Filament Tapes Market Synopsis:

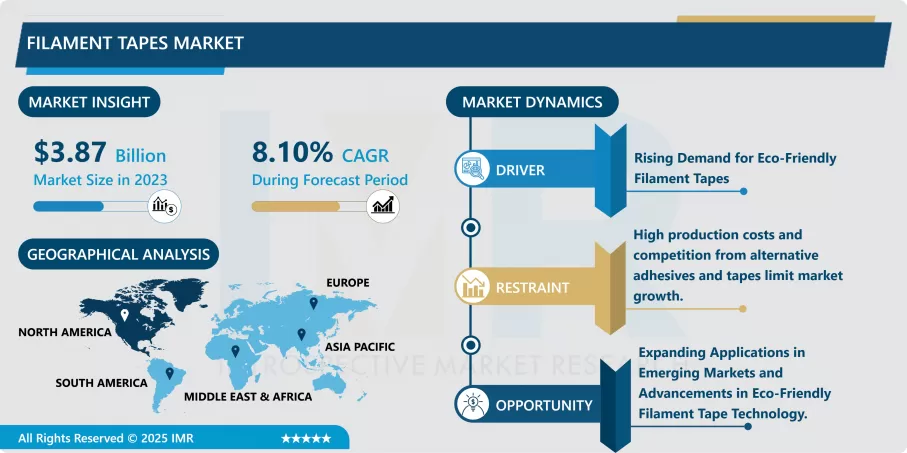

Filament Tapes Market Size Was Valued at USD 3.87 Billion in 2023, and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 8.10% from 2024-2032.

The Filament Tapes Market is steadily growing due to its usability in various industries for various types of applications and its dependability. Filament tapes are coated with pressure-sensitive adhesive that includes fiberglass or polyester filaments in the carrier that provides higher tensile strength and better durability’s. These tapes are quite popular for the purpose of packaging and sealing, mechanical fastening and binding, in connection with the manufacturing and construction industries and many others. The increase in e-commerce activities has continued to add to the demand for filament tapes since they are useful in admitting heavy consignments and ensure non-delamination delivery.

- Specifically, it considers changes in adhesive technologies and the creation of syntactic tapes that conform to environmental requirements. They are available in single coated and double coated forms and the manufacturers are more interested in improving the adhesion and durability of the filament tapes given the requirements of the final consumer in such application. Currently, the Asia-Pacific region is dominant in the consumption of petroleum resins owing to its rapidly growing industrial and packaging industries, while North America and Europe remain highly significant in the use of these products, particularly in technically advance specific applications.

- Consumer awareness about the ecological factors in products and packaging are also demanding more inventions from the side of the manufacturers. Current stakeholders are using resources to address the need for developing bio-degradable and solvent-free filament tapes. Pain points like swings in the price for the raw material and threats from various substitutes such as strapping material cause minute hurdles to growth; however, the evolving uses of filament tapes in specific applications augur well for growth in the market.

Filament Tapes Market Trend Analysis:

Rising Demand for Eco-Friendly Filament Tapes

- Most of the industries across the globe have realized the importance of sustainable and environment friendly products and therefore, more change is being observed in the use of filament tapes. Suppliers continue to work on the technology of using bio-degradable filament tapes and low solvents adhesive systems. These green tapes help industries that aspire to professional environmental standards while not cutting on functionality. This trend is most evident in Europe and North America where the government has developed strict environmental standards that makes it mandatory for companies to go green in areas such as packaging and industrial uses.

Growing Adoption in the E-Commerce and Logistics Sector

- Due to the advancement in the e-commerce sector, there has been high demand for filament tapes when packaging and bundling heavy packaged items. It is for this reason that these tapes come in operational strength needed to accommodate the long distance transport and heavy laden applications, which make logistics a necessity. This explains why consumers are demanding faster and safer deliveries – a situation that has made the use of filament tapes inevitable. This is particularly due to growth in e-business platforms occasioned by increased traffic in e-selling related to the modern world’s online buying spree, especially in Asia Pacific.

Filament Tapes Market Segment Analysis:

Filament Tapes Market Segmented on the basis of Filament Type, Backing Adhesive Type, Adhesive Type, Width, Application, End Use, and Region.

By Filament Type, Single Sided Tapes segment is expected to dominate the market during the forecast period

- The Filament Tapes Market based on filament type comprises single sided tapes and double sided tapes thus serving various applications in various sectors. Single coated filament tapes are the most popular type today because they are extensively used for various industries for packaging, flattening, and carton sealing, due to their high tensile strength and dependability to secure shipments. In contrast, double-sided filament tapes are gradually finding application in specific sectors, automotive, construction, electronics, etc., where bond is expected on both the surfaces. Due to innovation of adhesive products and rising customer requirements, both segments are expanding, especially in the Asia-Pacific region and North America that have developed manufacturing and distribution networks.

By End Use, Food and Beverages segment expected to held the largest share

- The End-use applications of Filament Tapes are vast and varied indicating the adaptability of this market domain. Thus, in shipping and logistics they used to bundle and secure packages that are really heavy in transit, and in building and construction to reinforce and seal applications. This sector especially the food and beverages sector use filament tapes mainly in sealing cartons during packaging. In electrical and electronics, because of the insulating capacity, they find use in wire bundling and holding of components. Uses include part assembly, and for temporarily holding materials in place throughout manufacturing operations within the automotive industry. In the same manner, the healthcare and hygiene sector utilize these tapes to cover medical products in order to gain more favourable characteristics as regards packaging with an emphasis on sterility. Manufacturing particularly printing and metal working sectors, use the filament tapes, for splicing and bundling of the thick substances while the oil and gas sector deploys the high strength tapes in the pipe wrapping or securing. More specifically, in the general industrial and consumer goods markets, filament tapes are commonly used for the bundling, securing and repair purposes and their use is not limited only to the above-mentioned major application categories but also extends to others.

Filament Tapes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America region is expected to exhibit a strong growth in Filament Tapes Market across the forecast period due to increase in demands from industrial, logistics and e-commerce segments. The slated regions packaging industry, along with the growing demand for tamper evident and heavy-duty bundling needs have ensured that filament tapes come out on top. Moreover, growth in the adhesive technologies and availability of higher strength and heat-resistant tapes are fulfilling the requirements of specific sectors including aerospace, automotive and construction. The increased use of sustainable packaging solutions and the high regulatory demands for the use of green materials propel the market further. Owing to the increased emphasis of important manufactures on product development and strategic alliances, the filament tapes market of North America is anticipated to retain its supremacy in the said market.

Active Key Players in the Filament Tapes Market:

- 3M (U.S)

- Nippon Industries (Japan)

- Gripking Tapes India Pvt. Ltd., (India)

- PPM Industries SpA (Italy)

- PIONEER CORPORATION (Japan)

- Szxinst (China)

- Ajit Industries Pvt. Ltd. (India)

- Nitto Denko Corporation (Japan)

- Tesa Tapes (Germany)

- AVERY DENNISON CORPORATION (U.S.)

- Scapa (U.K.)

- Lohmann GmbH & Co. Kg (Germany)

- Mactac, LLC (U.S.)

- JTAPE LTD. (U.K.)

- Decofix Papers & Tapes (India)

- LINTEC Corporation (Japan)

- Shurtape Technologies, LLC (U.S.)

- Tape India (India)

- VITS TECHNOLOGY GMBH (Germany), and Other Active Players

Filament Tapes Market Scope:

|

Global Filament Tapes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Billion |

|

Forecast Period 2024-32 CAGR: |

8.10% |

Market Size in 2032: |

USD 7.22 Billion |

|

Segments Covered: |

By Filament Type |

|

|

|

Backing Adhesive Type |

|

||

|

Adhesive Type |

|

||

|

Width |

|

||

|

Application |

|

||

|

End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Filament Tapes Market by By Filament Type (2018-2032)

4.1 Filament Tapes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Single Sided Tapes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Double Sided Tapes

Chapter 5: Filament Tapes Market by Backing Adhesive Type (2018-2032)

5.1 Filament Tapes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Plastic Film

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Paper

5.5 Fabric

5.6 Foam

Chapter 6: Filament Tapes Market by Adhesive Type (2018-2032)

6.1 Filament Tapes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Rubber Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Acrylic Based

6.5 Hot Melt Adhesive

Chapter 7: Filament Tapes Market by Width (2018-2032)

7.1 Filament Tapes Market Snapshot and Growth Engine

7.2 Market Overview

7.3 12 mm

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 18 mm

7.5 24 mm

7.6 36 mm

7.7 48 mm

7.8 72 mm

7.9 96 mm

Chapter 8: Filament Tapes Market by Application (2018-2032)

8.1 Filament Tapes Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Bundling

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Strapping

8.5 Insulation

8.6 Carton Sealing

8.7 Sealing

8.8 Others

Chapter 9: Filament Tapes Market by End Use (2018-2032)

9.1 Filament Tapes Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Shipping and Logistics

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Building and Construction

9.5 Food and Beverages

9.6 Electrical and Electronics

9.7 Automotive

9.8 Healthcare and Hygiene

9.9 Printing

9.10 Metalworking

9.11 Oil and Gas

9.12 General Industrial

9.13 Consumer Goods

9.14 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Filament Tapes Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 3M (U.S.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 NIPPON INDUSTRIES (JAPAN)

10.4 GRIPKING TAPES INDIA PVT. LTD. (INDIA)

10.5 PPM INDUSTRIES SPA (ITALY)

10.6 PIONEER CORPORATION (JAPAN)

10.7 SZXINST (CHINA)

10.8 AJIT INDUSTRIES PVT. LTD. (INDIA)

10.9 NITTO DENKO CORPORATION (JAPAN)

10.10 TESA TAPES (GERMANY)

10.11 AVERY DENNISON CORPORATION (U.S.)

10.12 SCAPA (U.K.)

10.13 LOHMANN GMBH & CO. KG (GERMANY)

10.14 MACTAC LLC (U.S.)

10.15 JTAPE LTD. (U.K.)

10.16 DECOFIX PAPERS & TAPES (INDIA)

10.17 LINTEC CORPORATION (JAPAN)

10.18 SHURTAPE TECHNOLOGIES LLC (U.S.)

10.19 TAPE INDIA (INDIA)

10.20 VITS TECHNOLOGY GMBH (GERMANY)

10.21 OTHER ACTIVE PLAYERS.

Chapter 11: Global Filament Tapes Market By Region

11.1 Overview

11.2. North America Filament Tapes Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Filament Type

11.2.4.1 Single Sided Tapes

11.2.4.2 Double Sided Tapes

11.2.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.2.5.1 Plastic Film

11.2.5.2 Paper

11.2.5.3 Fabric

11.2.5.4 Foam

11.2.6 Historic and Forecasted Market Size By Adhesive Type

11.2.6.1 Rubber Based

11.2.6.2 Acrylic Based

11.2.6.3 Hot Melt Adhesive

11.2.7 Historic and Forecasted Market Size By Width

11.2.7.1 12 mm

11.2.7.2 18 mm

11.2.7.3 24 mm

11.2.7.4 36 mm

11.2.7.5 48 mm

11.2.7.6 72 mm

11.2.7.7 96 mm

11.2.8 Historic and Forecasted Market Size By Application

11.2.8.1 Bundling

11.2.8.2 Strapping

11.2.8.3 Insulation

11.2.8.4 Carton Sealing

11.2.8.5 Sealing

11.2.8.6 Others

11.2.9 Historic and Forecasted Market Size By End Use

11.2.9.1 Shipping and Logistics

11.2.9.2 Building and Construction

11.2.9.3 Food and Beverages

11.2.9.4 Electrical and Electronics

11.2.9.5 Automotive

11.2.9.6 Healthcare and Hygiene

11.2.9.7 Printing

11.2.9.8 Metalworking

11.2.9.9 Oil and Gas

11.2.9.10 General Industrial

11.2.9.11 Consumer Goods

11.2.9.12 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Filament Tapes Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Filament Type

11.3.4.1 Single Sided Tapes

11.3.4.2 Double Sided Tapes

11.3.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.3.5.1 Plastic Film

11.3.5.2 Paper

11.3.5.3 Fabric

11.3.5.4 Foam

11.3.6 Historic and Forecasted Market Size By Adhesive Type

11.3.6.1 Rubber Based

11.3.6.2 Acrylic Based

11.3.6.3 Hot Melt Adhesive

11.3.7 Historic and Forecasted Market Size By Width

11.3.7.1 12 mm

11.3.7.2 18 mm

11.3.7.3 24 mm

11.3.7.4 36 mm

11.3.7.5 48 mm

11.3.7.6 72 mm

11.3.7.7 96 mm

11.3.8 Historic and Forecasted Market Size By Application

11.3.8.1 Bundling

11.3.8.2 Strapping

11.3.8.3 Insulation

11.3.8.4 Carton Sealing

11.3.8.5 Sealing

11.3.8.6 Others

11.3.9 Historic and Forecasted Market Size By End Use

11.3.9.1 Shipping and Logistics

11.3.9.2 Building and Construction

11.3.9.3 Food and Beverages

11.3.9.4 Electrical and Electronics

11.3.9.5 Automotive

11.3.9.6 Healthcare and Hygiene

11.3.9.7 Printing

11.3.9.8 Metalworking

11.3.9.9 Oil and Gas

11.3.9.10 General Industrial

11.3.9.11 Consumer Goods

11.3.9.12 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Filament Tapes Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Filament Type

11.4.4.1 Single Sided Tapes

11.4.4.2 Double Sided Tapes

11.4.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.4.5.1 Plastic Film

11.4.5.2 Paper

11.4.5.3 Fabric

11.4.5.4 Foam

11.4.6 Historic and Forecasted Market Size By Adhesive Type

11.4.6.1 Rubber Based

11.4.6.2 Acrylic Based

11.4.6.3 Hot Melt Adhesive

11.4.7 Historic and Forecasted Market Size By Width

11.4.7.1 12 mm

11.4.7.2 18 mm

11.4.7.3 24 mm

11.4.7.4 36 mm

11.4.7.5 48 mm

11.4.7.6 72 mm

11.4.7.7 96 mm

11.4.8 Historic and Forecasted Market Size By Application

11.4.8.1 Bundling

11.4.8.2 Strapping

11.4.8.3 Insulation

11.4.8.4 Carton Sealing

11.4.8.5 Sealing

11.4.8.6 Others

11.4.9 Historic and Forecasted Market Size By End Use

11.4.9.1 Shipping and Logistics

11.4.9.2 Building and Construction

11.4.9.3 Food and Beverages

11.4.9.4 Electrical and Electronics

11.4.9.5 Automotive

11.4.9.6 Healthcare and Hygiene

11.4.9.7 Printing

11.4.9.8 Metalworking

11.4.9.9 Oil and Gas

11.4.9.10 General Industrial

11.4.9.11 Consumer Goods

11.4.9.12 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Filament Tapes Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Filament Type

11.5.4.1 Single Sided Tapes

11.5.4.2 Double Sided Tapes

11.5.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.5.5.1 Plastic Film

11.5.5.2 Paper

11.5.5.3 Fabric

11.5.5.4 Foam

11.5.6 Historic and Forecasted Market Size By Adhesive Type

11.5.6.1 Rubber Based

11.5.6.2 Acrylic Based

11.5.6.3 Hot Melt Adhesive

11.5.7 Historic and Forecasted Market Size By Width

11.5.7.1 12 mm

11.5.7.2 18 mm

11.5.7.3 24 mm

11.5.7.4 36 mm

11.5.7.5 48 mm

11.5.7.6 72 mm

11.5.7.7 96 mm

11.5.8 Historic and Forecasted Market Size By Application

11.5.8.1 Bundling

11.5.8.2 Strapping

11.5.8.3 Insulation

11.5.8.4 Carton Sealing

11.5.8.5 Sealing

11.5.8.6 Others

11.5.9 Historic and Forecasted Market Size By End Use

11.5.9.1 Shipping and Logistics

11.5.9.2 Building and Construction

11.5.9.3 Food and Beverages

11.5.9.4 Electrical and Electronics

11.5.9.5 Automotive

11.5.9.6 Healthcare and Hygiene

11.5.9.7 Printing

11.5.9.8 Metalworking

11.5.9.9 Oil and Gas

11.5.9.10 General Industrial

11.5.9.11 Consumer Goods

11.5.9.12 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Filament Tapes Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Filament Type

11.6.4.1 Single Sided Tapes

11.6.4.2 Double Sided Tapes

11.6.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.6.5.1 Plastic Film

11.6.5.2 Paper

11.6.5.3 Fabric

11.6.5.4 Foam

11.6.6 Historic and Forecasted Market Size By Adhesive Type

11.6.6.1 Rubber Based

11.6.6.2 Acrylic Based

11.6.6.3 Hot Melt Adhesive

11.6.7 Historic and Forecasted Market Size By Width

11.6.7.1 12 mm

11.6.7.2 18 mm

11.6.7.3 24 mm

11.6.7.4 36 mm

11.6.7.5 48 mm

11.6.7.6 72 mm

11.6.7.7 96 mm

11.6.8 Historic and Forecasted Market Size By Application

11.6.8.1 Bundling

11.6.8.2 Strapping

11.6.8.3 Insulation

11.6.8.4 Carton Sealing

11.6.8.5 Sealing

11.6.8.6 Others

11.6.9 Historic and Forecasted Market Size By End Use

11.6.9.1 Shipping and Logistics

11.6.9.2 Building and Construction

11.6.9.3 Food and Beverages

11.6.9.4 Electrical and Electronics

11.6.9.5 Automotive

11.6.9.6 Healthcare and Hygiene

11.6.9.7 Printing

11.6.9.8 Metalworking

11.6.9.9 Oil and Gas

11.6.9.10 General Industrial

11.6.9.11 Consumer Goods

11.6.9.12 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Filament Tapes Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Filament Type

11.7.4.1 Single Sided Tapes

11.7.4.2 Double Sided Tapes

11.7.5 Historic and Forecasted Market Size By Backing Adhesive Type

11.7.5.1 Plastic Film

11.7.5.2 Paper

11.7.5.3 Fabric

11.7.5.4 Foam

11.7.6 Historic and Forecasted Market Size By Adhesive Type

11.7.6.1 Rubber Based

11.7.6.2 Acrylic Based

11.7.6.3 Hot Melt Adhesive

11.7.7 Historic and Forecasted Market Size By Width

11.7.7.1 12 mm

11.7.7.2 18 mm

11.7.7.3 24 mm

11.7.7.4 36 mm

11.7.7.5 48 mm

11.7.7.6 72 mm

11.7.7.7 96 mm

11.7.8 Historic and Forecasted Market Size By Application

11.7.8.1 Bundling

11.7.8.2 Strapping

11.7.8.3 Insulation

11.7.8.4 Carton Sealing

11.7.8.5 Sealing

11.7.8.6 Others

11.7.9 Historic and Forecasted Market Size By End Use

11.7.9.1 Shipping and Logistics

11.7.9.2 Building and Construction

11.7.9.3 Food and Beverages

11.7.9.4 Electrical and Electronics

11.7.9.5 Automotive

11.7.9.6 Healthcare and Hygiene

11.7.9.7 Printing

11.7.9.8 Metalworking

11.7.9.9 Oil and Gas

11.7.9.10 General Industrial

11.7.9.11 Consumer Goods

11.7.9.12 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Filament Tapes Market Scope:

|

Global Filament Tapes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Billion |

|

Forecast Period 2024-32 CAGR: |

8.10% |

Market Size in 2032: |

USD 7.22 Billion |

|

Segments Covered: |

By Filament Type |

|

|

|

Backing Adhesive Type |

|

||

|

Adhesive Type |

|

||

|

Width |

|

||

|

Application |

|

||

|

End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

3M (U.S.), Nippon Industries (Japan), Gripking Tapes India Pvt. Ltd. (India), PPM Industries SpA (Italy), PIONEER CORPORATION (Japan), Szxinst (China), Ajit Industries Pvt. Ltd. (India), Nitto Denko Corporation (Japan), Tesa Tapes (Germany), AVERY DENNISON CORPORATION (U.S.), Scapa (U.K.), Lohmann GmbH & Co. Kg (Germany), Mactac, LLC (U.S.), JTAPE LTD. (U.K.), Decofix Papers & Tapes (India), LINTEC Corporation (Japan), Shurtape Technologies, LLC (U.S.), Tape India (India), VITS TECHNOLOGY GMBH (Germany), and Other Active Players .

The Filament Tapes Market is segmented into By Filament Type, Backing Adhesive Type, Adhesive Type, Width, Application, End Use and region. By Filament Type (Single Sided Tapes, Double Sided Tapes), Backing Adhesive Type (Plastic Film, Paper, Fabric, Foam), Adhesive Type (Rubber Based, Acrylic Based, Hot Melt Adhesive), Width (12 mm, 18 mm, 24 mm, 36 mm, 48 mm, 72 mm, 96 mm), Application (Bundling, Strapping, Insulation, Carton Sealing, Sealing, Others), End Use (Shipping and Logistics, Building and Construction, Food and Beverages, Electrical and Electronics, Automotive, Healthcare and Hygiene, Printing, Metalworking, Oil and Gas, General Industrial, Consumer Goods, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Filament tapes, also known as strapping tapes, are specialized adhesive tapes reinforced with embedded filaments, typically made of fiberglass or polyester. These filaments provide exceptional tensile strength, making the tape ideal for bundling, securing, or reinforcing heavy loads and packages. The adhesive used in filament tapes is often pressure-sensitive, ensuring strong adhesion to various surfaces while being resistant to splitting or tearing. Commonly used in industries like shipping, construction, and manufacturing, filament tapes are valued for their durability, reliability, and ability to withstand stress in demanding applications.

Filament Tapes Market Size Was Valued at USD 3.87 Billion in 2023, and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 8.10% from 2024-2032.