Etching Resist Ink Market Synopsis

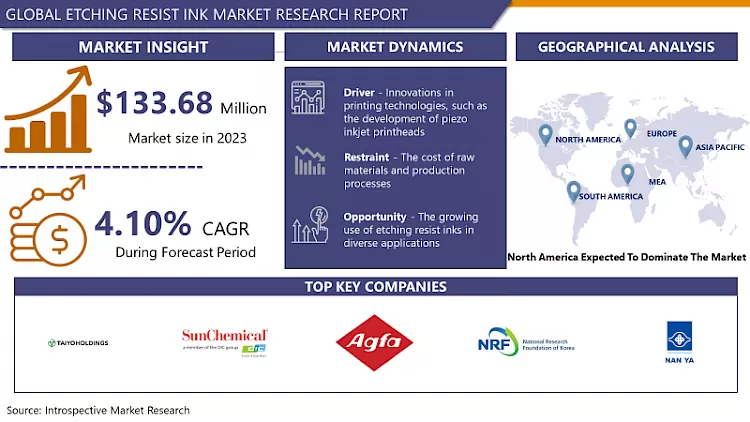

Etching Resist Ink Market Size Was Valued at USD 133.68 Million in 2023, and is Projected to Reach USD 191.92 Million by 2032, Growing at a CAGR of 4.10% From 2024-2032.

Unlike ordinary paint, stencil ink is technical, an etching fluid for the fabrication of the integrated circuit and structural appliances. The plating is etched within a substrate plate, ei. a copper-clad board, while the by-products of acid spray are been washed out by the machine itself. The process preserves the short period of the selective etching producing a “print” on the substrate with discrete circuits. Resist ink for etching processes are all designed to remain corrosion resistant even after the exposure to the chemicals used in etching processes. While the zones left unprotected will be etched, the resist ink will protect the zones to remain the same.

- The wide usage of special inks is more connected with the high-end electronic automotive, aerospace and electronics companies, just among others.

- This technology is most contrived based on these etching resist inks, and PCBs play an outstanding role to organize device electronic functioning.

- Electronics in vehicles are increasingly becoming the norm and will remain an important market for etching inks, hence an indication of active demand for the same.

- Also, ICs or chips are being made the size that is smaller and smaller which is why PCBs are trending to be more compact and their patterns well organized with smaller precise dimensions.

- Etch resist inks are among the monitored entities in any PCB process as they stop the circuit traces with be conductive at the same time enable the areas that are unwanted to eliminate themselves.

- In addition to the upcoming growth, which we foresaw a higher supply of etching-resist ink that are high stable and exhibits the following special properties of excellent adhesion, superb resolution and outstanding chemical affinity.

- On top of this, the spot light that falls on ecological sustainability is a base point that is igniting the greening of etching resist inks which is at the same accelerating their rate.

- As specified by the governmental RoHS directive (the Restriction of Hazardous Substances), the producers applied environmental laws that produce the inks without dangerous substances like lead and cadmium.

- The growing penetration of the being rather than a conventional printer market for ink manufacturers certainly will be an advantage.

Etching Resist Ink Market Trend Analysis

The Rise of Etching Resist Inks, Factors Driving Market Expansion

- Contrarily to the popular saying, the Etching Resist Ink industry mainly goes through an important expansion by virtue of several important contributing factors. An important element is that the need for electronic devices has become an overhead of producing PCBs thus, the electronics industry.

- The pigments containing resits are cast directly onto copper panels being the final stage for Print Circuit Boards through the creation of circuit patterns that later involve placement of devices as well as semiconductors to ensure quality and durability.

- Further, the major factor which leads to the increase in the customer base of etching resists printed inks that industries such as aerospace, automotive, and medical devices are utilizing these inking inks. What make the difference between these form of inks and the other methods is convertibility into a hard, durable and sturdy surface capable of resisting immensely toughest of climatic conditions. Therefore, these inks will last for a long time after they are not applied.

- Additionally, the company foresees the technological development of printing inks such as the formulation of both degradable and high-performing inks that lead to market development.

- For satisfying the fast-paced customers corporations based on technology are considering the enhanced chemical resistance and adhesion of intaglio ink (ink for printing that accepts a deep impression when the design will be transferred onto it) as well as resolution capacity as critical factors of the markers for lithography.

- Afterwards, the digital printing industry has been the most booming area because it has adapted a new technology that is a revolutionary approach which has contributed to the production process acceleration that enables companies to save the paper, water, chemicals and soil. Moreover, it eliminates waste, and increases design flexibility. It is apparent as a notable breakthrough that the digital etching ink resists technologies are one of those important ways whose emergence is the result of this transition chain particularly in the case of signs and vector graphics.

Opportunity

- The market for etching resist ink is an area of great potential so as to be successful and to gain. As a result, one of the chief domains in which a PCB of good quality has an opportunity to grow its global consumption is in the healthcare, automotive, consumer electronics, and aerospace sectors (whereof PCBs have higher demand). Digital ink materials cost is a growing concern since the effectiveness improvement is enforced on the circuit boards having high performance printed circuits and tiny patterns which ultimately result in growing demand for miniature devices, with high power capacity and efficiency.

- Conversely, in relation to the direct silvering the electroless copper conductive adhesive is actually limited in terms of the application of such resist inks, especially when applying it to the nano-structured features and the other level of integration done at the presence of the sophisticated packaging technologies like System-in-Package (SiP) and 3D packaging.

- On the subject of resources progress, with the ecological problem filling in, environmentally-friendly etching resist inks will consequently become more popular. This mechanism helps to implement regulations and, thus, determines the amount of waste produced during printed circuit board manufacturing.

- Furthermore, the growth of electronics industry in few poor and developing countries (e.g. China, India, Brazil) became involved in manufacturing photomasks which plays an important role in emerging for the vendors.

- Increasing necessity for high quality printed circuit boards, innovations in high-tech packaging systems and widespread application of eco-friendly technologies together with development of electronics manufacturing bases in the fast-growing countries – all these factors are in favor of the market development which means more employment opportunities.

Etching Resist Ink Market Segment Analysis:

Etching Resist Ink Market is Segmented based on type, application.

By Type, Photoimageable segment is expected to dominate the market during the forecast period

- By type, the market for etching resist inks can be divided into three primary categories: interchangeable, photo imageable, UV curable and thermal curable.

- Photolithography uses the light reactivity of photo imageable resist pigments (similar to light-sensitive materials that composed of resists that are limited to the locations that light has not touched). Thus, that lighting can be presented by means of the mark.

- The UV instructor’s chemicals responsible for the pigment become cured if exposed to it group of radiation and this causes them to be more fitted. Thin lines can be solved with good resolution and sleep caching speed that cartridge-printing provides over other applications.

- Taking place is thermal curing which relies on the application of heat. Consumers can find there products from daily use to high chemical stabilities products where highest levels of chemical stability are needed and when long-term lasting properties are required.

- The use of ink for resist offers a unique fashion to the board-makers through which they can determine the best variant of ink. In this way, the PCB fabrications can be made in quality manner.

By Application, Metal Etching segment held the largest share in 2023

- By application, the market for Etching Resist Ink can be divided into three primary groups: Wet etching is suitable for all PCB etching needs, metal etching and in general, other applications.

- For instance, the etching resist ink is used in PCB etching panel for a long period. In this case, a certain area of PCB is protected by the ink from the etching process. That way it is ensured that the precise section to be cutse is the sole region changed not the pattern.

- The way to mastering is followed by the etching of the metal with striving resist pigments being the etched areas when it comes to the making of metal features. In case of applying a resist that metal face, some of the areas defy the etchant and it removes the metal of themselves. It assurance that the etchant gets in touch with the metal where resist is placed thus making it possible to the inventors to make patterns within different area of the metal.

- MEMS fabrication, or the creation of microelectromechanical systems, sensory systems, and electronic devices that need some sort of resist ink for patterning, is one of the main goals of using the etching resistance ink for this. Those dyestuff are able to carry out the tasks which were undertaken formerly consistently but with the help of the most sophisticated devices and equipment’s used.

Etching Resist Ink Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The extremity of ethnic adherence under the condition of highly advanced printed electronic boards (PCBs) is a discriminating feature within the automotive, aerospace, healthcare, and consumer industries for the North American market of Etching Resist Printed organic light emitting diode (OLED) ink. One of the biggest market forces is the result of high demand for advanced electronic parts caused by this region's environment, which is an intriguing place for science and technology.

- Apart from the development of the technology, making production packaging more effective and using 3D packaging which in its turn needs intensive etching, the market for resin coating inks will be able to use this effect.

- Implemented effective practices for the production of etching resist inks with green elements is among the ways N. American circuit board manufacturers can play the part. The practices must meet the current and future world regulations and compensation not only the polluting effects of printed circuit board activities, but all the pollution-generating practices.

- Besides where great emphasis is put on research and development, the headquarters of electronic industry giants being predominantly established in North America results into more business chances for the etching resist ink market.

Active Key Players in the Etching Resist Ink Market.

- Agfa Corporation (Belgium)

- Asahi Chemical Research Laboratory (Japan)

- Dongguan Lanbang (China)

- Hong Kong Rockent Industries (Hong Kong)

- Nan Ya Plastics (Taiwan)

- Nazdar (United States)

- Seoul Chemical Research Laboratory (South Korea)

- Shenzhen RongDa (China)

- Sun Chemical (United States)

- Taiyo Holdings (Japan)

- Tiflex (France), and Others Players

|

Global Etching Resist Ink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 133.68 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.10% |

Market Size in 2032 : |

USD 191.92 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Etching Resist Ink Market by By Type (2018-2032)

4.1 Etching Resist Ink Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Photoimageable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 UV Curable

4.5 Thermal Curable

Chapter 5: Etching Resist Ink Market by By Application (2018-2032)

5.1 Etching Resist Ink Market Snapshot and Growth Engine

5.2 Market Overview

5.3 PCB Etching

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Metal Etching

5.5 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Etching Resist Ink Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALMAXCO (MALAYSIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALPOLIC (JAPAN)

6.4 ALSTRONG (INDIA)

6.5 ALUBOND U.S.A (UNITED STATES)

6.6 ALUCOBOND (GERMANY)

6.7 ALUCOIL (SPAIN)

6.8 ALUDECOR (INDIA)

6.9 ARCONIC (UNITED STATES)

6.10 JYI SHYANG INDUSTRIAL (TAIWAN)

6.11 KNOTWOOD (AUSTRALIA)

6.12 LAMINATORS INCORPORATED (UNITED STATES)

6.13 MULK HOLDINGS (UNITED ARAB EMIRATES)

6.14 REYNOBOND (UNITED STATES)

6.15 SEVEN GROUP (CHINA)

6.16 SHILDAN GROUP (UNITED STATES)

6.17 SHIN YANG STEEL (TAIWAN)

6.18 SISTEM METAL (TURKEY)

6.19 SOTECH (UNITED KINGDOM)

6.20 WABASH VALLEY (UNITED STATES)

6.21 YARET INDUSTRIAL GROUP (CHINA)

6.22 OTHER KEY PLAYERS

Chapter 7: Global Etching Resist Ink Market By Region

7.1 Overview

7.2. North America Etching Resist Ink Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Photoimageable

7.2.4.2 UV Curable

7.2.4.3 Thermal Curable

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 PCB Etching

7.2.5.2 Metal Etching

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Etching Resist Ink Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Photoimageable

7.3.4.2 UV Curable

7.3.4.3 Thermal Curable

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 PCB Etching

7.3.5.2 Metal Etching

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Etching Resist Ink Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Photoimageable

7.4.4.2 UV Curable

7.4.4.3 Thermal Curable

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 PCB Etching

7.4.5.2 Metal Etching

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Etching Resist Ink Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Photoimageable

7.5.4.2 UV Curable

7.5.4.3 Thermal Curable

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 PCB Etching

7.5.5.2 Metal Etching

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Etching Resist Ink Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Photoimageable

7.6.4.2 UV Curable

7.6.4.3 Thermal Curable

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 PCB Etching

7.6.5.2 Metal Etching

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Etching Resist Ink Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Photoimageable

7.7.4.2 UV Curable

7.7.4.3 Thermal Curable

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 PCB Etching

7.7.5.2 Metal Etching

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Etching Resist Ink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 133.68 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.10% |

Market Size in 2032 : |

USD 191.92 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Etching Resist Ink Market research report is 2024-2032.

Agfa Corporation (Belgium), Asahi Chemical Research Laboratory (Japan), Dongguan Lanbang (China), Hong Kong Rockent Industries (Hong Kong), Nan Ya Plastics (Taiwan), Nazdar (United States), Seoul Chemical Research Laboratory (South Korea), Shenzhen RongDa (China), Sun Chemical (United States), Taiyo Holdings (Japan), Tiflex (France), Others Major Players.

The Etching Resist Ink Market is segmented by Solution (Photoimageable, UV Curable, Thermal Curable), Services, Application (PCB Etching, Metal Etching, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Etching resist ink is a specialized material used in the process of etching, particularly in electronics manufacturing and printed circuit board (PCB) production. It is applied to the surface of a substrate, typically a copper-clad board, to protect specific areas from being etched away by chemical processes. This selective etching creates circuit patterns or designs on the substrate. Etching resist inks are designed to withstand the harsh chemicals used in the etching process, ensuring that the protected areas remain intact while the exposed areas are etched away.

Etching Resist Ink Market Size Was Valued at USD 133.68 Million in 2023, and is Projected to Reach USD 191.92 Million by 2032, Growing at a CAGR of 4.10% From 2024-2032.