Demineralized Bone Matrix Market Synopsis:

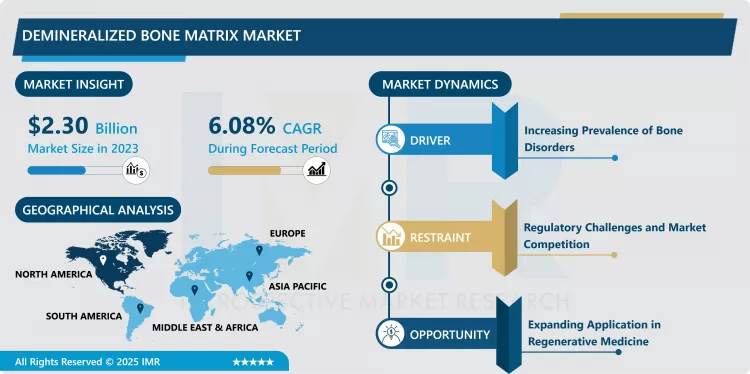

Demineralized Bone Matrix Market Size Was Valued at USD 2.30 Billion in 2023, and is Projected to Reach USD 3.91 Billion by 2032, Growing at a CAGR of 6.08% From 2024-2032.

The product market referred to as Demineralized Bone Matrix (DBM) is a bone-tissue-based product that has been demineralized, leaving behind its scaffold which supports bone regeneration and healing. DBM has been used in various orthopedic and dental applications as it offers osteoconductive and osteoinductive properties; it acts as a substitute for biological tissue through bone grafting by prompting new bone growth in patients with surgical procedures.

The growth in the past few years of Demineralized Bone Matrix for orthopedic and dental disorders has been substantial. DBM is incredibly efficient in stimulating bone healing and regeneration, thus preferred in surgical applications like spinal fusion, joint reconstruction, and dental surgeries. The growing geriatric population and increasing incidence of bone-related diseases and injuries are among the significant drivers of demand for DBM products. Growth in surgical techniques and inventive designs of DBM will also further spur the market.

Increasingly, market participants are focusing on expanding their product portfolios and enhancing the quality of DBM products through research and development efforts. Growing awareness about the least invasive surgical techniques and their benefits over traditional methods is another driver for the DBM market. Another major driver for the DBM market is going to be continued regulatory approvals of new and advanced DBM products. Rising concern for the safety of patients and efficacy of treatments will make a huge impact on the DBM market and lead to steady growth in the following years.

Demineralized Bone Matrix Market Trend Analysis:

Growing Adoption of Minimally Invasive Surgical Techniques

- Growing demand for minimally invasive surgical techniques is emerging as a prominent trend in the Demineralized Bone Matrix market. Surgeons prefer MIS due to its benefits, such as lesser postoperative pain, shorter recovery periods, and minimal scarring. This trend consequently increases the demand for DBM products because they are especially well-suited to be used in these procedures, allowing easier application and integration into the surgical site. With more and more patients opting for less invasive options, the demand for DBM in orthopedic and dental surgeries is likely to be very high.

- More importantly, with increased health care providers embracing MIS, they need innovative solutions that go beyond better patient outcomes to faster healing and bone regeneration. Bioactive properties of DBM products thus support fast integration and healing time periods that fall in line with the goals of minimally invasive procedures. Therefore, the overlap between technological progressions and surgical practices is fostering a healthy environment for the DBM market, promoting growth, and encouraging the development of next-generation DBM products that are specifically designed to suit the application area of surgery.

Expanding Application in Regenerative Medicine

- Clearly, the scope of the market in Demineralized Bone Matrix lies in the horizon of regenerative medicine. With continuous development in the field, more and more products are invented to work as an auxiliary tool in tissue engineering and regenerative therapies. All these characteristics that DBM inherently retains-cell attachment, proliferation, and differentiation characteristics-make it an essential resource for those researchers and clinicians exploring new treatment modalities. In addition, with the incorporation of DBM in regenerative medicine, the possibility to apply it in new applications other than its traditional use within orthopedics and dentistry has opened even to the treatment of bone defects and injuries.

- In addition to this, alliances between industry players and research institutions can explore the use of DBM combined with other biomaterials and growth factors to provide advancement in regenerative therapies. So, the demand for effective and customized treatment options is expected to increase, where DBM market will capitalize on these emerging opportunities and pave ways for new applications and a larger footprint in the healthcare sector.

Demineralized Bone Matrix Market Segment Analysis:

Demineralized Bone Matrix Market is Segmented on the basis of Product type, Application, End User, and Region

By Product Type, Sponge segment is expected to dominate the market during the forecast period

- The product types of the Demineralized Bone Matrix market include putty, fiber, sponge, paste, gel, and others. Putty is one of the most conventional forms, which remains a dominant form due to its ease of handling and application in most surgical procedures, which is practiced widely. This preferred product is moldable in shape, allowing surgeons to shape it according to the requirements of the surgical site. Fiber-based products are also emerging, which find applications where flexibility and adaptiveness are desired. Structurally, they enhance the process of bone regeneration through the availability of an interface for cell adhesion and proliferation.

- Increasing market demand fosters and propels development, so formulation improvements will continue to push better performance within each product. A paradigm case is a gel or paste that possesses high flow characteristics and enhances integration within the surgical site. This further development is expected to fulfill specific surgical needs and in turn increase the market shares of such product types further. Overall, the various DBM product types ensure that surgeons have appropriate solutions at their disposal for a wide variety of clinical situations.

By Application, Spinal Fusion segment expected to held the largest share

- Applications of Demineralized Bone Matrix In terms of applications, the Demineralized Bone Matrix market finds usage in spinal fusion, dental procedures, joint reconstruction, hand, foot and ankle surgeries, long bone repair, and craniomaxillofacial surgeries. The spinal fusion segment is particularly highly significant due to the increasing incidence of spinal disorders and the quantum of spinal surgeries undertaken globally. DBM's osteoconductive properties make it an ideal choice for enhancing fusion success rates in spinal procedures.

- Another factor that is encouraged for the growth in the dental application of DBM is the increasing demand for dental implants and reconstructive surgeries. In the dental field, support given by DBM in osseointegration and bone healing is a significant role player. Generally, growth in awareness about oral health will encourage the increasing demand for DBM in the dental application. Such wide applications point to the adaptability of DBM and its importance in modern surgical practices.

Demineralized Bone Matrix Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The dominance in the Demineralized Bone Matrix market currently comes from North America owing to the region's superiority in health care infrastructure, as well as the sharp rise in the prevalence of bone-related disorders. This region focuses much on research and development, thereby regularly bringing out new innovations in DBM products. In addition to this, the presence of significant market players and robust distribution channels allows for easy and quick adoption of DBM in various surgical applications. Among other factors, the rise in orthopedic and dental surgeries is a strong factor enhancing the demand for DBM; such a scenario made North America a critical market to the stakeholders.

- Positive reimbursement policies and more awareness about bone health are other factors that characterize North America's market leadership. The region would benefit from the focus on minimally invasive surgical procedures since it is increasingly becoming an adopted DBM product in clinical practice. Healthcare providers are going to concentrate more on patient outcome and invest in the best therapies possible, thereby positioning North America as the leader in the Demineralized Bone Matrix market for the foreseeable future.

Active Key Players in the Demineralized Bone Matrix Market:

- Medtronic (Ireland)

- DePuy Synthes (USA)

- Stryker (USA)

- Zimmer Biomet (USA)

- Integra LifeSciences (USA)

- Wright Medical Group (USA)

- Osiris Therapeutics (USA)

- MTF Biologics (USA)

- allograft (USA)

- Bone Solutions, Inc. (USA)

- Xtant Medical (USA)

- RTI Surgical (USA)

- Other Active Players

Key Industry Developments in the Demineralized Bone Matrix Market:

- January 2023: Orthofix Medical Inc. and SeaSpine merged to enhance their biologics product portfolio, bone growth therapies, and orthopedic solutions.

- June 2022: AlloSource launched the AlloFuse microfibers demineralized bone graft for spinal, foot, and ankle procedures.

- June 2022: Stryker inaugurated its new research and development facility in Gurgaon, India. Installing these new facilities aims to strengthen their R&D capabilities and accelerate product innovation.

|

Demineralized Bone Matrix Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.30 Billion |

|

Forecast Period 2024-32 CAGR: |

6.08% |

Market Size in 2032: |

USD 3.91 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Demineralized Bone Matrix Market by By Product Type (2018-2032)

4.1 Demineralized Bone Matrix Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Putty

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fiber

4.5 Sponge

4.6 Paste

4.7 Gel

4.8 Others

Chapter 5: Demineralized Bone Matrix Market by By Application (2018-2032)

5.1 Demineralized Bone Matrix Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Spinal Fusion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dental

5.5 Joint Reconstruction

5.6 Hand

5.7 Foot

5.8 and Ankle

5.9 Long Bone

5.10 Craniomaxillofacial

Chapter 6: Demineralized Bone Matrix Market by By End User (2018-2032)

6.1 Demineralized Bone Matrix Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Outpatient Facilities

6.5 Specialized Orthopedic Clinics

6.6 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Demineralized Bone Matrix Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DEPUY SYNTHES (USA)

7.4 STRYKER (USA)

7.5 ZIMMER BIOMET (USA)

7.6 INTEGRA LIFESCIENCES (USA)

7.7 WRIGHT MEDICAL GROUP (USA)

7.8 OSIRIS THERAPEUTICS (USA)

7.9 MTF BIOLOGICS (USA)

7.10 ALLOGRAFT (USA)

7.11 BONE SOLUTIONS INC. (USA)

7.12 XTANT MEDICAL (USA)

7.13 RTI SURGICAL (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Demineralized Bone Matrix Market By Region

8.1 Overview

8.2. North America Demineralized Bone Matrix Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Putty

8.2.4.2 Fiber

8.2.4.3 Sponge

8.2.4.4 Paste

8.2.4.5 Gel

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Spinal Fusion

8.2.5.2 Dental

8.2.5.3 Joint Reconstruction

8.2.5.4 Hand

8.2.5.5 Foot

8.2.5.6 and Ankle

8.2.5.7 Long Bone

8.2.5.8 Craniomaxillofacial

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Outpatient Facilities

8.2.6.3 Specialized Orthopedic Clinics

8.2.6.4 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Demineralized Bone Matrix Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Putty

8.3.4.2 Fiber

8.3.4.3 Sponge

8.3.4.4 Paste

8.3.4.5 Gel

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Spinal Fusion

8.3.5.2 Dental

8.3.5.3 Joint Reconstruction

8.3.5.4 Hand

8.3.5.5 Foot

8.3.5.6 and Ankle

8.3.5.7 Long Bone

8.3.5.8 Craniomaxillofacial

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Outpatient Facilities

8.3.6.3 Specialized Orthopedic Clinics

8.3.6.4 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Demineralized Bone Matrix Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Putty

8.4.4.2 Fiber

8.4.4.3 Sponge

8.4.4.4 Paste

8.4.4.5 Gel

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Spinal Fusion

8.4.5.2 Dental

8.4.5.3 Joint Reconstruction

8.4.5.4 Hand

8.4.5.5 Foot

8.4.5.6 and Ankle

8.4.5.7 Long Bone

8.4.5.8 Craniomaxillofacial

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Outpatient Facilities

8.4.6.3 Specialized Orthopedic Clinics

8.4.6.4 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Demineralized Bone Matrix Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Putty

8.5.4.2 Fiber

8.5.4.3 Sponge

8.5.4.4 Paste

8.5.4.5 Gel

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Spinal Fusion

8.5.5.2 Dental

8.5.5.3 Joint Reconstruction

8.5.5.4 Hand

8.5.5.5 Foot

8.5.5.6 and Ankle

8.5.5.7 Long Bone

8.5.5.8 Craniomaxillofacial

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Outpatient Facilities

8.5.6.3 Specialized Orthopedic Clinics

8.5.6.4 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Demineralized Bone Matrix Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Putty

8.6.4.2 Fiber

8.6.4.3 Sponge

8.6.4.4 Paste

8.6.4.5 Gel

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Spinal Fusion

8.6.5.2 Dental

8.6.5.3 Joint Reconstruction

8.6.5.4 Hand

8.6.5.5 Foot

8.6.5.6 and Ankle

8.6.5.7 Long Bone

8.6.5.8 Craniomaxillofacial

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Outpatient Facilities

8.6.6.3 Specialized Orthopedic Clinics

8.6.6.4 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Demineralized Bone Matrix Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Putty

8.7.4.2 Fiber

8.7.4.3 Sponge

8.7.4.4 Paste

8.7.4.5 Gel

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Spinal Fusion

8.7.5.2 Dental

8.7.5.3 Joint Reconstruction

8.7.5.4 Hand

8.7.5.5 Foot

8.7.5.6 and Ankle

8.7.5.7 Long Bone

8.7.5.8 Craniomaxillofacial

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Outpatient Facilities

8.7.6.3 Specialized Orthopedic Clinics

8.7.6.4 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Demineralized Bone Matrix Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.30 Billion |

|

Forecast Period 2024-32 CAGR: |

6.08% |

Market Size in 2032: |

USD 3.91 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Demineralized Bone Matrix Market research report is 2024-2032.

Medtronic (Ireland), DePuy Synthes (USA), Stryker (USA), Zimmer Biomet (USA), Integra LifeSciences (USA), Wright Medical Group (USA), Osiris Therapeutics (USA), MTF Biologics (USA), Allograft (USA), Bone Solutions, Inc. (USA), Xtant Medical (USA), RTI Surgical (USA), and Other Active Players.

The Demineralized Bone Matrix Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Putty, Fiber, Sponge, Paste, Gel, Others. By Application, the market is categorized into Spinal Fusion, Dental, Joint Reconstruction, Hand, Foot, and Ankle, Long Bone, Craniomaxillofacial. By End-use, the market is categorized into Hospitals, Outpatient Facilities, Specialized Orthopedic Clinics, Ambulatory Surgical Centers. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The product market referred to as Demineralized Bone Matrix (DBM) is a bone-tissue-based product that has been demineralized, leaving behind its scaffold which supports bone regeneration and healing. DBM has been used in various orthopedic and dental applications as it offers osteoconductive and osteoinductive properties; it acts as a substitute for biological tissue through bone grafting by prompting new bone growth in patients with surgical procedures.

Demineralized Bone Matrix Market Size Was Valued at USD 2.30 Billion in 2023, and is Projected to Reach USD 3.91 Billion by 2032, Growing at a CAGR of 6.08% From 2024-2032.