Demolition Material Handlers Market Synopsis

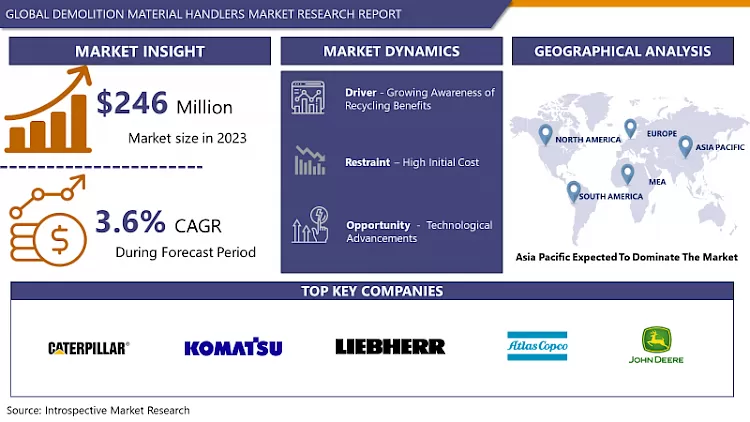

The Global Demolition Material Handlers Market Size Was Valued at USD 246 million in 2023 and is Projected to Reach USD 338.20 million by 2032, Growing at a CAGR of 3.6 % From 2024-2032.

Demolition Material Handlers are specialized machines used in the construction and demolition industry for efficient and controlled demolition of structures and debris. They are equipped with attachments for specific tasks, facilitating selective removal, sorting, and recycling of materials, contributing to improved safety, precision, and environmental sustainability.

- Building demolition involves the systematic removal of residential, commercial, or industrial buildings. Bridge demolition involves the safe dismantling of bridges, minimizing environmental impact. Industrial demolition involves the dismantling of large industrial complexes, while road demolition removes roads, highways, and infrastructure, contributing to urban redevelopment projects.

- Demolition Material Handlers are machines designed for precise and controlled demolition, reducing the risk of collateral damage to structures. Equipped with attachments like grapples and crushers, they handle debris efficiently, promoting recycling and waste management. These machines are designed with advanced technology to minimize risks associated with manual demolition. They offer versatility, catering to diverse tasks and project requirements. They promote environmental sustainability by selectively removing and sorting materials, reducing the environmental impact of demolition projects. They also increase productivity, contributing to faster project completion times. Some models feature remote-controlled operation, enhancing operator safety. They can operate in various conditions, including tight spaces or challenging terrains.

Demolition Material Handlers Market Trend Analysis:

Growing Awareness of Recycling Benefits

- There is a growing acknowledgment of the environmental impact associated with construction and demolition activities, leading to an increased focus on sustainable practices. As environmental awareness becomes more prevalent, stakeholders in the construction industry, including contractors and project developers, are actively seeking solutions that promote responsible waste management.

- Demolition Material Handlers, equipped with advanced recycling capabilities, play a crucial role in addressing these concerns. These machines enable the efficient sorting, handling, and processing of demolition materials, allowing for the extraction of recyclable components such as concrete, metal, and wood. The ability to recycle materials not only reduces the volume of waste sent to landfills but also contributes to the circular economy by reintegrating reclaimed materials into new construction projects.

- This trend is closely tied to regulatory pressures and societal expectations for eco-friendly construction practices. As governments and organizations increasingly prioritize sustainable construction methodologies, the demand for Demolition Material Handlers capable of promoting recycling benefits continues to rise. Manufacturers responding to this trend by developing and promoting machinery with enhanced recycling capabilities position themselves at the forefront of an environmentally conscious market, contributing to the overall sustainability of the construction and demolition industry.

Technological Advancements

- The Demolition Material Handlers market presents significant growth opportunities driven by technological advancements. The integration of state-of-the-art technologies enhances the performance, safety, and efficiency of these machines, paving the way for innovation. Smart Demolition Material Handlers, equipped with Internet of Things (IoT) sensors and artificial intelligence, enable real-time monitoring and data analysis. This capability not only boosts operational efficiency but also facilitates predictive maintenance, reducing downtime and overall lifecycle costs.

- Furthermore, advancements in automation and remote-controlled operation contribute to improved safety by allowing operators to manage the equipment from a safe distance, especially in hazardous environments. These technological innovations align with the industry's sustainability goals, enabling manufacturers to develop eco-friendly handlers with enhanced energy efficiency and reduced emissions.

- Additionally, the ongoing evolution of advanced attachments and tools, such as more efficient crushers and grapples, creates opportunities for manufacturers to provide versatile solutions that meet the changing needs of the construction and demolition sector. As the industry embraces and invests in these technological opportunities, it stands to benefit from increased efficiency, safety, and environmental responsibility, fostering the overall growth of the Demolition Material Handlers market.

Demolition Material Handlers Market Segment Analysis:

Demolition Material Handlers Market Segmented on the basis of Type, Power Source, Capacity, Application and End-User

By Application, Building Demolition Segment is Expected to Dominate the Market During the Forecast Period

- The Building Demolition segment is expected to take a prominent position in the Demolition Material Handlers market. This anticipation is driven by the increasing demand for controlled and precise dismantling of structures within the construction and redevelopment sectors. Building Demolition Material Handlers are designed to efficiently navigate and dismantle various types of structures, including residential, commercial, and industrial buildings.

- The growing trend of urbanization, coupled with the necessity for urban redevelopment projects, significantly contributes to the prominence of this segment. These handlers play a crucial role in ensuring the safe and systematic removal of buildings, addressing safety concerns and minimizing collateral damage. As the construction industry continues to evolve with a focus on sustainable and strategic demolition practices, the Building Demolition segment is poised to lead the market, providing specialized solutions that cater to the unique challenges posed by structures of different sizes and complexities.

By Power Source, Hydraulic Demolition Material Handlers Segment Held the Largest Share of 66.19% in 2022

- The Hydraulic Demolition Material Handlers segment has taken the lead, securing the largest share of the market. This dominance is credited to the efficiency and versatility provided by hydraulic systems in the controlled dismantling of structures. Hydraulic Demolition Material Handlers leverage advanced hydraulic technology, granting operators precise control, power, and adaptability. These handlers excel in managing various attachments, including crushers and grapples, ensuring efficient material handling and processing during demolition activities. The demand for Hydraulic Demolition Material Handlers is driven by their capability to navigate diverse demolition scenarios, such as urban environments and tight spaces.

- Additionally, their robust power and performance make them crucial in addressing the evolving needs of the construction and demolition industry. With a surge in construction and infrastructure projects, the Hydraulic Demolition Material Handlers segment is poised to uphold its dominance by providing reliability and technology.

Demolition Material Handlers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to dominate the Demolition Material Handlers market, showcasing robust growth and emerging as a key player in the industry. This dominance can be attributed to rapid urbanization, increasing construction and infrastructure development activities, and a surge in urban redevelopment projects across countries like China, India, and Japan.

- The escalating demand for controlled and strategic demolition practices in these regions, driven by evolving regulatory frameworks and environmental considerations, further fuels the adoption of advanced Demolition Material Handlers. Additionally, the focus on sustainable construction practices and the continuous growth of the construction and demolition sector contribute to the expanding market in the Asia Pacific.

Key Players Covered in Demolition Material Handlers Market:

- Caterpillar (US)

- John Deere (US)

- Komatsu (US)

- Liebherr (US)

- Hyundai Construction Equipment (US)

- Hitachi Construction Machinery (US)

- Doosan Bobcat (US)

- Atlas Copco (US)

- Epiroc (US)

- JCB (UK)

- Case New Holland (UK)

- Sandvik (Sweden)

- Atlas Weyhausen (Germany)

- Liebherr (Germany)

- Volvo Construction Equipment (Sweden)

- Hitachi Construction Machinery (Japan)

- Doosan Infracore (South Korea)

- Komatsu (Japan) Liugong Machinery (China), and Other Major Players

Key Industry Developments in the Demolition Material Handlers Market:

- In April 2024, Develon, formerly known as Doosan Construction Equipment, proudly introduced the DX140RDM-7, the latest innovation in its lineup of demolition excavators. Weighing 22.5 tonnes, this new addition offers various configurations, akin to its larger counterparts ranging from 31 to 61 tonnes. The DX140RDM-7 provides versatility for diverse projects, including a multi-purpose version suitable for other on-site applications besides demolition. With this launch, Develon continues its commitment to delivering tailored solutions to meet the evolving needs of its customers.

- In January 2022, Caterpillar introduced the Cat MH3024, a new demolition material handler designed for improved performance and operator comfort.

- In October 2023, Caterpillar announced plans to expand its demolition material handler production capacity in response to increasing demand.

|

Global Demolition Material Handlers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 246 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.6 % |

Market Size in 2032: |

USD 338.20 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Source |

|

||

|

By Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Demolition Material Handlers Market by By Type (2018-2032)

4.1 Demolition Material Handlers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 High-Reach Excavators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Crushers/Pulverizers

4.5 Material Grapples

4.6 Wrecking Balls

4.7 Concrete Processors

Chapter 5: Demolition Material Handlers Market by By Power Source (2018-2032)

5.1 Demolition Material Handlers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hydraulic Demolition Material Handlers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electric Demolition Material Handlers

5.5 Diesel-Powered Demolition Material Handlers

Chapter 6: Demolition Material Handlers Market by By Capacity (2018-2032)

6.1 Demolition Material Handlers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Weight 20-50 Tons

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Weight 50-100 Tons

6.5 Weight more than 100 Tons

Chapter 7: Demolition Material Handlers Market by By Application (2018-2032)

7.1 Demolition Material Handlers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Building Bridge

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Industrial

7.5 Road

Chapter 8: Demolition Material Handlers Market by By End-User (2018-2032)

8.1 Demolition Material Handlers Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Construction Industry

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Waste Management and Recycling

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Demolition Material Handlers Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ORBCOMM INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 GARMIN LTD (U.S.)

9.4 L3HARISS TECHNOLOGIES INC. (U.S.)

9.5 ACR ELECTRONICS INC. (U.S.)

9.6 EXACTEARTH LTD (CANADA)

9.7 COMNAV MARINE LTD (CANADA)

9.8 SAAB AB (SWEDEN)

9.9 C.N.S. SYSTEMS AB (SWEDEN)

9.10 TRUE HEADING AB (SWEDEN)

9.11 KONGSBERG GRUPPEN ASA (NORWAY)

9.12 JOTRON AS (NORWAY)

9.13 WARTSILA OYJ ABP (FINLAND)

9.14 RAYMARINE (UK)

9.15 THALES (FRANCE)

9.16 MARINETRAFFIC (GREECE)

9.17 FURUNO ELECTRIC CO. LTD (JAPAN)

9.18 JAPAN RADIO CO. LTD. (JAPAN)

9.19 ONWA MARINE ELECTRONICS CO. LTD (HONG KONG)

9.20

Chapter 10: Global Demolition Material Handlers Market By Region

10.1 Overview

10.2. North America Demolition Material Handlers Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 High-Reach Excavators

10.2.4.2 Crushers/Pulverizers

10.2.4.3 Material Grapples

10.2.4.4 Wrecking Balls

10.2.4.5 Concrete Processors

10.2.5 Historic and Forecasted Market Size By By Power Source

10.2.5.1 Hydraulic Demolition Material Handlers

10.2.5.2 Electric Demolition Material Handlers

10.2.5.3 Diesel-Powered Demolition Material Handlers

10.2.6 Historic and Forecasted Market Size By By Capacity

10.2.6.1 Weight 20-50 Tons

10.2.6.2 Weight 50-100 Tons

10.2.6.3 Weight more than 100 Tons

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Building Bridge

10.2.7.2 Industrial

10.2.7.3 Road

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Construction Industry

10.2.8.2 Waste Management and Recycling

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Demolition Material Handlers Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 High-Reach Excavators

10.3.4.2 Crushers/Pulverizers

10.3.4.3 Material Grapples

10.3.4.4 Wrecking Balls

10.3.4.5 Concrete Processors

10.3.5 Historic and Forecasted Market Size By By Power Source

10.3.5.1 Hydraulic Demolition Material Handlers

10.3.5.2 Electric Demolition Material Handlers

10.3.5.3 Diesel-Powered Demolition Material Handlers

10.3.6 Historic and Forecasted Market Size By By Capacity

10.3.6.1 Weight 20-50 Tons

10.3.6.2 Weight 50-100 Tons

10.3.6.3 Weight more than 100 Tons

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Building Bridge

10.3.7.2 Industrial

10.3.7.3 Road

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Construction Industry

10.3.8.2 Waste Management and Recycling

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Demolition Material Handlers Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 High-Reach Excavators

10.4.4.2 Crushers/Pulverizers

10.4.4.3 Material Grapples

10.4.4.4 Wrecking Balls

10.4.4.5 Concrete Processors

10.4.5 Historic and Forecasted Market Size By By Power Source

10.4.5.1 Hydraulic Demolition Material Handlers

10.4.5.2 Electric Demolition Material Handlers

10.4.5.3 Diesel-Powered Demolition Material Handlers

10.4.6 Historic and Forecasted Market Size By By Capacity

10.4.6.1 Weight 20-50 Tons

10.4.6.2 Weight 50-100 Tons

10.4.6.3 Weight more than 100 Tons

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Building Bridge

10.4.7.2 Industrial

10.4.7.3 Road

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Construction Industry

10.4.8.2 Waste Management and Recycling

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Demolition Material Handlers Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 High-Reach Excavators

10.5.4.2 Crushers/Pulverizers

10.5.4.3 Material Grapples

10.5.4.4 Wrecking Balls

10.5.4.5 Concrete Processors

10.5.5 Historic and Forecasted Market Size By By Power Source

10.5.5.1 Hydraulic Demolition Material Handlers

10.5.5.2 Electric Demolition Material Handlers

10.5.5.3 Diesel-Powered Demolition Material Handlers

10.5.6 Historic and Forecasted Market Size By By Capacity

10.5.6.1 Weight 20-50 Tons

10.5.6.2 Weight 50-100 Tons

10.5.6.3 Weight more than 100 Tons

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Building Bridge

10.5.7.2 Industrial

10.5.7.3 Road

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Construction Industry

10.5.8.2 Waste Management and Recycling

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Demolition Material Handlers Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 High-Reach Excavators

10.6.4.2 Crushers/Pulverizers

10.6.4.3 Material Grapples

10.6.4.4 Wrecking Balls

10.6.4.5 Concrete Processors

10.6.5 Historic and Forecasted Market Size By By Power Source

10.6.5.1 Hydraulic Demolition Material Handlers

10.6.5.2 Electric Demolition Material Handlers

10.6.5.3 Diesel-Powered Demolition Material Handlers

10.6.6 Historic and Forecasted Market Size By By Capacity

10.6.6.1 Weight 20-50 Tons

10.6.6.2 Weight 50-100 Tons

10.6.6.3 Weight more than 100 Tons

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Building Bridge

10.6.7.2 Industrial

10.6.7.3 Road

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Construction Industry

10.6.8.2 Waste Management and Recycling

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Demolition Material Handlers Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 High-Reach Excavators

10.7.4.2 Crushers/Pulverizers

10.7.4.3 Material Grapples

10.7.4.4 Wrecking Balls

10.7.4.5 Concrete Processors

10.7.5 Historic and Forecasted Market Size By By Power Source

10.7.5.1 Hydraulic Demolition Material Handlers

10.7.5.2 Electric Demolition Material Handlers

10.7.5.3 Diesel-Powered Demolition Material Handlers

10.7.6 Historic and Forecasted Market Size By By Capacity

10.7.6.1 Weight 20-50 Tons

10.7.6.2 Weight 50-100 Tons

10.7.6.3 Weight more than 100 Tons

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Building Bridge

10.7.7.2 Industrial

10.7.7.3 Road

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Construction Industry

10.7.8.2 Waste Management and Recycling

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Demolition Material Handlers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 246 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.6 % |

Market Size in 2032: |

USD 338.20 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Source |

|

||

|

By Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the market research report is 2024-2032.

Caterpillar (US), John Deere (US), Komatsu (US), Liebherr (US), Hyundai Construction Equipment (US), Hitachi Construction Machinery (US), Doosan Bobcat (US), Atlas Copco (US), Epiroc (US), JCB (UK), Case New Holland (UK), Sandvik (Sweden), Atlas Weyhausen (Germany), Liebherr (Germany), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery (Japan), Doosan Infracore (South Korea), Komatsu (Japan) Liugong Machinery (China), and Other Major Players

The Demolition Material Handlers Market is segmented into Type, Power Source, Capacity, Application, End-User and region. By Type, the market is categorized into High-Reach Excavators, Crushers/Pulverizers, Material Grapples, Wrecking Balls, and Concrete Processors. By Power Source, the market is categorized into Hydraulic Demolition Material Handlers, Electric Demolition Material Handlers, and Diesel-Powered Demolition Material Handlers. By Capacity, the market is categorized into Weight 20-50 Tons, Weight 50-100 Tons, and Weight more than 100 Tons. By Application, the market is categorized into Building Bridge, Industrial, and Road. By End-User, the market is categorized into Construction Industry and Waste Management and Recycling. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Demolition Material Handlers are specialized machines used in the construction and demolition industry for efficient and controlled demolition of structures and debris. They are equipped with attachments for specific tasks, facilitating selective removal, sorting, and recycling of materials, contributing to improved safety, precision, and environmental sustainability.

The Global Demolition Material Handlers Market Size Was Valued at USD 246 million in 2023 and is Projected to Reach USD 338.20 million by 2032, Growing at a CAGR of 3.6 % From 2024-2032.