Electric Mining Dump Truck Market Synopsis

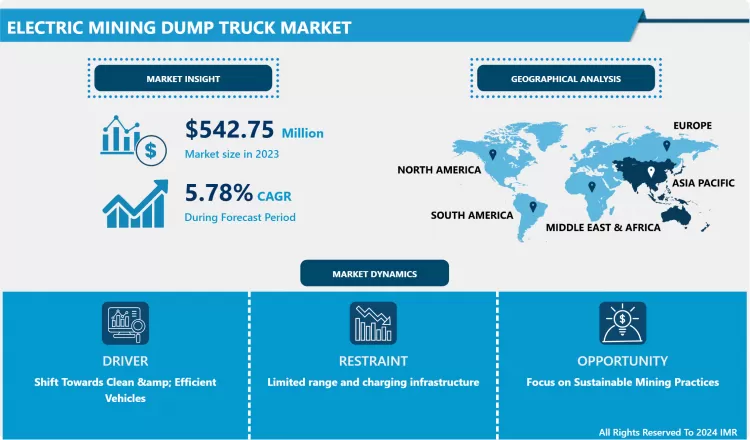

Electric Mining Dump Truck Market Size Was Valued at USD 542.75 Million in 2023, and is Projected to Reach USD 899.98 Million by 2032, Growing at a CAGR of 5.78% From 2024-2032.

An Electric Mining Dump is a specialized vehicle used in mining operations to transport materials such as ore, coal, or waste over rough terrain. It typically features an electric drivetrain powered by batteries or overhead lines, reducing emissions and operating costs compared to traditional diesel-powered vehicles. Electric Mining Dumps often have large capacities, sturdy construction, and advanced safety features to withstand harsh mining environments while efficiently moving large volumes of material.

- These specialized trucks are designed to transport large quantities of materials in mining operations, offering benefits such as reduced emissions, lower operating costs, and improved safety compared to traditional diesel-powered counterparts.

- Key factors fueling market growth include stringent environmental regulations, rising awareness about the adverse impacts of fossil fuels, and advancements in battery technology. Electric mining dump trucks are powered by batteries or overhead power lines, enabling them to operate efficiently in underground mines and surface mining sites while minimizing carbon footprint.

- Moreover, the growing adoption of automation and digitalization in the mining industry is further propelling the demand for electric mining dump trucks. These vehicles are often equipped with advanced features such as autonomous driving capabilities, telematics systems, and remote monitoring, enhancing productivity and operational efficiency.

- Geographically, regions with significant mining activities such as North America, Latin America, Asia Pacific, and Europe are witnessing substantial investments in electric mining dump trucks. Additionally, collaborations between mining companies, technology providers, and government organizations are fostering innovation and the development of next-generation electric vehicles tailored to meet the evolving needs of the mining sector.

Electric Mining Dump Truck Market Trend Analysis

Shift Towards Clean & Efficient Vehicles

- The Electric Mining Dump Truck Market is experiencing a significant shift towards clean and efficient vehicles, driven by a confluence of environmental, economic, and technological factors. With growing concerns over carbon emissions and environmental sustainability, industries are increasingly adopting electric vehicles to reduce their carbon footprint. In the mining sector, where heavy machinery plays a crucial role, the transition to electric dump trucks offers substantial benefits.

- The electric mining dump trucks significantly reduce greenhouse gas emissions compared to their diesel counterparts, contributing to cleaner air and mitigating climate change effects. Additionally, electric vehicles have lower operating costs over their lifetime due to reduced fuel consumption and maintenance requirements, making them economically advantageous for mining companies.

- Technological advancements in battery technology and charging infrastructure have also made electric vehicles more viable for heavy-duty applications like mining. As a result, mining companies are increasingly investing in electrification initiatives to modernize their fleets and align with sustainability goals.

- The shift towards clean and efficient vehicles is a major driving force behind the growth of the Electric Mining Dump Truck Market, offering environmental benefits, cost savings, and technological advancements to the mining industry.

Focus on Sustainable Mining Practices

- The growing industries are prioritizing environmental responsibility, the demand for eco-friendly solutions in mining operations has surged. Electric mining dump trucks offer a compelling solution by significantly reducing carbon emissions and noise pollution compared to their diesel counterparts.

- Investing in sustainable mining practices not only aligns with corporate social responsibility goals but also enhances operational efficiency and long-term viability. Electric trucks minimize the environmental impact of mining activities by reducing greenhouse gas emissions and dependence on fossil fuels. Moreover, they contribute to improved air quality and health benefits for workers and nearby communities.

- Embracing sustainable mining practices also fosters innovation and technological advancement in the industry. Companies that lead the transition to electric mining equipment position themselves as market leaders and attract environmentally conscious investors. Additionally, governments and regulatory bodies increasingly incentivize the adoption of sustainable technologies, providing further impetus for market growth.

- The focusing on sustainable mining practices presents a compelling opportunity for stakeholders in the Electric Mining Dump Truck Market, driving both environmental stewardship and economic prosperity.

Electric Mining Dump Truck Market Segment Analysis:

Electric Mining Dump Truck Market Segmented on the basis of Type, Size, and Application

By Type, Rear dump trucks segment is expected to dominate the market during the forecast period

- The Rear dump trucks offer a higher payload capacity and can navigate challenging terrains with ease, making them ideal for various mining applications. Their rear-mounted dump bodies facilitate quick and efficient unloading of materials, enhancing productivity at mining sites. Additionally, rear dump trucks are often equipped with advanced features such as autonomous driving technology, enhancing safety and reducing operational costs.

- Their widespread adoption by mining companies seeking to improve operational efficiency and reduce environmental impact further solidifies their dominance in the market. With advancements in electric propulsion technology, rear dump trucks are increasingly favored for their lower emissions and reduced reliance on fossil fuels, aligning with the industry's sustainability goals. As a result, the segment continues to lead the Electric Mining Dump Truck Market by type, driving innovation and growth in the sector.

By Application, Open-Pit Mining segment held the largest share of xx% in 2022

- Open-pit mining, characterized by vast excavations, relies heavily on large-scale equipment like electric mining dump trucks for efficient material transportation. These trucks offer high payload capacities and lower operational costs due to their electric propulsion systems, making them ideal for the demanding conditions of open-pit mining. Additionally, stringent environmental regulations drive the adoption of electric vehicles in mining operations to minimize emissions and reduce carbon footprints.

- Moreover, advancements in battery technology have enhanced the performance and reliability of electric mining dump trucks, further boosting their popularity in this segment. The ability of these trucks to operate continuously without the need for refueling, coupled with their robust design for handling rugged terrains, solidifies their dominance in the open-pit mining sector, where productivity and efficiency are paramount. Hence, by application, the open-pit mining segment remains the primary driver of the electric mining dump truck market.

Electric Mining Dump Truck Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to assert dominance in the electric mining dump truck market for several compelling reasons. It hosts key mining powerhouses such as China, Australia, and India, which drive substantial demand for mining equipment. Secondly, there's a global push towards sustainability, prompting industries to adopt cleaner alternatives like electric vehicles. The Asia Pacific's rapid industrialization and increasing environmental consciousness, the shift to electric mining trucks is particularly pronounced in this region.

- Government support plays a pivotal role, with various initiatives promoting electric vehicle adoption, including subsidies, tax incentives, and stringent emission regulations. Furthermore, ongoing advancements in battery technology and vehicle design are enhancing the efficiency and reliability of electric mining trucks, making them more appealing to mining companies across the Asia Pacific.

- The convergence of favorable market conditions, environmental imperatives, and technological innovations positions the Asia Pacific region as the frontrunner in the electric mining dump truck market.

Electric Mining Dump Truck Market Top Key Players:

- GM Terex Corporation (United States)

- Caterpillar (United States)

- BelAZ (Belarus)

- Kuhn Schweiz AG (Switzerland)

- Liebherr Group (Switzerland)

- Epiroc Mining (Sweden)

- Hitachi (Japan)

- Komatsu (Japan), and Other Major Players.

- SANY

- XCMG

- ZOOMLION

- SANDVIK AB

- PROPEL INDUSTRIES

Key Industry Developments in the Electric Mining Dump Truck Market:

- In July 2024, building on their ongoing cooperative efforts, Liebherr and Fortescue further combined their areas of expertise to develop and validate an Autonomous Haulage Solution (AHS). The AHS was integrated with the zero-emission haul trucks that the companies were co-developing, aiming to be the first AHS operating zero-emissions vehicles globally.

- In May 2024, Caterpillar Inc. announced a $90 million investment to prepare its facilities in Schertz and Seguin, Texas, for the production of the all-new Cat® C13D industrial engine. The investment was set to create 25 jobs at Schertz starting in 2026. The Caterpillar team in Texas will produce the quality parts and engines needed for our customers as we help them build a better, more sustainable world.

|

Electric Mining Dump Truck Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 542.75 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.78% |

Market Size in 2032: |

USD 899.98 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Mining Dump Truck Market by By Type (2018-2032)

4.1 Electric Mining Dump Truck Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rear dump trucks

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bottom dump trucks

Chapter 5: Electric Mining Dump Truck Market by By Size (2018-2032)

5.1 Electric Mining Dump Truck Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small (90-150 metric tons)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium (151-250 metric tons)

5.5 Large (251-350 metric tons)

5.6 Ultra (above 351 metric tons)

Chapter 6: Electric Mining Dump Truck Market by By Application (2018-2032)

6.1 Electric Mining Dump Truck Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Open-Pit Mining

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Underground Mining

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Mining Dump Truck Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SIMCO-ION/ITW (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TERRA UNIVERSAL (UNITED STATES)

7.4 SCS (UNITED STATES)

7.5 STREAMTEK (CANADA)

7.6 ELTEX (RUSSIA)

7.7 HAUG (SWITZERLAND)

7.8 MEECH INTERNATIONAL (UNITED KINGDOM)

7.9 PULS ELECTRONIC (GERMANY)

7.10 KOREA HUGLE ELECTRONICS (SOUTH KOREA)

7.11 PANASONIC (JAPAN)

7.12 EXAIR CORPORATION (UNITED STATES)

7.13 FRASER ANTI-STATIC TECHNIQUES (UNITED KINGDOM)

7.14 MATSUSHITA ELECTRIC WORKS (JAPAN)

7.15 SIMCO B.V. (NEDERLAND)

7.16 KOREA HUGLE ELECTRONICS (SOUTH KOREA)

7.17

Chapter 8: Global Electric Mining Dump Truck Market By Region

8.1 Overview

8.2. North America Electric Mining Dump Truck Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Rear dump trucks

8.2.4.2 Bottom dump trucks

8.2.5 Historic and Forecasted Market Size By By Size

8.2.5.1 Small (90-150 metric tons)

8.2.5.2 Medium (151-250 metric tons)

8.2.5.3 Large (251-350 metric tons)

8.2.5.4 Ultra (above 351 metric tons)

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Open-Pit Mining

8.2.6.2 Underground Mining

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Mining Dump Truck Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Rear dump trucks

8.3.4.2 Bottom dump trucks

8.3.5 Historic and Forecasted Market Size By By Size

8.3.5.1 Small (90-150 metric tons)

8.3.5.2 Medium (151-250 metric tons)

8.3.5.3 Large (251-350 metric tons)

8.3.5.4 Ultra (above 351 metric tons)

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Open-Pit Mining

8.3.6.2 Underground Mining

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Mining Dump Truck Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Rear dump trucks

8.4.4.2 Bottom dump trucks

8.4.5 Historic and Forecasted Market Size By By Size

8.4.5.1 Small (90-150 metric tons)

8.4.5.2 Medium (151-250 metric tons)

8.4.5.3 Large (251-350 metric tons)

8.4.5.4 Ultra (above 351 metric tons)

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Open-Pit Mining

8.4.6.2 Underground Mining

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Mining Dump Truck Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Rear dump trucks

8.5.4.2 Bottom dump trucks

8.5.5 Historic and Forecasted Market Size By By Size

8.5.5.1 Small (90-150 metric tons)

8.5.5.2 Medium (151-250 metric tons)

8.5.5.3 Large (251-350 metric tons)

8.5.5.4 Ultra (above 351 metric tons)

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Open-Pit Mining

8.5.6.2 Underground Mining

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Mining Dump Truck Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Rear dump trucks

8.6.4.2 Bottom dump trucks

8.6.5 Historic and Forecasted Market Size By By Size

8.6.5.1 Small (90-150 metric tons)

8.6.5.2 Medium (151-250 metric tons)

8.6.5.3 Large (251-350 metric tons)

8.6.5.4 Ultra (above 351 metric tons)

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Open-Pit Mining

8.6.6.2 Underground Mining

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Mining Dump Truck Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Rear dump trucks

8.7.4.2 Bottom dump trucks

8.7.5 Historic and Forecasted Market Size By By Size

8.7.5.1 Small (90-150 metric tons)

8.7.5.2 Medium (151-250 metric tons)

8.7.5.3 Large (251-350 metric tons)

8.7.5.4 Ultra (above 351 metric tons)

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Open-Pit Mining

8.7.6.2 Underground Mining

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Electric Mining Dump Truck Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 542.75 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.78% |

Market Size in 2032: |

USD 899.98 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Mining Dump Truck Market research report is 2024-2032.

GM Terex Corporation (United States), Caterpillar (United States), BelAZ (Belarus), Kuhn Schweiz AG (Switzerland), Liebherr Group (Switzerland), Epiroc Mining (Sweden), Hitachi (Japan), Komatsu (Japan), and Other Major Players.

The Electric Mining Dump Truck Market is segmented into Type, Size, Application, and region. By Type, the market is categorized into Rear dump trucks, and Bottom dump trucks. By Size, the market is categorized into Small (90-150 metric tons), Medium (151-250 metric tons), Large (251-350 metric tons), and Ultra (above 351 metric tons). By Application, the market is categorized into Open-Pit Mining, and Underground Mining. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An Electric Mining Dump is a specialized vehicle used in mining operations to transport materials such as ore, coal, or waste over rough terrain. It typically features an electric drivetrain powered by batteries or overhead lines, reducing emissions and operating costs compared to traditional diesel-powered vehicles. Electric Mining Dumps often have large capacities, sturdy construction, and advanced safety features to withstand harsh mining environments while efficiently moving large volumes of material.

Electric Mining Dump Truck Market Size Was Valued at USD 542.75 Million in 2023, and is Projected to Reach USD 899.98 Million by 2032, Growing at a CAGR of 5.78% From 2024-2032.