Food Desiccants Market Overview:

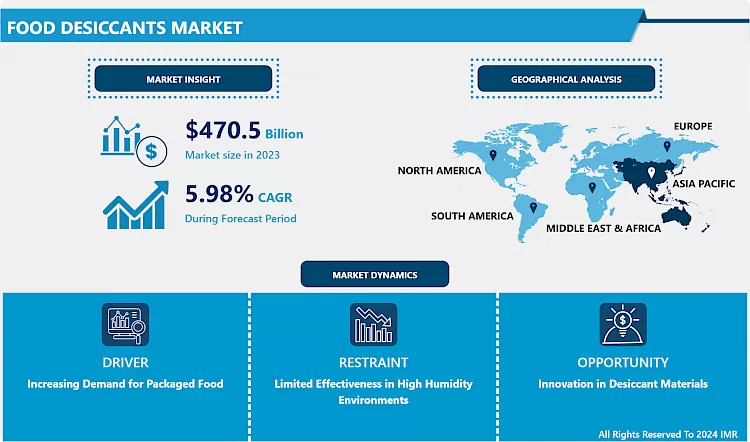

Global Food Desiccants Market size is expected to grow from USD 470.5 Billion in 2023 to USD 790.86 Billion by 2032, at a CAGR of 5.94% during the forecast period (2024-2032).

Food desiccants are moisture-absorbing substances used in food packaging to prevent moisture-related issues like mold, spoilage, and staleness. Comprising materials like silica gel or clay, these desiccants act as humidity regulators, preserving the freshness and quality of packaged food products during storage and transportation.

- Food desiccants offer several advantages in the preservation and packaging of food products. They effectively absorb moisture, preventing the growth of mold and bacteria that can lead to spoilage. Maintaining a dry environment, desiccants help preserve the texture, flavor, and nutritional quality of packaged foods, ultimately extending their shelf life. Food desiccants are crucial for products prone to moisture-related degradation, such as grains, cereals, snacks, and certain baked goods.

- By reducing humidity, they inhibit bacterial growth and maintain the food's texture, flavor, and nutritional content. Commonly available in sachets, canisters, or integrated into packaging, food desiccants play a vital role in extending the shelf life of various food items, ensuring they reach consumers in optimal condition for consumption.

- The Food Desiccants Market is witnessing a huge rise in increased awareness of food quality and safety. As consumers demand products with extended shelf life and better sensory attributes, the use of desiccants has become integral in various food packaging applications. The market is experiencing a flow of innovative packaging solutions that integrate desiccants seamlessly, providing enhanced protection without compromising convenience. Furthermore, the market is shifting towards online retail has created opportunities for the sale of individual desiccant products to consumers for home use. The Food Desiccants Market is growing towards eco-friendly materials and versatile packaging designs to meet growing consumer preferences for convenient, sustainable packaging and stringent food safety regulations.

Food Desiccants Market Trend Analysis:

Increasing Demand for Packaged Food

- The increasing demand for packaged food is an important factor in the Food Desiccants Market, due to changing consumer lifestyles and preferences. As urbanization accelerates and more people lead busy lives, there is a growing dependence on convenient, ready-to-eat, and packaged food products. Consumers pursue foods that are not only convenient but also have an extended shelf life, ensuring freshness over time. This trend is particularly obvious in developing economies where the adoption of packaged foods has surged.

- Packaging plays a crucial role in preserving the quality and safety of these packaged food items. Moisture, a common rival, can lead to spoilage, mold growth, and a decline in product quality. The Food Desiccants Market is experiencing a growth in demand due to their ability to absorb moisture, maintain food integrity, and preserve taste, texture, and nutritional value. As global food preferences continue to rise, the demand for desiccants is expected to remain strong.

Innovation in Desiccant Materials

- Innovation in desiccant materials creates a crucial opportunity in the Food Desiccants Market, as it enables the development of more effective, sustainable, and versatile solutions. The growth of the Market focuses on environmentally friendly and biodegradable packaging materials evolving consumer preferences and regulatory demands. The opportunity lies in researching and developing desiccant materials that efficiently absorb moisture, preserve food quality, and align with sustainability. Manufacturers are exploring innovative materials that offer enhanced moisture control while minimizing the environmental impact of packaging.

- Innovative desiccant materials address specific challenges exhibited by diverse food products. Customized materials for fresh produce and dry goods can optimize preservation processes, ensuring desiccants can adapt to different food requirements. These new processes will enhance their effectiveness and applicability across various products. Companies in the Food Desiccants Market can meet market demands and position themselves at the forefront of a sustainable and dynamic packaging industry by seizing the opportunity to innovate in desiccant materials.

Food Desiccants Market Segment Analysis:

Food Desiccants Market Segmented based on Product Type, Packaging Type, Application and Distribution Channel

By Product Type, Silica Gel segment is expected to dominate the market during the forecast Period

- Silica gel stands out for its exceptional moisture-absorbing capabilities, making it a preferred choice for preserving the freshness and quality of various food products. Its high efficiency, cost-effectiveness, and versatility contribute to its widespread adoption across the food packaging industry. Silica gel can operate efficiently over a broad temperature range, ensuring consistent moisture control in diverse storage conditions.

- The adaptability of silica gel to different packaging types, such as sachets, canisters, and bulk packaging, enhances its versatility and applicability across a wide range of food items. As consumer awareness of the importance of moisture control in food preservation grows, the Silica Gel segment is expected to maintain its dominance, offering an effective and reliable solution for extending the shelf life and ensuring the overall quality of packaged food products.

Food Desiccants Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the food desiccants market due to rising disposable incomes and busy lifestyles. Processed foods, reliant on desiccants, cater to the growing preference for convenient, shelf-stable options while maintaining quality and freshness, making them crucial for the market. The Region is focused on food safety due to increased awareness of foodborne illnesses and stricter regulations are compelling food producers to prioritize hygiene and preservation. Desiccants play a pivotal role in inhibiting moisture and microbial growth, extending shelf life, and ensuring food safety.

- The changing consumer preferences towards convenience are driving the demand for ready-to-eat meals, snacks, and other convenient food items, with desiccants facilitating their production and storage. The booming cold chain infrastructure in the region is also contributing significantly. The expansion of cold chain networks enables the efficient distribution of temperature-sensitive food products, and desiccants play a crucial role in managing moisture within these systems, minimizing spoilage, and ensuring product quality throughout the supply chain. Governmental initiatives focused on food security and promoting agricultural exports make straight with the benefits of desiccants in minimizing food waste and enhancing export competitiveness.

Key Players Covered in Food Desiccants Market:

- Drytech Inc. (USA)

- Interra Global (USA)

- Sorbent Systems (USA)

- Multisorb (USA)

- WidgetCo (USA)

- Desiccare Inc. (USA)

- AGM Container Controls (USA)

- IMPAK Corporation (USA)

- GeeJay Chemicals (United Kingdom)

- Absortech (Sweden)

- Sorbead India (India), and Other Major Players

Key Industry Developments in the Food Desiccants Market:

- In June 2023, Clariant introduced Desi Pak ECO, a plastic-free, bio-based desiccant solution, further advancing its sustainability initiatives. Made from responsibly-mined natural clay, these eco-friendly moisture-adsorbing packets effectively protect sealed packaged goods, such as nutraceuticals and foods, from moisture damage. Desi Pak ECO contributes to reducing carbon emissions associated with packaging production and transportation, offering an environmentally-conscious alternative for various applications.

- In May 2024, Sorbead India and Swambe Chemicals declared their merger, creating Sorbchem India Private Limited. By merging their expertise and industry knowledge, two leading companies come together to provide enhanced desiccant and adsorbent solutions under one brand.

|

Food Desiccants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 470.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.94% |

Market Size in 2032: |

USD 790.86 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Desiccants Market by By Product Type (2018-2032)

4.1 Food Desiccants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Clay Desiccants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Silica Gel

4.5 Activated Carbon

Chapter 5: Food Desiccants Market by By Packaging Type (2018-2032)

5.1 Food Desiccants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sachets/Pouches

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Canisters

5.5 Bulk Packaging

Chapter 6: Food Desiccants Market by By Application (2018-2032)

6.1 Food Desiccants Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Processed Foods

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Bakery and Confectionery

6.5 Dried Fruits and Nuts

Chapter 7: Food Desiccants Market by By Distribution Channel (2018-2032)

7.1 Food Desiccants Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Online Retail

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Offline Retail

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Food Desiccants Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SIGMA-ALDRICH (MERCK) – (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TCI CHEMICALS – (JAPAN)

8.4 SANTA CRUZ BIOTECHNOLOGY – (UNITED STATES)

8.5 ALFA AESAR – (UNITED STATES)

8.6 THERMO FISHER SCIENTIFIC – (UNITED STATES)

8.7 ABCAM – (UNITED KINGDOM)

8.8 TORONTO RESEARCH CHEMICALS – (CANADA)

8.9 BOC SCIENCES – (UNITED STATES/CHINA)

8.10 LGC STANDARDS – (UNITED KINGDOM)

8.11 ARK PHARM INC. – (UNITED STATES)

8.12 OTHERS

Chapter 9: Global Food Desiccants Market By Region

9.1 Overview

9.2. North America Food Desiccants Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Clay Desiccants

9.2.4.2 Silica Gel

9.2.4.3 Activated Carbon

9.2.5 Historic and Forecasted Market Size By By Packaging Type

9.2.5.1 Sachets/Pouches

9.2.5.2 Canisters

9.2.5.3 Bulk Packaging

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Processed Foods

9.2.6.2 Bakery and Confectionery

9.2.6.3 Dried Fruits and Nuts

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Online Retail

9.2.7.2 Offline Retail

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Food Desiccants Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Clay Desiccants

9.3.4.2 Silica Gel

9.3.4.3 Activated Carbon

9.3.5 Historic and Forecasted Market Size By By Packaging Type

9.3.5.1 Sachets/Pouches

9.3.5.2 Canisters

9.3.5.3 Bulk Packaging

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Processed Foods

9.3.6.2 Bakery and Confectionery

9.3.6.3 Dried Fruits and Nuts

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Online Retail

9.3.7.2 Offline Retail

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Food Desiccants Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Clay Desiccants

9.4.4.2 Silica Gel

9.4.4.3 Activated Carbon

9.4.5 Historic and Forecasted Market Size By By Packaging Type

9.4.5.1 Sachets/Pouches

9.4.5.2 Canisters

9.4.5.3 Bulk Packaging

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Processed Foods

9.4.6.2 Bakery and Confectionery

9.4.6.3 Dried Fruits and Nuts

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Online Retail

9.4.7.2 Offline Retail

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Food Desiccants Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Clay Desiccants

9.5.4.2 Silica Gel

9.5.4.3 Activated Carbon

9.5.5 Historic and Forecasted Market Size By By Packaging Type

9.5.5.1 Sachets/Pouches

9.5.5.2 Canisters

9.5.5.3 Bulk Packaging

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Processed Foods

9.5.6.2 Bakery and Confectionery

9.5.6.3 Dried Fruits and Nuts

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Online Retail

9.5.7.2 Offline Retail

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Food Desiccants Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Clay Desiccants

9.6.4.2 Silica Gel

9.6.4.3 Activated Carbon

9.6.5 Historic and Forecasted Market Size By By Packaging Type

9.6.5.1 Sachets/Pouches

9.6.5.2 Canisters

9.6.5.3 Bulk Packaging

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Processed Foods

9.6.6.2 Bakery and Confectionery

9.6.6.3 Dried Fruits and Nuts

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Online Retail

9.6.7.2 Offline Retail

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Food Desiccants Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Clay Desiccants

9.7.4.2 Silica Gel

9.7.4.3 Activated Carbon

9.7.5 Historic and Forecasted Market Size By By Packaging Type

9.7.5.1 Sachets/Pouches

9.7.5.2 Canisters

9.7.5.3 Bulk Packaging

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Processed Foods

9.7.6.2 Bakery and Confectionery

9.7.6.3 Dried Fruits and Nuts

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Online Retail

9.7.7.2 Offline Retail

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Food Desiccants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 470.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.94% |

Market Size in 2032: |

USD 790.86 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Food Desiccants Market research report is 2024-2032.

Drytech Inc. (USA), Interra Global (USA), Sorbent Systems (USA), Multisorb (USA), WidgetCo (USA), Desiccare Inc. (USA), AGM Container Controls (USA), IMPAK Corporation (USA) , GeeJay Chemicals (United Kingdom), Absortech (Sweden), Sorbead India (India), and Other Major Players.

The Food Desiccants Market is segmented into Product Type, Packaging Type, Application, Distribution Channel, and region. By Product Type, the market is categorized into Clay Desiccants, Silica Gel, and Activated Carbon. By Packaging Type, the market is categorized into Sachets/Pouches, Canisters, and Bulk Packaging. By Application, the market is categorized into Processed Foods, Bakery and Confectionery, and Dried Fruits and Nuts. By Distribution Channel, the market is categorized into Online Retail and Offline Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food desiccants are moisture-absorbing substances used in food packaging to prevent moisture-related issues like mold, spoilage, and staleness. Comprising materials like silica gel or clay, these desiccants act as humidity regulators, preserving the freshness and quality of packaged food products during storage and transportation.

Global Food Desiccants Market size is expected to grow from USD 470.5 Billion in 2023 to USD 790.86 Billion by 2032, at a CAGR of 5.94% during the forecast period (2024-2032).