Epinephrine Autoinjector Market Synopsis:

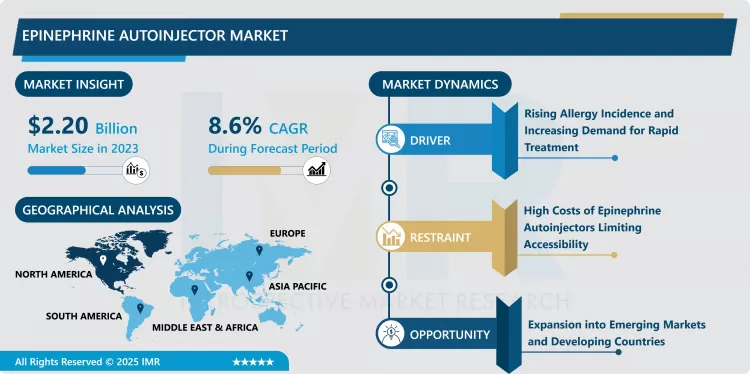

Epinephrine Autoinjector Market Size Was Valued at USD 2.20 Billion in 2023, and is Projected to Reach USD 4.62 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

Epinephrine autoinjector is a portable instrument that is developed to be used by the patient to administer epinephrine to the body to counter acute allergic reactions such as anaphylaxis. It is an auto-injector that provides a previously calculated correct amount of epinephrine responsible for neutralizing severe allergies caused by foods, insect bites or sting, certain medication or any other allergens. Epinephrine autoinjectors are literally lifesaving because the epinephrine promptly alleviates signs and symptoms such as airway constriction, respiratory distress, and hypotension. Autoinjectors are easy to carry, convenient to use and respond immediately during emergencies; therefore, suitable for people prone to anaphylaxis.

Food allergy being more common than other allergies is one of the key factors that promote the market growth of epinephrine autoinjectors. As the incidents of anaphylactic reactions continue to increase worldwide, especially among the youths, there is a increasing demand for efficient emergent management techniques. Increased awareness in autonomic epinephrine autoinjector from health care facilities and government organizations has also added to the need to ensure there is stock of the autoinjectors in schools, working places and other public area. In addition, lifestyle factors including exposure to new allergens and increased rate of urbanization has contributed to increased incidences of allergy and hence the need for these devices.

Another reason includes the recent spurt in compliance requirements and recommendations for epinephrine autoinjectors in publicly accessible areas. In number of countries, schools and other institutions are obliged to have spare stocks of these devices to provide protection of dangerous persons. In addition, new innovations in the auto injector technology including safe guard mechanisms and portability and friendly features of the product has seen many people accept the product hence boosting the market forward.

Epinephrine Autoinjector Market Trend Analysis:

Shift towards generic alternatives.

- Another trend that is already observable in the context of the epinephrine autoinjector is the increase of the offer of generic substitutes. Since the patents on branded epinephrine autoinjectors are expiring, several pharmaceutical firms are bringing out their copy products into the market. These options are cheaper for patients and days to pay compared to the prevalent high prices that have limited the market access in the past. The entry of generics is also increasing competition and innovation on the features of the device to the advantage of end users.

- Another trend on the rise is concerning the expanding training and awareness initiatives related to the right utilization of autoinjectors containing epinephrine. Most healthcare institutions, schools, and advocacy organizations are trying to help patients and caregivers understand when and how these devices can be employed. Visibility is equipped and aids in the smooth functioning of autoinjectors during emergencies, minimizing the hesitations or mistakes that are normally encountered as far as these devices are concerned, thus increasing general safety.

Expanding access to epinephrine autoinjectors in developing regions.

- Of them, one of the potential developments may be related to increasing the availability of epinephrine autoinjectors in developing countries. The developed countries such North America and Europe that have standardized health care structures and procedures for handling people with severe allergies may provide an easy market for these devices, there is still a large market in the developing world for this product because many people do not have access to such devices. This gap can be exploited by existing firms by providing more products and making them available at cheaper prices as well as entering into partnership with local governments or health care facilities to educate the society on the need to seek check-up.

- Another important opportunity identified is a technological advancement. Since the emergence of telemedicine and other forms of digital medicine, it might be possible to connect epinephrine autoinjectors to CHW systems. For example, future models of autoinjectors could have dose metering and Bluetooth capability to alert next of kin or doctors when an autoinjector has been used, and hence hasten follow-up care. This innovation could revolutionaries how allergic reactions are managed which in turn improves the patient’s status.

Epinephrine Autoinjector Market Segment Analysis:

Epinephrine Autoinjector Market is Segmented on the basis of Dosage, Age Group, end user, and region

By Dosage, 0.15 mg segment is expected to dominate the market during the forecast period

- The epinephrine autoinjector market by dosage-main areas of the market are divided into 0.15 mg, 0.30 mg and others. The 0.15 mg dosing is used in children or people with lower body weight, mostly between 15 and 30 kilograms due to the smaller epinephrine dose required to reverse an allergic reaction. The dosage of 0.30 mg should be for big people, for adult and those who weigh more than 30 kg as this concentration will be required to afford significantly faster relief during anaphylaxis. Other dosages may also include some components for people with special requirements for the treatment, but they are used very seldom compared to the standard dosages.

By Age Group, Pediatric segment expected to held the largest share

- Concerning typology, the market is divided into the pediatric and adult epinephrine autoinjector market. Child-specific epinephrine autoinjectors are widely available and small-dose, frequently containing 0.15 mg of active substance, as this dosage eliminates risks associated with anaphylaxis in children. These devices are invaluable for children who have anaphylactic risks as a result of food allergies, bees’ stings or any allergens. Finally, adult autoinjectors typically have a stronger concentration of 0.30 mg and are intended for those patients whose weight exceeds 30 kgs. People of adults are also at risk from similar allergens and these autoinjectors are critical lifesaving tools when treating severe allergies.

Epinephrine Autoinjector Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Today, North America is the biggest market for epinephrine autoinjectors due in particular to a high incidence of allergies and the availability of advanced healthcare services in the US and Canada. The U.S. market also has millions of people vulnerable to anaphylactic reactions caused by food, insect stings and medications which in turns calls for autoinjectors. The region has also one of the most stringent regulatory which requires the facial epinephrine autoinjectors to be provided in places like schools, and this has also made the region to lead in this market.

- Further, North America is relatively sensitized on the management of allergy and treatment of anaphylaxis due to persistent health education campaigns by healthcare organizations and anaphylaxis support groups. This area is also including key stakeholders of epinephrine autoinjector market for research, development and availability. Due to numerous large pharmaceutical companies and well-equipped health care centers, all modern autoinjector technologies are used in North America.

Active Key Players in the Epinephrine Autoinjector Market:

- Mylan N.V. (Netherlands)

- Teva Pharmaceuticals (Israel)

- Sanofi S.A. (France)

- Pfizer Inc. (United States)

- ALK-Abelló A/S (Denmark)

- Adamis Pharmaceuticals Corporation (United States)

- Kaléo, Inc. (United States)

- Antares Pharma (United States)

- Becton, Dickinson and Company (United States)

- Amneal Pharmaceuticals, Inc. (United States)

- Other Active Players

|

Global Epinephrine Autoinjector Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.20 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 4.62 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Age Group |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Epinephrine Autoinjector Market by By Dosage (2018-2032)

4.1 Epinephrine Autoinjector Market Snapshot and Growth Engine

4.2 Market Overview

4.3 0.15 mg

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 0.30 mg

4.5 Others

Chapter 5: Epinephrine Autoinjector Market by By Age Group (2018-2032)

5.1 Epinephrine Autoinjector Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pediatric

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adult

Chapter 6: Epinephrine Autoinjector Market by By End User (2018-2032)

6.1 Epinephrine Autoinjector Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare Settings

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Epinephrine Autoinjector Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MYLAN N.V. (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TEVA PHARMACEUTICALS (ISRAEL)

7.4 SANOFI S.A. (FRANCE)

7.5 PFIZER INC. (UNITED STATES)

7.6 ALK-ABELLÓ A/S (DENMARK)

7.7 ADAMIS PHARMACEUTICALS CORPORATION (UNITED STATES)

7.8 KALÉO INC. (UNITED STATES)

7.9 ANTARES PHARMA (UNITED STATES)

7.10 BECTON

7.11 DICKINSON AND COMPANY (UNITED STATES)

7.12 AMNEAL PHARMACEUTICALS INC. (UNITED STATES)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Epinephrine Autoinjector Market By Region

8.1 Overview

8.2. North America Epinephrine Autoinjector Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Dosage

8.2.4.1 0.15 mg

8.2.4.2 0.30 mg

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size By By Age Group

8.2.5.1 Pediatric

8.2.5.2 Adult

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Homecare Settings

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Epinephrine Autoinjector Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Dosage

8.3.4.1 0.15 mg

8.3.4.2 0.30 mg

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size By By Age Group

8.3.5.1 Pediatric

8.3.5.2 Adult

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Homecare Settings

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Epinephrine Autoinjector Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Dosage

8.4.4.1 0.15 mg

8.4.4.2 0.30 mg

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size By By Age Group

8.4.5.1 Pediatric

8.4.5.2 Adult

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Homecare Settings

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Epinephrine Autoinjector Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Dosage

8.5.4.1 0.15 mg

8.5.4.2 0.30 mg

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size By By Age Group

8.5.5.1 Pediatric

8.5.5.2 Adult

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Homecare Settings

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Epinephrine Autoinjector Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Dosage

8.6.4.1 0.15 mg

8.6.4.2 0.30 mg

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size By By Age Group

8.6.5.1 Pediatric

8.6.5.2 Adult

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Homecare Settings

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Epinephrine Autoinjector Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Dosage

8.7.4.1 0.15 mg

8.7.4.2 0.30 mg

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size By By Age Group

8.7.5.1 Pediatric

8.7.5.2 Adult

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Homecare Settings

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Epinephrine Autoinjector Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.20 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 4.62 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Age Group |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Epinephrine Autoinjector Market research report is 2024-2032.

Mylan N.V. (Netherlands), Teva Pharmaceuticals (Israel), Sanofi S.A. (France), Pfizer Inc. (United States), ALK-Abelló A/S (Denmark), Adamis Pharmaceuticals Corporation (United States), Kaléo, Inc. (United States), Antares Pharma (United States), Becton, Dickinson and Company (United States), Amneal Pharmaceuticals, Inc. (United States), and Other Active Players.

The Epinephrine Autoinjector Market is segmented into by Dosage (0.15 mg, 0.30 mg, Others), by Age Group (Pediatric, Adult), End User (Hospitals & Clinics, Homecare Settings, Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Epinephrine autoinjector is a portable instrument that is developed to be used by the patient to administer epinephrine to the body to counter acute allergic reactions such as anaphylaxis. It is an auto-injector that provides a previously calculated correct amount of epinephrine responsible for neutralizing severe allergies caused by foods, insect bites or sting, certain medication or any other allergens. Epinephrine autoinjectors are literally lifesaving because the epinephrine promptly alleviates signs and symptoms such as airway constriction, respiratory distress, and hypotension. Autoinjectors are easy to carry, convenient to use and respond immediately during emergencies; therefore, suitable for people prone to anaphylaxis.

Epinephrine Autoinjector Market Size Was Valued at USD 2.20 Billion in 2023, and is Projected to Reach USD 4.62 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.