Emergency Medical Services (EMS) Billing Software Market Synopsis:

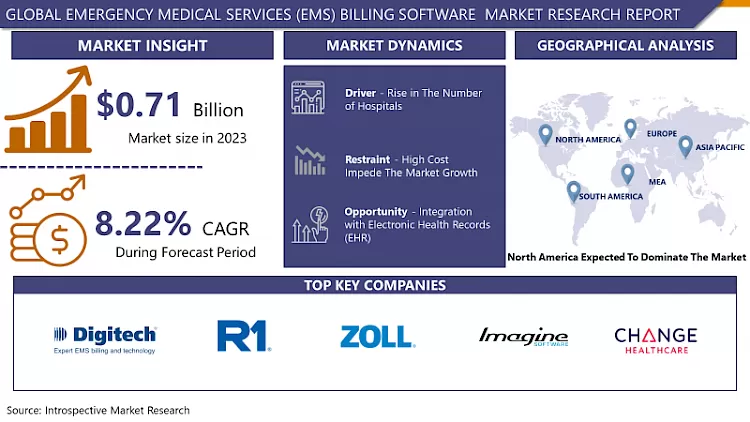

Emergency Medical Services (EMS) Billing Software Market Size Was Valued at USD 0.71 Billion in 2023 and is Projected to Reach USD 1.45 Billion by 2032, Growing at a CAGR of 8.22% From 2024-2032.

Emergency Medical Services (EMS) billing software is a specialized digital solution that is specifically engineered to optimize and mechanize the invoicing procedure for providers of ambulance and emergency medical services. It enables the streamlined administration of patient data, insurance assertions, billing, and reimbursement monitoring. EMS billing software commonly establishes integrations with electronic health records (EHR) systems to guarantee precise documentation and classification, thereby enhancing billing precision and adherence to regulatory obligations. By optimizing operational processes, streamlining administrative duties, and expediting revenue cycle management, this software ultimately enhances the financial performance and patient care delivery of EMS agencies.

- A growing trend among consumers is the preference for customized and personalized goods and services. Organizations are employing AI and data analytics to tailor their products and services to the particular preferences and needs of their clientele.

- With organizations adopting digital platforms for marketing, sales, and customer interaction, the Emergency Medical Services Billing Software industry is enduring a digital revolution. Platforms for electronic commerce are gaining importance as channels for communicating with customers.

- The purpose of emergency medical services billing software is to expedite the payment of claims and eradicate billing errors. Several configurable criteria are applied to each claim that enters the system in order to validate it for errors; only valid claims are forwarded to payers or the clearing house. The service is user-friendly and adaptable, with a low error rate, which facilitates the completion of the workflow with outstanding support and saves a substantial quantity of time and man-hours. During the period of forecast, the market for emergency medical services billing software is anticipated to expand at a quicker rate. As a result of the proliferation of digital technologies and individuals' chaotic lifestyles, hospitals are experiencing a surge in demand for user-friendly and compatible software that effectively manages patient records and settles invoices. As a result, the market for emergency medical services billing software expands further.

Emergency Medical Services (EMS) Billing Software Market Trend Analysis

Growing need for streamlined and effective invoicing procedures

- A significant driver is the growing need for streamlined and effective invoicing procedures in the healthcare industry. Healthcare facilities and emergency medical services (EMS) providers are perpetually seeking methods to optimize their revenue cycle management. To address this, specialized invoicing software solutions are developed.

- Furthermore, the proliferation of electronic health records (EHRs) and the shift towards digital healthcare infrastructure have fostered a conducive setting for EMS billing software. This is due to the seamless integration of EMS billing software with these systems, which effectively mitigates errors and enhances the precision of billing.

Rising number of Emergency Department

- Emergence of independent freestanding emergency departments (EDs) and an increase in ED visits are anticipated to fuel the expansion of the emergency medical services (EMS) billing services market.

- The expansion is supported by developments in invoicing software technology, which increase the visibility, velocity, and effectiveness of processes, thereby generating more revenue. Furthermore, the increasing frequency of visits to emergency rooms (ERs) and the proliferation of autonomous ER facilities are driving the need for streamlined payment source management and accurate reimbursement procedures.

Emergency Medical Services (EMS) Billing Software Market Segment Analysis:

Emergency Medical Services (EMS) Billing Software Market is Segmented based on type, and application.

By Type, Land Ambulance Services segment is expected to dominate the market during the forecast period

- Land Ambulance Services, Classified The primary objective of this specialized software is to streamline the invoicing and revenue cycle management procedures in the land-based ambulance service industry. By optimizing the documentation, coding, and invoicing processes that are specific to ground-based emergency medical services (EMS), this system guarantees precision, adherence to healthcare regulations, and effective reimbursement. As a result, ambulance services and healthcare facilities experience improved financial performance.

By Application, hospital segment held the largest share in 2023

- Hospitals utilize applications as an essential instrument to optimize revenue cycle management. By utilizing this software, healthcare facilities can effectively process and oversee the invoicing process for emergency medical services rendered on-site. By optimizing the billing process, ensuring precise classification and adherence to healthcare regulations, and mitigating billing errors and delays, it improves financial performance.

Emergency Medical Services (EMS) Billing Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Emergence of novel technologies and developments and digitization within the healthcare sector are significant market drivers in North America. In the United States, for instance, the transition towards a healthcare sector that is heavily reliant on data has instigated the implementation of novel approaches aimed at promoting the progress of advanced healthcare. Moreover, increased healthcare expenditures and hospital admissions in North America, along with proactive government initiatives designed to facilitate the efficient maintenance of digital health records, are driving the upward trend in software solution demand. Over the course of recent years, medical billing errors have been observed in healthcare facilities throughout the region. Error reduction has therefore contributed to the expansion of EMS billing software.

- Additionally, the expansion of the market has been facilitated by strategic endeavors executed by major participants, including product developments, approvals, mergers, partnerships, and joint ventures. To illustrate, the partnership agreement between R1 RCM Inc. and American Physician Partners (APP) for revenue cycle management (RCM) with R1 was extended until 2031 in October 2021. APP has established itself as an industry leader in intensive care administration, emergency medicine, and hospital medicine through its extensive network of over 150 hospital and system partnerships. Furthermore, Trapeze engaged in a collaborative effort with the Council of Ambulance Authority (CAA) in July 2021. At the Council of Ambulance Authorities (CAA) Virtual Expo, Trapeze Group and the CAA co-facilitated their annual knowledge collaboration initiative, a "ideas board" where the industry gathered to share their experience and expertise on a pressing topic within the ambulance sector.

- Consequently, the market is anticipated to expand as a result of the increased demand for EMS invoicing software, which is propelled by the aforementioned factors.

Active Key Players in the Emergency Medical Services (EMS) Billing Software Market

- Digitech Computer, Inc (US)

- R1 RCM, Inc (US)

- Zoll Medical Corporation (US)

- ImagineSoftware (US)

- Change Healthcare (US)

- AIM (US)

- ESO (Germany)

- MP Cloud Technologies (Austin)

- Traumasoft (US)

- Medapoint (US)

- Other Key Players

Key Industry Developments in the Emergency Medical Services (EMS) Billing Software Market:

- EmsCharts and HealthCall established a significant collaboration in September 2023, signifying a turning point in the healthcare technology industry. This collaborative effort provides EMS agencies with the ability to seamlessly incorporate telehealth functionalities directly into the EmsCharts platform.

- A strategic move was executed by ESO Solutions in August 2023 through the merger with another reputable provider of EMS software. This momentous consolidation unites two frontrunners in the industry, creating a dynamic and formidable entity within the EMS sector. The outcome is anticipated to be an exceptionally all-encompassing collection of solutions that are precisely designed to function for EMS agencies.

|

Global Emergency Medical Services (EMS) Billing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.71 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.22% |

Market Size in 2032: |

USD 1.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Emergency Medical Services (EMS) Billing Software Market by By Type (2018-2032)

4.1 Emergency Medical Services (EMS) Billing Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Land Ambulance Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Air Ambulance Services

4.5 Water Ambulance Services

Chapter 5: Emergency Medical Services (EMS) Billing Software Market by By Application (2018-2032)

5.1 Emergency Medical Services (EMS) Billing Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Enterprise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hospitals

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Emergency Medical Services (EMS) Billing Software Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADP (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BAMBOOHR (USA)

6.4 BULLHORN (USA)

6.5 CORNERSTONE ONDEMAND (USA)

6.6 GREENHOUSE SOFTWARE (USA)

6.7 IBM (USA)

6.8 ICIMS (USA)

6.9 JAZZHR (USA)

6.10 JOBVITE (USA)

6.11 ORACLE (USA)

6.12 PAYCOR (USA)

6.13 PEOPLEFLUENT (USA)

6.14 RACARIE SOFTWARE (CANADA)

6.15 RECRUITERBOX (USA)

6.16 SAP (GERMANY)

6.17 SILKROAD TECHNOLOGY (USA)

6.18 ULTIMATE SOFTWARE (USA)

6.19 ZOHO CORP. (INDIA)

6.20 OTHER KEY PLAYERS

Chapter 7: Global Emergency Medical Services (EMS) Billing Software Market By Region

7.1 Overview

7.2. North America Emergency Medical Services (EMS) Billing Software Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Land Ambulance Services

7.2.4.2 Air Ambulance Services

7.2.4.3 Water Ambulance Services

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Enterprise

7.2.5.2 Hospitals

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Emergency Medical Services (EMS) Billing Software Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Land Ambulance Services

7.3.4.2 Air Ambulance Services

7.3.4.3 Water Ambulance Services

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Enterprise

7.3.5.2 Hospitals

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Emergency Medical Services (EMS) Billing Software Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Land Ambulance Services

7.4.4.2 Air Ambulance Services

7.4.4.3 Water Ambulance Services

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Enterprise

7.4.5.2 Hospitals

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Emergency Medical Services (EMS) Billing Software Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Land Ambulance Services

7.5.4.2 Air Ambulance Services

7.5.4.3 Water Ambulance Services

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Enterprise

7.5.5.2 Hospitals

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Emergency Medical Services (EMS) Billing Software Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Land Ambulance Services

7.6.4.2 Air Ambulance Services

7.6.4.3 Water Ambulance Services

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Enterprise

7.6.5.2 Hospitals

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Emergency Medical Services (EMS) Billing Software Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Land Ambulance Services

7.7.4.2 Air Ambulance Services

7.7.4.3 Water Ambulance Services

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Enterprise

7.7.5.2 Hospitals

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Emergency Medical Services (EMS) Billing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.71 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.22% |

Market Size in 2032: |

USD 1.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Emergency Medical Services (EMS) Billing Software Market research report is 2024-2032.

Digitech Computer, Inc, R1 RCM, Inc, Zoll Medical Corporation, ImagineSoftware, Change Healthcare, AIM, ESO, MP Cloud Technologies, HealthCall, Traumasoft, Medapoint, and Other Major Players.

The Emergency Medical Services (EMS) Billing Software Market is segmented into type, application, and region. By type, the market is categorized into land ambulance services, air ambulance services, and water ambulance services. By application, the market is categorized into enterprise and hospitals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

EMS billing software is a digital instrument designed to expedite and automate the billing process for ambulance and emergency medical services providers. It facilitates the effective administration of patient information, insurance assertions, billing, and reimbursement monitoring. By being seamlessly integrated with electronic health records (EHR), it guarantees precise documentation, categorization, and adherence to regulatory requirements. For EMS agencies, this software optimizes revenue cycle management, reduces administrative burdens, and increases operational efficiency.

Emergency Medical Services (EMS) Billing Software Market Size Was Valued at USD 0.71 Billion in 2023 and is Projected to Reach USD 1.45 Billion by 2032, Growing at a CAGR of 8.22% From 2024-2032.