Electric Vehicle Battery Trays Market Synopsis

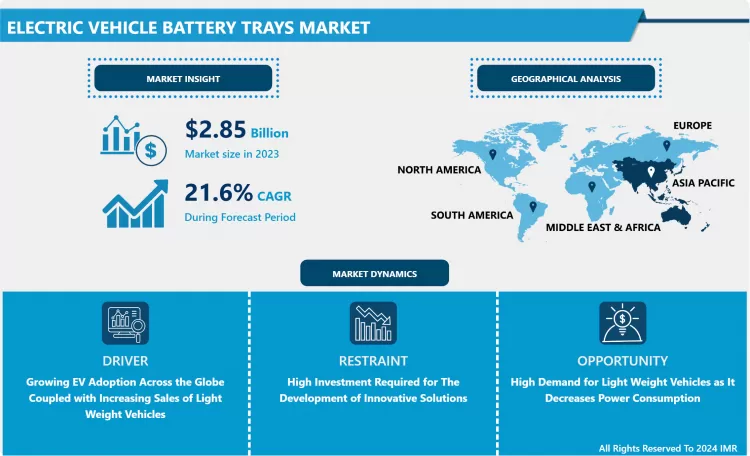

Electric Vehicle Battery Trays Market Size Was Valued at USD 2.85 Billion in 2023, and is Projected to Reach USD 16.57 Billion by 2032, Growing at a CAGR of 21.6% From 2024-2032.

-

The market niche for electric vehicle battery pouches is now witnessing robust growth due to the increasing worldwide demand for electric vehicles (EVs). These trays not only provide the structural support of the battery cells but also ensure the safe installation and operation of electric vehicles. Environmental concerns and stricter emissions regulations are pushing the car industry to switch to electrification, thus boosting the demand for energy and lightweight battery compartment solutions. In order to improve the weight and performance of battery containers as well as the overall efficiency of vehicles, manufacturers will focus on developing new designs and advanced materials. In addition to this, rising investments in research and development activities for enhancing the battery technology and extending the vehicle range play a vital role in the growth of the market. Constantly developing technologies and increasing rates of electric vehicles (EVs) adoption mean that the market for battery containers for electric vehicles (EVs) should expand in years to come.

-

The car's battery or electric vehicle battery is the core operational part of the vehicle. With growing number of electric cars, there is demand for lightweight components that have the capability to safely hold the battery packs. The battery usually connects to the vehicle frame by means of a straight metal cable.

-

This solution not only limits the vertical displacement of the battery, but also stops its oscillating motion. Although this type of technique is proven to be effective during regular driving, it is much less efficient when it comes to traveling off-road. These circumstances, therefore, require a battery receptacle to be a necessity. A battery tray is designed to hold large battery packs. The tray prevents the battery from rolling out of its place and thus cause damage to the tray itself or other objects. This can be achieved with mounting fasteners and adjustable straps to secure the tray and battery.

-

Besides this, these trays protect from the dripping of battery acid and other hazardous liquids on adjacent surfaces which is going to drive growth of the electric vehicle batter tray market in the projected period.

Electric Vehicle Battery Trays Market Trend Analysis

Modular Battery Tray Designs

-

A critical area in the electric vehicle battery compartment market lies in adoptable modular designs that are called for due to the need for flexibility and scalability in different battery configurations.

-

Modular battery container designs ensure the continuous changeover of batteries of different dimensions and shapes thus accommodating electric models from various vehicle segments as they keep changing.

-

This tendency is in accordance with the automobile industry's focus on standardization and platform sharing, which enables the reduction of manufacturing and operational costs by using identical components on different vehicle platforms.

-

In addition, it shows the industry's solution with modular battery container designs to the crucial issue of the future of electric vehicles.

-

The development in battery technology has given automakers a flexibility of effectively responding to the emerging battery innovations through modular designs that eliminates the need for substantial redesigns or retooling.

-

Through the utilization of this methodology, electric vehicle production may increase in efficiency while making sure that they remain competitive in spite of the dynamic market environments.

-

The implementation of modular battery tray designs is very likely to change the face of the electric vehicle battery tray market, giving way to more flexibility and innovation in the designing of electric cars.

Integration of Thermal Management Systems

-

The implementation of thermal management systems marked a major milestone in the electric vehicle battery container market as it efficiently provides the solution to the key challenge of temperature control in battery packs.

-

The provision of extended driving range and prolonged battery life is closely associated with the maintenance of an optimal battery temperature for electric vehicles. Sheet metal trays that have been done with thermal management systems, like air or liquid conditioning channels, which are able to efficiently control temperature and dissipate heat, will protect battery cells from overheating and thermal degradation.

-

Through incorporating reliable and durable electric vehicle batteries, it further enhances the reliability and safety of EVs overall, in turn, facilitating the adoption of this technology by customers.

-

Moreover, there is high demand for battery containers with thermal management capabilities mainly because of the growing number of electric vehicles all over the globe. As a solution to battery heating and cooling problems during battery charging, discharging, and intense driving, automakers are paying particular attention to heat management technologies.

-

Accordingly, thermal management is becoming more and more important as a distinguishing component in electric vehicle design and the heaters are playing a vital role in maintaining the efficient operation of electric vehicle powertrains.

-

Thermal management systems will be continue to the core trends of electric vehicle battery container market, pushing through the developments and formulating the electric mobility future.

Electric Vehicle Battery Trays Market Segment Analysis:

- Electric Vehicle Battery Trays Market is segmented based on Material and Applications

By Material, Trim segment dominance characterizes the global Electric Vehicle Battery Trays market.

- The market for electric vehicle (EV) battery trays is expanding at a fast rate driven by materials’ development and increased worldwide adoption of EVs. Organized by material type—steel, glass fiber, and aluminum—each category provides unique benefits and a broad spectrum of consumer needs.

- Steel trays are the most common due to their sturdiness, low prices, and wide area of distribution. They retain that strength and resilience while still offering excellent battery support for electric vehicles in many environments. In addition, steel is highly resistant to impact and vibration, which is crucial in terms of battery safety.

- Glass-fiber containers are growing in potency due to their superior corrosion resistance and low weight. They lower the weight-to-strength ratio by increasing the total performance and range of the vehicle. Apart from that, their adaptability makes it possible to design intricate patterns, helping to optimize the space within the electric vehicles.

- High performance electric vehicles have recognized the use of aluminum containers for their amazing strength-to-weight ratios. Although aluminum trays are more expensive than other options, they have better heat conductivity properties that promote even distribution of heat that leads to effective cooling of the battery and prolong its lifespan.

- To meet the rising demand for electric vehicles (EVs) quality, manufacturers are adapting the resource allocation towards the development of new materials and designs. The companies are assured of continued growth and competition for electric vehicle battery trays due to the varied environment.

By Applications, Passenger segment is anticipated to maintain a market share over the forecast period.

-

The electric vehicle (EV) battery trays are gaining popularity as the demand for widely varied applications such as two- and three-wheelers, as well as passenger cars and commercial vehicles is increasing. Each phase infers its own set of issues and demands that help develop the batteries tray design and materials further.

-

Battery containers in B2 and B3 segments are of great importance as they maximize space in the vehicle chassis while guaranteeing balance and stability. Most desirable are lightweight materials like fiberglass-based composites and aluminium because they enhance agility and maneuverability which are crucial assets for urban commuting and shorter trips.

-

Battery trays for passenger automobiles as the most dominant sector of the electric vehicle (EV) market, combine a significant weight with durability and safety specifications. Trays made of steel continue to be highly popular thanks to their reliability and affordability whereas premium models gradually try to incorporate aluminium trays into their design to improve range and performance.

-

Buses and trucks, as well as other commercial vehicles, need good battery trays that are able to withstand heavy workload and accept bigger battery packs. In this market niche, steel containers have high traction as they are durable and reliable hence, they offer safe transportation of passengers and cargo over long distances.

-

More and more electric vehicles are being spread across the world today, car manufacturers are however dedicating resources towards development of advanced materials and manufacturing processes with a view of satisfying varied applications in different vehicle classes. The constant innovation in electric vehicle battery trays drives the market growth and competition, which, in turn, results in the creative and dynamic electric transportation solutions.

Global Electric Vehicle Battery Trays Market Regional Insights

Asia Pacific Dominates the Market Over the Forecast Period

-

The Asia Pacific region is highly dominant in the variety of sectors including e-vehicle battery box supply. Over the next few years, Asia Pacific is expected to main its leading position in this fast-growing industry.

-

The EV battery container industry in Asia Pacific is dominated by a number of aspects. The region will be home to some of the world's most important economies, such as South Korea, Japan, and China, all of which are primary actors in electric vehicles industry. These countries are known for their significant manufacturing capacities, advanced technological infrastructures, and significant financial investments in research and development, which result in knowledge dissemination and the extensive use of electric vehicles.

-

Besides that, governmental policy and programs that are favorable to the growth of sustainable transport alternatives will help the EV industry to develop in Asia Pacific region. Regulatory frameworks, subsidies and incentives create opportunities for manufacturing and consumers to adopt electric vehicles which results in an increased demand for components that include battery containers.

-

In addition, the presence of the mature and emerging auto companies, as well as a wide group of suppliers and distributors, provides an excellent environment for the expansion of electric vehicle battery trays production and influence in the Asia-Pacific region.

-

Considering its firm industrial base, favorable regulatory ecosystem, and rising consumer demand for electric vehicles, the Asia-Pacific region is likely to become the leading market for electric vehicle battery casings during the expected time period.

Active Key Players in the Global Electric Vehicle Battery Trays Market

- BENTELER

- Constellium

- Standard Technologies

- ZEISS

- Foshan Shijun Hongmao Aluminum Technology Co. Ltd.

- Gestamp

- Waldaschaff Automotive GmbH

- Aluminum Extruders Council

- Atlas Copco AB

- DURA AUTOMOTIVE SYSTEMS

- PRATIC CNC Technology Co. Ltd

- FSM Group

- Farasis Energy (USA)

- Inergy Automotive Systems (France)

- Novelis Inc (USA)

- Sika Automotive (Switzerland)

- Webasto Group (Germany)

- Other Major Players.

Key Industry Developments in The Electric Vehicle Battery Trays Market:

- In April 2024, Hyundai Motor Company and Kia Corporation partnered with Exide Energy Solutions Ltd for electric vehicle battery localization in India. The collaboration, announced on Monday, involved a Memorandum of Understanding (MOU) signed by Hyundai Motor Group with Exide Energy Solutions Ltd. As part of their expansion plans in the electric vehicle (EV) sector, Hyundai and Kia aimed to localize their EV battery production, focusing specifically on lithium-iron-phosphate (LFP) cells to support their growing presence in the Indian market.

- In January 2024, SGL Carbon partnered with E-Works Mobility on a technology initiative. SGL Carbon supplied a battery case made of glass fiber-reinforced plastic for E-Works Mobility, a Munich-based company specializing in electric van development. The collaboration aimed to enhance the E-Works HEERO, a high-performance e-transporter. Engineers recently completed a full redesign of a new battery box to replace the previous aluminum construction, marking a significant advancement in the vehicle's evolution.

Global Electric Vehicle Battery Trays Market Scope:

|

Global Electric Vehicle Battery Trays Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.85 Bn |

|

Forecast Period 2024-32 CAGR: |

21.6% |

Market Size in 2032: |

USD 16.57 Bn |

|

Segments Covered: |

By Material Type |

|

|

|

By Vehicle Type |

|

||

|

By Battery Type |

|

||

|

By Manufacturing Process |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Battery Trays Market by By Material Type (2018-2032)

4.1 Electric Vehicle Battery Trays Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Steel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Aluminum

4.5 Composites (CFRP

4.6 GFRP)

4.7 Others (hybrid materials

4.8 advanced polymers)

Chapter 5: Electric Vehicle Battery Trays Market by By Vehicle Type (2018-2032)

5.1 Electric Vehicle Battery Trays Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles (buses

5.5 delivery vans

5.6 trucks)

5.7 Two-Wheelers (electric scooters

5.8 motorcycles)

5.9 Off-Highway Vehicles (industrial

5.10 agricultural

5.11 construction EVs)

Chapter 6: Electric Vehicle Battery Trays Market by By Battery Type (2018-2032)

6.1 Electric Vehicle Battery Trays Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Lithium-Ion Batteries

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Solid-State Batteries

6.5 Nickel-Metal Hydride (NiMH) Batteries

6.6 Other Battery Types

Chapter 7: Electric Vehicle Battery Trays Market by By Manufacturing Process (2018-2032)

7.1 Electric Vehicle Battery Trays Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Stamping

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Extrusion

7.5 Casting

7.6 Injection Molding

7.7 Additive Manufacturing (3D Printing)

Chapter 8: Electric Vehicle Battery Trays Market by By Distribution Channel (2018-2032)

8.1 Electric Vehicle Battery Trays Market Snapshot and Growth Engine

8.2 Market Overview

8.3 OEMs

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Aftermarket

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Vehicle Battery Trays Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BOUNCE INFINITY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CONTEMPORARY AMPEREX TECHNOLOGY

9.4 DAIMLER

9.5 E-CHARGE UP SOLUTIONS

9.6 GOGORO

9.7 GROUPE RENAULT

9.8 HONEYWELL

9.9 KIA

9.10 LEO MOTORS

9.11 NIO NEXTEV

9.12 NUMOCITY TECHNOLOGIES

9.13 OCOTILLO POWER SYSTEMS

9.14 OYIKA

9.15 RCI BANK AND SERVICES

9.16 RENAULT GROUP

9.17 SUN MOBILITY

9.18 TESLA

9.19 VOLTUP

9.20 OTHER KEY PLAYERS

Chapter 10: Global Electric Vehicle Battery Trays Market By Region

10.1 Overview

10.2. North America Electric Vehicle Battery Trays Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Material Type

10.2.4.1 Steel

10.2.4.2 Aluminum

10.2.4.3 Composites (CFRP

10.2.4.4 GFRP)

10.2.4.5 Others (hybrid materials

10.2.4.6 advanced polymers)

10.2.5 Historic and Forecasted Market Size By By Vehicle Type

10.2.5.1 Passenger Vehicles

10.2.5.2 Commercial Vehicles (buses

10.2.5.3 delivery vans

10.2.5.4 trucks)

10.2.5.5 Two-Wheelers (electric scooters

10.2.5.6 motorcycles)

10.2.5.7 Off-Highway Vehicles (industrial

10.2.5.8 agricultural

10.2.5.9 construction EVs)

10.2.6 Historic and Forecasted Market Size By By Battery Type

10.2.6.1 Lithium-Ion Batteries

10.2.6.2 Solid-State Batteries

10.2.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.2.6.4 Other Battery Types

10.2.7 Historic and Forecasted Market Size By By Manufacturing Process

10.2.7.1 Stamping

10.2.7.2 Extrusion

10.2.7.3 Casting

10.2.7.4 Injection Molding

10.2.7.5 Additive Manufacturing (3D Printing)

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 OEMs

10.2.8.2 Aftermarket

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Vehicle Battery Trays Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Material Type

10.3.4.1 Steel

10.3.4.2 Aluminum

10.3.4.3 Composites (CFRP

10.3.4.4 GFRP)

10.3.4.5 Others (hybrid materials

10.3.4.6 advanced polymers)

10.3.5 Historic and Forecasted Market Size By By Vehicle Type

10.3.5.1 Passenger Vehicles

10.3.5.2 Commercial Vehicles (buses

10.3.5.3 delivery vans

10.3.5.4 trucks)

10.3.5.5 Two-Wheelers (electric scooters

10.3.5.6 motorcycles)

10.3.5.7 Off-Highway Vehicles (industrial

10.3.5.8 agricultural

10.3.5.9 construction EVs)

10.3.6 Historic and Forecasted Market Size By By Battery Type

10.3.6.1 Lithium-Ion Batteries

10.3.6.2 Solid-State Batteries

10.3.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.3.6.4 Other Battery Types

10.3.7 Historic and Forecasted Market Size By By Manufacturing Process

10.3.7.1 Stamping

10.3.7.2 Extrusion

10.3.7.3 Casting

10.3.7.4 Injection Molding

10.3.7.5 Additive Manufacturing (3D Printing)

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 OEMs

10.3.8.2 Aftermarket

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Vehicle Battery Trays Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Material Type

10.4.4.1 Steel

10.4.4.2 Aluminum

10.4.4.3 Composites (CFRP

10.4.4.4 GFRP)

10.4.4.5 Others (hybrid materials

10.4.4.6 advanced polymers)

10.4.5 Historic and Forecasted Market Size By By Vehicle Type

10.4.5.1 Passenger Vehicles

10.4.5.2 Commercial Vehicles (buses

10.4.5.3 delivery vans

10.4.5.4 trucks)

10.4.5.5 Two-Wheelers (electric scooters

10.4.5.6 motorcycles)

10.4.5.7 Off-Highway Vehicles (industrial

10.4.5.8 agricultural

10.4.5.9 construction EVs)

10.4.6 Historic and Forecasted Market Size By By Battery Type

10.4.6.1 Lithium-Ion Batteries

10.4.6.2 Solid-State Batteries

10.4.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.4.6.4 Other Battery Types

10.4.7 Historic and Forecasted Market Size By By Manufacturing Process

10.4.7.1 Stamping

10.4.7.2 Extrusion

10.4.7.3 Casting

10.4.7.4 Injection Molding

10.4.7.5 Additive Manufacturing (3D Printing)

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 OEMs

10.4.8.2 Aftermarket

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Vehicle Battery Trays Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Material Type

10.5.4.1 Steel

10.5.4.2 Aluminum

10.5.4.3 Composites (CFRP

10.5.4.4 GFRP)

10.5.4.5 Others (hybrid materials

10.5.4.6 advanced polymers)

10.5.5 Historic and Forecasted Market Size By By Vehicle Type

10.5.5.1 Passenger Vehicles

10.5.5.2 Commercial Vehicles (buses

10.5.5.3 delivery vans

10.5.5.4 trucks)

10.5.5.5 Two-Wheelers (electric scooters

10.5.5.6 motorcycles)

10.5.5.7 Off-Highway Vehicles (industrial

10.5.5.8 agricultural

10.5.5.9 construction EVs)

10.5.6 Historic and Forecasted Market Size By By Battery Type

10.5.6.1 Lithium-Ion Batteries

10.5.6.2 Solid-State Batteries

10.5.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.5.6.4 Other Battery Types

10.5.7 Historic and Forecasted Market Size By By Manufacturing Process

10.5.7.1 Stamping

10.5.7.2 Extrusion

10.5.7.3 Casting

10.5.7.4 Injection Molding

10.5.7.5 Additive Manufacturing (3D Printing)

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 OEMs

10.5.8.2 Aftermarket

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Vehicle Battery Trays Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Material Type

10.6.4.1 Steel

10.6.4.2 Aluminum

10.6.4.3 Composites (CFRP

10.6.4.4 GFRP)

10.6.4.5 Others (hybrid materials

10.6.4.6 advanced polymers)

10.6.5 Historic and Forecasted Market Size By By Vehicle Type

10.6.5.1 Passenger Vehicles

10.6.5.2 Commercial Vehicles (buses

10.6.5.3 delivery vans

10.6.5.4 trucks)

10.6.5.5 Two-Wheelers (electric scooters

10.6.5.6 motorcycles)

10.6.5.7 Off-Highway Vehicles (industrial

10.6.5.8 agricultural

10.6.5.9 construction EVs)

10.6.6 Historic and Forecasted Market Size By By Battery Type

10.6.6.1 Lithium-Ion Batteries

10.6.6.2 Solid-State Batteries

10.6.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.6.6.4 Other Battery Types

10.6.7 Historic and Forecasted Market Size By By Manufacturing Process

10.6.7.1 Stamping

10.6.7.2 Extrusion

10.6.7.3 Casting

10.6.7.4 Injection Molding

10.6.7.5 Additive Manufacturing (3D Printing)

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 OEMs

10.6.8.2 Aftermarket

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Vehicle Battery Trays Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Material Type

10.7.4.1 Steel

10.7.4.2 Aluminum

10.7.4.3 Composites (CFRP

10.7.4.4 GFRP)

10.7.4.5 Others (hybrid materials

10.7.4.6 advanced polymers)

10.7.5 Historic and Forecasted Market Size By By Vehicle Type

10.7.5.1 Passenger Vehicles

10.7.5.2 Commercial Vehicles (buses

10.7.5.3 delivery vans

10.7.5.4 trucks)

10.7.5.5 Two-Wheelers (electric scooters

10.7.5.6 motorcycles)

10.7.5.7 Off-Highway Vehicles (industrial

10.7.5.8 agricultural

10.7.5.9 construction EVs)

10.7.6 Historic and Forecasted Market Size By By Battery Type

10.7.6.1 Lithium-Ion Batteries

10.7.6.2 Solid-State Batteries

10.7.6.3 Nickel-Metal Hydride (NiMH) Batteries

10.7.6.4 Other Battery Types

10.7.7 Historic and Forecasted Market Size By By Manufacturing Process

10.7.7.1 Stamping

10.7.7.2 Extrusion

10.7.7.3 Casting

10.7.7.4 Injection Molding

10.7.7.5 Additive Manufacturing (3D Printing)

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 OEMs

10.7.8.2 Aftermarket

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Global Electric Vehicle Battery Trays Market Scope:

|

Global Electric Vehicle Battery Trays Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.85 Bn |

|

Forecast Period 2024-32 CAGR: |

21.6% |

Market Size in 2032: |

USD 16.57 Bn |

|

Segments Covered: |

By Material Type |

|

|

|

By Vehicle Type |

|

||

|

By Battery Type |

|

||

|

By Manufacturing Process |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Vehicle Battery Trays Market research report is 2024-2032.

BENTELER, Constellium, Standard Technologies, ZEISS, Foshan Shijun Hongmao Aluminum Technology Co. Ltd., Gestamp, Waldaschaff Automotive GmbH, Aluminum Extruders Council, Atlas Copco AB, DURA AUTOMOTIVE SYSTEMS, PRATIC CNC Technology Co. Ltd, FSM Group, and Other Major Players.

The Electric Vehicle Battery Trays Market is segmented into Material Type, Application, and Region. By Material Type the market is categorized into Steel Based, Glass Fiber Based, and Aluminum Based. By Application, the market is categorized into 2 & 3-Wheeler, Passenger Cars, and Commercial Vehicles. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

A battery tray is a device used to secure large battery packs. The tray keeps the battery from rolling out of place and damaging nearby objects or even the battery itself. Many have mounting bolts to keep the tray in place, as well as adjustable straps to keep the battery in place.

Electric Vehicle Battery Trays Market Size Was Valued at USD 2.85 Billion in 2023, and is Projected to Reach USD 16.57 Billion by 2032, Growing at a CAGR of 21.6% From 2024-2032.