Cysteine Market Synopsis

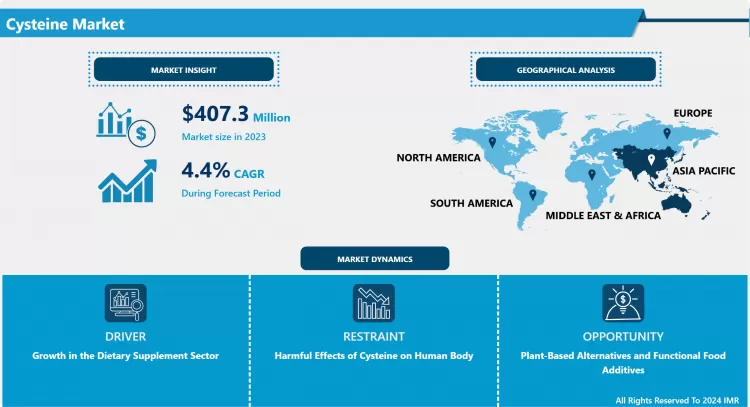

Cysteine Market Size Was Valued at USD 407.3 Million in 2023, and is Projected to Reach USD 600.09 Million by 2032, Growing at a CAGR of 4.4% From 2024-2032.

Cysteine is a semi-essential amino acid that contains sulfur, playing a key role in protein synthesis and maintaining cellular health. It supports the formation of disulfide bonds, crucial for protein structure, and acts as a precursor for glutathione, an important antioxidant in the body. Cysteine is found in high-protein foods like eggs, poultry, and dairy.

- The Cysteine Market refers to the global industry involved in the production, distribution, and sale of cysteine and its derivatives. Cysteine is a naturally occurring amino acid that is essential for various biological processes in living organisms. It is also synthesized for use in a wide range of industrial applications. The market encompasses various segments based on the type of cysteine, its applications, and the industries that use it.

- In the biological system, through its unique properties of sulfur and thiol, cysteine also plays important roles in the stability, structure, catalytic activity, and regulation of numerous proteins. In nature, cysteine can be found in animal proteins, fruits, vegetables, legumes and cereal. Due to its wide application, the production of cysteine on a large scale is in favour. At present, cysteine is produced from keratin of animal sources as well as through microbial bioconversion and fermentation.

- Cysteine is produced from keratin of animal sources as well as through microbial bioconversion and fermentation. Each production method poses its own challenges and limitations; which includes low yield, high cost and poor consumer acceptance. As such, an alternative source for large-scale cysteine production is of interest. Plants are seen to be an attractive substrate for the extraction of cysteine.

Cysteine Market Trend Analysis

Growth in the Dietary Supplement Sector

- Growing interest in natural and bio-based products is driving demand in the Cysteine Market, especially in food, pharmaceuticals, and cosmetics, as consumers show a preference for them. Increasing awareness of health benefits, particularly for NAC, is fuelling growth in the dietary supplement industry.

- The food & beverage sector is expanding, fueled by growing markets that are boosting the need for L-Cysteine. Developments in fermentation and synthetic biology are enhancing production efficiency to satisfy worldwide demand.

- A movement towards non-animal-derived cysteine is being fueled by increasing interest in ethical sourcing and sustainability. Changes in regulations within the food and pharmaceutical sectors influence both production methods and pricing tactics.

Plant-Based Alternatives and Functional Food Additives

- Substantial potential for expansion in developing regions such as Asia-Pacific, Latin America, and MEA. The need for cysteine in food, pharmaceuticals, and cosmetics is on the rise as a result of fast-paced industrialization and urbanization. The animal feed industry has the potential to grow by incorporating cysteine as a supplement.

- Rapid industrialization and urbanization create significant opportunities for cysteine in the food, pharmaceuticals, cosmetics, and animal feed industries in emerging markets such as Asia-Pacific, Latin America, and the Middle East & Africa.

- Synthetic and plant-based cysteine alternatives offer opportunities for manufacturers to cater to vegan/vegetarian markets, addressing ethical concerns and reducing reliance on animal sources. Cysteine's pharmaceutical applications, including its role in synthesizing glutathione and its use in respiratory/liver health products, drive demand in the sector.

- The rising trend of functional foods creates opportunities for cysteine as an additive due to its antioxidant properties and nutritional benefits. Increased investment in research and development can lead to new applications and improved efficacy of cysteine, opening up new market segments.

Cysteine Market Segment Analysis:

Cysteine Market Segmented on the basis of Type, Production Process, Application, and End-User.

By Type, L-Cysteine Segment Is Expected to Dominate the Market During the Forecast Period

- L-Cysteine is expected to dominate the Cysteine Market due to its versatile applications across various industries. In the food & beverage sector, it is used as a dough conditioner and flavour enhancer. In the pharmaceutical industry, it is utilized in expectorants and mucolytics, as well as in dietary supplements. In the cosmetics industry, it is incorporated into hair and skin care products.

- Benefits of L-Cysteine production involve affordable techniques achieved through natural extraction and fermentation. Its market dominance and popularity among manufacturers are fueled by its approval for global use across various industries.

- Rising middle class in developing markets like Asia-Pacific is causing a rise in the need for processed foods, supplements, and personal care items that include L-Cysteine as a main component. Increased demand is also fueled by urbanization and industrial growth, alongside advancements in fermentation technology improving production efficiency and sustainability.

By Application, Flavour Enhancer Segment Held the Largest Share in 2023

- L-Cysteine is commonly utilized in the culinary sector to boost the savoury taste in manufactured products such as soups, condiments, and snacks. Assisting in personalizing taste profiles in a competitive market, fueled by growing desire for quick meals and increasing trend of pre-packaged snacks.

- Progress in food processing technology has resulted in enhanced flavour creation by utilizing L-Cysteine as a flavour booster. This component can now be incorporated into food items more efficiently without changing their texture or appearance. Its capability of generating reliable and uniform taste characteristics has positioned it as a top pick for producers, who advantage of its approved regulations and established safety record for effective flavour improvement.

- There is a growing desire among consumers for more intense flavours, especially favouring strong and savoury tastes. L-Cysteine assists producers in satisfying these requirements by boosting umami and savoury flavours, enabling adjustments for local preferences in growing markets.

Cysteine Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Strong production capabilities and increasing demand in the food & beverage industry have propelled China, along with other countries in the Asia-Pacific region, to dominate the Cysteine Market. It acts as a significant manufacturing centre with plentiful raw materials and skilled workforce, shipping products worldwide. The rapid growth of the processed food industry is increasing the demand for L-Cysteine to act as a dough conditioner and improve flavour. The increasing demand for Cysteine in countries such as China, India, and Japan is fueled by the growing popularity of bakery products in the region.

- As health consciousness in the Asia-Pacific region increases, the need for pharmaceuticals and dietary supplements also rises. N-acetyl-l-cysteine (NAC) is well-known for its antioxidant characteristics. With more than half of the global population living in the area, there is a significant demand for products containing cysteine. The cosmetics sector is thriving, incorporating L-Cysteine in hair and skin care items. Industry growth is fueled by technological advancements in cysteine production and a commitment to sustainability.

- Positive government regulations in the Asia-Pacific region benefit sectors such as food processing and pharmaceuticals, promoting expansion through investments and adoption of technology. Trade deals make it easier to sell cysteine overseas, while urban growth and increasing middle-class numbers drive up the need for cysteine goods.

Cysteine Market Active Players

- Wacker Chemie AG (Germany)

- Ajinomoto Co., Inc. (Japan)

- Nippon Rika Co., Ltd. (Japan)

- BASF SE (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Zhangjiagang Huachang Pharmaceutical Co., Ltd. (China)

- Ningbo Zhenhai Haide Amino Acid Co., Ltd. (China)

- Wuhan Grand Hoyo Co., Ltd. (China)

- Shine Star (Hubei) Biological Engineering Co., Ltd. (China)

- Hebei Huayang Biological Technology Co., Ltd. (China)

- Shanghai Soyoung Biotechnology Inc. (China)

- Evonik Industries AG (Germany)

- Ferro Pfanstiehl Laboratories, Inc. (USA)

- Merck KGaA (Germany)

- Prinova Group LLC (USA)

- Tokyo Chemical Industry Co., Ltd. (TCI) (Japan)

- Toray Industries, Inc. (Japan)

- CJ CheilJedang Corp. (South Korea)

- Shandong Jincheng Pharmaceutical Group Co., Ltd. (China)

- Kyowa Hakko Bio Co., Ltd. (Japan)

- Evonik Rexim S.A.S. (France)

- Guangzhou Yihai Pharmaceutical Co., Ltd. (China)

- Hubei Weideli Chemical Technology Co., Ltd. (China)

- Xi’an Huisun Bio-Tech Co., Ltd. (China)

- Shijiazhuang Donghua Jinlong Chemical Co., Ltd. (China)

- Chem-Impex International, Inc. (USA)

- Sisco Research Laboratories Pvt. Ltd. (India)

- Alfa Aesar (part of Thermo Fisher Scientific) (USA)

- Hangzhou Trylead Chemical Technology Co., Ltd. (China)

- Amino GmbH (Germany), and Other Active Players.

Key Industry Developments in the Cysteine Market:

- In May 2024, Plexus Worldwide, a health and wellness company, launched IronWoman, an iron supplement specifically formulated for the unique needs of women. The supplement was made by combining L Plantarum strain, with cysteine, and Vitamin C to create a combination that offers superior iron absorption.

- In April 2024, Doctor's Best Inc., a nutritional supplement firm, introduced two new products: Glutathione + Milk Thistle with Setria and Boswellia + UC-II. Milk thistle extract contains silymarin, which boosts cysteine levels in the liver, one of the major amino acids involved in glutathione production.

- In November 2023, Vital Beautie, owned by K-beauty giant Amorepacific, launched a retinol-based dietary supplement. The formulation included L-cysteine.

|

Global Cysteine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 407.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 600.09 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cysteine Market by By Type (2018-2032)

4.1 Cysteine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 L-Cysteine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 D-Cysteine

4.5 L-Cysteine Hydrochloride

4.6 N-Acetyl-L-Cysteine (NAC)

Chapter 5: Cysteine Market by By Production Process (2018-2032)

5.1 Cysteine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Synthetic

Chapter 6: Cysteine Market by By Application (2018-2032)

6.1 Cysteine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Conditioner

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Flavor Enhancer

6.5 Reducing Agent

6.6 Reducing Agent

Chapter 7: Cysteine Market by By End-User (2018-2032)

7.1 Cysteine Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverage Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical Industry

7.5 Cosmetics & Personal Care Industry

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cysteine Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 WACKER CHEMIE AG (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AJINOMOTO COINC. (JAPAN)

8.4 NIPPON RIKA COLTD. (JAPAN)

8.5 BASF SE (GERMANY)

8.6 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

8.7 ZHANGJIAGANG HUACHANG PHARMACEUTICAL COLTD. (CHINA)

8.8 NINGBO ZHENHAI HAIDE AMINO ACID COLTD. (CHINA)

8.9 WUHAN GRAND HOYO COLTD. (CHINA)

8.10 SHINE STAR (HUBEI) BIOLOGICAL ENGINEERING COLTD. (CHINA)

8.11 HEBEI HUAYANG BIOLOGICAL TECHNOLOGY COLTD. (CHINA)

8.12 SHANGHAI SOYOUNG BIOTECHNOLOGY INC. (CHINA)

8.13 EVONIK INDUSTRIES AG (GERMANY)

8.14 FERRO PFANSTIEHL LABORATORIES INC. (USA)

8.15 MERCK KGAA (GERMANY)

8.16 PRINOVA GROUP LLC (USA)

8.17 TOKYO CHEMICAL INDUSTRY COLTD. (TCI) (JAPAN)

8.18 TORAY INDUSTRIES INC. (JAPAN)

8.19 CJ CHEILJEDANG CORP. (SOUTH KOREA)

8.20 SHANDONG JINCHENG PHARMACEUTICAL GROUP COLTD. (CHINA)

8.21 KYOWA HAKKO BIO COLTD. (JAPAN)

8.22 EVONIK REXIM S.A.S. (FRANCE)

8.23 GUANGZHOU YIHAI PHARMACEUTICAL COLTD. (CHINA)

8.24 HUBEI WEIDELI CHEMICAL TECHNOLOGY COLTD. (CHINA)

8.25 XI’AN HUISUN BIO-TECH COLTD. (CHINA)

8.26 SHIJIAZHUANG DONGHUA JINLONG CHEMICAL COLTD. (CHINA)

8.27 CHEM-IMPEX INTERNATIONAL INC. (USA)

8.28 SISCO RESEARCH LABORATORIES PVT. LTD. (INDIA)

8.29 ALFA AESAR (PART OF THERMO FISHER SCIENTIFIC) (USA)

8.30 HANGZHOU TRYLEAD CHEMICAL TECHNOLOGY COLTD. (CHINA)

8.31 AMINO GMBH (GERMANY)

8.32 AND

Chapter 9: Global Cysteine Market By Region

9.1 Overview

9.2. North America Cysteine Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 L-Cysteine

9.2.4.2 D-Cysteine

9.2.4.3 L-Cysteine Hydrochloride

9.2.4.4 N-Acetyl-L-Cysteine (NAC)

9.2.5 Historic and Forecasted Market Size By By Production Process

9.2.5.1 Natural

9.2.5.2 Synthetic

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Conditioner

9.2.6.2 Flavor Enhancer

9.2.6.3 Reducing Agent

9.2.6.4 Reducing Agent

9.2.7 Historic and Forecasted Market Size By By End-User

9.2.7.1 Food & Beverage Industry

9.2.7.2 Pharmaceutical Industry

9.2.7.3 Cosmetics & Personal Care Industry

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cysteine Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 L-Cysteine

9.3.4.2 D-Cysteine

9.3.4.3 L-Cysteine Hydrochloride

9.3.4.4 N-Acetyl-L-Cysteine (NAC)

9.3.5 Historic and Forecasted Market Size By By Production Process

9.3.5.1 Natural

9.3.5.2 Synthetic

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Conditioner

9.3.6.2 Flavor Enhancer

9.3.6.3 Reducing Agent

9.3.6.4 Reducing Agent

9.3.7 Historic and Forecasted Market Size By By End-User

9.3.7.1 Food & Beverage Industry

9.3.7.2 Pharmaceutical Industry

9.3.7.3 Cosmetics & Personal Care Industry

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cysteine Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 L-Cysteine

9.4.4.2 D-Cysteine

9.4.4.3 L-Cysteine Hydrochloride

9.4.4.4 N-Acetyl-L-Cysteine (NAC)

9.4.5 Historic and Forecasted Market Size By By Production Process

9.4.5.1 Natural

9.4.5.2 Synthetic

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Conditioner

9.4.6.2 Flavor Enhancer

9.4.6.3 Reducing Agent

9.4.6.4 Reducing Agent

9.4.7 Historic and Forecasted Market Size By By End-User

9.4.7.1 Food & Beverage Industry

9.4.7.2 Pharmaceutical Industry

9.4.7.3 Cosmetics & Personal Care Industry

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cysteine Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 L-Cysteine

9.5.4.2 D-Cysteine

9.5.4.3 L-Cysteine Hydrochloride

9.5.4.4 N-Acetyl-L-Cysteine (NAC)

9.5.5 Historic and Forecasted Market Size By By Production Process

9.5.5.1 Natural

9.5.5.2 Synthetic

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Conditioner

9.5.6.2 Flavor Enhancer

9.5.6.3 Reducing Agent

9.5.6.4 Reducing Agent

9.5.7 Historic and Forecasted Market Size By By End-User

9.5.7.1 Food & Beverage Industry

9.5.7.2 Pharmaceutical Industry

9.5.7.3 Cosmetics & Personal Care Industry

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cysteine Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 L-Cysteine

9.6.4.2 D-Cysteine

9.6.4.3 L-Cysteine Hydrochloride

9.6.4.4 N-Acetyl-L-Cysteine (NAC)

9.6.5 Historic and Forecasted Market Size By By Production Process

9.6.5.1 Natural

9.6.5.2 Synthetic

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Conditioner

9.6.6.2 Flavor Enhancer

9.6.6.3 Reducing Agent

9.6.6.4 Reducing Agent

9.6.7 Historic and Forecasted Market Size By By End-User

9.6.7.1 Food & Beverage Industry

9.6.7.2 Pharmaceutical Industry

9.6.7.3 Cosmetics & Personal Care Industry

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cysteine Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 L-Cysteine

9.7.4.2 D-Cysteine

9.7.4.3 L-Cysteine Hydrochloride

9.7.4.4 N-Acetyl-L-Cysteine (NAC)

9.7.5 Historic and Forecasted Market Size By By Production Process

9.7.5.1 Natural

9.7.5.2 Synthetic

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Conditioner

9.7.6.2 Flavor Enhancer

9.7.6.3 Reducing Agent

9.7.6.4 Reducing Agent

9.7.7 Historic and Forecasted Market Size By By End-User

9.7.7.1 Food & Beverage Industry

9.7.7.2 Pharmaceutical Industry

9.7.7.3 Cosmetics & Personal Care Industry

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Cysteine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 407.3 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 600.09 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cysteine Market research report is 2024-2032.

Wacker Chemie AG (Germany), Ajinomoto Co., Inc. (Japan), Nippon Rika Co., Ltd. (Japan), BASF SE (Germany), Mitsubishi Chemical Corporation (Japan), Zhangjiagang Huachang Pharmaceutical Co., Ltd. (China), Ningbo Zhenhai Haide Amino Acid Co., Ltd. (China), Wuhan Grand Hoyo Co., Ltd. (China), Shine Star (Hubei) Biological Engineering Co., Ltd. (China), Hebei Huayang Biological Technology Co., Ltd. (China), Shanghai Soyoung Biotechnology Inc. (China), Evonik Industries AG (Germany), Ferro Pfanstiehl Laboratories, Inc. (USA), Merck KGaA (Germany), Prinova Group LLC (USA), Tokyo Chemical Industry Co., Ltd. (TCI) (Japan), Toray Industries, Inc. (Japan), CJ CheilJedang Corp. (South Korea), Shandong Jincheng Pharmaceutical Group Co., Ltd. (China), Kyowa Hakko Bio Co., Ltd. (Japan), Evonik Rexim S.A.S. (France), Guangzhou Yihai Pharmaceutical Co., Ltd. (China), Hubei Weideli Chemical Technology Co., Ltd. (China),Xi’an Huisun Bio-Tech Co., Ltd. (China), Shijiazhuang Donghua Jinlong Chemical Co., Ltd. (China), Chem-Impex International, Inc. (USA), Sisco Research Laboratories Pvt. Ltd. (India), Alfa Aesar (part of Thermo Fisher Scientific) (USA), Hangzhou Trylead Chemical Technology Co., Ltd. (China), Amino GmbH (Germany) and Other Active Players.

The Cysteine Market is segmented into Type, Production Process, Application, End-User, and region. By Type, the market is categorized into L-Cysteine, D-Cysteine, L-Cysteine Hydrochloride, and N-Acetyl-L-Cysteine (NAC). By Production Process, the market is categorized into Natural and synthetic. By Application, the market is categorized into Conditioners, Flavor Enhancer, Reducing Agents, and Reducing Agents. By End-User, the market is categorized into the Food & Beverage Industry, Pharmaceutical Industry, and Cosmetics & Personal Care Industry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cysteine is a semi-essential amino acid that contains sulfur, playing a key role in protein synthesis and maintaining cellular health. It supports the formation of disulfide bonds, crucial for protein structure, and acts as a precursor for glutathione, an important antioxidant in the body. Cysteine is found in high-protein foods like eggs, poultry, and dairy.

Cysteine Market Size Was Valued at USD 407.3 Million in 2023, and is Projected to Reach USD 600.09 Million by 2032, Growing at a CAGR of 4.4% From 2024-2032.