construction

7.2.5.4 Wind Energy

7.2.5.5 Automotive

7.2.5.6 Consumer Goods

7.2.5.7 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Core Materials for Composites Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Foam Core

7.3.4.2 HoneyComb

7.3.4.3 Wood

7.3.5 Historic and Forecasted Market Size By By End Use Industry

7.3.5.1 Aerospace and Defense

7.3.5.2 Marine

7.3.5.3 Construction

7.3.5.4 Wind Energy

7.3.5.5 Automotive

7.3.5.6 Consumer Goods

7.3.5.7 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Core Materials for Composites Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Foam Core

7.4.4.2 HoneyComb

7.4.4.3 Wood

7.4.5 Historic and Forecasted Market Size By By End Use Industry

7.4.5.1 Aerospace and Defense

7.4.5.2 Marine

7.4.5.3 Construction

7.4.5.4 Wind Energy

7.4.5.5 Automotive

7.4.5.6 Consumer Goods

7.4.5.7 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Core Materials for Composites Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Foam Core

7.5.4.2 HoneyComb

7.5.4.3 Wood

7.5.5 Historic and Forecasted Market Size By By End Use Industry

7.5.5.1 Aerospace and Defense

7.5.5.2 Marine

7.5.5.3 Construction

7.5.5.4 Wind Energy

7.5.5.5 Automotive

7.5.5.6 Consumer Goods

7.5.5.7 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Core Materials for Composites Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Foam Core

7.6.4.2 HoneyComb

7.6.4.3 Wood

7.6.5 Historic and Forecasted Market Size By By End Use Industry

7.6.5.1 Aerospace and Defense

7.6.5.2 Marine

7.6.5.3 Construction

7.6.5.4 Wind Energy

7.6.5.5 Automotive

7.6.5.6 Consumer Goods

7.6.5.7 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Core Materials for Composites Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Foam Core

7.7.4.2 HoneyComb

7.7.4.3 Wood

7.7.5 Historic and Forecasted Market Size By By End Use Industry

7.7.5.1 Aerospace and Defense

7.7.5.2 Marine

7.7.5.3 Construction

7.7.5.4 Wind Energy

7.7.5.5 Automotive

7.7.5.6 Consumer Goods

7.7.5.7 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Core Materials for Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.76 Billion |

|

Forecast Period 2024-32 CAGR: |

6.43% |

Market Size in 2032: |

USD 4.84 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Core Materials for Composites Market research report is 2024-2032.

3A Composites (Switzerland), Airborne International (Netherlands), Carbon-Core Corporation (USA), Chongqing Polycomp International Corporation (China), Diab Group (Sweden), Evonik Industries AG (Germany), Gurit Holding AG (Switzerland), Hexcel Corporation (USA), Matrix Composite Materials Company (UK), Mitsubishi Chemical Corporation (Japan), Plascore Incorporated (USA), SABIC (Saudi Arabia), Schweiter Technologies (Switzerland), The Gill Corporation (USA), Toray Industries, Inc. (Japan), and Other Active Players.

The Core Materials for Composites Market is segmented into Type, End Use Industry, and region. By Type, the market is categorized into Foam Core, Honeycomb, Wood. By End Use Industry, the market is categorized into Aerospace and Defense, Marine, Construction, Wind Energy, Automotive , Consumer Goods , Other By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Core Materials for Composites Market pertains to a specific niche of the overall materials sector in demand for lightweight, high strength and high performance core materials for composite structures. A lot of these materials for instance foam cores, honeycomb cores, and balsa wood are vital in the improvement of mechanical features, rigidity and strength in composite products. They are widely used in aerospace applications, marine, wind energy, automotive, and construction to guarantee high performance and minimum weight.

Core Materials for Composites Market Size Was Valued at USD 2.76 Billion in 2023, and is Projected to Reach USD 4.84 Billion by 2032, Growing at a CAGR of 6.43% From 2024-2032