Drug Eluting Balloon Market Synopsis:

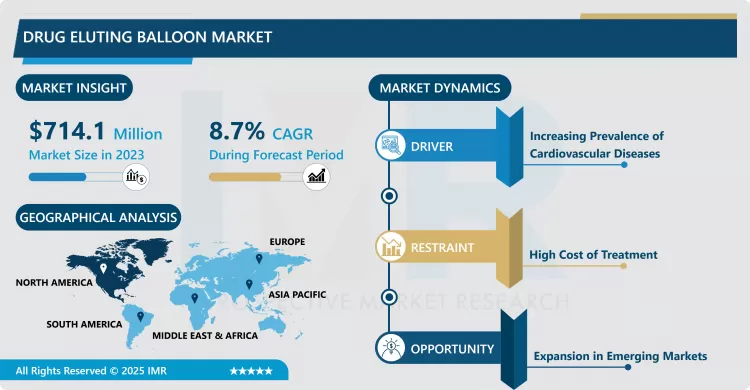

Drug Eluting Balloon Market Size Was Valued at USD 714.1 Million in 2023, and is Projected to Reach USD 1,512.95 Million by 2032, Growing at a CAGR of 8.7% From 2024-2032.

The Drug Eluting Balloon (DEB) Market incorporates vascular endoprostheses which are employed in interventions on blood vessels – stenosis treatment. These balloons are coated with drugs that are released in the artery preventing the artery from re-narrowing or restenosis and help in increase of blood flow and general vascular health. These stents are commonly used in patients who suffer from coronary and peripheral artery diseases since their use provides the least invasive approach to enable circulation.

DEB market has expanded over the past several years due to high prevalence of CAD and PAD, which are the primary global health concerns. It is proving popular in clinical uses as an alternative or in addition to DES because it does not involve the implantation of a permanent device – the balloons. DEBs are used in ‘angioplasty in which balloon catheters are expanded to open blocked arteries. These are balloons that are coated with a therapeutic drug that is released slowly during the treatment, which minimises the risk of re-stenosis since it has an effect on reducing smooth muscle cell growth that cuts across the arterials’ width after treatment.

Population growth in aged persons and the advance in unhealthy lifestyles for instance inadequate diets, smoking and inadequate exercise are some of the major causes of cardiovascular diseases. Therefore, there has been increased demand to vascular intervention devices, inclusive of DEB. Second, the technological development has now increased the efficiency of drug eluting balloons and they are seem more valuable for the healthcare providers. These DEBs are more commonly being used in both coronary and peripheral procedures and are the primary end user of the device in the hospital and ambulatory surgery center. Due to increased costs associated with the treatment of diseases and improvements in investments on cardiovascular related products, the market for the devices is expected to continue expanding. Besides, the growth in the global healthcare DEBs needs to enhance regulatory approval on one hand, and the continuously increasing prevalence of chronic diseases on the other.

Drug Eluting Balloon Market Trend Analysis:

Rise in Minimally Invasive Procedures

- The strategically important trend, currently influencing the growth of the Drug Eluting Balloon market, consists in the development of minimally invasive procedures. The medical fraternity has been on the lookout for noninvasive options to replace traditional invasive surgical procedures, and drug eluting balloons fill that requirement. It will be recalled that most minimally invasive techniques are useful because they pose fewer risks of complications, take less time to heal from, and produce mild discomfort to the patient. DEBs are very useful in treating CAD and PAD since they work well to widen the arteries, and are not accompanied by an implantation of stent that is common with other procedures and might cause long term complications such as thrombosis.

- It is evident that patient choice, now more than ever, is requesting fewer invasive approaches to treatments as well as healthcare providers who want to cut-costs on procedures. These procedures also minimise delays on discharge and an overdration on the post-procedure care. As newer and improved versions of DEBs continue to be developed and introduced, DEBs will continue to transition to additional sophisticated vascular procedures, which will enhance the development of minimally invasive treatment modalities in the cardiovascular specialty.

Expansion in Emerging Markets

- One of the most important trends which can be considered in the Drug Eluting Balloon market is the penetration into new markets. Asia-Pacific with countries in Latin America and parts of Africa are witnessing a gradual rise in their health care infrastructure which in turn is creating the market for sophisticated MEs and DEBs. These regions are experiencing elevated prevalence of lifestyle diseases including hypertension, diabetes, and cardiovascular complications – demand for treatments including drug-eluting balloons is therefore rising. Authorities in these areas are also focused on the augmentation of healthcare provision, which creates the requisite market development.

- Great benefits are therefore expected for companies who are able to effectively market affordable yet effective DEB products to these markets. As the healthcare facilities advance, the need for these vascular interventions in these areas will increase therefore presenting a great potential market in the coming years. Apart from that, more cooperation with local medical practitioners and distributors could also contribute to its market entry and subsequent product utilisation.

Drug Eluting Balloon Market Segment Analysis:

Drug Eluting Balloon Market is Segmented on the basis of product type, technology, end user, and region

By Product Type, Coronary Drug Eluting Balloon segment is expected to dominate the market during the forecast period

- The Drug Eluting Balloon market is headed by a few regions mainly targeting coronary applications and peripheral vessel applications. Coronary drug-eluting balloons apply to coronary artery disease which refers to the obstruction’s or constriction’s of the arteries delivering blood to the heart. This product segment has also been developing dramatically as the number of cardiovascular diseases is increasing, and many patients choose a procedure like balloon angioplasty rather than conventional surgery. Coronary DEBs are most useful for patients who cannot undergo stenting, for example in small vessel disease or restenosis.

- The peripheral drug-eluting balloons on the other hand are used in the treatment of the peripheral artery disease which affects arteries other than the heart, normally in the legs. As it has been pointed out that the rate of developing PAD is rising, there is a concurrent rise in the requirement of peripheral DEBs. This segment is growing as the technology advances, delivers better patient care, and results in swifter rehabilitation. Decades of gradually shifting to treatment for both coronary and peripheral diseases with a single approach present a rich opportunity to producers.

By End User, Hospitals & Ambulatory Surgery Centers segment expected to held the largest share

- The main consumers of the Drug Eluting Balloon are therefore identified as hospitals including ambulatory surgery centres and catheterization (CATH) laboratories. Within the healthcare industry, the two largest end-users have been operative care centers and hospitals and ambulatory surgical centers because of constitution in volumes of patients and a surged application of minimally invasive surgeries. The usage rates for DEBs are increasing as patients seek less invasive, highly effective treatments for coronary and peripheral artery diseases. The scope of these settings is to provide the infrastructure, material, and facilities required for balloon angioplasty with DEBs.

- CATH laboratories also forms a large part of it as it mainly provides services for diagnosis and /or management of cardiovascular afflictions requiring interventional procedures. Currently, drug-eluting balloons are allowed in CATH labs for patients who undergo angioplasty or stenting procedures. DEBs interventions are technically challenging, and with increasing medical technologies and improvements in imaging in CATH laboratories, the market is expected to grow.

Drug Eluting Balloon Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market of Drug Eluting Balloon is led by North America because of well-established healthcare systems, high per capita health care spending, early adoption of innovative technologies, and rising incidences of cardiovascular diseases. For instance, the United States alone has a significant number of patients living with coronary artery disease, who require suitable treatment procedures that include drug-eluting balloons. Further, the region presents proper legal systems and high healthcare expenditures, which facilitate innovation as well as distribution of complex healthcare tools such as DEBs.

- North American market is also benefited from high research and development investment and North American DEB technologies are advanced and are in process of innovation. In this region, hospitals, healthcare providers and individual physicians are using the drug-eluting balloon for treating coronary and peripheral arterial diseases, which also augments the North American dominance of the DEBs market.

Active Key Players in the Drug Eluting Balloon Market:

- Medtronic (Ireland)

- Boston Scientific (USA)

- Abbott Laboratories (USA)

- Cordis Corporation (USA)

- Biotronik (Germany)

- Cook Medical (USA)

- Cardiovascular Systems (USA)

- Terumo Corporation (Japan)

- B. Braun Melsungen (Germany)

- Plethora Solutions (UK)

- MIV Therapeutics (Canada)

- AngioScore (USA)

- Other Active Players

Key Industry Developments in the Drug Eluting Balloon Market:

- On March 1, 2024, Boston Scientific Corporation, a medical device company, announced that the U.S. Food and Drug Administration had approved the AGENT Drug-Coated Balloon (DCB), which is indicated to treat coronary in-stent restenosis (ISR) in patients with coronary artery disease

- In January 2023, Med Alliance SA, a medical technology company, announced that it had received conditional U.S. FDA investigational device exemption (IDE), for its its novel sirolimus-eluting balloon.

|

Drug Eluting Balloon Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 714.1 Million |

|

Forecast Period 2024-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1,512.95 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Drug Eluting Balloon Market by By Product Type (2018-2032)

4.1 Drug Eluting Balloon Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Coronary Drug Eluting Balloon

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Peripheral Drug Eluting Balloon

4.5 Others

Chapter 5: Drug Eluting Balloon Market by By Technology (2018-2032)

5.1 Drug Eluting Balloon Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Paccocath

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 FreePac

5.5 TransPax

5.6 EnduraCoat

5.7 Others

Chapter 6: Drug Eluting Balloon Market by By End User (2018-2032)

6.1 Drug Eluting Balloon Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Ambulatory Surgery Centers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 CATH Laboratories

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Drug Eluting Balloon Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOSTON SCIENTIFIC (USA)

7.4 ABBOTT LABORATORIES (USA)

7.5 CORDIS CORPORATION (USA)

7.6 BIOTRONIK (GERMANY)

7.7 COOK MEDICAL (USA)

7.8 CARDIOVASCULAR SYSTEMS (USA)

7.9 TERUMO CORPORATION (JAPAN)

7.10 B. BRAUN MELSUNGEN (GERMANY)

7.11 PLETHORA SOLUTIONS (UK)

7.12 MIV THERAPEUTICS (CANADA)

7.13 ANGIOSCORE (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Drug Eluting Balloon Market By Region

8.1 Overview

8.2. North America Drug Eluting Balloon Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Coronary Drug Eluting Balloon

8.2.4.2 Peripheral Drug Eluting Balloon

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 Paccocath

8.2.5.2 FreePac

8.2.5.3 TransPax

8.2.5.4 EnduraCoat

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals & Ambulatory Surgery Centers

8.2.6.2 CATH Laboratories

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Drug Eluting Balloon Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Coronary Drug Eluting Balloon

8.3.4.2 Peripheral Drug Eluting Balloon

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 Paccocath

8.3.5.2 FreePac

8.3.5.3 TransPax

8.3.5.4 EnduraCoat

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals & Ambulatory Surgery Centers

8.3.6.2 CATH Laboratories

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Drug Eluting Balloon Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Coronary Drug Eluting Balloon

8.4.4.2 Peripheral Drug Eluting Balloon

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 Paccocath

8.4.5.2 FreePac

8.4.5.3 TransPax

8.4.5.4 EnduraCoat

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals & Ambulatory Surgery Centers

8.4.6.2 CATH Laboratories

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Drug Eluting Balloon Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Coronary Drug Eluting Balloon

8.5.4.2 Peripheral Drug Eluting Balloon

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 Paccocath

8.5.5.2 FreePac

8.5.5.3 TransPax

8.5.5.4 EnduraCoat

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals & Ambulatory Surgery Centers

8.5.6.2 CATH Laboratories

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Drug Eluting Balloon Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Coronary Drug Eluting Balloon

8.6.4.2 Peripheral Drug Eluting Balloon

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 Paccocath

8.6.5.2 FreePac

8.6.5.3 TransPax

8.6.5.4 EnduraCoat

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals & Ambulatory Surgery Centers

8.6.6.2 CATH Laboratories

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Drug Eluting Balloon Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Coronary Drug Eluting Balloon

8.7.4.2 Peripheral Drug Eluting Balloon

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 Paccocath

8.7.5.2 FreePac

8.7.5.3 TransPax

8.7.5.4 EnduraCoat

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals & Ambulatory Surgery Centers

8.7.6.2 CATH Laboratories

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Drug Eluting Balloon Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 714.1 Million |

|

Forecast Period 2024-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1,512.95 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Drug Eluting Balloon Market research report is 2024-2032.

Medtronic (Ireland), Boston Scientific (USA), Abbott Laboratories (USA), Cordis Corporation (USA), Biotronik (Germany), Cook Medical (USA), Cardiovascular Systems (USA), Terumo Corporation (Japan), B. Braun Melsungen (Germany), Plethora Solutions (UK), MIV Therapeutics (Canada), AngioScore (USA), and Other Active Players

The Drug Eluting Balloon Market is segmented into Product Type, Technology, End User and region. By Product Type, the market is categorized into Coronary Drug Eluting Balloon, Peripheral Drug Eluting Balloon, Others. By Technology, the market is categorized into Paccocath, FreePac, TransPax, EnduraCoat, Others. By End-user, the market is categorized into Hospitals & Ambulatory Surgery Centers, CATH Laboratories, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Drug Eluting Balloon (DEB) Market incorporates vascular endoprostheses which are employed in interventions on blood vessels – stenosis treatment. These balloons are coated with drugs that are released in the artery preventing the artery from re-narrowing or restenosis and help in increase of blood flow and general vascular health. These stents are commonly used in patients who suffer from coronary and peripheral artery diseases since their use provides the least invasive approach to enable circulation.

Drug Eluting Balloon Market Size Was Valued at USD 714.1 Million in 2023, and is Projected to Reach USD 1,512.95 Million by 2032, Growing at a CAGR of 8.7% From 2024-2032.