Drone Camera Market Synopsis

Drone Camera Market Size Was Valued at USD 10.75 Billion in 2023 and is Projected to Reach USD 82.43 Billion by 2032, Growing at a CAGR of 25.4% From 2024-2032.

A drone camera is a camera that is attached to an aerial vehicle or drone. It allows the capture of photographs and videos from a high altitude or different angles. These are often used in various industries such as photography, filmmaking, surveillance, agriculture, mapping, and more.

- Drones equipped with high-quality cameras allow photographers and videographers to capture stunning aerial shots and cinematic footage. It can assess the extent of natural disasters, such as earthquakes or floods, by capturing aerial images and videos which helps in rescue operations and damage assessment.

- Drones can quickly and accurately survey large areas of land and create detailed maps which is useful in urban planning, construction, agriculture, and environmental monitoring. They are often widely used in the film industry to capture dynamic and immersive shots.

- Drones can monitor crops, identify diseases, analyze soil conditions, and assist in precision agriculture by providing valuable data. Also helps to monitor wildlife populations, track animal movements, and detect any illegal activities. Drones can inspect bridges, power lines, pipelines, and other infrastructure more efficiently and safely than traditional methods and enable engineers to detect potential issues or damages.

- Drones equipped with cameras are used by the military to gather information, conduct surveillance, monitor enemy activities, and assess battlefield situations to make informed decisions. The volume of the global drone market in 2023 was 7.56 million pieces.

- The global drone market has witnessed a remarkable surge in volume over the past six years, as indicated by the data from 2018 to 2023. Drones, also known as unmanned aerial vehicles (UAVs), have become integral in various industries due to their versatility and cost-effectiveness. This report analyzes the growth trends and implications for businesses operating in this dynamic market.

- The upward trajectory of the global drone market volume from 2018 to 2023 reflects the increasing adoption and acceptance of drones across industries worldwide. Businesses that navigate the evolving landscape by leveraging innovation, complying with regulations, and addressing security concerns are well-positioned to capitalize on the myriad opportunities presented by this burgeoning market.

Drone Camera Market Trend Analysis

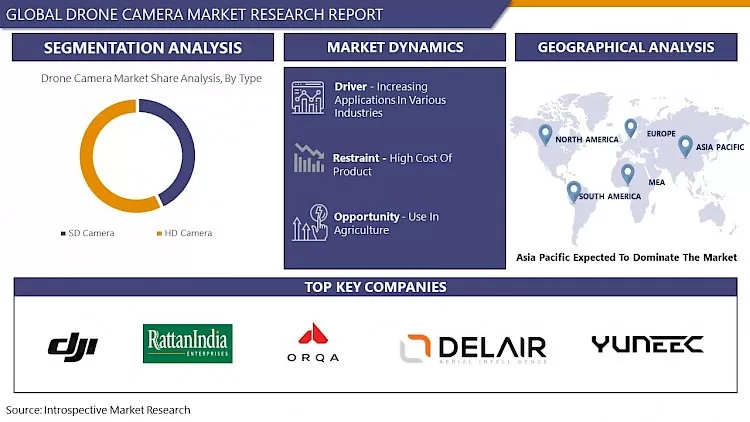

Increasing Applications In Various Industries

- The drones equipped with cameras offer unique perspectives and aerial views that were previously inaccessible. These have proven to be invaluable tools in sectors like agriculture, and construction. They can be used for crop monitoring, construction monitoring, and assessing the impact of disaster management. Drones can quickly and efficiently capture high-resolution images and videos of sites and can do accurate mapping. Companies like Amazon are testing drone delivery services, aiming to transport packages quickly and efficiently for delivering goods in congested and remote areas.

- Drone cameras offer enhanced surveillance and monitoring capabilities, making them valuable tools in various security-related domains. It can cover large areas and provide real-time aerial footage, making it easier to monitor borders and detect any unauthorized activities or breaches. It can be utilized for crowd monitoring during events or protests for public safety. It can also used for security purposes in private properties, residential areas, and commercial establishments. They are widely used in the film industry for capturing cinematic aerial shots with creative perspectives, fluid movements, and immersive visuals.

Opportunity

Use In Agriculture

- Drones equipped with high-resolution cameras can capture detailed images and videos of crops. This allows farmers to assess the health and growth of plants on a much larger scale. This helps to manage targeted application of fertilizers, pesticides, and water resources resulting in cost savings and minimized environmental impact. Drone cameras can provide real-time monitoring of crops helping farmers to detect issues like nutrient deficiencies, pests, or diseases at an early stage helping to improve crop health and maximize yields.

- The crop monitoring and field analysis eliminates the need for manual inspections and helps to reduce time consumption due to manual monitoring which further leads to a reduction in labor cost required for monitoring. Drones can be used for precision planting and seeding, ensuring accurate seed placement and spacing while promoting uniform crop growth and reducing seed wastage. It provides valuable data for research purposes to study crop performance, climate patterns, and land use changes.

Drone Camera Market Segment Analysis:

Drone Camera Market is segmented on the basis of Type, Product Type, Application, Resolution, End-Users, And Distribution Channel.

By Type, HD Camera Segment Is Expected to Dominate the Market During the Forecast Period

By type, there are two segments in the market, SD Camera and HD Camera. Among these HD Camera segment is expected to dominate during the forecast period.

- HD (high definition) cameras offer superior image quality compared to SD cameras. They capture images and videos with higher resolution, clarity, and detail which is essential for crop analysis, disease detection, and yield estimation. The superior image quality makes them highly desirable for various applications, including aerial photography, videography, surveillance, and inspection. These are widely preferred by professional drone operators, filmmakers, and photographers who require top-notch image quality. HD Cameras are capable of capturing finer details, colors, and textures which is crucial for applications such as aerial mapping, surveying, and inspection to analyze and make decisions.

- HD Cameras are crucial for live streaming and broadcasting applications enabling the real-time transmission of high-quality videos, making them ideal for sports events, news coverage, and live events where immediate and immersive visual experiences are in demand. HD cameras come equipped with image stabilization capabilities that reduce the effects of drone movement and shaky footage resulting in smoother, clearer footage.

By End-user, Military Segment Held the Largest Share In 2023

By end-user, there are three segments in the market, Commercial industries, military, and homeland security. Among these military segment is expected to dominate during the forecast period.

- Drone cameras have become an integral part of modern military operations due to their ability to gather intelligence, conduct surveillance, and carry out missions with reduced risks. These are used for purposes such as reconnaissance, target acquisition, situational awareness, and monitoring enemy activities.

- In this sector, there is a demand for high-performance cameras with long range that are crucial to capturing detailed and actionable intelligence with their superior resolution, and image quality in remote and congested areas. Military-grade drone cameras play a vital role in border surveillance, coastal monitoring, perimeter security, and protection of critical infrastructure by providing border surveillance, coastal monitoring, and perimeter security. Also helps to detect and track potential threats for effective decision making.

- Drone cameras equipped with night vision and thermal imaging capabilities are required to capture at night, low light areas. Also military requires cameras with stringent security and confidentiality measures to protect classified information. This sector uses cameras with encryption protocols, secure transmission channels, and built-in safeguards to prevent unauthorized access.

Drone Camera Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region has experienced a significant increase in the demand for drone cameras in various industries such as agriculture, construction, media, entertainment, and military. The demand is fueled by the need for aerial photography, surveillance, inspection, and security. The region has seen significant growth in e-commerce platforms and delivery services resulting in the trend of drone delivery.

- Several governments in the Asia Pacific region provide incentives, subsidies, and favorable policies to the consumers for use of drone cameras in industries like agriculture. This overall results in increased production, and reduced damage. These are used for environmental monitoring, disaster management, and conservation efforts further boosting the demand for drone cameras. There is a demand for drones for aerial photography and videography to capture stunning visuals of diverse cultural heritage, scenic landscapes, and tourist attractions for attracting tourists.

Drone Camera Market Active Players:

- DJI (China)

- Orqa International (Crotia)

- AeroVironment (US)

- PowerVision(China)

- Parrot (France)

- Autel Robotics (China)

- Skydio (California)

- Delair (France)

- Ehang (China)

- Freefly (USA)

- Flyability (Switzerland)

- Insitu (Washington)

- Wingtra (Switzerland)

- Airobotics (Israel)

- JOUAV (China)

- Draganfly (Canada)

- Yuneec (China)

- Hubsan (China)

- Syma (China)

- Hindustan Aeronautics (India)

- Zen Technologies (India)

- RattanIndia Enterprises (India)

- Paras Defence and Space Tech (India)

- Info Edge (India)

- Aibotix (Germany) and Other Active Players

Key Industry Developments in the Drone Camera Market:

- On 10 Jan 2024, DJI, the world’s leader in civil drones and creative camera technology launched FlyCart 30 (FC30) to the global market. This is a delivery drone. It can carry a 30 kg payload of 16 km.

- In 2024, A drone start-up Garuda Aerospace launched a nano drone, Droni. Droni is a small-sized foldable quadcopter launched for the consumer photography and cinematography segment.

|

Global Drone Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.4% |

Market Size in 2030: |

USD 80.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Resolution |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

DJI (China), Orqa International (Croatia), AeroVironment (US), PowerVision(China), Parrot (France), and Other Active Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Drone Camera Market by By Type (2018-2032)

4.1 Drone Camera Market Snapshot and Growth Engine

4.2 Market Overview

4.3 SD Camera

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 HD Camera

Chapter 5: Drone Camera Market by By Product Type (2018-2032)

5.1 Drone Camera Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Multirotor

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fixed-wing

Chapter 6: Drone Camera Market by By Application (2018-2032)

6.1 Drone Camera Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Photography & Videography

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Thermal Imaging

6.5 Surveillance

Chapter 7: Drone Camera Market by By Resolution (2018-2032)

7.1 Drone Camera Market Snapshot and Growth Engine

7.2 Market Overview

7.3 12MP

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 12 to 20 MP

7.5 20 to 32 MP

7.6 32 MP and above

Chapter 8: Drone Camera Market by By End-user (2018-2032)

8.1 Drone Camera Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Commercial Industries

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Military security

8.5 Homeland Security

Chapter 9: Drone Camera Market by By Distribution Channel (2018-2032)

9.1 Drone Camera Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Online

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Offline

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Drone Camera Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 DJI (CHINA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 ORQA INTERNATIONAL (CROTIA)

10.4 AEROVIRONMENT (US)

10.5 POWERVISION(CHINA)

10.6 PARROT (FRANCE)

10.7 AUTEL ROBOTICS (CHINA)

10.8 SKYDIO (CALIFORNIA)

10.9 DELAIR (FRANCE)

10.10 EHANG (CHINA)

10.11 FREEFLY (USA)

10.12 FLYABILITY (SWITZERLAND)

10.13 INSITU (WASHINGTON)

10.14 WINGTRA (SWITZERLAND)

10.15 AIROBOTICS (ISRAEL)

10.16 JOUAV (CHINA)

10.17 DRAGANFLY (CANADA)

10.18 YUNEEC (CHINA)

10.19 HUBSAN (CHINA)

10.20 SYMA (CHINA)

10.21 HINDUSTAN AERONAUTICS (INDIA)

10.22 ZEN TECHNOLOGIES (INDIA)

10.23 RATTANINDIA ENTERPRISES (INDIA)

10.24 PARAS DEFENCE AND SPACE TECH (INDIA)

10.25 INFO EDGE (INDIA)

10.26 AIBOTIX (GERMANY)

Chapter 11: Global Drone Camera Market By Region

11.1 Overview

11.2. North America Drone Camera Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Type

11.2.4.1 SD Camera

11.2.4.2 HD Camera

11.2.5 Historic and Forecasted Market Size By By Product Type

11.2.5.1 Multirotor

11.2.5.2 Fixed-wing

11.2.6 Historic and Forecasted Market Size By By Application

11.2.6.1 Photography & Videography

11.2.6.2 Thermal Imaging

11.2.6.3 Surveillance

11.2.7 Historic and Forecasted Market Size By By Resolution

11.2.7.1 12MP

11.2.7.2 12 to 20 MP

11.2.7.3 20 to 32 MP

11.2.7.4 32 MP and above

11.2.8 Historic and Forecasted Market Size By By End-user

11.2.8.1 Commercial Industries

11.2.8.2 Military security

11.2.8.3 Homeland Security

11.2.9 Historic and Forecasted Market Size By By Distribution Channel

11.2.9.1 Online

11.2.9.2 Offline

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Drone Camera Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Type

11.3.4.1 SD Camera

11.3.4.2 HD Camera

11.3.5 Historic and Forecasted Market Size By By Product Type

11.3.5.1 Multirotor

11.3.5.2 Fixed-wing

11.3.6 Historic and Forecasted Market Size By By Application

11.3.6.1 Photography & Videography

11.3.6.2 Thermal Imaging

11.3.6.3 Surveillance

11.3.7 Historic and Forecasted Market Size By By Resolution

11.3.7.1 12MP

11.3.7.2 12 to 20 MP

11.3.7.3 20 to 32 MP

11.3.7.4 32 MP and above

11.3.8 Historic and Forecasted Market Size By By End-user

11.3.8.1 Commercial Industries

11.3.8.2 Military security

11.3.8.3 Homeland Security

11.3.9 Historic and Forecasted Market Size By By Distribution Channel

11.3.9.1 Online

11.3.9.2 Offline

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Drone Camera Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Type

11.4.4.1 SD Camera

11.4.4.2 HD Camera

11.4.5 Historic and Forecasted Market Size By By Product Type

11.4.5.1 Multirotor

11.4.5.2 Fixed-wing

11.4.6 Historic and Forecasted Market Size By By Application

11.4.6.1 Photography & Videography

11.4.6.2 Thermal Imaging

11.4.6.3 Surveillance

11.4.7 Historic and Forecasted Market Size By By Resolution

11.4.7.1 12MP

11.4.7.2 12 to 20 MP

11.4.7.3 20 to 32 MP

11.4.7.4 32 MP and above

11.4.8 Historic and Forecasted Market Size By By End-user

11.4.8.1 Commercial Industries

11.4.8.2 Military security

11.4.8.3 Homeland Security

11.4.9 Historic and Forecasted Market Size By By Distribution Channel

11.4.9.1 Online

11.4.9.2 Offline

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Drone Camera Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Type

11.5.4.1 SD Camera

11.5.4.2 HD Camera

11.5.5 Historic and Forecasted Market Size By By Product Type

11.5.5.1 Multirotor

11.5.5.2 Fixed-wing

11.5.6 Historic and Forecasted Market Size By By Application

11.5.6.1 Photography & Videography

11.5.6.2 Thermal Imaging

11.5.6.3 Surveillance

11.5.7 Historic and Forecasted Market Size By By Resolution

11.5.7.1 12MP

11.5.7.2 12 to 20 MP

11.5.7.3 20 to 32 MP

11.5.7.4 32 MP and above

11.5.8 Historic and Forecasted Market Size By By End-user

11.5.8.1 Commercial Industries

11.5.8.2 Military security

11.5.8.3 Homeland Security

11.5.9 Historic and Forecasted Market Size By By Distribution Channel

11.5.9.1 Online

11.5.9.2 Offline

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Drone Camera Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Type

11.6.4.1 SD Camera

11.6.4.2 HD Camera

11.6.5 Historic and Forecasted Market Size By By Product Type

11.6.5.1 Multirotor

11.6.5.2 Fixed-wing

11.6.6 Historic and Forecasted Market Size By By Application

11.6.6.1 Photography & Videography

11.6.6.2 Thermal Imaging

11.6.6.3 Surveillance

11.6.7 Historic and Forecasted Market Size By By Resolution

11.6.7.1 12MP

11.6.7.2 12 to 20 MP

11.6.7.3 20 to 32 MP

11.6.7.4 32 MP and above

11.6.8 Historic and Forecasted Market Size By By End-user

11.6.8.1 Commercial Industries

11.6.8.2 Military security

11.6.8.3 Homeland Security

11.6.9 Historic and Forecasted Market Size By By Distribution Channel

11.6.9.1 Online

11.6.9.2 Offline

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Drone Camera Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Type

11.7.4.1 SD Camera

11.7.4.2 HD Camera

11.7.5 Historic and Forecasted Market Size By By Product Type

11.7.5.1 Multirotor

11.7.5.2 Fixed-wing

11.7.6 Historic and Forecasted Market Size By By Application

11.7.6.1 Photography & Videography

11.7.6.2 Thermal Imaging

11.7.6.3 Surveillance

11.7.7 Historic and Forecasted Market Size By By Resolution

11.7.7.1 12MP

11.7.7.2 12 to 20 MP

11.7.7.3 20 to 32 MP

11.7.7.4 32 MP and above

11.7.8 Historic and Forecasted Market Size By By End-user

11.7.8.1 Commercial Industries

11.7.8.2 Military security

11.7.8.3 Homeland Security

11.7.9 Historic and Forecasted Market Size By By Distribution Channel

11.7.9.1 Online

11.7.9.2 Offline

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Drone Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.4% |

Market Size in 2030: |

USD 80.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Resolution |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

DJI (China), Orqa International (Croatia), AeroVironment (US), PowerVision(China), Parrot (France), and Other Active Players. |

||

Frequently Asked Questions :

The forecast period in the Drone Camera Market research report is 2024-2032.

DJI (China), Orqa International (Croatia), AeroVironment (US), PowerVision(China), Parrot (France), and Other Active Players.

The Drone Camera Market is segmented into Type, Product Type, Application, Resolution, End-user, Distribution Channel, and region. By Type, the market is categorized into SD Camera and HD Camera. By Product Type, the market is categorized into Multirotor and Fixed-Wing. By Application, the market is categorized into Photography & Videography, Thermal Imaging, and Surveillance. By Resolution, the market is categorized into 12MP, 12 to 20 MP, 20 to 32 MP, 32 MP, and above. By End-user, the market is categorized into Commercial Industries, Military security, and Homeland Security. By Distribution Channel, the market is categorized into Online and Offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A drone camera is a camera that is attached to an aerial vehicle or drone. It allows the capture of photographs and videos from a high altitude or different angles. These are often used in various industries such as photography, filmmaking, surveillance, agriculture, mapping, and more.

Drone Camera Market size was valued at USD 10.75 billion in 2023 and is projected to reach USD 80.32 billion by 2032, growing at a CAGR of 25.4% from 2024-2032.