Fluid Transfer System For Electric And Hybrid Vehicle Market Global Market Synopsis

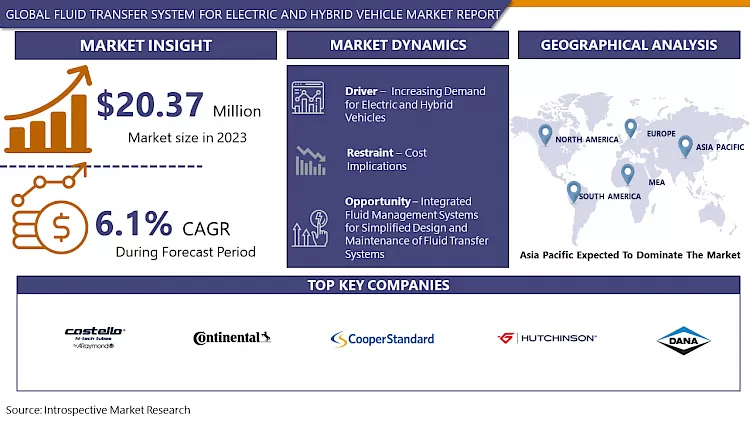

The Fluid Transfer System for the Electric and Hybrid Vehicle market estimated at USD 20.37 Billion in the year 2023, is projected to reach a revised size of USD 34.71 Billion by 2032, growing at a CAGR of 6.1% over the analysis period 2024-2032

- The hydraulic systems of hybrid electric vehicles are designed to control the flow of fluids including coolant, hydraulic fluid, and transmission oil in the vehicle. This is done in order to ensure proper temperature control as well as the efficiency of sub-systems which would increase productivity and efficiency using technologies such as electric pumps and electro-hydraulic valves.

- A steady growth of the global market for fluid transfer systems in electric and hybrid cars can be attributed to the expanding use of electric and hybrid cars all around the world. These systems are the backbone of all these operations, providing cooling for the batteries, electric motors, and power electronics among others. The growth of environmental awareness and stricter emission regulations result in automakers investing more in electric and hybrid vehicles consequently paving the way for the growing demand of fluid transfer systems.

- The technological progress in fluid transport, including lightweight materials and enhanced thermal management, is one of the major driving forces of this market. Apart from that, it is expected that the expanding electric vehicle infrastructure and government incentives for electric vehicle adopting will propel the market in the coming years. Nevertheless, the significant initial costs and the lack of reliability of fluid transfer mechanisms could hamper the market growth to a limited extent.

- The fluid transfer systems market for fully electric and hybrid vehicles is experiencing a switch towards the use of more energy-efficient and eco-friendly solutions. The manufacturers are increasingly putting a focus on R&D to produce fluid transfer technologies that help enhance vehicle performance while minimizing the environmental footprint. These can be exemplified by the creation leak-proof and corrosion-resistant materials, as well as the inclusion of smart sensors and controls for real-time monitoring and optimum fluid flow.

- The partnerships of automakers and fluid transfer system suppliers are fostering new products and standards across the industry, including a common shipment of vehicle models and components. Seeing as the demand for electric and hybrid cars is on the rise, which is driven by environmental sustainability issues and air quality concerns, the fluid transfer system market is heading towards expansion. On the other hand, the market vendors should face the issues of cost-effectiveness and scalability in order to exploit the available opportunities in this constantly shifting sector.

Fluid Transfer System For Electric And Hybrid Vehicle Market Trend Analysis

Increased Adoption of Lightweight Materials

- The main trend in this market is related to the use of lightweight materials in fluid transfer systems for electric and hybrid vehicles due to the need for higher performance and efficiency. Lighter materials such as aluminum, titanium, and a vast range of composites have benefits which include reduction of the overall vehicle weight, improved fuel efficiency, and increased range for electric vehicles.

- · The materials used display excellent corrosion resistance and durability with lifespan reliability of the fluid transfer systems in automobiles. The tendency of the automotive sector in achieving sustainability and emission reduction is going to lead to an increase in demand for electric and hybrid vehicles, which will in turn promote the use of lightweight materials in the fluid systems to maintain the tough regulatory requirements and consumer tastes. The change testifies to a radical change in automotive design and manufacturing towards more modern and green alternatives.

Integrated Fluid Management Systems with the Design and Maintenance Made Easy

- Implementing integrated fluid management systems provides a comprehensive solution to the fluid design and maintenance issues arising in electric and hybrid vehicles. Through combining different fluids into one system manufacturers can simplify designing and maintenance needs. This integrated approach increase the efficiency while reduce the complexity as well as the risk of possible failures or leaks. With the electric and hybrid vehicle market on the fast track, where lightness and compactness are the key issues, the integrated fluid management systems have an attractive edge. These sophisticated systems allow for better vehicles performance and reliability but also follow the strict safety and governmental regulations of the automotive industry.

- These systems are not only useful for streamlining the design and maintenance but they offer great benefits in terms of performance and sustainability in the electric and hybrid vehicles market. This integrated system of fluid components including cooling, lubricating, and power steering systems, maximizes the available space in the vehicle design. This is especially important for electric and hybrid vehicles in which every gram of weight and cubic centimeter of space matters to extend the range and enhance efficiency in total.

- The consolidating of fluid systems reduces the number of possible failure points, thus increases vehicle reliability and safety. In addition, integrated fluid management systems will simplify upgrades and modifications, thus providing manufacturers with the capacity to react to technological advancements and customers' preferences more quickly. The evolution of fluid management systems will keep pace with the rise in demand for electric and hybrid vehicles and will increasingly drive innovation while pushing the sustainability of transportation forward..

Fluid Transfer System for Electric and Hybrid Vehicle Market Market Segment Analysis:

Fluid Transfer System for Electric and Hybrid Vehicle Market Segmented based on System, Vehicle Type and Battery.

By System , Transmission Oil Cooling Lines segment is expected to dominate the market during the forecast period

- Air Suspension Lines: These lines are part of the air suspension system that helps to control vehicle height through control of air pressure in the suspension components.

- Brake Lines: Hydraulic brake lines are responsible for transmitting pressure from the brake master cylinder to the brake calipers or wheel cylinders, which ultimately lead in to proper braking.

- AC Lines: AC lines are responsible to make refrigerant transfer from the AC system components including the compressor, condenser, evaporator, and expansion valve.

- Transmission Oil Cooling Lines: These lines are the transmission cooling system part and assist in controlling the temperature of the transmission fluid to avoid overheating and to guarantee the transmission operation is smooth.

- Coolant Lines: Cooling lines carry coolant throughout the engine including the radiator, heater core, and other parts to moderate engine temperature and avoid overheating.

- Other: In this category are included many other fluid transfer parts for example power steering lines, fuel lines, washer fluid lines, etc. which depend on the design and configuration of the vehicle.

By Vehicle Type, Battery Electric Vehicle (BEV) segment is expected to dominate the market during the forecast period

- Plug-in Hybrid Vehicle (PHEV): PHEVs feature an internal combustion engine, electric motor and battery pack all in one. The PCU in PHEVs needs to balance the power flow among the engine, electric motor, and battery system while maximizing efficiency and performance. Demand for PCUs in PHEVs is affected by factors including the government regulations, consumers’ desire for the hybrid technology, and charging infrastructure availability.

- Battery Electric Vehicle (BEV): BEVs are the vehicles that are solely dependent on electric power which is stored in a battery pack, for propulsion. The PCU in BEVs performs a significant function in the activity of power distribution, motor control and energy regeneration. The BEV PCU must have high efficiency in order to maximize the driving range and performance, and thus the power electronics and thermal management advances are indispensable.

- Hybrid Electric Vehicle (HEV): HEVs employ both the internal combustion engine and the electric motor, yet unlike the PHEVs, they do not plug in for recharging. The PCUs in HEVs are the components that ensure a smooth shift from electric to combustion modes, thus maximizing the efficiency in terms of fuel consumption and emissions levels. HEV PCUs nearly always strive for lightweight design and small size in order to accommodate performance requirements and limited space.

Fluid Transfer System for Electric and Hybrid Vehicle Market Regional Insights:

Asia Pacific is the largest marketplace for fluid transfer systems in electric and hybrid vehicles.

- The Asia Pacific region has been a driving force behind the market for fluid transfer systems in electrical and hybrid vehicles. As a result of the combination of advanced technology, robust manufacturing capabilities and a developing automotive industry, countries in the region are at the cutting edge of the design and production sector in automotive. Nations such as Japan, South Korea, and China have emerged as key market players due to major automotive manufacturers investing heavily in research and development, focusing on improving the effectiveness and performance of fluid transfer systems. This monopoly has its base on the sustainable mobility solution promotion by the region leading to adoption of electric and hybrid vehicles which in turn generate demand for the related parts. While the global automotive industry veers towards electrification, the Asia Pacific region's position in the field of fluid transfer systems is in no danger of changing. This evolution of automotive technology will shape the world's sustainability in the future.

- Technological competitiveness and production capacity are crucial factors for the Asia-Pacific region, which is supported by a conducive ecosystem comprising government initiatives, favorable policies, and strategic partnerships. Governments are implementing the stringent emission regulations and providing incentives to encourage the utilization of electric and hybrid vehicles. Consequently, investors are attracted to related technologies such as fluid transfer systems.

Active Key Players in the Fluid Transfer System for Electric and Hybrid Vehicle Market Market

- AKWEL

- Castello Italia SpA

- ContiTech AG

- Cooper Standard

- Gates Corporation

- Hutchinson SA

- Kongsberg Automotive

- Lander Automotive LTD

- TI Fluid Systems

- Continental AG

- Robert Bosch GmbH

- Dana Incorporated

- Delphi Technologies

- Eaton Corporation

- Aptiv PLC

- BorgWarner Inc.

- Magna International Inc.

- Mahle GmbH

- Schaeffler AG

- Valeo SA

- Yazaki Corporation

- Freudenberg Sealing Technologies

- Saint-Gobain

- Trelleborg AB

- Sumitomo Riko Company Limited

- Tristone Flowtech Holding SA

- Other key player

Key Industry Developments in the Electric Vehicle Power Control Unit Market:

- In August 2023, Lander Tubular Products entered into a strategic partnership with In-Comm Training Services Ltd. (UK). The relationship will cover all recruitment and selection, advice on tapping into funding, and induction process and training, with In-Comm trainers and assessors set to be permanently based at Lander Tubular Products’ internal academy at its Woodgate Business Park factory in Birmingham.

- In March 2023, Kongsberg Automotive secured a contract to supply a fluid transfer system to a Tier 1 automotive supplier in North America. The company’s FTS unit will supply the Fluoro-Comp hoses and stainless-steel braided polytetrafluoroethylene brake lines over 4 years.

|

Global Fluid Transfer System for Electric and Hybrid Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 34.71 Bn. |

|

Segments Covered: |

By System |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Trends : |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

Integrated Fluid Management Systems for Simplified Design and Maintenance of Fluid Transfer Systems |

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fluid Transfer System for Electric and Hybrid Vehicle Market by By System (2018-2032)

4.1 Fluid Transfer System for Electric and Hybrid Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Air Suspension Lines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Brake Lines

4.5 AC Lines

4.6 Transmission Oil Cooling Lines

4.7 Coolant Lines

4.8 Other

Chapter 5: Fluid Transfer System for Electric and Hybrid Vehicle Market by By Vehicle Type (2018-2032)

5.1 Fluid Transfer System for Electric and Hybrid Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Plug-in Hybrid Vehicle (PHEV)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Battery Electric Vehicle (BEV)

5.5 Hybrid Electric Vehicle (HEV))

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Fluid Transfer System for Electric and Hybrid Vehicle Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DELPHI TECHNOLOGIES

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SIEMENS AG

6.4 BOSCH

6.5 INFINEON TECHNOLOGIES AG

6.6 LEAR CORPORATION

6.7 PANASONIC CORPORATION

6.8 MITSUBISHI ELECTRIC CORPORATION

6.9 DELTA ELECTRONICS

6.10 SIGNET SYSTEMS INC.

6.11 SCHNEIDER ELECTRIC

6.12 BORGWARNER INCALFANAR GROUP

6.13 POWELL INDUSTRIES

6.14 KIRLOSKAR ELECTRIC COMPANY

6.15 BELL POWER SOLUTION

6.16 BRUSA ELEKTRONIK AG

6.17 CURRENT WAYS INCEATON CORPORATION

6.18 STERCOM POWER SOLUTIONS GMBH

6.19 STMICROELECTRONICS

6.20 INNOLECTRIC AG

6.21 AVID TECHNOLOGY LIMITED

6.22 FICOSA INTERNATIONAL SA

6.23 TOYOTA INDUSTRIES CORPORATION

6.24 XEPICS ITALIA SRL

6.25 OTHER KEY PLAYERS

Chapter 7: Global Fluid Transfer System for Electric and Hybrid Vehicle Market By Region

7.1 Overview

7.2. North America Fluid Transfer System for Electric and Hybrid Vehicle Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By System

7.2.4.1 Air Suspension Lines

7.2.4.2 Brake Lines

7.2.4.3 AC Lines

7.2.4.4 Transmission Oil Cooling Lines

7.2.4.5 Coolant Lines

7.2.4.6 Other

7.2.5 Historic and Forecasted Market Size By By Vehicle Type

7.2.5.1 Plug-in Hybrid Vehicle (PHEV)

7.2.5.2 Battery Electric Vehicle (BEV)

7.2.5.3 Hybrid Electric Vehicle (HEV))

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Fluid Transfer System for Electric and Hybrid Vehicle Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By System

7.3.4.1 Air Suspension Lines

7.3.4.2 Brake Lines

7.3.4.3 AC Lines

7.3.4.4 Transmission Oil Cooling Lines

7.3.4.5 Coolant Lines

7.3.4.6 Other

7.3.5 Historic and Forecasted Market Size By By Vehicle Type

7.3.5.1 Plug-in Hybrid Vehicle (PHEV)

7.3.5.2 Battery Electric Vehicle (BEV)

7.3.5.3 Hybrid Electric Vehicle (HEV))

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Fluid Transfer System for Electric and Hybrid Vehicle Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By System

7.4.4.1 Air Suspension Lines

7.4.4.2 Brake Lines

7.4.4.3 AC Lines

7.4.4.4 Transmission Oil Cooling Lines

7.4.4.5 Coolant Lines

7.4.4.6 Other

7.4.5 Historic and Forecasted Market Size By By Vehicle Type

7.4.5.1 Plug-in Hybrid Vehicle (PHEV)

7.4.5.2 Battery Electric Vehicle (BEV)

7.4.5.3 Hybrid Electric Vehicle (HEV))

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Fluid Transfer System for Electric and Hybrid Vehicle Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By System

7.5.4.1 Air Suspension Lines

7.5.4.2 Brake Lines

7.5.4.3 AC Lines

7.5.4.4 Transmission Oil Cooling Lines

7.5.4.5 Coolant Lines

7.5.4.6 Other

7.5.5 Historic and Forecasted Market Size By By Vehicle Type

7.5.5.1 Plug-in Hybrid Vehicle (PHEV)

7.5.5.2 Battery Electric Vehicle (BEV)

7.5.5.3 Hybrid Electric Vehicle (HEV))

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Fluid Transfer System for Electric and Hybrid Vehicle Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By System

7.6.4.1 Air Suspension Lines

7.6.4.2 Brake Lines

7.6.4.3 AC Lines

7.6.4.4 Transmission Oil Cooling Lines

7.6.4.5 Coolant Lines

7.6.4.6 Other

7.6.5 Historic and Forecasted Market Size By By Vehicle Type

7.6.5.1 Plug-in Hybrid Vehicle (PHEV)

7.6.5.2 Battery Electric Vehicle (BEV)

7.6.5.3 Hybrid Electric Vehicle (HEV))

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Fluid Transfer System for Electric and Hybrid Vehicle Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By System

7.7.4.1 Air Suspension Lines

7.7.4.2 Brake Lines

7.7.4.3 AC Lines

7.7.4.4 Transmission Oil Cooling Lines

7.7.4.5 Coolant Lines

7.7.4.6 Other

7.7.5 Historic and Forecasted Market Size By By Vehicle Type

7.7.5.1 Plug-in Hybrid Vehicle (PHEV)

7.7.5.2 Battery Electric Vehicle (BEV)

7.7.5.3 Hybrid Electric Vehicle (HEV))

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Fluid Transfer System for Electric and Hybrid Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 34.71 Bn. |

|

Segments Covered: |

By System |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Trends : |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

Integrated Fluid Management Systems for Simplified Design and Maintenance of Fluid Transfer Systems |

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fluid Transfer System for Electric and Hybrid Vehicle Market research report is 2024-2032.

AKWEL, Castello Italia SpA, ContiTech AG, Cooper Standard, Gates Corporation, Hutchinson SA, Kongsberg Automotive, Lander Automotive LTD TI Fluid Systems, Continental AG , Robert Bosch GmbH, Other Major Players.

The Fluid Transfer System for the Electric and Hybrid Vehicle Market is segmented into By Vehicle Type, By System, and Region. By Vehicle Type, the market is categorized into Plug-in Hybrid Vehicle (PHEV), Battery Electric Vehicle (BEV), and Hybrid Electric Vehicle (HEV). By System, the market is categorized into Air Suspension Lines, Brake Lines, AC Lines, Transmission Oil Cooling Lines, Coolant Lines, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc

A Fluid Transfer System for Electric and Hybrid Vehicles manages the flow of fluids like coolant, hydraulic fluids, and transmission fluids within the vehicle. It ensures optimal temperatures and smooth operation of subsystems, enhancing efficiency and performance. Utilizing technologies like electric pumps and valves, it maximizes energy efficiency while maintaining the vehicle's functionality.

The Fluid Transfer System for the Electric and Hybrid Vehicle market estimated at USD 20.37 Billion in the year 2023, is projected to reach a revised size of USD 34.71 Billion by 2032, growing at a CAGR of 6.1% over the analysis period 2024-2032