Dental Cameras Market Synopsis:

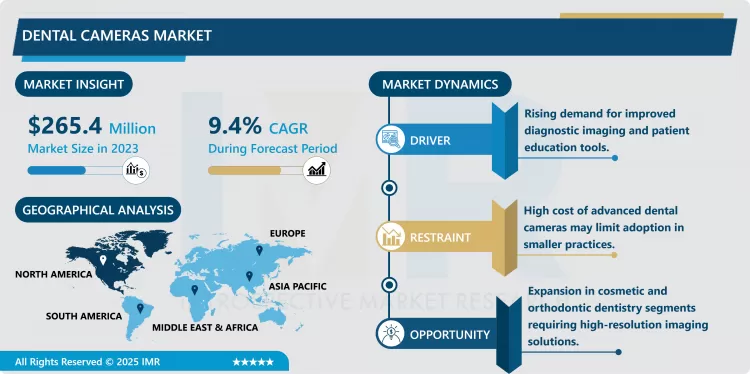

Dental Cameras Market Size Was Valued at USD 265.4 Million in 2023, and is Projected to Reach USD 595.74 Million by 2032, Growing at a CAGR of 9.4 % From 2024-2032.

In simple terms Dental Cameras can be described as a range of transportable camera apparatuses used in dental practices that is used to take high-quality, porcelain dental architecture images to help in arrival at the right diagnosis and also to explain to the patient and planning for a treatment procedure. Telescopic cameras, endoscopic cameras and digitalising cameras are used by the dentists to have a wider view of the teeth, gums and other structures which are not normally seen under ordinary light. What’s more, it is ineffective to use them in modern methods of diagnostics and treatment of the diseases of the oral cavity, they provide visible data that are helpful in practical analysis and clear explanation to the patient.

This trend has applied to the growth in the dental cameras, which is quite facilitated by the enhanced technological features within the imaging technology and enhanced knowledge on the importance of early detection of diseases within the mouth. Considering that new procedures are being adopted by dentists to better diagnose their patients, and to treat them, dental cameras have become essential instruments utilized globally. Among them intraoral camera, this is because these cameras offer instant view of the oral cavity of the patient via a monitor. This capability enhances the relation between dentists and patient because patient have to be privileged with a view of their problems for him/ her to have better understanding of solution provided by dentist. Third there is the aspect of the dental cameras in record and documentation inclusive of the record of the progress of the patients and insurance.

General shift towards oral health and incidences of oral health problems like tooth decay, gum disease, and dental anomalies providing an good market for high quality imaging systems. The advanced technological features have led to the raising of prospects for dental cameras through improved imaging systems, portable editions, and wireless intraoral cameras that are used both at large dental facilities and local dental practices. Since there is always demand for better outcomes for the patients and dentists are continually focusing on the results giving importance to the cameras while diagnosing and treating, the dental cameras market will grow continuously.

Dental Cameras Market Trend Analysis:

Growing Demand for AI-Enhanced Dental Cameras

- One of the growing markets in the dental cameras include cameras equipped with functions that relate to AI features shading out possible oral issues. These integrating and learning systems enable analysis of objects on images in real time especially symptoms of cavity, decay and gum diseases and enable the dentist to give right diagnosis in the least time possible. Incorporation of AI into dental cameras does assist in diagnosing the patients but as well allows the dentist to explain to the patient the kind of condition that is being detected by the camera. This continues the broader utilization of AI in the giant health and dental industries where AI is, in fact, famous for diagnosing, creating treatment plans, and observing patients. As patients seek better diagnostics during their dental check-up, coupled with improved visuals that the AI integrated dental cameras will provide, are also likely to become normal mode of tools for detailed practices in dentistry.

Rising Adoption in Cosmetic and Orthodontic Dentistry

- When it comes to size of the market, the dental cameras have a big market in cosmetic and orthodontic dentistry as patient’s awareness of aesthetic and correction procedures is rising. Orthodontic treatments, tooth whitening and other aesthetic procedures are widely used by patients and thus benefit, contemporary dental practice uses treatment planning imaging. Cameras are still important in dentistry to capture and show the patient both before and after treatment in order to make him aware of what can be done. In the carriage of Orthodontic cameras, are utilized to record progress at every stage of the process this enables the doctors to confirm progress and fine tune as required. The specific and elective dentistry, other with the steady improvement in camera technology offers the cosmetic and orthodontic segment as the prime growth opportunity in the dental cameras market.

Dental Cameras Market Segment Analysis:

Dental Cameras Market is Segmented on the basis of product type, application, end user, and Regiohn.

By Type, Intraoral Dental Camera segment is expected to dominate the market during the forecast period

- According to the analysis performed, the largest segment of the dental cameras market will be the Intraoral Dental Camera segment during the forecast period. Intraoral cameras provide the dentist with clear images of complex regions in the mouth, which makes them useful in diagnosis in addition to a communication aid. The features with which these cameras equip dentists are capable of diagnosing cavities, plaque deposit, gum inflammation and other related oral problems from the mouth. These simple devices enable the dentist to take picture images from within the mouth in a moment and display them on screen in the same moment to give a better explanation of the trouble to the patient. Due to advancements in wireless as well as intraoral camera via USB adaptors, the concept of intraoral cameras uses and implementation into dental practice management systems is on the lip service quickly. This change of focus has placed intraoral cameras most favourably and hence they are part of the leading category in the market due probably to the options for prevention, regular check-up and minimal invasive methods among other advantages.

By Application, the Orthodontics segment expected to held the largest share

- The Orthodontics segment may hold the largest market for dental camera because of the growing application of the imaging systems in corrective and alignment operations. Brackets bands aligners, retainers and all types of related oral appliances are accurate appliances based on planning and operated on a checks or review cycle hence dental cameras forms vital documentations and check-up instruments. Earlier, middle and at the end orthodontists capture clear image of the patient’s mouth through cameras, and then consult the images to determine the best strategic plan and adjust the treatment plan according to their desire. Furthermore, patients under orthodontic care need extensive photographic documentation of the treatment progress as this increases patient satisfaction and therefore high levels of compliance to the set treatment regimen. As clear aligners and other orthodontic products are being called more and more, the need for cameras that could offer high resolution necessary for orthopaedic dentistry will strengthen this segment, which itself is ahead in the global market.

Dental Cameras Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis done on regional segments, North America will dominate the dental cameras market over the forecast period due to well-developed healthcare systems, increased demand for dental health, and key players. Of these, it is the United States that had the most developed dental care market focusing on timely diagnostics and preventive actions in which dental imaging solutions are essential. The large number of operative dental clinics in combination with insurance and reimbursement for dental care services which are generally more favorable in North America add to the market growth for dental cameras.

- The factors driving the growth of the market in Canada include growing consciousness regarding oral health, along with a growing focus towards government-sponsored dental care. The strategizing of incorporating technology in regional health practices and care delivery has inspired dental professionals in the region to get equipped with camera systems that BETTER teach patients, facilitate data capture, and contribute to medical diagnosis. In addition, a large number of manufacturers and subsequent product developments associated with dental cameras place North America at the forefront of the global market.

Active Key Players in the Dental Cameras Market:

- ACTEON Group (France)

- Align Technology, Inc. (US)

- Carestream Dental (US)

- Danaher Corporation (US)

- DENTSPLY SIRONA Inc. (US)

- Designs for Vision, Inc. (US)

- Envista Holdings Corporation (US)

- GC Corporation (Japan)

- Hamamatsu Photonics K.K. (Japan)

- Hu-Friedy Mfg. Co., LLC (US)

- Midmark Corporation (US)

- Owandy Radiology (France)

- Planmeca Oy (Finland)

- Royal Philips (Netherlands)

- Vatech Co., Ltd. (South Korea)

- Other Active Players

|

Dental Cameras Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD265.4 Million |

|

Forecast Period 2024-32 CAGR: |

9.4 % |

Market Size in 2032: |

USD 595.74 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Cameras Market by By Type (2018-2032)

4.1 Dental Cameras Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Intraoral

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dental

4.5 Extraoral Cameras

Chapter 5: Dental Cameras Market by By Application (2018-2032)

5.1 Dental Cameras Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Orthodontics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Endodontics

5.5 Dental Diagnosis

5.6 Others

Chapter 6: Dental Cameras Market by By End User (2018-2032)

6.1 Dental Cameras Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dental

6.5 Clinics

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Dental Cameras Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACTEON GROUP (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALIGN TECHNOLOGY INC. (US)

7.4 CARESTREAM DENTAL (US)

7.5 DANAHER CORPORATION (US)

7.6 DENTSPLY SIRONA INC. (US)

7.7 DESIGNS FOR VISION INC. (US)

7.8 ENVISTA HOLDINGS CORPORATION (US)

7.9 GC CORPORATION (JAPAN)

7.10 HAMAMATSU PHOTONICS K.K. (JAPAN)

7.11 HU-FRIEDY MFG. CO. LLC (US)

7.12 MIDMARK CORPORATION (US)

7.13 OWANDY RADIOLOGY (FRANCE)

7.14 PLANMECA OY (FINLAND)

7.15 ROYAL PHILIPS (NETHERLANDS)

7.16 VATECH CO. LTD. (SOUTH KOREA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Dental Cameras Market By Region

8.1 Overview

8.2. North America Dental Cameras Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Intraoral

8.2.4.2 Dental

8.2.4.3 Extraoral Cameras

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Orthodontics

8.2.5.2 Endodontics

8.2.5.3 Dental Diagnosis

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Dental

8.2.6.3 Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Dental Cameras Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Intraoral

8.3.4.2 Dental

8.3.4.3 Extraoral Cameras

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Orthodontics

8.3.5.2 Endodontics

8.3.5.3 Dental Diagnosis

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Dental

8.3.6.3 Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Dental Cameras Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Intraoral

8.4.4.2 Dental

8.4.4.3 Extraoral Cameras

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Orthodontics

8.4.5.2 Endodontics

8.4.5.3 Dental Diagnosis

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Dental

8.4.6.3 Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Dental Cameras Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Intraoral

8.5.4.2 Dental

8.5.4.3 Extraoral Cameras

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Orthodontics

8.5.5.2 Endodontics

8.5.5.3 Dental Diagnosis

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Dental

8.5.6.3 Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Dental Cameras Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Intraoral

8.6.4.2 Dental

8.6.4.3 Extraoral Cameras

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Orthodontics

8.6.5.2 Endodontics

8.6.5.3 Dental Diagnosis

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Dental

8.6.6.3 Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Dental Cameras Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Intraoral

8.7.4.2 Dental

8.7.4.3 Extraoral Cameras

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Orthodontics

8.7.5.2 Endodontics

8.7.5.3 Dental Diagnosis

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Dental

8.7.6.3 Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Dental Cameras Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD265.4 Million |

|

Forecast Period 2024-32 CAGR: |

9.4 % |

Market Size in 2032: |

USD 595.74 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Dental Cameras Market research report is 2024-2032.

ACTEON Group (France), Align Technology, Inc. (US), Carestream Dental (US), Danaher Corporation (US), DENTSPLY SIRONA Inc. (US), Designs for Vision, Inc. (US), Envista Holdings Corporation (US), GC Corporation (Japan), Hamamatsu Photonics K.K. (Japan), Hu-Friedy Mfg. Co., LLC (US), Midmark Corporation (US), Owandy Radiology (France), Planmeca Oy (Finland), Royal Philips (Netherlands), Vatech Co., Ltd. (South Korea), and Other Active Players.

The Dental Cameras Market is segmented into Type, Application, End User, and region. By Type, the market is categorized into Intraoral, Dental, and Extraoral Cameras. By Application, the market is categorized into Orthodontics, Endodontics, Dental Diagnosis Others. By End User, the market is categorized into Hospitals, Dental Clinics, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

In simple terms Dental Cameras can be described as a range of transportable camera apparatuses used in dental practices that is used to take high-quality, porcelain dental architecture images to help in arrival at the right diagnosis and also to explain to the patient and planning for a treatment procedure. Telescopic cameras, endoscopic cameras and digitalising cameras are used by the dentists to have a wider view of the teeth, gums and other structures which are not normally seen under ordinary light. What’s more, it is ineffective to use them in modern methods of diagnostics and treatment of the diseases of the oral cavity, they provide visible data that are helpful in practical analysis and clear explanation to the patient.

Dental Cameras Market Size Was Valued at USD 265.4 Million in 2023, and is Projected to Reach USD 595.74 Million by 2032, Growing at a CAGR of 9.4 % From 2024-2032.