Electronic Health Records Market Synopsis:

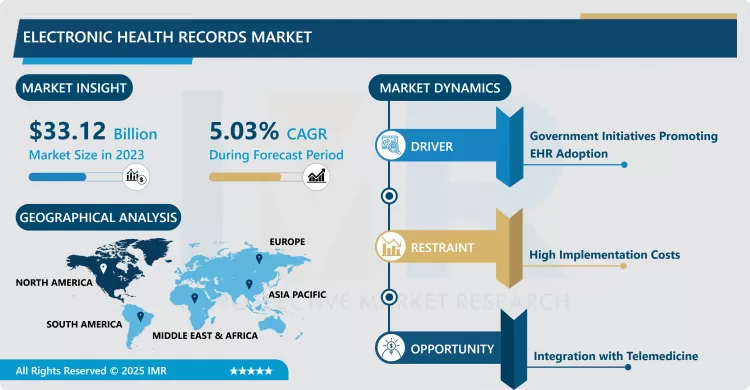

Electronic Health Records Market Size Was Valued at USD 33.12 Billion in 2023, and is Projected to Reach USD 51.51 Billion by 2032, Growing at a CAGR of 5.03% From 2024-2032.

EHR stands for Electronic Health Records and it is up to date electronic data collected and organized in a standardized manner that aids by healthcare providers. EHR systems help to improve the processes of patient treatment by providing healthcare professionals with easy access to patients’ electronic health records, medical history, diseases, treatment and required tests, and results. All these systems were designed and are in use in an organisation with an aim of reducing working time on clinical activity, increasing data quality as well as improving patient satisfaction.

The EHR market has been expanding considerably over the last few years because of the advance use of information technology in the delivery and growth of healthcare services around the world. Due to increased technology applications, many care centers have begun to embrace paperless systems in keeping records in a bid to increase efficiency in patient record retrieval and reduce instances of data errors. This transition has been occasioned by the desire to improve the handling of data, decision-making processes, and communication among the health care givens.

Market drivers that have spurred growth of the EHR systems market include government and regulatory efforts to advance EHR system use in developed countries. The increased adoption of EHR technology is driven by the president’s requests for payment incentives for many health care systems to improve the quality of the health care services offered and also to reduce the level of medical errors. Besides, growth in patient ergonomics, interconnectivity, and coordinated systems is also contributing to EHR uptake among hospitals, clinics, and specialized care centers.

It is also metamorphosing from a simple hub for new capabilities like the integration of telemedicine, cloud storage and artificial intelligence for data analysis among others. The COVID-19 pandemic seriously underlined the value of digital solutions in healthcare; thus, it also boosted the EHR market, as well as the need for remote care and accessing data in real time.

Electronic Health Records Market Trend Analysis:

Cloud-Based EHR Solutions

- There is increased trend towards cloud-based solutions in EHR market The increasing use of cloud-based EHR systems. Unlike in-house services, that can be installed at a provider’s physical business location, cloud-based systems enable storing and accessing of patient data remotely. This trend is picking up due to the fact that it is a scalable solution with relatively low acquisition cost as well as it can easily be integrated with other forms of digital health care delivery systems like telemedicine and mobile health applications.

- Consequently, SaaS implementation is a growing trend because individual practices and small to midsize healthcare organizations, particularly, may use cloud based EHRs without capital investments. Also, cloud solutions have stronger security of data and compliance with the existing legal acts such as HIPAA or GDPR, which makes cloud solutions quite interesting and much-in-demand for the providers that want to optimize their working process and develop the overall treatment quality.

Integration with Telemedicine

- A critical trend in the market is the compatibility of EHR systems with telemedicine systems. Since the use of remote healthcare services continues to increase, especially during and after the COVID 19 pandemic, the interoperability of data between telehealth services and EHR systems is essential. Telemedicine enables patients to be treated without physically visiting a healthcare facility but reversed with EHR connection, patient data could become disintegrated thereby resulting to care gaps.

- • Any healthcare provider who understands how to connect telemedicine with EHR systems is in a position to improve the patient’s satisfaction since all records, tests and treatment plans are available during a teleconsultation. This integration also benefits clinicians by improving diagnostic accuracy and enabling more personalized care management.

Electronic Health Records Market Segment Analysis:

Electronic Health Records Market is Segmented on the basis of Type, Product ,Business Models, End user, and Region

By Type, Acute segment is expected to dominate the market during the forecast period

- Acute: Acute care focused EHR systems are crucial in hospitals where the concept of patient care is majorly based on short term treatment-oriented services. These systems facilitate the communication of information between departments and enables clinician to monitor patient’s progress in real time. Specialised acute care EHRs provide additional functionality related to complex environments of care such as emergency /trauma or intensive care.

- Post-Acute: The post-acute care EHRs targets entities such as nursing homes, rehabilitation hospitals and agencies as well as home care. Some of these systems are designed for examining the post-discharge patient recovery as well as the patients with long-term illnesses. They usually contain the means for, and options for, future management and integrated patient care following hospital admission.

- Ambulatory: These ambulatory EHRs are designed to be applied only in outpatients situations like doctors’ office, clinics, and urgent care.. These systems put much emphasize on the aspects of speed and accessibility, making routine examinations, cases for preliminary examinations and simple operations more streamlined. Discharge EHRs are important in the process of managing the patient visits and ensuring that right health records are recorded.

By End User, Ambulatory Services segment expected to held the largest share

- Hospitals: The healthcare facilities are the biggest consumers of EHR systems with centralized interfaces that solve numerous issues, such as hospital administrative operations, patient care, and diagnoses, surgeries. EHR systems assist hospitals to integrate treatment plans to all the departments, minimize mistake, and conform to health standards.

- Clinics: EHR systems used by clinics such as general practitioner and specialists use EHR systems for patient data management. These features integrate appointment scheduling, billing, and even follow up of patients making it a useful tool to outpatient services. Ambulatory Services: Outpatient surgical facilities and urgent care centers are some of the ambulatory care settings that deploy EHR systems to give authorized users get-time data on patients. EHRs interdisciplinary and support decision and improve operational flow in an acute, variable environment.

- Specialty Centers: The EHR systems help hospitals and specialty centers in particular to keep track of complex patient records that cannot be treated with general procedures. Centers themselves provide an individual approach to selection of EHR systems that can address definite medical issues, providing more accurate care. Others: Other end users include nursing homes, rehabilitation centers and mental health institutions. These providers use EHR systems with the ability to monitor patients’ progress over long periods increases the efficiency of providing care.

Electronic Health Records Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the leading market, due to the existence of sophisticated healthcare systems coupled with governmental support encouraging the use of EHR. The US is already dominant in this region because it spends a lot on health IT and offers strong regulatory backing, such as the HITECH Act that encourages episodic implementation of certified EHRs.

- Moreover, existence of major EHR vendors especially in North America have also immensely boosted this bracket as well. These vendors provide solutions for essentially all types and sizes of healthcare organizations from large academic medical centers down to individual specialty practices. Currently, the emphasis on the generally enhanced quality of healthcare, reduction of medical errors with the help of technology has established the region as the leader in the global EHR market.

Active Key Players in the Electronic Health Records Market

- Cerner Corporation (USA)

- Epic Systems Corporation (USA)

- Allscripts Healthcare Solutions (USA)

- McKesson Corporation (USA)

- Meditech (USA)

- GE Healthcare (USA)

- eClinicalWorks (USA)

- Greenway Health (USA)

- NextGen Healthcare (USA)

- Athenahealth (USA)

- CPSI (USA)

- AdvancedMD (USA)

- Other Active Players

Key Industry Developments in the Electronic Health Records Market:

- In July 2023, NextGen Healthcare announced the expansion of its collaboration with the American Podiatric Medical Association (APMA). As per this collaboration, the ‘NextGen Office’ cloud-based small practice EHR and practice management solution is the sole platform to incorporate blueprints exclusively developed with APMA. These podiatry blueprints address several issues, including diabetes, dermatitis, infection, and injuries.

- In June 2023, CPSI and the MidCoast Health System expanded their four-year partnership, through the implementation of CPSI’s EHR, accounts receivables services, and IT-managed services at the ‘Crockett Medical Center’ critical access hospital in Texas. Other MidCoast Health System hospitals to successfully implement CPSI healthcare solutions in recent years include the El Campo Memorial Hospital and the Palacios Community Medical Center, among others.

- In May 2023, MEDITECH announced an agreement with Canada Health Infoway to connect with the latter’s e-prescribing service ‘PrescribeIT’. This agreement would allow prescribers in Canada to electronically transmit a prescription directly from MEDITECH’s Expanse EHR to the patient’s preferred choice of pharmacy. The functionality would allow ease of creation of new prescriptions, allow existing prescription renewal, and also cancel prescription requests.

- In April 2023, Microsoft announced an expansion of its strategic partnership with Epic for the development and integration of generative AI into healthcare, through the combination of Epic’s advanced electronic health record software and the scale of Microsoft’s Azure OpenAI Service. The resulting generative AI solutions would help enhance patient care, increase productivity, and improve the financial integrity of health systems worldwide.

- In February 2023, King’s College Hospital London - Dubai announced a strategic partnership with Oracle Cerner to accelerate innovation, through the utilization of Oracle Cloud Infrastructure (OCI) services via the Oracle Cloud Dubai Region for operating and managing the upgraded and enhanced electronic medical records system for KCH Dubai.

- In February 2023, Oracle Cerner announced that the province of Nova Scotia, in partnership with Nova Scotia Health Authority (NSHA) and IWK Health (IWK), had signed a 10-year agreement for implementing an integrated electronic care record in the entire province. Known in Nova Scotia as “One Person One Record”, it is intended to provide clinicians easier access to real-time health information and allow healthcare workers to spend more time with their patients.

- In January 2023, Veradigm (formerly Allscripts) announced that the Veradigm Network EHR Data would be available within the OMOP CDM format. Veradigm Network EHR is a complete statistically de-identified dataset with three integrated EHR sources. This transformation is expected to facilitate data sales for clients who require it to be delivered in OMOP format.

- In January 2022, Health Information Management Systems launched AxiaGram, a mobile communication care app, which can seamlessly work with an existing EHR platform. The company expanded its product portfolio with this.

- In May 2022, CPSI entered into a partnership agreement with Medicomp Systems to launch Quippe Clinical Lens. The new technology aims to empower EHR users with proper access to clinical information at PoC.

|

Electronic Health Records Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.12 Billion |

|

Forecast Period 2024-32 CAGR: |

5.03% |

Market Size in 2032: |

USD 51.51 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Business Models |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Health Records Market by By Type (2018-2032)

4.1 Electronic Health Records Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Acute

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Post-Acute

4.5 Ambulatory

Chapter 5: Electronic Health Records Market by By Product (2018-2032)

5.1 Electronic Health Records Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Web Server Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Client Server Based

Chapter 6: Electronic Health Records Market by By Business Models (2018-2032)

6.1 Electronic Health Records Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Licensed Software

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Technology Resale

6.5 Subscriptions

6.6 Professional Services

6.7 Others

Chapter 7: Electronic Health Records Market by By End User (2018-2032)

7.1 Electronic Health Records Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinics

7.5 Ambulatory Services

7.6 Specialty Centers

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electronic Health Records Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CERNER CORPORATION (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EPIC SYSTEMS CORPORATION (USA)

8.4 ALLSCRIPTS HEALTHCARE SOLUTIONS (USA)

8.5 MCKESSON CORPORATION (USA)

8.6 MEDITECH (USA)

8.7 GE HEALTHCARE (USA)

8.8 ECLINICALWORKS (USA)

8.9 GREENWAY HEALTH (USA)

8.10 NEXTGEN HEALTHCARE (USA)

8.11 ATHENAHEALTH (USA)

8.12 CPSI (USA)

8.13 ADVANCEDMD (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Electronic Health Records Market By Region

9.1 Overview

9.2. North America Electronic Health Records Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Acute

9.2.4.2 Post-Acute

9.2.4.3 Ambulatory

9.2.5 Historic and Forecasted Market Size By By Product

9.2.5.1 Web Server Based

9.2.5.2 Client Server Based

9.2.6 Historic and Forecasted Market Size By By Business Models

9.2.6.1 Licensed Software

9.2.6.2 Technology Resale

9.2.6.3 Subscriptions

9.2.6.4 Professional Services

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Hospitals

9.2.7.2 Clinics

9.2.7.3 Ambulatory Services

9.2.7.4 Specialty Centers

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electronic Health Records Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Acute

9.3.4.2 Post-Acute

9.3.4.3 Ambulatory

9.3.5 Historic and Forecasted Market Size By By Product

9.3.5.1 Web Server Based

9.3.5.2 Client Server Based

9.3.6 Historic and Forecasted Market Size By By Business Models

9.3.6.1 Licensed Software

9.3.6.2 Technology Resale

9.3.6.3 Subscriptions

9.3.6.4 Professional Services

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Hospitals

9.3.7.2 Clinics

9.3.7.3 Ambulatory Services

9.3.7.4 Specialty Centers

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electronic Health Records Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Acute

9.4.4.2 Post-Acute

9.4.4.3 Ambulatory

9.4.5 Historic and Forecasted Market Size By By Product

9.4.5.1 Web Server Based

9.4.5.2 Client Server Based

9.4.6 Historic and Forecasted Market Size By By Business Models

9.4.6.1 Licensed Software

9.4.6.2 Technology Resale

9.4.6.3 Subscriptions

9.4.6.4 Professional Services

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Hospitals

9.4.7.2 Clinics

9.4.7.3 Ambulatory Services

9.4.7.4 Specialty Centers

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electronic Health Records Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Acute

9.5.4.2 Post-Acute

9.5.4.3 Ambulatory

9.5.5 Historic and Forecasted Market Size By By Product

9.5.5.1 Web Server Based

9.5.5.2 Client Server Based

9.5.6 Historic and Forecasted Market Size By By Business Models

9.5.6.1 Licensed Software

9.5.6.2 Technology Resale

9.5.6.3 Subscriptions

9.5.6.4 Professional Services

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Hospitals

9.5.7.2 Clinics

9.5.7.3 Ambulatory Services

9.5.7.4 Specialty Centers

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electronic Health Records Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Acute

9.6.4.2 Post-Acute

9.6.4.3 Ambulatory

9.6.5 Historic and Forecasted Market Size By By Product

9.6.5.1 Web Server Based

9.6.5.2 Client Server Based

9.6.6 Historic and Forecasted Market Size By By Business Models

9.6.6.1 Licensed Software

9.6.6.2 Technology Resale

9.6.6.3 Subscriptions

9.6.6.4 Professional Services

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Hospitals

9.6.7.2 Clinics

9.6.7.3 Ambulatory Services

9.6.7.4 Specialty Centers

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electronic Health Records Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Acute

9.7.4.2 Post-Acute

9.7.4.3 Ambulatory

9.7.5 Historic and Forecasted Market Size By By Product

9.7.5.1 Web Server Based

9.7.5.2 Client Server Based

9.7.6 Historic and Forecasted Market Size By By Business Models

9.7.6.1 Licensed Software

9.7.6.2 Technology Resale

9.7.6.3 Subscriptions

9.7.6.4 Professional Services

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Hospitals

9.7.7.2 Clinics

9.7.7.3 Ambulatory Services

9.7.7.4 Specialty Centers

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Electronic Health Records Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.12 Billion |

|

Forecast Period 2024-32 CAGR: |

5.03% |

Market Size in 2032: |

USD 51.51 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Business Models |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electronic Health Records Market research report is 2024-2032.

Cerner Corporation (USA), Epic Systems Corporation (USA), Allscripts Healthcare Solutions (USA), McKesson Corporation (USA), Meditech (USA), GE Healthcare (USA), eClinicalWorks (USA), Greenway Health (USA), NextGen Healthcare (USA), Athenahealth (USA), CPSI (USA), AdvancedMD (USA), Other Active Players.

The Electronic Health Records Market is segmented into Type, product, Business Models , End User and region. By Type, the market is categorized into Acute, Post-Acute, Ambulatory. By Product, the market is categorized into Web Server Based, Client Server Based. By Business Models, the market is categorized into Licensed Software, Technology Resale, Subscriptions, Professional Services, Others. By End User, the market is categorized into Hospitals, Clinics, Ambulatory Services, Specialty Centers, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

EHR stands for Electronic Health Records and it is up to date electronic data collected and organized in a standardized manner that aids by healthcare providers. EHR systems help to improve the processes of patient treatment by providing healthcare professionals with easy access to patients’ electronic health records, medical history, diseases, treatment and required tests, and results. All these systems were designed and are in use in an organisation with an aim of reducing working time on clinical activity, increasing data quality as well as improving patient satisfaction

Electronic Health Records Market Size Was Valued at USD 33.12 Billion in 2023, and is Projected to Reach USD 51.51 Billion by 2032, Growing at a CAGR of 5.03% From 2024-2032.