Corneal Pachymetry Market Synopsis:

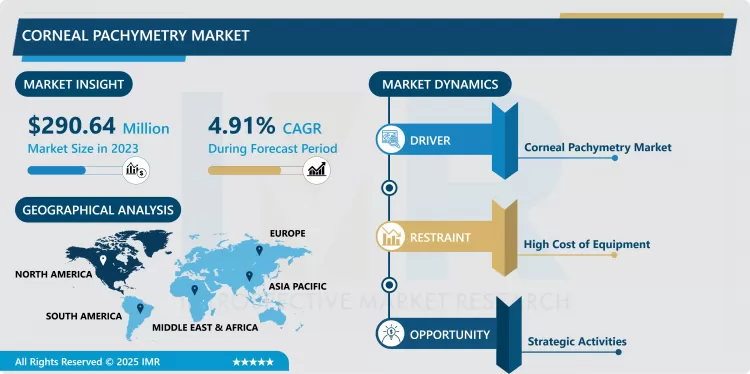

Corneal Pachymetry Market Size Was Valued at USD 290.64 Million in 2023, and is Projected to Reach USD 447.41 Million by 2032, Growing at a CAGR of 4.91% From 2024-2032.

Corneal pachymetry is hereby a test that aims at determining the thickness of cornea. Intraocular eye pressure IOP and corneal thickness are recognizable facts which knowledge facilitates the determination of the degree of IOP measurement accuracy. Also, corneal characteristics such as keratoconus, corneal edoema, glaucoma and refractive surgery employ the corneal pachymetry test.

The important diagnostics measure in ophthalmology industry, the corneal pachymetry, directs its attention to the measurement of corneal thickness. It is invaluable in diagnosing and handling of several other ocular diseases like glaucoma, keratoconus, and the various corneal disorders. The factors fuelling market growth are the growing incidence of ocular diseases, the aging population, and the technological improvement. The society is highly aging hence there is a high prevalence of age related eye diseases and therefore the need to carry out proper diagnosis. Further, new technology like the non-contact pachymetry and newest optical coherence tomography (OCT) has improved and increased corneal thickness measurement’s precision and practicality leading to more usage by ophthalmologists and optometrists.

Regionally, North America has the highest share in the corneal pachymetry market due to better health care facilities, the awareness level about the eye and better players in the market. It enjoys a solid Research and Development setup which lubricates innovation in wearable ophthalmic technologies in the region. On the other hand, the Asia-Pacific is poised to experience a strong growth due to the growing healthcare spending, enhanced awareness about the eye diseases and better health care centers. As more countries develop their health care and opt to import quality diagnostics equipment it is for this reasons that corneal pachymetry is anticipate to increase dramatically.

In addition, risks like high costs of the latest pachymetry equipment machinery, insufficient availability of qualified health care personnel, act as constraints hindering the market accessibility in some locations. However, the same challenges afford market players the opportunity to make investments in the development of affordable products and training for skills deficient in diagnosing diseases of the eyes. Moreover, there is still ongoing research being conducted on new diagnostic tools ad thus, there is hope to develop the new technology of corneal pachymetrypositively to allow better function ion clinical setting hence, improving the patients’ status. That is why market players are expected to rely on the strategies, such as partnerships, acquisitions, and developments in technologies that provide enhanced ocular measurements to fulfill the market’s growing need.

Corneal Pachymetry Market Trend Analysis:

Emerging Trends in Corneal Pachymetry

- Contemporary to this is corneal pachymetry, a non-contact technique of obtaining measurement of the thickness of the cornea that is increasingly used in diagnosis of conditions such as glaucoma and keratoconus. The rising consciousness of the key health care participants regarding the importance of accurate measurements of the corneas is the major reason behind this requirement. Lately, as clinicians have seen the importance of the corneal thickness for managing eyes conditions and choosing the right therapy approaches, the market for the corneal pachymetry devices is growing. This development is complemented with a shift in focus towards diagnosis and treatment of vision impaired as early as possible to improve patient’s well-being and prevent blindness.

- It is therefore evident that technological factors also have a strong impact on the corneal pachymetry market, more so through the development of high resolution optical coherence tomography and even advanced ultrasound pachymeters. It has been also highlighted that these advanced technologies bring benefits at increased precision and measurement reliability, which could be crucial in meaningful clinical work. The use of pachymetry to acquire detailed and accurate data of corneal thickness enhances the use of pachymetry in various cases, formal eye examinations or future eye treatments. Thus, over the years corneal thickness measurement technology is expected to facilitate the integration of corneal pachymetry into systems for a complete diagnosis of the eye, thereby increasing the market potential.

Strategic activities

- With the ever growing population requiring refractive surgery and treatment of ocular abnormalities, corneal pachymetry has therefore assumed an emerging importance in ophthalmology. A key instrument for evaluating patients for refractive surgery including LASIK is measurement of corneal thickness which this diagnostic tool provides accurately. The recent increased frequency of eye pathologies, including glaucoma and keratoconus, the lack of measurement accuracy becomes so critical as never before. These conditions call for consistent measurement of the corneal thickness to avoid the aforementioned complications and enhance therapy making the market attractive for development and innovation by participants, for instance; enhanced pachymetry devices and single diagnostic platforms.

- In addition, the increasing level of knowledge of patients and healthcare providers on the importance of the eyes is leading to increasing demand for complete vision care. The incorporation of corneal pachymetry examination precludes the early detection and monitoring of the indicated eye diseases, which will benefit the ophthalmologists’ patient outcomes. It also provides opportunities for the stakeholders in the market to invent simple, non-interventional devices which can be integrated into the existing systems. Moreover, the growing trend of tele diagnosis and home monitoring healthcare sector is available opportunities for portable pachymetry solutions for the hardness of reach patients. On the whole, I can conclude that the corneal pachymetry market has potential for growth in the near future by focusing on the development of new, innovative technologies and an increasing trend in the number of procedures that are aimed at the prevention of patients’ severe eye pathologies.

Corneal Pachymetry Market Segment Analysis:

Corneal Pachymetry Market is Segmented on the basis of Modality, Method Type, Application, End User, and Region

By Modality, Handheld segment is expected to dominate the market during the forecast period

- Portables pachymetry have been widely accepted in clinical applications mainly because of the easy-to-use mobile devices. These portable devices enable optometrists, ophthalmologists and other eye care workers to perform pachymetry tests discretely at the patient’s bedside, in clinics, or even a patient’s home. Due to their portability, quick assessments can be made using them; they are suitable for use in mobile stations and even remote area health centres. Cassie uses the word ‘ease of use’ in this context because handling handheld devices does not require complex training in order for the practitioners to conduct tests and arrive at diagnosis.

- further, measurements using portable devices have improved in precision, this makes it easy to follow the thickness of the cornea in many patients. This modality is especially beneficial when knowledge about the current state of emergency or outpatient client’s health is essential. Aside from enhancing patients’ treatment outcomes, handheld pachymetry has a potential to save time for healthcare facilities and develop a more suitable approach to allocate resources. The opportunity to provide immediate assessment can indeed dramatically influence management plans, which is why handheld devices have become such a useful adjunct in contemporary ophthalmology.

By End User, Hospitals segment expected to held the largest share

- Hospitals are a major customer of pachymetric instruments both as handheld and desktop devices are used for various ophthalmic applications. In the ophthalmology department, pachymetry is used in performing a complete diagnosis to the patients who have been diagnosed to have various diseases including glaucoma, cataracts, and corneal diseases. The use of state-of-the-art pachymetric devices in hospitals improves on the ability of eye care professionals a better chance of detecting underlying ocular problems through measurements of the corneal thickness. This ability is crucial to the process of creating individualized patient treatment plans that reflect the unique character of he or she under treatment.

- In addition, hospitals always integrate the pachymetry tool into the care plan across numerous fields of medical practice, depending on the patient’s magnitude of the disease, such as ophthalmology, optometry, and corneal surgery. This coordination of work improves patient care outcomes since all aspects of a patient’s condition are covered when the plan of management is being developed. The better inclusion of pachymetric measurements in the total diagnostic process leads to improved decision-making hence enhanced health care delivery and patient satisfaction. With further progression of technology and development of interdisciplinary cooperation in hospitals the importance of using pachymetry will persist to be crucial in providing a high level of ophthalmic care.

Corneal Pachymetry Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest market share in corneal pachymetry principally because of the acceptance of high quality of ophthalmic equipment and developed healthcare facilities. The region has a high prevalence of various eye diseases and complications, particularly glaucoma and corneal diseases, therefore the demand for ever more accurate diagnostic tools. Another factor that has made more patient use of corneal pachymetry in clinical care is shifting perception of the significance of early identification and treatment of ocular diseases. Furthermore, the role of patient care and patient outcomes is growing widespread.as a result, hc providers are instilling more complicated diagnostic technologies into their practices.

- Besides, there is an increased market demand pulling key players in North America to invest on research and development to offer better products in the market. This trend means the efforts to create enhanced, more precise, ergonomic, and effective corneal pachymeters among them. Intersectoral cooperation initiatives with key players, such as universities and clinics, contribute to the development of new authoritative solutions. In turn, the North American market for corneal pachymetry equipment offers prospects for further development due to the increasing availability of new and more effective diagnostic equipment for enhancing patients’ satisfaction and enhancing efficiency of practices.

Active Key Players in the Corneal Pachymetry Market:

- Quantel Medical (France)

- Optovue Incorporated (U.S.)

- DGH Technology, Inc. (U.S.)

- Tomey Corporation (Japan)

- Sonomed Escalon (U.S.)

- Reichert Inc. (U.S.)

- AMETEK Inc. (U.S.)

- MicroMedical Devices (MMD) Inc. (U.S.)

- OCULUS (Germany)

- Topcon (Japan)

- Ophtec BV (Netherlands)

- NIDEK Co. Ltd. (U.S.)

- CSO (Ireland)

- Zeiss International (Germany)

- Essilor (France)

- Bausch & Lomb Incorporated (Canada)

- Other Active Players

|

Corneal Pachymetry Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 290.64 Billion |

|

Forecast Period 2024-32 CAGR: |

4.91% |

Market Size in 2032: |

USD 447.41 Billion |

|

Segments Covered: |

By Modality |

|

|

|

By Method Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Corneal Pachymetry Market by By Modality (2018-2032)

4.1 Corneal Pachymetry Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Handheld

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Desktop

Chapter 5: Corneal Pachymetry Market by By Method Type (2018-2032)

5.1 Corneal Pachymetry Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ultrasonic Pachymetry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Optical Pachymetry

Chapter 6: Corneal Pachymetry Market by By Application (2018-2032)

6.1 Corneal Pachymetry Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Glaucoma Diagnostics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Refractive Surgery

6.5 Keratoconus Screening

6.6 Others

Chapter 7: Corneal Pachymetry Market by By End User (2018-2032)

7.1 Corneal Pachymetry Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Clinics

7.5 Diagnostic Laboratories

7.6 Ambulatory Surgical Centers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Corneal Pachymetry Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 QUANTEL MEDICAL (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 OPTOVUE INCORPORATED (U.S.)

8.4 DGH TECHNOLOGY INC. (U.S.)

8.5 TOMEY CORPORATION (JAPAN)

8.6 SONOMED ESCALON (U.S.)

8.7 REICHERT INC. (U.S.)

8.8 AMETEK INC. (U.S.)

8.9 MICROMEDICAL DEVICES (MMD) INC. (U.S.)

8.10 OCULUS (GERMANY)

8.11 TOPCON (JAPAN)

8.12 OPHTEC BV (NETHERLANDS)

8.13 NIDEK CO. LTD. (U.S.)

8.14 CSO (IRELAND)

8.15 ZEISS INTERNATIONAL (GERMANY)

8.16 ESSILOR (FRANCE)

8.17 BAUSCH & LOMB INCORPORATED (CANADA)

8.18 OTHER ACTIVE PLAYERS

Chapter 9: Global Corneal Pachymetry Market By Region

9.1 Overview

9.2. North America Corneal Pachymetry Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Modality

9.2.4.1 Handheld

9.2.4.2 Desktop

9.2.5 Historic and Forecasted Market Size By By Method Type

9.2.5.1 Ultrasonic Pachymetry

9.2.5.2 Optical Pachymetry

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Glaucoma Diagnostics

9.2.6.2 Refractive Surgery

9.2.6.3 Keratoconus Screening

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Hospitals

9.2.7.2 Specialty Clinics

9.2.7.3 Diagnostic Laboratories

9.2.7.4 Ambulatory Surgical Centers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Corneal Pachymetry Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Modality

9.3.4.1 Handheld

9.3.4.2 Desktop

9.3.5 Historic and Forecasted Market Size By By Method Type

9.3.5.1 Ultrasonic Pachymetry

9.3.5.2 Optical Pachymetry

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Glaucoma Diagnostics

9.3.6.2 Refractive Surgery

9.3.6.3 Keratoconus Screening

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Hospitals

9.3.7.2 Specialty Clinics

9.3.7.3 Diagnostic Laboratories

9.3.7.4 Ambulatory Surgical Centers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Corneal Pachymetry Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Modality

9.4.4.1 Handheld

9.4.4.2 Desktop

9.4.5 Historic and Forecasted Market Size By By Method Type

9.4.5.1 Ultrasonic Pachymetry

9.4.5.2 Optical Pachymetry

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Glaucoma Diagnostics

9.4.6.2 Refractive Surgery

9.4.6.3 Keratoconus Screening

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Hospitals

9.4.7.2 Specialty Clinics

9.4.7.3 Diagnostic Laboratories

9.4.7.4 Ambulatory Surgical Centers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Corneal Pachymetry Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Modality

9.5.4.1 Handheld

9.5.4.2 Desktop

9.5.5 Historic and Forecasted Market Size By By Method Type

9.5.5.1 Ultrasonic Pachymetry

9.5.5.2 Optical Pachymetry

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Glaucoma Diagnostics

9.5.6.2 Refractive Surgery

9.5.6.3 Keratoconus Screening

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Hospitals

9.5.7.2 Specialty Clinics

9.5.7.3 Diagnostic Laboratories

9.5.7.4 Ambulatory Surgical Centers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Corneal Pachymetry Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Modality

9.6.4.1 Handheld

9.6.4.2 Desktop

9.6.5 Historic and Forecasted Market Size By By Method Type

9.6.5.1 Ultrasonic Pachymetry

9.6.5.2 Optical Pachymetry

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Glaucoma Diagnostics

9.6.6.2 Refractive Surgery

9.6.6.3 Keratoconus Screening

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Hospitals

9.6.7.2 Specialty Clinics

9.6.7.3 Diagnostic Laboratories

9.6.7.4 Ambulatory Surgical Centers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Corneal Pachymetry Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Modality

9.7.4.1 Handheld

9.7.4.2 Desktop

9.7.5 Historic and Forecasted Market Size By By Method Type

9.7.5.1 Ultrasonic Pachymetry

9.7.5.2 Optical Pachymetry

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Glaucoma Diagnostics

9.7.6.2 Refractive Surgery

9.7.6.3 Keratoconus Screening

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Hospitals

9.7.7.2 Specialty Clinics

9.7.7.3 Diagnostic Laboratories

9.7.7.4 Ambulatory Surgical Centers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Corneal Pachymetry Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 290.64 Billion |

|

Forecast Period 2024-32 CAGR: |

4.91% |

Market Size in 2032: |

USD 447.41 Billion |

|

Segments Covered: |

By Modality |

|

|

|

By Method Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Corneal Pachymetry Market research report is 2024-2032.

Quantel Medical (France), Optovue Incorporated (U.S.), DGH Technology, Inc. (U.S.), Tomey Corporation (Japan), Sonomed Escalon (U.S.), Reichert Inc. (U.S.), AMETEK Inc. (U.S.), MicroMedical Devices (MMD) Inc. (U.S.), OCULUS (Germany), Topcon (Japan), Ophtec BV (Netherlands), NIDEK Co. Ltd. (U.S.), CSO (Ireland), Zeiss International (Germany), Essilor (France), Bausch & Lomb Incorporated (Canada), and Other Active Players.

The Corneal Pachymetry Market is segmented into By Modality, By Method Type, By Application, By End User and region. By Modality, the market is categorized into Handheld and Desktop. By Method Type, the market is categorized into Ultrasonic Pachymetry and Optical Pachymetry. By Application, the market is categorized into Glaucoma Diagnostics, Refractive Surgery, Keratoconus Screening and Others. By End User, the market is categorized into Hospitals, Specialty Clinics, Diagnostic Laboratories and Ambulatory Surgical Centers. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

A test to measure the cornea's thickness is called corneal pachymetry. The accuracy of intraocular eye pressure (IOP) measurement is determined using knowledge about corneal thickness. In addition, various corneal diseases, including keratoconus, corneal edoema, glaucoma, and refractive surgery, are assessed using the corneal pachymetry test.

Corneal Pachymetry Market Size Was Valued at USD 290.64 Million in 2023, and is Projected to Reach USD 447.41 Million by 2032, Growing at a CAGR of 4.91% From 2024-2032.