Fiber Optic Collimating Lens Market Synopsis

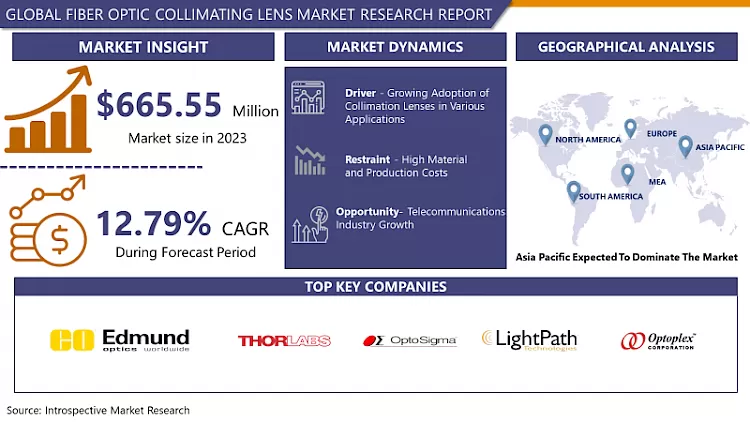

Fiber Optic Collimating Lens Market Size Was Valued at USD 665.55 Million in 2023, and is Projected to Reach USD 1966.15 Million by 2032, Growing at a CAGR of 12.79% From 2024-2032.

A collimator is an optical lens that parallels the beams of light entering your spectrometer setup. These lenses enable users to control the field of view, collection efficiency, and spatial resolution of their setup and configure illumination and collection angle for sampling.

- Collimating micro lens optical fiber assemblies are designed to provide collimation of the emitted beam or the focus of the coupled beam. The assemblies can be customized with a variety of connector types and lens shapes to suit the customer's desired application. With a comprehensive portfolio of various specialty fibers, collimated fiber assemblies can be manufactured for any application.

- Augmenting investment in optical fiber is expected to drive demand for fiber optic components, including optical fiber collimators. For example, North American broadband suppliers are expected to invest more than $60 billion in fiber-to-the-door (FTTH) projects over the upcoming years, almost double the amount invested in fiber-to-the-door (FTTH) projects. FTTH works during the previous 5 years, according to the report.

- Major FTTH players such as AT&T and Verizon are exploring new opportunities for fiber, where they can deploy FTTH despite large investments in the past and may even eventually find ways to expand FTTH beyond their traditional market boundaries. AT&T has declared that approximately two million new homes will be built by 2021. All these investments are probably to drive demand for optical fiber collimators.

Fiber Optic Collimating Lens Market Trend Analysis

Growing Adoption of Collimation Lenses in Various Applications

- Fiber is characterized by scalability. Therefore, at a time of rapid expansion, the company can easily access unlimited bandwidth. For this access, the company does not have to deal with service delays and additional monthly fees from the ISP. In recent years, the manufacturing process of aspherical lenses has made great progress.

- The manufacturing cost of these aspherical lenses is relatively higher than that of conventional aspherical lenses. In the past, optical fiber was notoriously expensive and fragile for factory floors. However, the diversified development of optical fiber over the past few years has brought countless demand opportunities to the market. Therefore, based on these factors, the optical fiber collimator lens market is expected to witness growth paths in the coming years.

Telecommunications Industry Growth create an Opportunity for Fiber Optic Collimating Lens Market

- The telecommunications industry's rapid growth presents significant opportunities for the Fiber Optic Collimating Lens Market. As telecommunications networks continue to evolve towards higher bandwidths and faster data transmission rates, the demand for advanced optical communication components, such as collimating lenses, is on the rise. Fiber optic collimating lenses play a crucial role in optimizing signal transmission by ensuring that light signals emitted from optical fibers are parallel and well-focused.

- With the increasing deployment of 5G networks and the burgeoning demand for high-speed internet connectivity, there is a growing need for efficient and reliable optical communication systems. Fiber optic collimating lenses address this need by enhancing the performance of optical devices used in telecommunications infrastructure. They contribute to minimizing signal loss and improving overall network efficiency.

- Moreover, as data centers expand and upgrade their optical interconnects to handle larger volumes of data, the Fiber Optic Collimating Lens Market stands to benefit. These lenses enable precise control of light beams, supporting the development of faster and more reliable data transmission systems. In essence, the flourishing telecommunications industry creates a favorable landscape for the growth and innovation within the Fiber Optic Collimating Lens Market.

Fiber Optic Collimating Lens Market Segment Analysis:

Fiber Optic Collimating Lens Market Segmented based on type, Lens type Mode, and application.

By Type, fiber lenses segment is expected to dominate the market during the forecast period.

- Based on the lens type, the fiber lenses type of the segment is expected to hold the significant fiber optic collimating lens market share during the forecast period. With the development of high-speed optical communication, optical fiber collimators have been used for a variety of applications, not only in optical transmission systems but also in coupled laser systems and other areas such as important passive optical devices.

- There are two main methods for fiber optic connections, one is arc splicing using the fiber splicing method and the other is fiber splicing with free space using the fiber splicing method. optics using a collimator. The first connection method is often used in laboratories or engineering companies where modifications are undesirable due to its high reliability and low connection loss; The latter connection method is often used in experimental research or optical communication in free space due to its flexibility and detachable characteristics. The optical fiber collimator has been widely used in various fields, especially for the mobile connection scene, such as laser space splicing, integrated fiber optic equipment, and so on.

By Application, communication segment held the largest share of 40% in 2022

- Based on the application, the communication segment is expected to dominate the fiber optic collimating lens market over the forecast period. Fiber-optic collimating lenses are used in communication, medical diagnostics & imaging, lasers and detectors, metrology, microscopy & spectroscopy, and others (display applications, cytometry, artificial intelligence, and LiDAR).

- The communication segment holds the largest market share owing to the increasing demand for digitalization and the growing need for being connected. The growing demand for fiber in the communication application is the key driver for the growth of this segment.

Fiber Optic Collimating Lens Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region is registering the maximum growth for the market and is expected to continue during the forecast period. There is a high demand for optical fiber collimators in various applications, such as LIDAR, medical equipment, and spectroscopy. Asia-Pacific countries, especially China and India, are expected to offer significant growth opportunities for fiber collimator lens manufacturers. Therefore, the growing demand for laser interferometry in the country is likely to drive demand for its supporting components, including optical fiber collimators.

- Therefore, the development of optical fiber collimators in China is expected to drive market growth in the APAC region. Furthermore, the automotive segment plays an important role in the growth of the market. The increasing use of LED headlights on vehicles ranging from high-end to mid-range, in turn, presents an opportunity to the market. Asian countries, particularly China and India, will provide significant growth opportunities for collimator lens manufacturers.

Fiber Optic Collimating Lens Market Top Key Players:

- OptoSigma (USA)

- LightPath Technologies (USA)

- Optoplex (USA)

- Excelitas Technologies (USA)

- Menlo Systems (Germany)

- Edmund Industrial Optics GmbH (Germany)

- Santec Corp. (Japan)

- Fuhjinn International Inc. (Taiwan)

- E-TEK Optoelectronics (Taiwan)

- CoreTech Optronics (Taiwan)

- Optoworld Co. Ltd. (Taiwan)

- Gooh Optics (China)

- Sun Optics (China)

- Future Optics (China)

- NeoOptix (China)

- Opticon (South Korea)

- SOPTIC Co. Ltd. (South Korea)

- SIFOC Technologies (Singapore)

Key Industry Developments in the Fiber Optic Collimating Lens Market:

- In September 2023, Edmund Optics introduced a new line of high-performance collimating lenses featuring ultra-low distortion and improved collimation quality. These lenses are ideal for demanding applications in laser beam shaping, spectroscopy, and metrology.

- In October 2023, Thorlabs launched a series of aspheric collimating lenses with increased numerical apertures (NA) up to 0.5. These lenses offer higher light throughput and tighter collimation angles, making them suitable for high-power laser applications.

|

Global Fiber Optic Collimating Lens Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 665.55 Mn |

|

Forecast Period 2024-32 CAGR: |

12.79 % |

Market Size in 2032: |

USD 1966.15 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Lens Type |

|

||

|

By Mode |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fiber Optic Collimating Lens Market by By Type (2018-2032)

4.1 Fiber Optic Collimating Lens Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Adjustable

Chapter 5: Fiber Optic Collimating Lens Market by By Lens Type (2018-2032)

5.1 Fiber Optic Collimating Lens Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fiber Lenses

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Grin Lenses

Chapter 6: Fiber Optic Collimating Lens Market by By Mode (2018-2032)

6.1 Fiber Optic Collimating Lens Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Single-Mode

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Multimode

Chapter 7: Fiber Optic Collimating Lens Market by By Application (2018-2032)

7.1 Fiber Optic Collimating Lens Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Lasers & Detectors

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Communication

7.5 Spectroscopy & Microscopy

7.6 Medical Diagnostic & Imaging

7.7 Metrology

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Fiber Optic Collimating Lens Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 KORNIT DIGITAL (ISRAEL)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BROTHER INTERNATIONAL CORPORATION (JAPAN)

8.4 EPSON (JAPAN)

8.5 AEOON TECHNOLOGIES (AUSTRIA)

8.6 M&R PRINTING EQUIPMENT INC. (USA)

8.7 RICOH (JAPAN)

8.8 MIMAKI (JAPAN)

8.9 OMNIPRINT INTERNATIONAL (USA)

8.10 COL-DESI INC. (USA)

8.11 ROQ INTERNATIONAL (PORTUGAL)

8.12 TEXJET (POLYPRINT S.A.) (GREECE)

8.13 DTG DIGITAL (PIGMENT.INC) (AUSTRALIA)

8.14 STAHLS' INTERNATIONAL (USA)

8.15 ANAJET (RICOH) (USA)

8.16 VASTEX INTERNATIONAL (USA)

8.17 SEIKO EPSON CORPORATION (JAPAN)

8.18 LAWSON SCREEN & DIGITAL PRODUCTS INC. (USA)

8.19 DTG MART (USA)

8.20 ASTRONOVA (USA)

8.21 HANWHA TECHWIN (SOUTH KOREA)

Chapter 9: Global Fiber Optic Collimating Lens Market By Region

9.1 Overview

9.2. North America Fiber Optic Collimating Lens Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Fixed

9.2.4.2 Adjustable

9.2.5 Historic and Forecasted Market Size By By Lens Type

9.2.5.1 Fiber Lenses

9.2.5.2 Grin Lenses

9.2.6 Historic and Forecasted Market Size By By Mode

9.2.6.1 Single-Mode

9.2.6.2 Multimode

9.2.7 Historic and Forecasted Market Size By By Application

9.2.7.1 Lasers & Detectors

9.2.7.2 Communication

9.2.7.3 Spectroscopy & Microscopy

9.2.7.4 Medical Diagnostic & Imaging

9.2.7.5 Metrology

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Fiber Optic Collimating Lens Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Fixed

9.3.4.2 Adjustable

9.3.5 Historic and Forecasted Market Size By By Lens Type

9.3.5.1 Fiber Lenses

9.3.5.2 Grin Lenses

9.3.6 Historic and Forecasted Market Size By By Mode

9.3.6.1 Single-Mode

9.3.6.2 Multimode

9.3.7 Historic and Forecasted Market Size By By Application

9.3.7.1 Lasers & Detectors

9.3.7.2 Communication

9.3.7.3 Spectroscopy & Microscopy

9.3.7.4 Medical Diagnostic & Imaging

9.3.7.5 Metrology

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Fiber Optic Collimating Lens Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Fixed

9.4.4.2 Adjustable

9.4.5 Historic and Forecasted Market Size By By Lens Type

9.4.5.1 Fiber Lenses

9.4.5.2 Grin Lenses

9.4.6 Historic and Forecasted Market Size By By Mode

9.4.6.1 Single-Mode

9.4.6.2 Multimode

9.4.7 Historic and Forecasted Market Size By By Application

9.4.7.1 Lasers & Detectors

9.4.7.2 Communication

9.4.7.3 Spectroscopy & Microscopy

9.4.7.4 Medical Diagnostic & Imaging

9.4.7.5 Metrology

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Fiber Optic Collimating Lens Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Fixed

9.5.4.2 Adjustable

9.5.5 Historic and Forecasted Market Size By By Lens Type

9.5.5.1 Fiber Lenses

9.5.5.2 Grin Lenses

9.5.6 Historic and Forecasted Market Size By By Mode

9.5.6.1 Single-Mode

9.5.6.2 Multimode

9.5.7 Historic and Forecasted Market Size By By Application

9.5.7.1 Lasers & Detectors

9.5.7.2 Communication

9.5.7.3 Spectroscopy & Microscopy

9.5.7.4 Medical Diagnostic & Imaging

9.5.7.5 Metrology

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Fiber Optic Collimating Lens Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Fixed

9.6.4.2 Adjustable

9.6.5 Historic and Forecasted Market Size By By Lens Type

9.6.5.1 Fiber Lenses

9.6.5.2 Grin Lenses

9.6.6 Historic and Forecasted Market Size By By Mode

9.6.6.1 Single-Mode

9.6.6.2 Multimode

9.6.7 Historic and Forecasted Market Size By By Application

9.6.7.1 Lasers & Detectors

9.6.7.2 Communication

9.6.7.3 Spectroscopy & Microscopy

9.6.7.4 Medical Diagnostic & Imaging

9.6.7.5 Metrology

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Fiber Optic Collimating Lens Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Fixed

9.7.4.2 Adjustable

9.7.5 Historic and Forecasted Market Size By By Lens Type

9.7.5.1 Fiber Lenses

9.7.5.2 Grin Lenses

9.7.6 Historic and Forecasted Market Size By By Mode

9.7.6.1 Single-Mode

9.7.6.2 Multimode

9.7.7 Historic and Forecasted Market Size By By Application

9.7.7.1 Lasers & Detectors

9.7.7.2 Communication

9.7.7.3 Spectroscopy & Microscopy

9.7.7.4 Medical Diagnostic & Imaging

9.7.7.5 Metrology

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Fiber Optic Collimating Lens Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 665.55 Mn |

|

Forecast Period 2024-32 CAGR: |

12.79 % |

Market Size in 2032: |

USD 1966.15 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Lens Type |

|

||

|

By Mode |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fiber Optic Collimating Lens Market research report is 2024-2032.

Edmund Optics (USA),Thorlabs (USA), OptoSigma (USA), LightPath Technologies (USA), Optoplex (USA), Excelitas Technologies (USA), Menlo Systems (Germany), Edmund Industrial Optics GmbH (Germany), Santec Corp. (Japan), Fuhjinn International Inc. (Taiwan), E-TEK Optoelectronics (Taiwan), CoreTech Optronics (Taiwan), Optoworld Co. Ltd. (Taiwan), Gooh Optics (China), Sun Optics (China), Future Optics (China), NeoOptix (China), Opticon (South Korea), SOPTIC Co. Ltd. (South Korea), SIFOC Technologies (Singapore) and Other Major Players.

The Fiber Optic Collimating Lens Market is segmented into Type, Lens Type, Mode Application, and region. By Type, the market is categorized into Fixed, Adjustable. By Lens Type, the market is categorized into Fiber Lenses, Grin Lenses), Mode (Single-Mode, Multimode. By Mode, the market is categorized into Single-Mode and Multimode. By Application, the market is categorized into Lasers & Detectors, Communication, Spectroscopy & Microscopy, Medical Diagnostic & Imaging, Metrology. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A collimator is an optical lens that parallels the beams of light entering your spectrometer setup. These lenses enable users to control the field of view, collection efficiency, and spatial resolution of their setup and configure illumination and collection angle for sampling.

Fiber Optic Collimating Lens Market Size Was Valued at USD 665.55 Million in 2023, and is Projected to Reach USD 1966.15 Million by 2032, Growing at a CAGR of 12.79% From 2024-2032.