Drug Device Combination Products Market Synopsis:

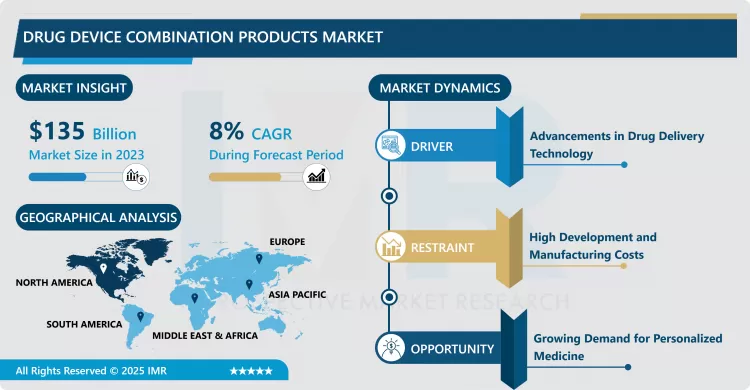

Drug Device Combination Products Market Size Was Valued at USD 135.00 Billion in 2023, and is Projected to Reach USD 269.86 Billion by 2032, Growing at a CAGR of 8.00% From 2024-2032.

Drug Device Combination Products Market refers to products that are combined both, a drug and a medical device for the purpose of improving the efficiency, efficacy and ease of administration of the product. Examples of these products are drug eluting stents, prefilled syringes, transdermal patches where product solutions have aspects of a device and a drug offering better therapeutic solutions to patients with better compliant. They are applied in cardiovascular systems, oncology, diabetes, respiratory therapy depending on the progress in the technology and increasing need for more effective medical equipment.

One of the main factors that are driving the Drug Device Combination Products Market growth is the growing cases of chronic diseases across the global population such as cardiovascular diseases, diabetes, and respiratory disorders. Since these diseases are currently prevalent for vast groups of the population, it is critical to develop the treatment that would enhance medication administration, minimize dosing mistakes, and increase the rate of compliance. These needs are met by drug device combination products where medication is combined with device purposeful to offer careful and specific drug discharge especially for patients with long-term diseases.

The other is the increasing trend towards Less Invasive Services, especially so in the developed healthcare markets. Both patients and healthcare providers prefer interventions that minimize the chances of acquiring an infection and shorten their hospitalization lengths, and recovery periods. Technological advances such as drug-eluting stents and transdermal patches withstand competition from traditional products that offer small, steady and constant dosage to Bodies from periods of time as long as a month and subsequently fuel further investment in this market. Furthermore, favourable policies within the industry and technological improvement in the industry enable manufacturing companies to come up with better products that address the safety of users hence promoting the growth of the market.

Drug Device Combination Products Market Trend Analysis:

Personalized Medicine and Customizable Devices

- A current trend in the Drug Device Combination Products Market is advancing technology especially in the area of product design and drug delivery. Media, smart sensors, and biodegradable materials in a consolidated product in order to enhance effectiveness, security, and clients’ satisfaction. For instance, advanced inhalers increasingly feature a dosing system and usage information gathering that can be of use to treating clinicians and can improve compliance. It has led the market to advance in the field, by setting a new generation of drug delivery systems.

- Worth mentioning also is the tendency towards individualized treatments and precise targeted cures in response to molecular and genetic peculiarities of each patient. More and more, such combinations are introduced so that they allow for a range of doses and individual instructions that would suit a patient’s needs in terms of the treatment. This is apparent in application specific drug delivery systems which include prefilled syringes where the drug is preloaded in syringes for specific doses specific to a patient and auto injectors that are already set for specific doses. The concept of personalized medicine is still a driving force in growth, which strengthens the overall trend of developing and creating more specific products that are both drugs and devices.

Strategic Collaborations and Partnerships

- As mentioned earlier, the Drug Device Combination Product Market’s primary emerging markets remain in Asia-Pacific, Latin America, and a few Middle Eastern countries. These regions are experiencing significant investments in healthcare facilities and the growing requirements for sophisticated treatments primarily because of growing prevalence of chronic diseases and a growing population base. This particularly explains why patient-friendly devices remain the Holy Grail of the modernizing healthcare systems around the globe thus poised to remain profitable appropriations for any drug-device companies in the future.

- This sector also provides opportunities in the form of mergers and alliances in the markets among the pharma and medical equipment industry. Cooperation between the companies will lead to the streamlining of their efforts to develop novel drug-device combination products and address the applicable standards. Such alliances enable firms to utilise the attribute of the other firm, penetrate other markets and diversify their product line, which enhances the level of competition and development of new forms of drug-device combinations.

Drug Device Combination Products Market Segment Analysis:

Drug Device Combination Products Market is Segmented on the basis of Product type, application, end user, and region

By Product Type, Drug-Eluting Stents segment is expected to dominate the market during the forecast period

- The segmented analysis of the global Drug Device Combination Products Industry by product type features numerous devices aim at improving drug delivery. Cardiovascular drugs are implanted through it while it delivers medication on the spot, and has proven to lower restenosis after treatments. These syringes come with a predetermined amount of medication to help reduce cases of medical mistakes and improved comfort particularly for patients that regularly use injections. Inhalers play an important role in respiratory therapy as they dispense little amounts of medication directly to the lungs in conditions such as; asthma and COPD. Patches let medicines to be taken directly into the blood stream slowly while the skin, and for illnesses like pain control and estrogen replacement therapy. It is used in dispensing drugs per time for critical information, such as insulin or chemotherapy requiring regular serving at intervals. Other combined drug and device products include a plethora of innovations that address a variety of therapeutic purposes, combined drug action with device performance to enhance the quality of the results given to patients.

By Application, Cardiovascular Diseases segment expected to held the largest share

- The Drug Device Combination Products market by application is a broad category as the above Medical condition all have applications that are enhanced by drug-device combinations. Cardiac diseases such as the coronary artery diseases secure the existing use of the drug eluting stents, while infusion pumps facilitate the efficient administration of drugs enhancing the patients’ standard of living. The prefilled syringes and insulin pumps are extensively used for diabetes administration due to helping patients with varying requirements for insulin have a constant and precise dosage. Insufflator and Inhalers are very useful in respiratory illness whereby they enable administration of drugs to the lungs in conditions such as asthma, chronic obstructive pulmonary disease (COPD) among others.

- Combinations of drugs with devices in oncology deliver drugs at specified localized sites thus minimizing side effects while enhancing treatment outcome. To ascertain these advantages drug-device combinations such as the infusion pump are utilized in neurological disorders such as Parkinsonism to influence endless medication on symptoms. Other application areas include a variety of medical conditions which make use of a synergy between drug delivery systems and medical devices to improve the overall treatments of the diseases and conditions they cover, such as chronic pain management, hormonal therapy, and other conditions.

Drug Device Combination Products Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American region holds the highest market share for the Drug Device Combination Products Market because of the well-developed healthcare facility, higher healthcare spending, and favorable policies in support of newly emerging technologies. The market for healthcare in the United States is highly developed to facilitate the fast growth of new technologies and products. Cardiovascular, diabetes and respiratory disorders are common diseases affecting the population and this has created a market for drud-device combination products regarding to patient compliance and improvements in treatment.

- Also, increased investment on research and development in North America has put emphasis on drug- device technologies hence attracting government departments and firms’ investments. North America has also benefited from the participation of key industry players and significant research activities in the same region. It is expected that this trend will persist due to the region’s investment in innovative therapeutic systems and the progress towards establishing proper approval and market development processes.

Active Key Players in the Drug Device Combination Products Market

- Abbott Laboratories (USA)

- Baxter International Inc. (USA)

- Bayer AG (Germany)

- Becton, Dickinson and Company (USA)

- Boston Scientific Corporation (USA)

- Johnson & Johnson (USA)

- Medtronic (USA)

- Novartis AG (Switzerland)

- Smith & Nephew (UK)

- Stryker Corporation (USA)

- Other Active Players

|

Drug Device Combination Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.00 Billion |

|

Forecast Period 2024-32 CAGR: |

8.00% |

Market Size in 2032: |

USD 269.86 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Drug Device Combination Products Market by By Product Type (2018-2032)

4.1 Drug Device Combination Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Drug-Eluting Stents

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Prefilled Syringes

4.5 Inhalers

4.6 Transdermal Patches

4.7 Infusion Pumps

4.8 Other

Chapter 5: Drug Device Combination Products Market by By Application (2018-2032)

5.1 Drug Device Combination Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiovascular Diseases

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diabetes

5.5 Respiratory Diseases

5.6 Oncology

5.7 Neurological Disorders

5.8 Other

Chapter 6: Drug Device Combination Products Market by By End User (2018-2032)

6.1 Drug Device Combination Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Home Care Settings

6.6 Ambulatory Surgical Centers

6.7 Other End Users

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Drug Device Combination Products Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JOHNSON & JOHNSON (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MEDTRONIC (USA)

7.4 ABBOTT LABORATORIES (USA)

7.5 BOSTON SCIENTIFIC CORPORATION (USA)

7.6 BECTON

7.7 DICKINSON AND COMPANY (USA)

7.8 STRYKER CORPORATION (USA)

7.9 NOVARTIS AG (SWITZERLAND)

7.10 BAYER AG (GERMANY)

7.11 SMITH & NEPHEW (UK)

7.12 BAXTER INTERNATIONAL INC. (USA)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Drug Device Combination Products Market By Region

8.1 Overview

8.2. North America Drug Device Combination Products Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Drug-Eluting Stents

8.2.4.2 Prefilled Syringes

8.2.4.3 Inhalers

8.2.4.4 Transdermal Patches

8.2.4.5 Infusion Pumps

8.2.4.6 Other

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Cardiovascular Diseases

8.2.5.2 Diabetes

8.2.5.3 Respiratory Diseases

8.2.5.4 Oncology

8.2.5.5 Neurological Disorders

8.2.5.6 Other

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Home Care Settings

8.2.6.4 Ambulatory Surgical Centers

8.2.6.5 Other End Users

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Drug Device Combination Products Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Drug-Eluting Stents

8.3.4.2 Prefilled Syringes

8.3.4.3 Inhalers

8.3.4.4 Transdermal Patches

8.3.4.5 Infusion Pumps

8.3.4.6 Other

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Cardiovascular Diseases

8.3.5.2 Diabetes

8.3.5.3 Respiratory Diseases

8.3.5.4 Oncology

8.3.5.5 Neurological Disorders

8.3.5.6 Other

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Home Care Settings

8.3.6.4 Ambulatory Surgical Centers

8.3.6.5 Other End Users

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Drug Device Combination Products Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Drug-Eluting Stents

8.4.4.2 Prefilled Syringes

8.4.4.3 Inhalers

8.4.4.4 Transdermal Patches

8.4.4.5 Infusion Pumps

8.4.4.6 Other

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Cardiovascular Diseases

8.4.5.2 Diabetes

8.4.5.3 Respiratory Diseases

8.4.5.4 Oncology

8.4.5.5 Neurological Disorders

8.4.5.6 Other

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Home Care Settings

8.4.6.4 Ambulatory Surgical Centers

8.4.6.5 Other End Users

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Drug Device Combination Products Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Drug-Eluting Stents

8.5.4.2 Prefilled Syringes

8.5.4.3 Inhalers

8.5.4.4 Transdermal Patches

8.5.4.5 Infusion Pumps

8.5.4.6 Other

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Cardiovascular Diseases

8.5.5.2 Diabetes

8.5.5.3 Respiratory Diseases

8.5.5.4 Oncology

8.5.5.5 Neurological Disorders

8.5.5.6 Other

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Home Care Settings

8.5.6.4 Ambulatory Surgical Centers

8.5.6.5 Other End Users

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Drug Device Combination Products Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Drug-Eluting Stents

8.6.4.2 Prefilled Syringes

8.6.4.3 Inhalers

8.6.4.4 Transdermal Patches

8.6.4.5 Infusion Pumps

8.6.4.6 Other

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Cardiovascular Diseases

8.6.5.2 Diabetes

8.6.5.3 Respiratory Diseases

8.6.5.4 Oncology

8.6.5.5 Neurological Disorders

8.6.5.6 Other

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Home Care Settings

8.6.6.4 Ambulatory Surgical Centers

8.6.6.5 Other End Users

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Drug Device Combination Products Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Drug-Eluting Stents

8.7.4.2 Prefilled Syringes

8.7.4.3 Inhalers

8.7.4.4 Transdermal Patches

8.7.4.5 Infusion Pumps

8.7.4.6 Other

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Cardiovascular Diseases

8.7.5.2 Diabetes

8.7.5.3 Respiratory Diseases

8.7.5.4 Oncology

8.7.5.5 Neurological Disorders

8.7.5.6 Other

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Home Care Settings

8.7.6.4 Ambulatory Surgical Centers

8.7.6.5 Other End Users

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Drug Device Combination Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.00 Billion |

|

Forecast Period 2024-32 CAGR: |

8.00% |

Market Size in 2032: |

USD 269.86 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Drug Device Combination Products Market research report is 2024-2032.

Johnson & Johnson (USA), Medtronic (USA), Abbott Laboratories (USA), Boston Scientific Corporation (USA), Becton, Dickinson and Company (USA), Stryker Corporation (USA), Novartis AG (Switzerland), Bayer AG (Germany), Smith & Nephew (UK), Baxter International Inc. (USA) and Other Active Players.

The Drug Device Combination Products Market is segmented into by Product Type (Drug-Eluting Stents, Prefilled Syringes, Inhalers, Transdermal Patches, Infusion Pumps, Other), Application (Cardiovascular Diseases, Diabetes, Respiratory Diseases, Oncology, Neurological Disorders, Other Applications), End User (Hospitals, Clinics, Home Care Settings, Ambulatory Surgical Centers, Other End Users). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Drug Device Combination Products Market refers to products that are combined both, a drug and a medical device for the purpose of improving the efficiency, efficacy and ease of administration of the product. Examples of these products are drug eluting stents, prefilled syringes, transdermal patches where product solutions have aspects of a device and a drug offering better therapeutic solutions to patients with better compliant. They are applied in cardiovascular systems, oncology, diabetes, respiratory therapy depending on the progress in the technology and increasing need for more effective medical equipment.

Drug Device Combination Products Market Size Was Valued at USD 135.00 Billion in 2023, and is Projected to Reach USD 269.86 Billion by 2032, Growing at a CAGR of 8.00% From 2024-2032.