Fungicide Market Synopsis

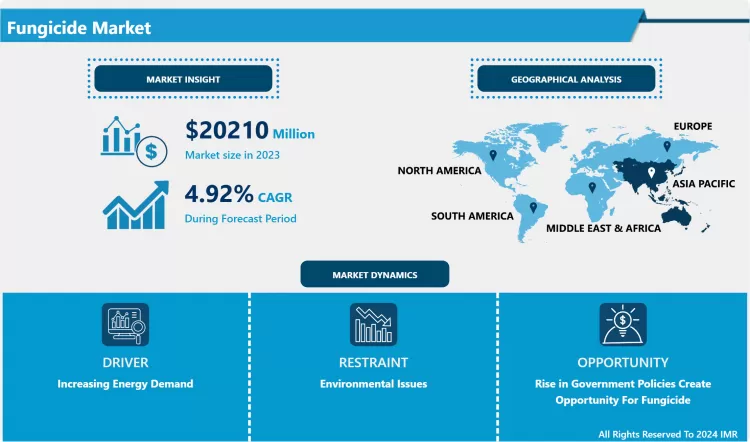

Fungicide Market Size Was Valued at USD 20210 Million in 2023, and is Projected to Reach USD 31140 Million by 2032, Growing at a CAGR of 4.92% From 2024-2032.

Fungicides are substances, either biological or chemical, that stop the growth of fungus or its spores. Contemporary fungicides merely stop the growth of fungus for a few days or weeks; they do not kill them. In agriculture, fungi can do significant harm, leading to significant losses in productivity, quality, and profit. Fungicides are applied to animals to combat fungal illnesses as well as in agriculture. Fungicides are chemicals that are used to suppress oomycetes, which are not fungi but infect plants using the same mechanisms as fungus.

- Genetic advancement, biotechnologies, and improved cropping technologies have all been brought about by the numerous changes in agricultural systems. In recent decades, there has been a noticeable increase in the significance of fungicide, driven by the need to increase agricultural productivity and ensure a sufficient supply of food for the growing global population. It is projected that the need for agrochemicals, particularly fungicide, would rise as new farming methods and policies are widely adopted by government agencies.

- Many developments in agricultural systems have resulted in advances in biotechnologies, enhanced farming technologies, and genetics. The necessity to boost agricultural production and provide an adequate supply of food for the expanding global population has led to a discernible growth in the significance of fungicide in recent decades.

- As new farming practices and laws are extensively embraced by government agencies, it is anticipated that the requirement for agrochemicals particularly fungicide will increase. Furthermore, the plant protection product market is changing, and this is not supported by the more challenging and bothersome use of bio-fungicide or the expensive registration process. But overuse of fungicide endangers human health and the environment, encourages pesticide resistance, and negatively affects ecosystem biodiversity.

- The use of plant protection chemicals is typically associated with a higher risk of developing health issues, including cancer and other diseases that affect the skin, gastrointestinal tract, brain system, respiratory system, reproductive system, and endocrine system, among others. The market for chemical fungicides is still growing if farmers are unwilling to employ non-chemical alternatives.

Fungicide Market Trend Analysis

Climate change increasing disease infestation in crops

- Climate change is becoming a significant driver of disease infestation in crops, which in turn is fueling the growth of the global fungicide market. As global temperatures rise, weather patterns become more erratic, and extreme weather events like floods, droughts, and heatwaves increase in frequency. These shifts create favorable conditions for the spread of crop diseases caused by fungi, such as rusts, mildews, and blights. Fungi thrive in warmer and more humid environments, making plants more susceptible to infestation. Prolonged periods of wet conditions, for instance, can lead to an increase in fungal spore production and rapid disease propagation across vast agricultural areas.

- Additionally, higher levels of atmospheric CO2 can exacerbate plant stress, making crops more vulnerable to infections. Changing temperatures and shifting growing seasons have also enabled the migration of fungal pathogens to new regions, infecting crops that previously had no exposure to these diseases. For farmers, these evolving challenges require more aggressive and targeted disease management strategies, driving increased demand for fungicides.

Rising demand for biological fungicide

- The rising demand for biological fungicides presents a significant growth opportunity for the global fungicide market. Biological fungicides, derived from natural sources like bacteria, fungi, and plant extracts, are gaining popularity due to their environmentally friendly and sustainable nature. As concerns over chemical residues and environmental damage intensify, consumers, farmers, and regulators increasingly shift toward eco-friendly alternatives. The growing focus on organic farming and sustainable agriculture further fuels the demand for biological fungicides. They not only control fungal diseases in crops but also improve soil health, promoting long-term agricultural productivity.

- One of the key drivers behind this trend is the increasing global awareness of food safety and the negative impact of synthetic chemicals on both human health and ecosystems. Consumers are now more conscious of the chemicals used in food production, prompting farmers to adopt biological fungicides to meet organic certification standards. Additionally, governments worldwide are enforcing stricter regulations on the use of chemical pesticides, which paves the way for biological fungicides as a safer and more compliant alternative.

- Moreover, advancements in biotechnology and microbial research are enhancing the efficacy and reliability of biological fungicides, making them a viable option for both large-scale commercial farming and small-scale organic agriculture. Companies in the agricultural sector are investing in research and development to formulate new and improved biological fungicide solutions. As these products gain wider acceptance and regulatory support, the fungicide market is expected to see robust growth, with biological fungicides capturing an increasing share.

Fungicide Market Segment Analysis:

Fungicide market is segmented on the basis of Type, Form, Mode of Application, Crop type, and Distribution.

By Type, Biochemical Segment Is Expected to Dominate the Market During the Forecast Period

- The biochemical segment is expected to dominate the fungicide marketduring the forecast period. Biochemical fungicides, which include naturally occurring substances like plant extracts, microbial-derived compounds, and organic acids, are increasingly preferred over synthetic chemical fungicides. This shift is driven by growing consumer demand for organic and sustainable agricultural practices, as well as stricter regulations on the use of synthetic chemicals in many countries.

- Biochemical fungicides offer a safer alternative, minimizing the negative environmental and health impacts associated with synthetic fungicides. They are often less toxic to non-target organisms, including beneficial insects, and reduce the risk of pesticide residues in crops, making them ideal for integrated pest management (IPM) programs. Additionally, many biochemical fungicides have novel modes of action that help in managing fungicide resistance, a major challenge in controlling plant diseases.

- The increasing adoption of organic farming, particularly in developed markets like North America and Europe, further boosts the demand for biochemical fungicides. As a result, manufacturers are investing in the development of more efficient and effective biochemical solutions, positioning this segment to play a dominant role in the fungicide market's future growth.

By Application, Seed Treatment Segment Held the Largest Share In 2023

- In the global fungicide market, the seed treatment segment has consistently held the largest share due to its vital role in protecting crops during their early growth stages. Seed treatment involves applying fungicides to seeds before planting to prevent seed-borne and soil-borne fungal diseases that can hinder germination and early development. This proactive approach is highly effective in reducing the need for extensive fungicide use later in the crop’s lifecycle, making it both cost-efficient and environmentally favorable.

- Farmers increasingly prefer seed treatment fungicides because they ensure better crop establishment, improve seedling vigor, and enhance yield potential by protecting against common diseases such as smut, rot, and mildew. Additionally, the rise of high-value crops like cereals, oilseeds, and pulses, which are vulnerable to early fungal infections, has boosted demand for seed treatment.

- Advancements in seed treatment technologies, including precision applications and combination fungicides that offer multi-disease protection, have further driven growth in this segment. These factors, coupled with growing awareness of sustainable agricultural practices and regulatory restrictions on aerial spraying, make seed treatment a dominant application in the fungicide market. This approach aligns with farmers' goals to improve productivity while minimizing environmental impact.

Fungicide Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the fungicides market due to factors driving growth in agricultural production and demand for crop protection. The region's large population, particularly in countries like China and India, leads to a growing demand for food, prompting farmers to adopt modern agricultural practices to increase crop yields. Fungicides play a critical role in preventing fungal diseases that can severely damage crops, which is essential for maintaining food security in the region.

- Asia Pacific is characterized by diverse climatic conditions, making it highly susceptible to various fungal infections in crops such as rice, wheat, fruits, and vegetables. The region's vast agricultural landscape, combined with frequent occurrences of crop diseases like blight, rust, and mildew, creates significant demand for effective fungicide solutions.

- Additionally, government initiatives to support farmers, increasing awareness of the benefits of fungicide use, and the expansion of export-oriented agriculture have contributed to market growth. Advancements in fungicide formulations, such as biopesticides and eco-friendly options, have also gained popularity, aligning with the region's focus on sustainable farming. As agricultural output continues to rise and farmers seek to enhance productivity, Asia Pacific is positioned to remain a dominant force in the global fungicide market.

Fungicide Market Active Players

- Corteva Agriscience (U.S.A)

- FMC Corporation (U.S.A)

- Arysta LifeScience Corporation (U.S.A)

- Marrone Bio innovations (U.S.A)

- Certis USA L.L.C. (U.S.A)

- Valent BioSciences Corporation (U.S.A)

- Dow AgroSciences LLC (U.S.A)

- BioWorks Inc (U.S.A)

- AMVAC Chemical Corporation (U.S.A)

- Quimental industrial S.A(Europe)

- Syngenta AG (Europe)

- Bayer AG(Germany)

- BASF SE(Germany)

- Isagro S.P.A(Italy)

- Jiangsu Yangnong Chemical Co., Ltd. (China)

- PI Industries (India)

- Dhanuka Agritech (India)

- UPL (India)

- Fungicides India Limited (India)

- Kumiai Chemical Industry Co., Ltd. (Japan)

- Nissan Chemical Corporation (Japan)

- Nippon Soda Co. Ltd. (Japan)

- Sumitomo Chemical Co. Ltd. (Japan)

- Nufarm (Australia)

- ADAMA(Israel) Other Active Players

|

Global Fungicide Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20210 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.92 % |

Market Size in 2032: |

USD 31140 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Mode of Application |

|

||

|

By Crop type |

|

||

|

By Distribution |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fungicide Market by By Type (2018-2032)

4.1 Fungicide Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chemical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 biochemical

Chapter 5: Fungicide Market by By Form (2018-2032)

5.1 Fungicide Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid

Chapter 6: Fungicide Market by By Mode of Application (2018-2032)

6.1 Fungicide Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Seed treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Soil treatment

6.5 Foliar spray

Chapter 7: Fungicide Market by By Crop type (2018-2032)

7.1 Fungicide Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Cereals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Oil seed

7.5 Pulses

7.6 Fruits

7.7 Vegetable

Chapter 8: Fungicide Market by By Distribution (2018-2032)

8.1 Fungicide Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Company Stores

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 E-Commerce

8.5 Hypermarkets/Supermarkets

8.6 Specialty Stores

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Fungicide Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CORTEVA AGRISCIENCE (U.S.A)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 FMC CORPORATION (U.S.A)

9.4 ARYSTA LIFESCIENCE CORPORATION (U.S.A)

9.5 MARRONE BIO INNOVATIONS (U.S.A)

9.6 CERTIS USA L.L.C. (U.S.A)

9.7 VALENT BIOSCIENCES CORPORATION (U.S.A)

9.8 DOW AGROSCIENCES LLC (U.S.A)

9.9 BIOWORKS INC (U.S.A)

9.10 AMVAC CHEMICAL CORPORATION (U.S.A)

9.11 QUIMENTAL INDUSTRIAL S.A(EUROPE)

9.12 SYNGENTA AG (EUROPE)

9.13 BAYER AG(GERMANY)

9.14 BASFSE(GERMANY)

9.15 ISAGRO S.P.A(ITALY)

9.16 JIANGSU YANGNONG CHEMICAL COLTD. (CHINA)

9.17 PI INDUSTRIES (INDIA)

9.18 DHANUKA AGRITECH (INDIA)

9.19 UPL (INDIA)

9.20 FUNGICIDES INDIA LIMITED (INDIA)

9.21 KUMIAI CHEMICAL INDUSTRY COLTD. (JAPAN)

9.22 NISSAN CHEMICAL CORPORATION (JAPAN)

9.23 NIPPON SODA CO. LTD. (JAPAN)

9.24 SUMITOMO CHEMICAL CO. LTD. (JAPAN)

9.25 NUFARM (AUSTRALIA)

9.26 ADAMA(ISRAEL)

Chapter 10: Global Fungicide Market By Region

10.1 Overview

10.2. North America Fungicide Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Chemical

10.2.4.2 biochemical

10.2.5 Historic and Forecasted Market Size By By Form

10.2.5.1 Dry

10.2.5.2 Liquid

10.2.6 Historic and Forecasted Market Size By By Mode of Application

10.2.6.1 Seed treatment

10.2.6.2 Soil treatment

10.2.6.3 Foliar spray

10.2.7 Historic and Forecasted Market Size By By Crop type

10.2.7.1 Cereals

10.2.7.2 Oil seed

10.2.7.3 Pulses

10.2.7.4 Fruits

10.2.7.5 Vegetable

10.2.8 Historic and Forecasted Market Size By By Distribution

10.2.8.1 Company Stores

10.2.8.2 E-Commerce

10.2.8.3 Hypermarkets/Supermarkets

10.2.8.4 Specialty Stores

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Fungicide Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Chemical

10.3.4.2 biochemical

10.3.5 Historic and Forecasted Market Size By By Form

10.3.5.1 Dry

10.3.5.2 Liquid

10.3.6 Historic and Forecasted Market Size By By Mode of Application

10.3.6.1 Seed treatment

10.3.6.2 Soil treatment

10.3.6.3 Foliar spray

10.3.7 Historic and Forecasted Market Size By By Crop type

10.3.7.1 Cereals

10.3.7.2 Oil seed

10.3.7.3 Pulses

10.3.7.4 Fruits

10.3.7.5 Vegetable

10.3.8 Historic and Forecasted Market Size By By Distribution

10.3.8.1 Company Stores

10.3.8.2 E-Commerce

10.3.8.3 Hypermarkets/Supermarkets

10.3.8.4 Specialty Stores

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Fungicide Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Chemical

10.4.4.2 biochemical

10.4.5 Historic and Forecasted Market Size By By Form

10.4.5.1 Dry

10.4.5.2 Liquid

10.4.6 Historic and Forecasted Market Size By By Mode of Application

10.4.6.1 Seed treatment

10.4.6.2 Soil treatment

10.4.6.3 Foliar spray

10.4.7 Historic and Forecasted Market Size By By Crop type

10.4.7.1 Cereals

10.4.7.2 Oil seed

10.4.7.3 Pulses

10.4.7.4 Fruits

10.4.7.5 Vegetable

10.4.8 Historic and Forecasted Market Size By By Distribution

10.4.8.1 Company Stores

10.4.8.2 E-Commerce

10.4.8.3 Hypermarkets/Supermarkets

10.4.8.4 Specialty Stores

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Fungicide Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Chemical

10.5.4.2 biochemical

10.5.5 Historic and Forecasted Market Size By By Form

10.5.5.1 Dry

10.5.5.2 Liquid

10.5.6 Historic and Forecasted Market Size By By Mode of Application

10.5.6.1 Seed treatment

10.5.6.2 Soil treatment

10.5.6.3 Foliar spray

10.5.7 Historic and Forecasted Market Size By By Crop type

10.5.7.1 Cereals

10.5.7.2 Oil seed

10.5.7.3 Pulses

10.5.7.4 Fruits

10.5.7.5 Vegetable

10.5.8 Historic and Forecasted Market Size By By Distribution

10.5.8.1 Company Stores

10.5.8.2 E-Commerce

10.5.8.3 Hypermarkets/Supermarkets

10.5.8.4 Specialty Stores

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Fungicide Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Chemical

10.6.4.2 biochemical

10.6.5 Historic and Forecasted Market Size By By Form

10.6.5.1 Dry

10.6.5.2 Liquid

10.6.6 Historic and Forecasted Market Size By By Mode of Application

10.6.6.1 Seed treatment

10.6.6.2 Soil treatment

10.6.6.3 Foliar spray

10.6.7 Historic and Forecasted Market Size By By Crop type

10.6.7.1 Cereals

10.6.7.2 Oil seed

10.6.7.3 Pulses

10.6.7.4 Fruits

10.6.7.5 Vegetable

10.6.8 Historic and Forecasted Market Size By By Distribution

10.6.8.1 Company Stores

10.6.8.2 E-Commerce

10.6.8.3 Hypermarkets/Supermarkets

10.6.8.4 Specialty Stores

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Fungicide Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Chemical

10.7.4.2 biochemical

10.7.5 Historic and Forecasted Market Size By By Form

10.7.5.1 Dry

10.7.5.2 Liquid

10.7.6 Historic and Forecasted Market Size By By Mode of Application

10.7.6.1 Seed treatment

10.7.6.2 Soil treatment

10.7.6.3 Foliar spray

10.7.7 Historic and Forecasted Market Size By By Crop type

10.7.7.1 Cereals

10.7.7.2 Oil seed

10.7.7.3 Pulses

10.7.7.4 Fruits

10.7.7.5 Vegetable

10.7.8 Historic and Forecasted Market Size By By Distribution

10.7.8.1 Company Stores

10.7.8.2 E-Commerce

10.7.8.3 Hypermarkets/Supermarkets

10.7.8.4 Specialty Stores

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Fungicide Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20210 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.92 % |

Market Size in 2032: |

USD 31140 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Mode of Application |

|

||

|

By Crop type |

|

||

|

By Distribution |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fungicide Market research report is 2024-2032.

Corteva Agriscience (U.S.A),FMC Corporation (U.S.A),Arysta LifeScience Corporation (U.S.A),Marrone Bio innovations (U.S.A),Certis USA L.L.C. (U.S.A),Valent BioSciences Corporation (U.S.A),Dow AgroSciences LLC (U.S.A),BioWorks Inc (U.S.A),AMVAC Chemical Corporation (U.S.A),Quimental industrial S.A(Europe),Syngenta AG (Europe),Bayer AG(Germany),BASF SE(Germany),Isagro S.P.A(Italy),Jiangsu Yangnong Chemical Co., Ltd. (China),PI Industries (India),Dhanuka Agritech (India),UPL (India),Fungicides India Limited (India),Kumiai Chemical Industry Co., Ltd. (Japan),Nissan Chemical Corporation (Japan),Nippon Soda Co. Ltd. (Japan),Sumitomo Chemical Co. Ltd. (Japan),Nufarm (Australia),ADAMA(Israel) Other Active Players.

The Fungicide Market is segmented into Type, Form, Mode of Application, Crop type, Distribution and region. By Type, the market is categorized into Chemical & Biochemical. By Form, the market is categorized into Dry & Liquid. By Mode of Application, the market is categorized into Seed treatment, Soil treatment, Foliar spray. By Crop type, the market is categorized into Cereals, Oil seed, Pulses, Fruits, Vegetable, By Distribution, The Market Is Categorized into Company Stores, E-Commerce, Hypermarkets/Supermarkets, Specialty Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fungicides are substances, either biological or chemical, that stop the growth of fungus or its spores. Contemporary fungicides merely stop the growth of fungus for a few days or weeks; they do not kill them. In agriculture, fungi can do significant harm, leading to significant losses in productivity, quality, and profit. Fungicides are applied to animals to combat fungal illnesses as well as in agriculture. Fungicides are chemicals that are used to suppress oomycetes, which are not fungi but infect plants using the same mechanisms as fungus.

Fungicide Market Size Was Valued at USD 20210 Million in 2023, and is Projected to Reach USD 31140 Million by 2032, Growing at a CAGR of 4.92% From 2024-2032.