Crab Market Synopsis

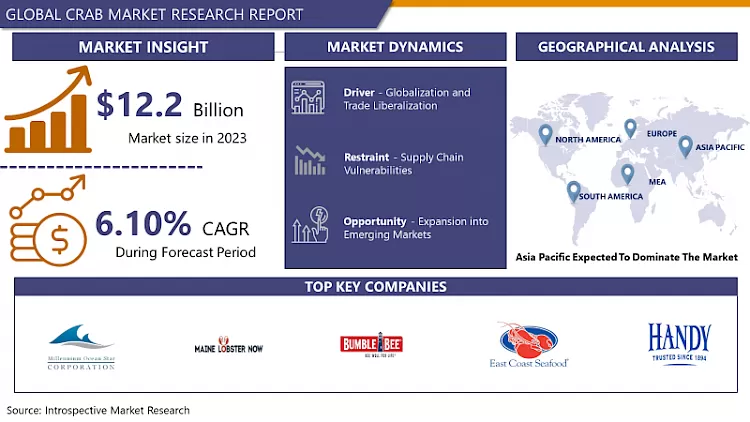

Crab Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 20.8 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.

A crab market is a specialized market where different types of crab are bought and sold for consumption, often in the seafood industry these markets can vary greatly in size, from smaller local vendors selling fresh crabs to wholesale supermarkets providing restaurants and retailers selling regionally or internationally Common features location, seasonality, local fishing regulations Depending on factors such as these. In some areas, certain types of crab, such as blue crab or Dungeness crab, can be especially valuable for their flavor and texture, leading to higher demand and potentially higher market prices Crab markets serve especially in delivering crabs to fishermen or crab eaters, so fresh and high-quality seafood : In addition to ensuring that food reaches the world’s table, crab markets are an important center of trade and commerce, it provides economic activity develops and supports livelihoods in coastal communities dependent on crab fishing and related industries

- This increased demand has created huge opportunities for suppliers and distributors operating within the market. In response to evolving consumer aspirations, there has been a marked shift towards more sustainable and ethical brands, with consumers placing increased emphasis on traceability and production is clearly in the supply chain

- Furthermore, advances in technology and transportation have enabled market expansion beyond traditional boundaries, enabling greater availability of crab products worldwide

- Despite this positive scenario, the crab market faces many challenges such as environmental problems, regulatory challenges, and fluctuating market prices but prompt manufacturers aimed to overcome challenges this year, with a focus on innovation and strategic partnerships

- Overall, the crab market presents an attractive opportunity for value-added players, characterized by strong demand, changing consumer preferences, and untapped potential to achieve sustainable development

Crab Market Trend Analysis

The Rising Demand for Eco-Friendly Crab Products

- The increasing popularity of sustainably sourced crab products is indicative of a global trend towards more conscientious consumption. Due to greater environmental awareness, individuals are increasingly aware of the impact of their purchasing decisions on the planet Consumers are increasingly concerned about the long-term sustainability of seafood, and consciously focus mainly on crack. Many individuals are now looking for confirmation that their seafood choices are consistent with sustainable fishing practices. As a result, more emphasis is placed on crab recovery from fisheries with strategies designed to reduce bycatch, conserve habitat, and ensure the long-term viability of crab populations

- In response to this trend, many crab fishermen are actively adopting eco-friendly harvesting methods and seeking certification from reputable organizations to ensure the sustainability of their practices are regularly valid These certificates, such as those issued by the Marine Supervisory Council (MSC) or the Aquatic Surveillance Commission (ASC). , serve as tangible evidence of the fishery’s commitment to sustainability Beyond the standards Rigorous scrutiny allows certified crab fisheries to differentiate their products in the marketplace, attract environmentally conscious consumers, enter attractive market segments prioritizing growth Finally, growing demand for sustainably sourced crab products and not only trends but a fundamental shift towards a more ethical and environmentally responsible seafood industry

Transforming Distribution and Sales in the Crab Industry

- Technological advances have indeed transformed the cracker industry, vastly increasing distribution and logistics capacity. Improved logistics infrastructure including expedited delivery methods and more efficient cold chain logistics play an important role in ensuring that crab reaches the market with minimal delays and in excellent condition These improvements not only reduced transit time but also helped keep the crackers fresher and better, meeting consumer expectations for high-quality seafood goods Ship the crab quickly and in new conditions reaching the market Suppliers can expand their geographic reach, into new markets to meet the global demand for high-quality seafood

- Furthermore, digital channels and the rise of online marketplaces have changed the way crack products are bought and sold, ushering in a new era of convenience and accessibility These digital channels act as important intermediaries, and affect crab suppliers' interact directly with customers, and simplify the buying process. The use of online platforms allows suppliers to showcase their products to a wider audience, allowing them to reach consumers who may not have access to traditional brick-and-mortar seafood markets Furthermore, digital channels enable better visibility and traceability of the crackers purchased, sustainably, providing quality information and enabling more informed purchasing decisions In other words and collectively, technological advances have not only improved distribution and logistics in the crab industry, but also democratized access to high-quality crab products through digital channels

Crab Market Segment Analysis:

Crab Market is Segmented Based on Type and Form.

By Type, Blue Crab segment is expected to dominate the market during the forecast period

- One of the most popular blue crab products is crabmeat, prized for its delicate flavor and versatility in both simple and complex dishes. Whether used as a salad topping, dipped in a creamy crab sauce, or presented as the main ingredient in a traditional crab cake, blue crab meat gives a sea of sweet, sweet flavors that are sure to satisfy

- Moreover, the culinary appeal of blue crabs goes beyond just their meat. Blue crab shells are often used as sweet and savory preserves, forming the base of comforting soups and biscuits. In addition, blue crab fingers, prized for their tender flesh, are often served simply with butter or juice to enjoy the steamed or boiled juices

- The versatility of blue crab extends to a variety of dishes, from Maryland crab feasts of fried whole crab seasoned with Old Bay spices to Asian-inspired dishes like Singaporean chili crab or Japanese crab sushi rolls Is essentially the taste and flavor profile of blue crab Ensures enduring popularity among seafood enthusiasts and chefs, securing its status as a favorite in the culinary world tough

By Form, the Frozen segment held the largest share in 2023

- Frozen crackers emerged as a dominant force in the market segment in terms of quality, gaining a significant share due to several compelling factors. First, refrigeration technology allows for longer preservation of the freshness and flavor of crab meat, addressing spoilage concerns and ensuring that consumers can enjoy high-quality crab of interest regardless of time or place.

- This method of preservation not only extends the shelf life of the product but also preserves its nutritional value, making frozen crab more convenient and healthy for consumers exploring the sea year-round food options

- Moreover, the softening factor plays an important role in the popularity of frozen crab products. With readily available frozen options at grocery stores and seafood markets, consumers have the option of buying and storing crabs for future use without having to eat them immediately

- Furthermore, frozen crackers can be transported long distances without compromising quality, expanding their market and availability to consumers worldwide Whether used in home cooking or added to restaurant dishes, the versatility and convenience of the frozen crab make it a favorite for seafood enthusiasts in search of quality and convenience

Crab Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The dominance of the Asia-Pacific region in the global crab market can be attributed to several major factors. First, China’s dominant presence as a producer and consumer plays an important role. Not only does China have many coastal areas suitable for crab farming and harvesting but it also has a large population with a strong cultural affinity for seafood including various species of crab This combination provides resources for the country’s consumption both internally and exports, increasing China’s market dominance.

- Second, the awareness of Japan’s taste for high-quality seafood, including premium crab species such as king crab and snow crab, further enhances the sector’s dominance Japanese consumers are willing to high prices will be paid for high-quality crab products and the demand for these affordable It varieties is growing not only in the domestic but also in the international markets

- Additionally, regional culinary traditions play an important role in crab demand. From the processing of China’s incredibly hairy crabs to the careful handling of various crabs treasured in Japanese sushi and sashimi, the versatility of the crab creates a demand for Asian dishes at market time all

Active Key Players in the Crab Market

- Bumble Bee Foods, LLC (United States)

- Handy Seafood (United States)

- Blue Star Foods Corp. (United States)

- East Coast Seafood Group (United States)

- Crown Prince, Inc. (United States)

- JM Clayton Seafood Company (United States)

- Supreme Crab and Seafood, Inc. (United States)

- Maine Lobster Now (United States)

- Millennium Ocean Star Corporation (Philippines)

- Phil-Union Frozen Foods, Inc. (Philippines)

- RGE Agridev Corporation (Philippines)

- Siam Canadian Group Limited (Thailand), and Other Key Players.

Key Industry Developments in the Crab Market:

- October 2022: Pescafresh, an Indian seafood supplier supplying mud crabs, opened a new processing and distribution hub in Mumbai.

- January 2022: A new crabbing vessel was launched for the Russian Crab Group at the Onega shipbuilding plant in Petrozadovsk. It is the first of a series that is under construction.

- January 2022: Handy Seafood (North America's oldest seafood processor) partnered with Old Bay seasoning for the launch of seafood products, mainly focusing on crab cakes featuring wild-caught blue swimming crab from fresh crabs.

|

Global Crab Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 20.8 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Crab Market by By Type (2018-2032)

4.1 Crab Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Blue Crab

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chinese Mitten

4.5 Gazami Crab

4.6 Other Crab Types

Chapter 5: Crab Market by By Form (2018-2032)

5.1 Crab Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Frozen

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Canned

5.5 Other Forms

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Crab Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CORTEVA AGRISCIENCE (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 REDDICK FUMIGANTS

6.4 LLC (U.S.)

6.5 DOUGLAS PRODUCTS AND PACKAGING PRODUCTS LLC (U.S.)

6.6 NEOGEN CORPORATION (U.S.)

6.7 INDUSTRIAL FUMIGATION COMPANY LLC (U.S.)

6.8 DEGESCH AMERICA INC. (U.S.)

6.9 BASF SE (GERMANY)

6.10 LANXESS (GERMANY)

6.11 CYTEC SOLVAY GROUP (BELGIUM)

6.12 RENTOKIL INITIAL PLC (UK)

6.13 IKEDA KOGYO COLTD. (JAPAN)

6.14 SUMITOMO CHEMICAL COLTD. (JAPAN)

6.15 NIPPON CHEMICAL INDUSTRIAL CO. LTD (JAPAN)

6.16 ADAMA AGRICULTURAL SOLUTIONS LTD (ISRAEL)

6.17 VIETNAM FUMIGATION JOINT STOCK COMPANY (VIETNAM)

6.18 UPL GROUP (INDIA)

6.19 FUMIGATION SERVICES PVT. LTD (INDIA)

6.20 NUFARM LIMITED (AUSTRALIA)

6.21

Chapter 7: Global Crab Market By Region

7.1 Overview

7.2. North America Crab Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Blue Crab

7.2.4.2 Chinese Mitten

7.2.4.3 Gazami Crab

7.2.4.4 Other Crab Types

7.2.5 Historic and Forecasted Market Size By By Form

7.2.5.1 Frozen

7.2.5.2 Canned

7.2.5.3 Other Forms

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Crab Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Blue Crab

7.3.4.2 Chinese Mitten

7.3.4.3 Gazami Crab

7.3.4.4 Other Crab Types

7.3.5 Historic and Forecasted Market Size By By Form

7.3.5.1 Frozen

7.3.5.2 Canned

7.3.5.3 Other Forms

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Crab Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Blue Crab

7.4.4.2 Chinese Mitten

7.4.4.3 Gazami Crab

7.4.4.4 Other Crab Types

7.4.5 Historic and Forecasted Market Size By By Form

7.4.5.1 Frozen

7.4.5.2 Canned

7.4.5.3 Other Forms

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Crab Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Blue Crab

7.5.4.2 Chinese Mitten

7.5.4.3 Gazami Crab

7.5.4.4 Other Crab Types

7.5.5 Historic and Forecasted Market Size By By Form

7.5.5.1 Frozen

7.5.5.2 Canned

7.5.5.3 Other Forms

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Crab Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Blue Crab

7.6.4.2 Chinese Mitten

7.6.4.3 Gazami Crab

7.6.4.4 Other Crab Types

7.6.5 Historic and Forecasted Market Size By By Form

7.6.5.1 Frozen

7.6.5.2 Canned

7.6.5.3 Other Forms

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Crab Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Blue Crab

7.7.4.2 Chinese Mitten

7.7.4.3 Gazami Crab

7.7.4.4 Other Crab Types

7.7.5 Historic and Forecasted Market Size By By Form

7.7.5.1 Frozen

7.7.5.2 Canned

7.7.5.3 Other Forms

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Crab Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 20.8 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players. |

||

Frequently Asked Questions :

The forecast period in the Crab Market research report is 2024-2032.

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players.

The Crab Market is segmented into By Type, By Form, and region. By Type, the market is categorized into Blue Crab, Chinese Mitten, Gazami Crab, and Other Crab Types. By Form, the market is categorized into Frozen, Canned, and Other Forms. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The crab market is a specialized marketplace where various species of crabs are bought and sold for consumption, typically within the seafood industry. These markets can vary widely in scale, ranging from small local vendors selling freshly caught crabs to large wholesale markets catering to restaurants and retailers on a regional or even international level. The availability of different crab species often depends on factors such as geographical location, seasonality, and local fishing regulations. In some regions, certain species of crabs, such as blue crabs or Dungeness crabs, may be particularly prized for their flavor and texture, leading to higher demand and potentially higher prices in the market. The crab market plays a crucial role in facilitating the distribution of crabs from fishermen or crabbers to consumers, ensuring that fresh and quality seafood reaches dining tables around the world. Additionally, the crab market serves as a hub for trade and commerce, fostering economic activity and supporting livelihoods within coastal communities reliant on crab fishing and related industries.

Crab Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 20.8 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.