Elderly And Disabled Assistive Devices Market Synopsis:

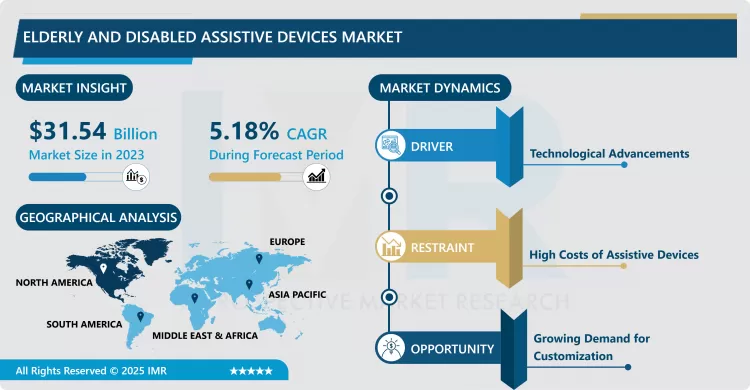

Elderly And Disabled Assistive Devices Market Size Was Valued at USD 31.54 Billion in 2023, and is Projected to Reach USD 49.69 Billion by 2032, Growing at a CAGR of 5.18% From 2024-2032.

The Disabled Assistive Devices Market refers to the combinations of products and technologies that help people with disabilities or the elderly have difficulties carrying out their everyday tasks. These devices are about, to provide the user with independence, elevate the quality of life and make the abilities of disabled people more accessible during interpersonal, personal and professional activities.

The Disabled Assistive Devices Market has experienced remarkable expansion in recent years due in large part to the growing elderly population and the public opinion toward disability and its products. They include mobility equipment; hearing devices; vision equipment; daily living; augmentative and alternative communication; and medical equipment; including mobility equipment such as wheelchairs and walkers, hearing, vision, daily living, speech-generating devices and medical alert devices. This market is not only vital for improving the quality of life for the disabled persons and elderly but is also important in helping to offload the burden on healthcare organizations due to self-reliant living.

Technology is rapidly involved in the enhancement of devices to initially support human function with advancements like smart home gadgets, AI, and IoT to improve the efficiency of these products. Also, the development of the concept of personalized medicine has expanded the usage of individually produced assistive devices. Such devices are part of social progress toward inclusion while more efforts and investments are being devoted to R&D to develop more effective devices.

Elderly And Disabled Assistive Devices Market Trend Analysis:

Increasing Adoption of Smart Assistive Devices

- One of the major trends expressed within the Disabled Assistive Devices Market involved the global uptake of intelligent supporting devices. These devices include high technologies like artificial intelligence and Internet of Things, and are developed to enhance user experience for the disable while making the interaction easier. Subcategories such as smart mobility aids include sensors and GPS technology to help the user to move within his environment and therefore increases the level of independence. The implementation of such technologies is not only functional in aspect but also makes the users have control over mobility and interaction.

- In addition, intelligentization of homes turns common assistive devices into a new category since smart home technologies. Some of them include voice-activated controls as well as automated systems and remote monitoring to allow disabled people and old-age persons enjoy a higher level of self-control in their homes. Technical adjustments in smart homes can greatly minimize user dependency on caregivers by providing safety and comfort to the users thereby enhancing the feeling of the user of being part of a community. Since the consumers of smart technologies are becoming more enlightened on the possible gains from smart technologies in their daily lives, the uptake of these assistive devices is expected to rise and define the market in future.

Growing Demand for Customization

- The area of that is considered to be a major opportunity in the Disabled Assistive Devices Market is increasing focus on the personalization and individualization of assistive devices. Manufacturers are therefore compelled to come up with new products that will address the specific needs of users in order to offer optimal product utility and usability. This trend is most noticeable with clients with special needs, or the elderly, as the device comes with better results in comparison to an off-the-shelf unit. This way companies are able to come up with solutions that help them stand out from their competitors and are able to cement their relationship with their customers.

- Also it is possible to note the appreciable opportunity for market growth, increasing the interest to use-centered approach at creation of assistive devices. When designing a product, it is crucial to admit that the user’s input on the design will give the company a product that both meets functional needs and provides an emotional bond. This makes listeners stick to the platform because they have the feeling that they are taking personal care in the platform’s update. Positive: With the rapidly increasing consumers’ need for individualized assistive devices, organizations that focus on customization and user needs as a major strategic direction and create products adapted to each client’s requirements, will likely gain and sustain competitive advantage in the long run.

Elderly And Disabled Assistive Devices Market Segment Analysis:

Elderly And Disabled Assistive Devices Market is Segmented on the basis of device type, Distribution Channel, end user, and region

By Device Type, Mobility Aids segment is expected to dominate the market during the forecast period

- The Disabled Assistive Devices Market can be classified by several types of devices these are mobility devices, hearing devices, vision devices, daily living devices, communication devices and medical alert devices. Other mobility equipment that might be helpful to the disabled person in order to improve their movement include wheel chairs and scooters. Such devices allow user to move around their surroundings in order to fully engage in various social activities thus helping them regain their independence. It has been noticed that there is a strong trends toward developing lighter and more comfortable mobility devices for its intended users.

- Aids such as hearing aids and vision aids are essential when it comes to people who have one form of sensory impairment or the other. New technologies have come up to produce advanced hearing aids in the market that can suit the preferred style of the user and also the environment. Also in the area of vision aids, smart glasses and magnifiers, integrate digital technologies to optimize aid functions and usability. Mobility aids and equipment and communication aids are also necessary to help people perform daily activities as well as communicate. These devices also show the world’s direction of making things more accessible and available to people with disabilities.

By End user, Elderly segment expected to held the largest share

- The Disabled Assistive Devices Market can be categorized by end users such as elderly people, disabled people, hospitals & clinics and others such as caregivers of the physically impaired. Market demand is also fueled by elderly people due to their disability that results from advancing in age and need the mobility aids to maintain their daily lives. As many senior citizens around the world experience new age-related ailments, they need assistive devices and, therefore, the size of this potential audience is likely to grow, putting pressure on manufacturers to create new devices that are more suitable for senior citizens.

- Another important end user group is the disabled people who require different devices to fulfill their needs and therefore stimulate demand. With the growth of society for disability rights, many disabled people are now looking for ways to get independence and perform routine tasks. Healthcare is another key channel in this market because many facilities and caregivers prescribe and even supply assistive devices to their patients and service users. The relationships between manufacturers, clinicians, and carers play a crucial role in helping users to receive the most beneficial and efficient aids, and thereby continue to fuel market expansion.

Elderly And Disabled Assistive Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is in fact the largest and most influential region in the Disabled Assistive Devices Market today because of its high-level concern on healthcare and large investment in research. The region contains many of the premier companies and organisations devoted to developing and increasing the quality of life for persons with disabilities by means of the use of assistive technologies. Another factor causing higher adoption rates of the assistive devices in this area is broad access to healthcare services and strong, protectant legal framework. In addition, demands for policies promoting the rights of disabled individuals have brought support to the growth and implementation of assistive technologies.

- Also, the increase in the elderly people in North America has creates high demand for assistive devices. As people grow older, they are likely to come across specific issues and disability in terms of mobility, vision, and hearing thus, a large market for the products. Additionally, policies, including funding programs and insurance coverage of the assistive device, also improve accessibility to users from this area. Therefore, with effective healthcare systems, favorable policies, and gradually increasing vulnerable population especially in North America are major factors that make North America as the most promising region in Disabled Assistive Devices Market.

Active Key Players in the Elderly And Disabled Assistive Devices Market:

- Invacare Corporation (USA)

- Sonova Holding AG (Switzerland)

- GN Store Nord A/S (Denmark)

- Ottobock SE & Co. KGaA (Germany)

- Demant A/S (Denmark)

- Medline Industries, Inc. (USA)

- Smith & Nephew plc (UK)

- Siemens AG (Germany)

- 3M Company (USA)

- Cochlear Limited (Australia)

- Tactile Medical (USA)

- Eargo, Inc. (USA)

- Other Active Players

|

Elderly And Disabled Assistive Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.18% |

Market Size in 2032: |

USD 49.69 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Elderly And Disabled Assistive Devices Market by By Device Type (2018-2032)

4.1 Elderly And Disabled Assistive Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mobility Aids

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hearing Aids

4.5 Vision Aids

4.6 Daily Living Aids

4.7 Communication Aids

4.8 Medical Alert Systems

Chapter 5: Elderly And Disabled Assistive Devices Market by By Distribution Channel (2018-2032)

5.1 Elderly And Disabled Assistive Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online Sales

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline Sales

Chapter 6: Elderly And Disabled Assistive Devices Market by By End User (2018-2032)

6.1 Elderly And Disabled Assistive Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Elderly

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Disabled Individuals

6.5 Healthcare Facilities

6.6 Caregivers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Elderly And Disabled Assistive Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INVACARE CORPORATION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SONOVA HOLDING AG (SWITZERLAND)

7.4 GN STORE NORD A/S (DENMARK)

7.5 OTTOBOCK SE & CO. KGAA (GERMANY)

7.6 DEMANT A/S (DENMARK)

7.7 MEDLINE INDUSTRIES INC. (USA)

7.8 SMITH & NEPHEW PLC (UK)

7.9 SIEMENS AG (GERMANY)

7.10 3M COMPANY (USA)

7.11 COCHLEAR LIMITED (AUSTRALIA)

7.12 TACTILE MEDICAL (USA)

7.13 EARGO INC. (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Elderly And Disabled Assistive Devices Market By Region

8.1 Overview

8.2. North America Elderly And Disabled Assistive Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Device Type

8.2.4.1 Mobility Aids

8.2.4.2 Hearing Aids

8.2.4.3 Vision Aids

8.2.4.4 Daily Living Aids

8.2.4.5 Communication Aids

8.2.4.6 Medical Alert Systems

8.2.5 Historic and Forecasted Market Size By By Distribution Channel

8.2.5.1 Online Sales

8.2.5.2 Offline Sales

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Elderly

8.2.6.2 Disabled Individuals

8.2.6.3 Healthcare Facilities

8.2.6.4 Caregivers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Elderly And Disabled Assistive Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Device Type

8.3.4.1 Mobility Aids

8.3.4.2 Hearing Aids

8.3.4.3 Vision Aids

8.3.4.4 Daily Living Aids

8.3.4.5 Communication Aids

8.3.4.6 Medical Alert Systems

8.3.5 Historic and Forecasted Market Size By By Distribution Channel

8.3.5.1 Online Sales

8.3.5.2 Offline Sales

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Elderly

8.3.6.2 Disabled Individuals

8.3.6.3 Healthcare Facilities

8.3.6.4 Caregivers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Elderly And Disabled Assistive Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Device Type

8.4.4.1 Mobility Aids

8.4.4.2 Hearing Aids

8.4.4.3 Vision Aids

8.4.4.4 Daily Living Aids

8.4.4.5 Communication Aids

8.4.4.6 Medical Alert Systems

8.4.5 Historic and Forecasted Market Size By By Distribution Channel

8.4.5.1 Online Sales

8.4.5.2 Offline Sales

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Elderly

8.4.6.2 Disabled Individuals

8.4.6.3 Healthcare Facilities

8.4.6.4 Caregivers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Elderly And Disabled Assistive Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Device Type

8.5.4.1 Mobility Aids

8.5.4.2 Hearing Aids

8.5.4.3 Vision Aids

8.5.4.4 Daily Living Aids

8.5.4.5 Communication Aids

8.5.4.6 Medical Alert Systems

8.5.5 Historic and Forecasted Market Size By By Distribution Channel

8.5.5.1 Online Sales

8.5.5.2 Offline Sales

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Elderly

8.5.6.2 Disabled Individuals

8.5.6.3 Healthcare Facilities

8.5.6.4 Caregivers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Elderly And Disabled Assistive Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Device Type

8.6.4.1 Mobility Aids

8.6.4.2 Hearing Aids

8.6.4.3 Vision Aids

8.6.4.4 Daily Living Aids

8.6.4.5 Communication Aids

8.6.4.6 Medical Alert Systems

8.6.5 Historic and Forecasted Market Size By By Distribution Channel

8.6.5.1 Online Sales

8.6.5.2 Offline Sales

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Elderly

8.6.6.2 Disabled Individuals

8.6.6.3 Healthcare Facilities

8.6.6.4 Caregivers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Elderly And Disabled Assistive Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Device Type

8.7.4.1 Mobility Aids

8.7.4.2 Hearing Aids

8.7.4.3 Vision Aids

8.7.4.4 Daily Living Aids

8.7.4.5 Communication Aids

8.7.4.6 Medical Alert Systems

8.7.5 Historic and Forecasted Market Size By By Distribution Channel

8.7.5.1 Online Sales

8.7.5.2 Offline Sales

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Elderly

8.7.6.2 Disabled Individuals

8.7.6.3 Healthcare Facilities

8.7.6.4 Caregivers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Elderly And Disabled Assistive Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.18% |

Market Size in 2032: |

USD 49.69 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Elderly And Disabled Assistive Devices Market research report is 2024-2032.

Invacare Corporation (USA), Sonova Holding AG (Switzerland), GN Store Nord A/S (Denmark), Ottobock SE & Co. KGaA (Germany), Demant A/S (Denmark), Medline Industries, Inc. (USA), Smith & Nephew plc (UK), Siemens AG (Germany),and Other Major Players.

The Elderly And Disabled Assistive Devices Market is segmented into Device Type, Distribution Channel, End User and region. By Device Type, the market is categorized into Mobility Aids, Hearing Aids, Vision Aids, Daily Living Aids, Communication Aids, Medical Alert Systems. By End User, the market is categorized into Elderly, Disabled Individuals, Healthcare Facilities, Caregivers. By Distribution Channel, the market is categorized into Online Sales, Offline Sales. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Disabled Assistive Devices Market refers to the combinations of products and technologies that help people with disabilities or the elderly have difficulties carrying out their everyday tasks. These devices are about, to provide the user with independence, elevate the quality of life and make the abilities of disabled people more accessible during interpersonal, personal and professional activities.

Elderly And Disabled Assistive Devices Market Size Was Valued at USD 31.54 Billion in 2023, and is Projected to Reach USD 49.69 Billion by 2032, Growing at a CAGR of 5.18% From 2024-2032.