Dental Prosthetics Market Synopsis:

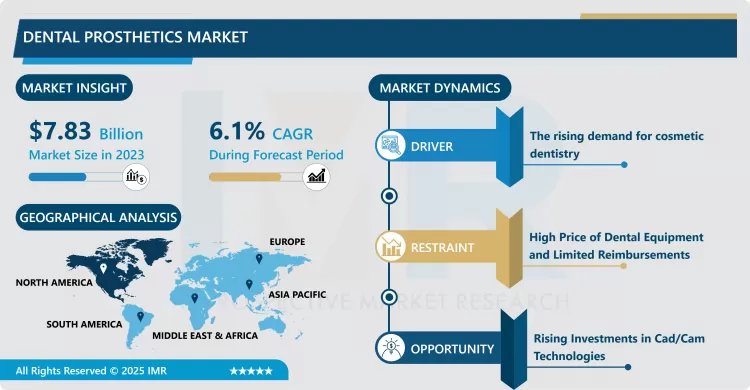

Dental Prosthetics Market Size Was Valued at USD 7.83 Billion in 2023, and is Projected to Reach USD 13.34 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

This blog defines dental prosthetics as an artificial dental appliance employed in the elimination of one or more teeth natural. These primarily include Crowns, inlays and onlays, bridges, dentures, partial dentures and dental implants. Basically the crown, inlays, and onlays was to restore the affected teeth.

The dental prosthetics field has been growing due to the development in technology as well as the incidence of dental diseases together with increased aged population across the globe. Dental prosthetic are essential in replacement of the lost structures of the teeth that includes crowns, bridges, dentures, and implants which are used to improve functionality, aesthetics, and thus the quality of a person’s life. The increasing knowledge of patients towards oral care and importance of dental prostheses also add to the growth of the market, since more and more patients want to have their beautiful smile restored as well as their dental health improved.

Advancements in technology continue to advance such as 3D printing, computer-aided design and manufacturing (CAD-CAM) and the development of biocompatible materials has advanced the manufacture of dental prosthetics. These improvements not only facilitate manufacturability but also serve to increase the accuracy and conformity and overall success of dental devices. Moreover, the introduction of different kinds of digital dentistry is helping in good treatment planning for the patient and helping in management of his/ her expectations thus increasing the patient satisfactory level and patient retention.

Based on the place of delivery of the product or service, the dental prosthetics market is growing at a fast pace in North America, Europe, and Asia-Pacific region. North America has the largest market share because of the developed healthcare industry, greater proportions of dental diseases and conditions, and increased concern for dental appearance. On the other hand, it is expected that Asia-Pacific market will show highest growth rate due to higher disposable income, increasing dental tourism and improving access to dental care among growing economies.

In fact, dental prosthetics market is a highly competitive with key players commercializing new products through investment in research and development, collaborations, partnerships, and acquisitions. These conditions are likely to increase competition and enhance possibilities of product supply to respond to diverse needs of the users including the patients and the dental personalities. Broadly speaking, the dental prosthetics market is expect to experience rising growth, especially through continued investments in the development of new solutions that are patient-centric and relevant to the needs of patients around the world.

Dental Prosthetics Market Trend Analysis

Increasing Demand for Dental Prosthetics Driven by Oral Health Awareness and Aging Population

- This is clear because the dental prosthetics market is experiencing a rapid rise in demand because of the increasing incidences of dental diseases that may f??? This trend is considered to be driven mainly by the population ageing which has higher incidences of caries, periodontal diseases and tooth loss. Furthermore, there are more conscious patients who are aware of good oral hygiene and those who would like to fix their teeth. An increase has been realized due to this awareness, and the generally increased traffic in dental studios resulting from the need for the several reparative dental procedures. Consequently, dental prosthetics have gained greater importance throughout the world, encouraging micro and sectors to create new and better solutions to the problem.

- This trend has been met with inventions such as the materials like digital dentures and implanted devices, tailored fit into the market demand. Digital dentures give better adaptation and increased comfort than conventional versions — thus improving the patient’s journey. In addition, implants that are created to accommodate specific patients provide better looks and functionality. Beside the time and efficiency benefits involved in using technology in the making of these prosthetics as well as fitting methods, the services offered are made more effective. Today, with increasing numbers of dental practitioners and patients adopting these innovations, the dental prosthetics market is positioned to sustain its growth with focus on updating the dental condition and increasing patient satisfaction.

Advancements in the Dental Prosthetics Market Driven by an Aging Population

- The increasing ageing group globally is a key factor to the dental prosthetics market because dental complications are more frequent in the elderly. Diseases related to the teeth are also prominent in elderly people, and this increases the popularity of restorative dental procedures including; dentures, bridges and implants. This demographic shift highly apparent in the developed countries where people’s overall health has improve hence increasing their life spans. Because an increasing population maintains their natural dentition throughout their lifetime, those who develop oral health issues are seeking ways to regain masticatory efficiency and quality of life. Dental prosthetics need among the geriatric population: the increase in the number of the elderly people and their high demand for dental prosthetics offer a promising market for the manufacturers of various prosthetic systems and dental practitioners.

- On top of the increasing number of elder population, there also increased focus in the oral health and wellbeing among the elderlynecessitating the use of dental prosthetics. A lot of elderly are now concerned in taking good care of their teeth, knowing that oral health is also a significant factor to general health. This change in attitude promotes theThough the Change in attitude promotes the need to attend routine check-ups with dentists and deal with dental problems when they are still small increases the demand for prosthetic services. Moreover, the increase in improved prosthetic limbs’ availability, combined with the availability of insurance coverage to dental treatment means that older adults make the trip to seek treatment in good time. Therefore dental prosthetics market could be expected to grow at a fast pace due to the special requirements of an ageing population and their perceived need for efficient and cosmetically appealing dental appliances.

Dental Prosthetics Market Segment Analysis:

Dental Prosthetics Market is Segmented on the basis of Type, Application, End Users, and Region

By Type, Dental Bridges segment is expected to dominate the market during the forecast period

- Dental bridges act simply as excellent fixed prosthetic appliances whose primary function is to supply one or more missing teeth through a connection to adjacent natural teeth or alternatively to dental implant. Not only do these devices bring back the function of a given patient’s bite but also their aesthetics thus playing a crucial role in what constitutes oral aesthetic. Increased incidence of dental caries and periodontal diseases has consequently raised the need for restorative dental services, as more people seek solutions to tooth loss. Dental bridges are now considered as an essential tool in a total dental treatment plan which offer the patients a secure solution for the management of their dental issues.

- Furthermore, the market of dental bridges is steadily progressing due to the tendency toward introduction of new materials and improvements in the design of dentures. Advancements and newer materials have spurred enhancements, and therefore dental bridges are continuing to gain popularity for use among patients as well s by dentists. Contemporary materials zirconia and advanced ceramics provide improved solutions for interfacing with natural teeth, making them comfortable, and aesthetically appealing to wear. With more people gaining knowledge on oral care, and a growing concern for both utility and cosmetics, demand for dental bridges will increase pushing growth and investments into this segment of the dental materials market.

By End Users, Hospitals segment expected to held the largest share

- Hospitals can be pictured as providing essential sources of CA for delivering extensive dental care especially for the patients that require surgeries and other complicated work on teeth. In this context, the market demand for dental material tends to increase because there is a constant increase in the number of dental surgeries performed. This mouth surgery may range from basic surgical operations like tooth extraction and implantation to complex surgeries such as correction of jaw malocclusions or periodontal surgery. Growing dental health problems suggest a need to produce and use more effective and long-lasting dental materials that can accommodate the demands of surgical work and improve patient’s prognosis.

- Further, through affiliating with pioneer technologies, hospitals can ensure that they use current clinical approaches in determining dental materials and innovation. Such access makes treatment more efficient and effective as well as increases the level of patient safety and satisfaction. He noted that many hospitals buy material and equipment that are more efficient, meaning the most effective for the treatment of common ailments. The increasing complexity of the dental care industry suggests that hospitals may expand their role even more in the application of highly developed dental materials on patients and towards the development of the entire dental health care profession.

Dental Prosthetics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Predictions of a continued growth of the North American dental prosthetics market are based mainly on the high incidence of dental diseases, the growing population of elderly patients and steady improvement in dentistry techniques. For instance, the United States market for this sector seems to have developed tremendously mainly due to the growing consumer consciousness of oral health. This awareness has resulted in increased desire for prosthetic dental treatments like implantation, capping, and bridging apart from needing to have normal chewing ability. The area has considerable contact base of dental personnel and clearly defined dental laboratories that enable fabrication and delivery of these prosthetics under high quality techniques and service.

- Secondly, there has been an expanded insurance of dental prosthetics thus expanding the market penetration of this important service. This element of insurance increases the number of patients seeking treatment of dental conditions that might with otherwise remain undiagnosed due to costs. This trend is supported by the use of sophisticated digital technologies including the 3D printing CAD CAM technology for realizing personalized dental products. Altogether, these factors create a premise for the strong development of the North American dental prosthetics market in the years ahead buoyed by the demand for new technologies as well as the consumer interest.

Active Key Players in the Dental Prosthetics Market:

- Cheng Crowns (U.S.)

- Altimed JSC (Belarus)

- Acero Crowns (U.S.)

- Directa AB (Sweden)

- Hu-Friedy Mfg (U.S.)

- DDS Lab Inc (India)

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- ZimVie Inc. (Zimmer Biomet) (U.S.)

- BioHorizons (U.S.)

- Cortex (Israel)

- Other Active Players

Key Industry Developments in the Dental Prosthetics Market:

- September 2023 – Boston Micro Fabrication (BMF), launched the UltraThineer, the thinnest cosmetic dental veneer. With the launch of this product the company entered in the market for dental prosthetics.

- November 2023 – Whites Beaconsfield launched non-peroxide natural teeth whitening products for dental veneers that removes stains and whitens them.

|

Dental Prosthetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.83 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 13.34 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Prosthetics Market by By Type (2018-2032)

4.1 Dental Prosthetics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dental Bridges

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dental Crowns

4.5 Dentures

4.6 Abutments

4.7 Veneers

4.8 Inlays

4.9 Onlays

Chapter 5: Dental Prosthetics Market by By Application (2018-2032)

5.1 Dental Prosthetics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Porcelain-Fused-To-Metal (PFM)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Metal

5.5 All-Ceramic

5.6 Others

Chapter 6: Dental Prosthetics Market by By End Users (2018-2032)

6.1 Dental Prosthetics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Dental Laboratories

6.6 Pharmacies

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Dental Prosthetics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DENTSPLY SIRONA (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ZIMMER BIOMET DENTAL (U.S.)

7.4 STRAUMANN GROUP (SWITZERLAND)

7.5 NOBEL BIOCARE (SWITZERLAND)

7.6 IVOCLAR VIVADENT AG (U.S.)

7.7 3M ESPE DENTAL (U.S.)

7.8 SHOFU DENTAL CORPORATION (JAPAN)

7.9 GC CORPORATION (JAPAN)

7.10 KULZER GMBH (GERMANY)

7.11 BEGO GMBH & CO. KG (GERMANY)

7.12 DENTAL WINGS INC. (CANADA)

7.13 PLANMECA OY (FINLAND)

7.14 VITA ZAHNFABRIK (GERMANY)

7.15 CANDULOR AG (SWITZERLAND)

7.16 AMANN GIRRBACH AG (AUSTRIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Dental Prosthetics Market By Region

8.1 Overview

8.2. North America Dental Prosthetics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Dental Bridges

8.2.4.2 Dental Crowns

8.2.4.3 Dentures

8.2.4.4 Abutments

8.2.4.5 Veneers

8.2.4.6 Inlays

8.2.4.7 Onlays

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Porcelain-Fused-To-Metal (PFM)

8.2.5.2 Metal

8.2.5.3 All-Ceramic

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By End Users

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Dental Laboratories

8.2.6.4 Pharmacies

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Dental Prosthetics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Dental Bridges

8.3.4.2 Dental Crowns

8.3.4.3 Dentures

8.3.4.4 Abutments

8.3.4.5 Veneers

8.3.4.6 Inlays

8.3.4.7 Onlays

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Porcelain-Fused-To-Metal (PFM)

8.3.5.2 Metal

8.3.5.3 All-Ceramic

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By End Users

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Dental Laboratories

8.3.6.4 Pharmacies

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Dental Prosthetics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Dental Bridges

8.4.4.2 Dental Crowns

8.4.4.3 Dentures

8.4.4.4 Abutments

8.4.4.5 Veneers

8.4.4.6 Inlays

8.4.4.7 Onlays

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Porcelain-Fused-To-Metal (PFM)

8.4.5.2 Metal

8.4.5.3 All-Ceramic

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By End Users

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Dental Laboratories

8.4.6.4 Pharmacies

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Dental Prosthetics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Dental Bridges

8.5.4.2 Dental Crowns

8.5.4.3 Dentures

8.5.4.4 Abutments

8.5.4.5 Veneers

8.5.4.6 Inlays

8.5.4.7 Onlays

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Porcelain-Fused-To-Metal (PFM)

8.5.5.2 Metal

8.5.5.3 All-Ceramic

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By End Users

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Dental Laboratories

8.5.6.4 Pharmacies

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Dental Prosthetics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Dental Bridges

8.6.4.2 Dental Crowns

8.6.4.3 Dentures

8.6.4.4 Abutments

8.6.4.5 Veneers

8.6.4.6 Inlays

8.6.4.7 Onlays

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Porcelain-Fused-To-Metal (PFM)

8.6.5.2 Metal

8.6.5.3 All-Ceramic

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By End Users

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Dental Laboratories

8.6.6.4 Pharmacies

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Dental Prosthetics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Dental Bridges

8.7.4.2 Dental Crowns

8.7.4.3 Dentures

8.7.4.4 Abutments

8.7.4.5 Veneers

8.7.4.6 Inlays

8.7.4.7 Onlays

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Porcelain-Fused-To-Metal (PFM)

8.7.5.2 Metal

8.7.5.3 All-Ceramic

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By End Users

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Dental Laboratories

8.7.6.4 Pharmacies

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Dental Prosthetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.83 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 13.34 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Dental Prosthetics Market research report is 2024-2032.

DENTSPLY SIRONA (U.S.), Zimmer Biomet Dental (U.S.), Straumann Group (Switzerland), Nobel Biocare (Switzerland), Ivoclar Vivadent AG (U.S.), 3M ESPE Dental (U.S.), Shofu Dental Corporation (Japan), GC Corporation (Japan), Kulzer GmbH (Germany), BEGO GmbH & Co. KG (Germany), Dental Wings Inc. (Canada), Planmeca Oy (Finland), VITA Zahnfabrik (Germany), Candulor AG (Switzerland), Amann Girrbach AG (Austria) and Other Active Players.

The Dental Prosthetics Market is segmented into By Type, By Application, By End Users and region. By Type, the market is categorized into Dental Bridges, Dental Crowns, Dentures, Abutments, Veneers, Inlays and Onlays. By Material Type, the market is categorized into Porcelain-Fused-To-Metal (PFM), Metal, All-Ceramic, Others. By End User, the market is categorized into Hospitals and Clinics, Dental Laboratories, Pharmacies, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Dental prosthetics is a type of artificial device that is used to restore one or more natural teeth. Crowns, inlays and onlays, bridges, dentures, partial dentures, and dental implants are generally involved in these devices. The main purpose of the crown, inlays, and onlays is to recover the damage to the teeth.

Dental Prosthetics Market Size Was Valued at USD 7.83 Billion in 2023, and is Projected to Reach USD 13.34 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.