Fecal Calprotectin Test Market Synopsis:

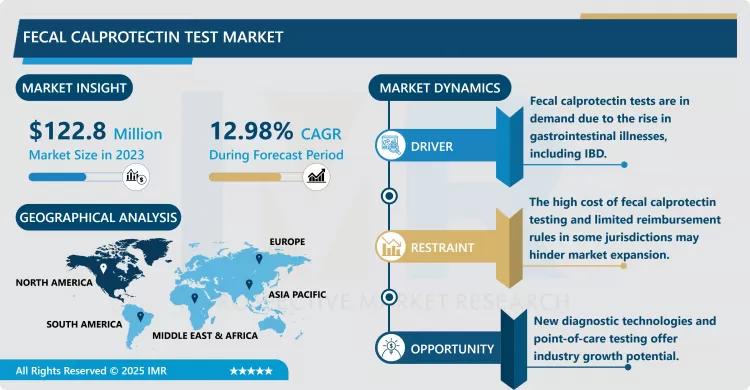

Fecal Calprotectin Test Market Size Was Valued at USD 122.8 Million in 2023, and is Projected to Reach USD 277.9 Million by 2032, Growing at a CAGR of 12.98% From 2024-2032.

The fecal calprotectin test market is a highly relevant market within the diagnostic space in healthcare, which aims at identifying inflammation in the GI tract. Calprotectin is a white blood cell protein; thus, its elevation in the stool results from intestinal inflammation. There is no cure for this condition but this test is helpful in diagnosis and management of IBD such as Crohn’s disease and ulcerative colitis. Thus, effectively, utilizing calprotectin testing helps distinquish betwen IBD and other GI, which therefore makes much fewer patients require colonoscopies.

Fecal calprotectin has been on the increase over the years because of high incidence of gastrointestinal diseases and because it is an effective noninvasive diagnostic tool. The market is fuelled by lucrative features of fecal calprotectin tests such as high reactivity, non-interference with bowel movement, and assessment of disease activity or inactivity. Further, more development has seen these test to be more efficient, more accurate and are more available to the population. Therefore, fecal calprotectin testing has now become routine in managing IBD and promoting market progress.

Location wise, the fecal calprotectin test market is growing; the largest markets are the North American and European market because of the more cases of IBD and better healthcare system infrastructure. Though there is still limited, but with the advancement of medical accessibility in emerging economies it has been increasingly used in Asia-Pacific region. This research predicts that the market will keep growing steady, primarily due to the advanced studies in biomarker testing and preventive medical attention. Furthermore, the growing partnership between diagnostic companies and healthcare organizations to increase the affordability of fecal calprotectin kits are also contributing to increased market growth.

Fecal Calprotectin Test Market Trend Analysis:

Increasing Demand for Non-Invasive Diagnostic Tests

- This is because the fecal calprotectin test is particularly beneficial for diagnosing diseases due to the non invasive nature of the test. As patients and healthcare providers seek less invasive, less painful, and more convenient ways to diagnose and treat conditions such as colon cancer, fecal calprotectin testing is emerging as an important adjunct in the diagnosis and treatment of IBD. This is especially of great aid in the diagnosis of IBD since majority of the citizens can afford the upper end endoscopy instead of other costly procedures including colonoscopy, consequently enhancing the accessibility and efficiency in the health sector.

Advancements in Point-of-Care Testing

- Another new development in the fecal calprotectin test market is the fast development of the POC testing. The availability of transportable, user-friendly testing devices means the fecal calprotectin tests can be performed at outpatient facilities or at home. The POC solutions carry the plus of expediting the diagnosis exercises to an extent of cutting down waiting time thereby making it more convenient. As more institutions implement such technologies, fecal calprotectin testing is becoming more prevalent and will continue to propel market growth in low-resource laboratories.

Fecal Calprotectin Test Market Segment Analysis:

Fecal Calprotectin Test Market Segmented on the basis of Assay Type, Indication, End-User, and Region

By Assay Type, Enzyme Fluroimmunoassay segment is expected to dominate the market during the forecast period

- The fecal calprotectin test market is segmented by assay type into three main categories: EIA (Enzyme Immunoassay), enzyme fluoroimmunoassay and chemiluminescent immunoassay and immune chromatography. ELISA is popular since it is well sensitive and specific when used to determine levels of calprotectin in the fecal samples because it is the most used method in clinical laboratories. Enzyme fluoroimmunoassay, which has better detection efficiency and comparatively shorter time to results, is becoming increasingly popular for use at the site of patient care. The immune-chromatography which is a common format in rapid diagnostic kits is proven to be convenient easy, and cost effective rendering easy testing directly from the hours on site particularly in developing nations. These assay types meet different diagnostic requirements so as to enlarge the spectrum of application and enhance the practicability of fecal calprotectin tests in clinic.

By End-User, Hospitals segment expected to held the largest share

- The fecal calprotectin test is divided by end users in hospitals, diagnostic laboratories, academic and research institutes and others. Hospitals are expected to continue leading the market demand because fecal calprotectin tests are particularly used in diagnosing IBS and other gastrointestinal conditions in hospitals. Equipment also involves in performing of these tests and diagnostic laboratories, in particular, has a significant role in offering the right results at the right time to physicians. Medical academia and research generic applicative subdivisions progress clinical knowledge of fecal calprotectin as a biomarker and the development of diagnostic techniques. More importantly, the “others” segment includes home care settings where point-of-care testing gaining popularity as it is convenient and easy to use.

Fecal Calprotectin Test Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Due to various factors which include well developed health care facilities, higher health expenditure, and emphasis on the diagnosis and treatment of GI diseases such as IBD, North America is expected to lead the fecal calprotectin test market revenues during the forecast period. However, the rising consciousness of people regarding the advantages of non-utilizing invasive diagnostic techniques and the use of portable diagnostic testing known as point-of-care testing also play an important role in developing the market in this region. The high level of development of healthcare services in North America and the consistently high demand for new diagnostic technologies can also promote the development of the Fecal Calprotectin test market.

Active Key Players in the Fecal Calprotectin Test Market:

- Rad Laboratories, Inc. (United States)

- EagleBio (United States)

- Svar Life Science (Sweden)

- DRG International, Inc. (United States)

- ALPCO (United States)

- Thermo Fisher Scientific Inc. (United States)

- Alpha Laboratories Ltd. (United Kingdom)

- Meridian Bioscience, Inc. (United States)

- BÜHLMANN (Switzerland)

- DIAZYME LABORATORIES, INC. (United States)

- Abbexa (United Kingdom)

- OPERON, S.A. (Spain)

- DiAgam (France)

- R-Biopharm AG (Germany)

- Biomerica (United States)

- Other Active Players

|

Fecal Calprotectin Test Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 122.8 Million |

|

Forecast Period 2024-32 CAGR: |

12.98% |

Market Size in 2032: |

USD 277.9 Million |

|

Segments Covered: |

By Assay Type |

|

|

|

By Indication |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fecal Calprotectin Test Market by By Assay Type (2018-2032)

4.1 Fecal Calprotectin Test Market Snapshot and Growth Engine

4.2 Market Overview

4.3 ELISA (Enzyme-Linked Immunosorbent Assay)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Enzyme Fluroimmunoassay

4.5 Immune-Chromatography

Chapter 5: Fecal Calprotectin Test Market by By Indication (2018-2032)

5.1 Fecal Calprotectin Test Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Inflammatory Bowel Disease (IBD) Diagnosis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Colorectal Cancer

5.5 Celiac disease

5.6 Others

Chapter 6: Fecal Calprotectin Test Market by By End-User (2018-2032)

6.1 Fecal Calprotectin Test Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.5 Academic and Research Institutes

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fecal Calprotectin Test Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 RAD LABORATORIES INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 EAGLEBIO (UNITED STATES)

7.4 SVAR LIFE SCIENCE (SWEDEN)

7.5 DRG INTERNATIONAL INC. (UNITED STATES)

7.6 ALPCO (UNITED STATES)

7.7 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

7.8 ALPHA LABORATORIES LTD. (UNITED KINGDOM)

7.9 MERIDIAN BIOSCIENCE INC. (UNITED STATES)

7.10 BÜHLMANN (SWITZERLAND)

7.11 DIAZYME LABORATORIES INC. (UNITED STATES)

7.12 ABBEXA (UNITED KINGDOM)

7.13 OPERON

7.14 S.A. (SPAIN)

7.15 DIAGAM (FRANCE)

7.16 R-BIOPHARM AG (GERMANY)

7.17 BIOMERICA (UNITED STATES)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Fecal Calprotectin Test Market By Region

8.1 Overview

8.2. North America Fecal Calprotectin Test Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Assay Type

8.2.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.2.4.2 Enzyme Fluroimmunoassay

8.2.4.3 Immune-Chromatography

8.2.5 Historic and Forecasted Market Size By By Indication

8.2.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.2.5.2 Colorectal Cancer

8.2.5.3 Celiac disease

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By End-User

8.2.6.1 Hospitals

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Academic and Research Institutes

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fecal Calprotectin Test Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Assay Type

8.3.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.3.4.2 Enzyme Fluroimmunoassay

8.3.4.3 Immune-Chromatography

8.3.5 Historic and Forecasted Market Size By By Indication

8.3.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.3.5.2 Colorectal Cancer

8.3.5.3 Celiac disease

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By End-User

8.3.6.1 Hospitals

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Academic and Research Institutes

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fecal Calprotectin Test Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Assay Type

8.4.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.4.4.2 Enzyme Fluroimmunoassay

8.4.4.3 Immune-Chromatography

8.4.5 Historic and Forecasted Market Size By By Indication

8.4.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.4.5.2 Colorectal Cancer

8.4.5.3 Celiac disease

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By End-User

8.4.6.1 Hospitals

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Academic and Research Institutes

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fecal Calprotectin Test Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Assay Type

8.5.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.5.4.2 Enzyme Fluroimmunoassay

8.5.4.3 Immune-Chromatography

8.5.5 Historic and Forecasted Market Size By By Indication

8.5.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.5.5.2 Colorectal Cancer

8.5.5.3 Celiac disease

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By End-User

8.5.6.1 Hospitals

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Academic and Research Institutes

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fecal Calprotectin Test Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Assay Type

8.6.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.6.4.2 Enzyme Fluroimmunoassay

8.6.4.3 Immune-Chromatography

8.6.5 Historic and Forecasted Market Size By By Indication

8.6.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.6.5.2 Colorectal Cancer

8.6.5.3 Celiac disease

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By End-User

8.6.6.1 Hospitals

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Academic and Research Institutes

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fecal Calprotectin Test Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Assay Type

8.7.4.1 ELISA (Enzyme-Linked Immunosorbent Assay)

8.7.4.2 Enzyme Fluroimmunoassay

8.7.4.3 Immune-Chromatography

8.7.5 Historic and Forecasted Market Size By By Indication

8.7.5.1 Inflammatory Bowel Disease (IBD) Diagnosis

8.7.5.2 Colorectal Cancer

8.7.5.3 Celiac disease

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By End-User

8.7.6.1 Hospitals

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Academic and Research Institutes

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Fecal Calprotectin Test Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 122.8 Million |

|

Forecast Period 2024-32 CAGR: |

12.98% |

Market Size in 2032: |

USD 277.9 Million |

|

Segments Covered: |

By Assay Type |

|

|

|

By Indication |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fecal Calprotectin Test Market research report is 2024-2032.

Rad Laboratories, Inc. (United States), EagleBio (United States), Svar Life Science (Sweden), DRG International, Inc. (United States), ALPCO (United States), Thermo Fisher Scientific Inc. (United States), Alpha Laboratories Ltd. (United Kingdom), Meridian Bioscience, Inc. (United States), BÜHLMANN (Switzerland), DIAZYME LABORATORIES, INC. (United States), Abbexa (United Kingdom), OPERON, S.A. (Spain), DiAgam (France), R-Biopharm AG (Germany), Biomerica (United States), Others.

The Fecal Calprotectin Test Market is segmented into By Assay Type, By Indication, By End-User and region. By Assay Type (ELISA (Enzyme-Linked Immunosorbent Assay), Enzyme Fluroimmunoassay, and Immune-Chromatography), By Indication (Inflammatory Bowel Disease (IBD) Diagnosis, Colorectal Cancer, Celiac disease, and Others), By End-User (Hospitals, Diagnostic Laboratories, Academic and Research Institutes, and Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The fecal calprotectin test is a diagnostic procedure used to measure the level of calprotectin, a protein released by white blood cells, in a stool sample. Elevated levels of calprotectin are typically associated with inflammation in the gastrointestinal tract, making this test a valuable tool for diagnosing and monitoring inflammatory bowel diseases (IBD) such as Crohn's disease and ulcerative colitis. It is often used as a non-invasive marker to assess inflammation, helping to differentiate between inflammatory and non-inflammatory gastrointestinal disorders. This test is also increasingly used to monitor disease activity, treatment efficacy, and potential flare-ups in IBD patients.

Fecal Calprotectin Test Market Size Was Valued at USD 122.8 Million in 2023, and is Projected to Reach USD 277.9 Million by 2032, Growing at a CAGR of 12.98% From 2024-2032.