Digital Biomanufacturing Market Synopsis:

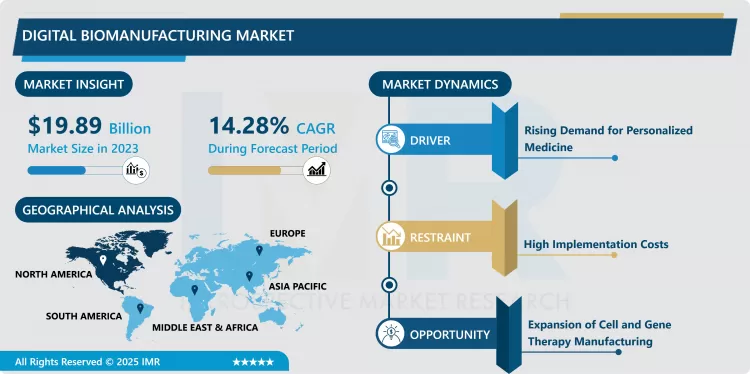

Digital Biomanufacturing Market Size Was Valued at USD 19.89 Billion in 2023, and is Projected to Reach USD 66.13 Billion by 2032, Growing at a CAGR of 14.28% From 2024-2032.

Biomanufacturing with automation with AI/ML and data analytics are the digital aspects that are part of the biomanufacturing processes. These technologies improve the capability in managing and operating biomanufacturing operations, especially for goods such as biopharmaceuticals, vaccines, and cell and gene therapies to be more productive and accurate, in addition to being amenable to real-time monitoring.

The rapidly growing digital biomanufacturing market is a result of burgeoning interaction between biotechnology and digital technologies. The traditional biosynthesis method was immobile to automation, and most of the manufacturing was under manual control. However, advances in digital technologies have now revolutionalised these processes and created the conditions for enabling smart factories. Biomanufacturing 4.0 integrates artificial intelligence and big data and cloud computing to drive performance, improve quality of products, and meet strict guidelines. Technology also brings in use of sensors and data which means real time process monitoring improving on time utilization and productivity.

With the current pressures on the biopharmaceutical sector cutting costs of production but without compromising on quality and the benefits of scale, digital biomanufacturing solutions are now critical. This is true specially for the manufacture of highly specialized biological commodities such as cell & gene therapies, monoclonal antibodies, recombinant proteins, etc., where accuracy is the essence. The market internationally is expected to grow significantly, driven by trends such as decentralised and agile manufacturing capabilities required to address increased demand for targeted therapies especially in cancer, orphan diseases and other long-term illnesses. Additionally, growth in the market is backed with federal and industrial capital towards building up the bio-manufacturing ecosystem with blended digital capabilities.

Digital Biomanufacturing Market Trend Analysis:

Shift Towards Automation in Biomanufacturing

- The automation that is now rapidly seeping its way into the field of digital biomanufacturing is revolutionizing it. Robotic applications are common in cell culture, material movement and bioreactor tracking and control. The change towards automating also eliminates one of the biggest factors for inefficiency that is human interference and also maintains the constant production throughout the 24 hours of operation. Consequently, they help minimize production constraints and accelerate the time to market for the biological products.

- In addition, automation assists biomanufacturers to continue meeting the required GMP and regulatory requirements. The major advantages of automated data collection and analysis is increased compliance with the quality standards deemed necessary by various regulatory bodies. Automation is also incorporated with smart cyber-twins, digital replicas of the manufacturing systems and processes that allow for anticipatory actions to be made where duration of downtimes due to mechanical breakdowns or poor performance is minimized.

Expansion of Cell and Gene Therapy Manufacturing

- One promising application in the digital biomanufacturing space is in the growth of cell and gene therapy manufacturing. Since these novel biotherapies can cure once untreatable diseases, there is a growing need towards the process improvement and manufacturing economy. Cell and gene therapies coming of age can transform patient care through digital technologies capable of enhancing the reproducibility and scalability of manufacturing through automation and real-time process control.

- This opportunity is backed by the regulatory agencies with the latter encouraging innovation in biomanufacturing. The provision of government support together with the possibilities to strengthen the control over the processes within the digital platforms will allow manufacturers to meet the growing demand for these therapies and provide the necessary quality at the same time. The potential is huge, especially because the portfolio of clinical stage gene and cell therapy assets is growing apace.

Digital Biomanufacturing Market Segment Analysis:

Digital Biomanufacturing Market is Segmented on the basis of Component, Application, End User, Deployment Mode, and Region

By Component, Service segment is expected to dominate the market during the forecast period

- The digital biomanufacturing market can therefore be categorized in software, hardware and services. Software in this context is instrumental in process control and real-time monitoring, system and data analysis. Manufacturing execution systems and enterprise resource planning system are essential solution anthems in managing and coordinating biomanufacturing activities. These software solutions connect to sensors and devices and are able to offer valuable information for improving product quality and optimising processes. The market is expected to grow even further as advanced artificial intelligence solutions are included into software solutions that manufacturers look towards to increase efficiency.

- Other equipment include bioreactors, sensors, and automation equipment are part of the digital biomanufacturing equipment. The smart bioreactors that have to be provided with sensors shall be able to track the important process parameters such as, pH, temperature and DO level and make change in the process as accordingly. On the services side, consulting and system integration services are gradually becoming more popular as businesses need help in choosing the right technology solutions and adjusting work processes to meet the necessary standards.

By Application, Cell & Gene Therapy segment expected to held the largest share

- The Digital Biomanufacturing applications are across some of the most strategic sectors such as Cell & Gene Therapy, Vaccines, Monoclonal Antibodies and Recombinant Proteins. Digitalization of production process in cell and gene therapy is beneficial in terms of improved control and increasing quantity of one-of-a-kind products. These conditions can be managed through digital portals conveniently making it easier to track cell cultures, a vital requirement for cell-based therapies.

- This is especially helpful in vaccine and monoclonal antibody products, where digital biomanufacturing reduces production complexity, especially in situations where demand surges, including pandemics. Digital technologies also enable accelerations of economies of scale in vaccine production; data analytics guarantee quality. The fact that it has been made possible to, digitize these processes contributes to reduction of development time and costs.

Digital Biomanufacturing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest share in the digital biomanufacturing market today because this area has well-developed biopharmaceutical industry and focuses on the development of new technologies. The biopharmaceutical market in the United States and Canada has. Beken a fast adoption rate because of the available research and manufacturing facilities. Moreover, the zone has had a good investment in health care technologies; this has enhanced the innovation and adoption of health care technology in biomanufacturing systems.

- Favourable government policies and supportive regulations in the country have also supported North America’s leadership. This one was signed in December 2016 and is known as 21st Century Cures Act, concept which aims at promoting innovation and simplifying regulation of ATMPs, including cell and gene therapies. This environment has enabled North America to continue leading in the advancement of digital biomanufacturing experiences.

Active Key Players in the Digital Biomanufacturing Market:

- Thermo Fisher Scientific (USA)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Danaher Corporation (USA)

- Cytiva (USA)

- Lonza Group (Switzerland)

- Boehringer Ingelheim (Germany)

- GE Healthcare (USA)

- Samsung Biologics (South Korea)

- Fujifilm Diosynth Biotechnologies (Japan)

- Catalent, Inc. (USA)

- Wuxi Biologics (China)

- Others Active Player

Key Industry Developments in the Digital Biomanufacturing Market:

- In June 2024, BioM Conference is expected to organize 6th CIRP Conference on Biomanufacturing in Dresden, Germany, with an aim to promote AI and digital methods in biomanufacturing.

- In June 2023, Kaia Health launched Angela, a HIPAA-compliant, AI-powered voice-based digital care assistant, companion, and guide with the aim to enhance physical therapy experience of the patients.

- In March 2023, MindMaze launched a proprietary medical device called Izar across the US and Europe with an aim to improve the hand recovery post-stroke.

|

Global Digital Biomanufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.89 Billion |

|

Forecast Period 2024-32 CAGR: |

14.28% |

Market Size in 2032: |

USD 66.13 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Deployment Mode: |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Biomanufacturing Market by By Component (2018-2032)

4.1 Digital Biomanufacturing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hardware

4.5 Services

Chapter 5: Digital Biomanufacturing Market by By Application (2018-2032)

5.1 Digital Biomanufacturing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cell and Gene Therapy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Vaccines

5.5 Monoclonal Antibodies

5.6 Recombinant Proteins

5.7 Other Bioproducts

Chapter 6: Digital Biomanufacturing Market by By Deployment Mode (2018-2032)

6.1 Digital Biomanufacturing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 : On-Premise

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud-Based

Chapter 7: Digital Biomanufacturing Market by By End User (2018-2032)

7.1 Digital Biomanufacturing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Biopharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Research Institutes

7.5 Contract Manufacturing Organizations (CMOs)

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Digital Biomanufacturing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THERMO FISHER SCIENTIFIC (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MERCK KGAA (GERMANY)

8.4 SARTORIUS AG (GERMANY)

8.5 DANAHER CORPORATION (USA)

8.6 CYTIVA (USA)

8.7 LONZA GROUP (SWITZERLAND)

8.8 BOEHRINGER INGELHEIM (GERMANY)

8.9 GE HEALTHCARE (USA)

8.10 SAMSUNG BIOLOGICS (SOUTH KOREA)

8.11 FUJIFILM DIOSYNTH BIOTECHNOLOGIES (JAPAN)

8.12 CATALENT INC. (USA)

8.13 WUXI BIOLOGICS (CHINA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Digital Biomanufacturing Market By Region

9.1 Overview

9.2. North America Digital Biomanufacturing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Component

9.2.4.1 Software

9.2.4.2 Hardware

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Cell and Gene Therapy

9.2.5.2 Vaccines

9.2.5.3 Monoclonal Antibodies

9.2.5.4 Recombinant Proteins

9.2.5.5 Other Bioproducts

9.2.6 Historic and Forecasted Market Size By By Deployment Mode

9.2.6.1 : On-Premise

9.2.6.2 Cloud-Based

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Biopharmaceutical Companies

9.2.7.2 Research Institutes

9.2.7.3 Contract Manufacturing Organizations (CMOs)

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Digital Biomanufacturing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Component

9.3.4.1 Software

9.3.4.2 Hardware

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Cell and Gene Therapy

9.3.5.2 Vaccines

9.3.5.3 Monoclonal Antibodies

9.3.5.4 Recombinant Proteins

9.3.5.5 Other Bioproducts

9.3.6 Historic and Forecasted Market Size By By Deployment Mode

9.3.6.1 : On-Premise

9.3.6.2 Cloud-Based

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Biopharmaceutical Companies

9.3.7.2 Research Institutes

9.3.7.3 Contract Manufacturing Organizations (CMOs)

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Digital Biomanufacturing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Component

9.4.4.1 Software

9.4.4.2 Hardware

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Cell and Gene Therapy

9.4.5.2 Vaccines

9.4.5.3 Monoclonal Antibodies

9.4.5.4 Recombinant Proteins

9.4.5.5 Other Bioproducts

9.4.6 Historic and Forecasted Market Size By By Deployment Mode

9.4.6.1 : On-Premise

9.4.6.2 Cloud-Based

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Biopharmaceutical Companies

9.4.7.2 Research Institutes

9.4.7.3 Contract Manufacturing Organizations (CMOs)

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Digital Biomanufacturing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Component

9.5.4.1 Software

9.5.4.2 Hardware

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Cell and Gene Therapy

9.5.5.2 Vaccines

9.5.5.3 Monoclonal Antibodies

9.5.5.4 Recombinant Proteins

9.5.5.5 Other Bioproducts

9.5.6 Historic and Forecasted Market Size By By Deployment Mode

9.5.6.1 : On-Premise

9.5.6.2 Cloud-Based

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Biopharmaceutical Companies

9.5.7.2 Research Institutes

9.5.7.3 Contract Manufacturing Organizations (CMOs)

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Digital Biomanufacturing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Component

9.6.4.1 Software

9.6.4.2 Hardware

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Cell and Gene Therapy

9.6.5.2 Vaccines

9.6.5.3 Monoclonal Antibodies

9.6.5.4 Recombinant Proteins

9.6.5.5 Other Bioproducts

9.6.6 Historic and Forecasted Market Size By By Deployment Mode

9.6.6.1 : On-Premise

9.6.6.2 Cloud-Based

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Biopharmaceutical Companies

9.6.7.2 Research Institutes

9.6.7.3 Contract Manufacturing Organizations (CMOs)

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Digital Biomanufacturing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Component

9.7.4.1 Software

9.7.4.2 Hardware

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Cell and Gene Therapy

9.7.5.2 Vaccines

9.7.5.3 Monoclonal Antibodies

9.7.5.4 Recombinant Proteins

9.7.5.5 Other Bioproducts

9.7.6 Historic and Forecasted Market Size By By Deployment Mode

9.7.6.1 : On-Premise

9.7.6.2 Cloud-Based

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Biopharmaceutical Companies

9.7.7.2 Research Institutes

9.7.7.3 Contract Manufacturing Organizations (CMOs)

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Digital Biomanufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.89 Billion |

|

Forecast Period 2024-32 CAGR: |

14.28% |

Market Size in 2032: |

USD 66.13 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Deployment Mode: |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Digital Biomanufacturing Market research report is 2024-2032.

Thermo Fisher Scientific (USA), Merck KGaA (Germany), Sartorius AG (Germany), Danaher Corporation (USA), Cytiva (USA), Lonza Group (Switzerland), Boehringer Ingelheim (Germany),GE Healthcare (USA), and Other Major Players.

The Digital Biomanufacturing Market is segmented into Component, Deployment Mode, Application and region. By Component, the market is categorized into, Software, Hardware, Services. By Application, the market is categorized into Cell and Gene Therapy, Vaccines, Monoclonal Antibodies, Recombinant Proteins, Other Bioproducts. By Deployment Mode, the market is categorized into On-Premise, Cloud-Based. By End User, the market is categorized into Biopharmaceutical Companies, Research Institutes, Contract Manufacturing Organizations (CMOs), Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Biomanufacturing with automation with AI/ML and data analytics are the digital aspects that are part of the biomanufacturing processes. These technologies improve the capability in managing and operating biomanufacturing operations, especially for goods such as biopharmaceuticals, vaccines, and cell and gene therapies to be more productive and accurate, in addition to being amenable to real-time monitoring.

Digital Biomanufacturing Market Size Was Valued at USD 19.89 Billion in 2023, and is Projected to Reach USD 66.13 Billion by 2032, Growing at a CAGR of 14.28% From 2024-2032.