Gamma Ray Spectroscopy Market Synopsis:

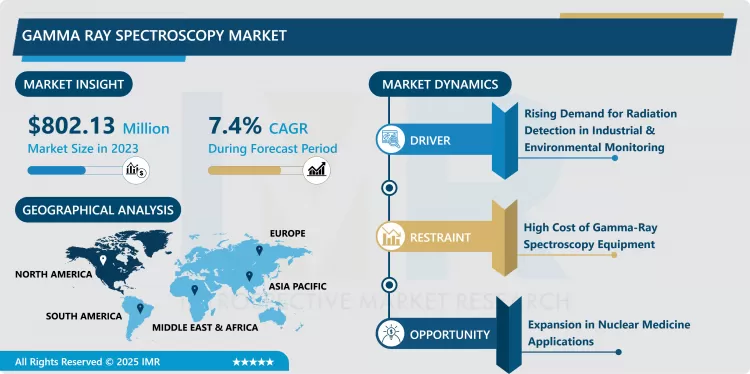

Gamma Ray Spectroscopy Market Size Was Valued at USD 802.13 Million in 2023, and is Projected to Reach USD 1,525.05 Million by 2032, Growing at a CAGR of 7.4% From 2024-2032.

Gamma-ray spectroscopy is a method in which the energy and intensity of gamma-ray emissions of any material substance can be determined. More commonly this method is used in different fields to determine and assess the concentration of radionuclides within the sample. As for the analysis of gamma rays for understanding the composition/structure of the material applied in environmental monitoring, nuclear medicine, and homeland security it is vital.

Gamma-ray spectroscopy is mainly a concept which is mainly dependent on the energy of the gamma rays, which is different for different isotopes. This helps in identification of many compounds as well as isotopes present in a certain sample of the material. Gamma ray spectroscopy has over the years enhanced with improved detectors and methods of analysis of measurements done.

In particular, the market of gamma-ray spectroscopy instruments has been gradually growing, because the need for the radiation detection is constantly increasing in nuclear energy, medicine and ecological safety. These applications are essential for security measures most especially where radiation products are in use. It is used in different fields, in the laboratory as well as in the industry for environmental samples and large industries for detecting radioactive emission.

Market growth is attributed to increased nuclear power and its security measures coupled with ecological population and radiation migration monitoring. Moreover, in nuclear areas applied for medical purposes such as nuclear medicine gamma-ray spectroscopy is significant for diagnosing illnesses connected with radioactive isotopes. Detector development and analysis software are constantly advancing which causes an increase in the use of gamma-ray spectrometry systems.

Another factor that drives the market is the rising importance of homeland security, where the instrument, gamma-ray spectroscopy is employed to detect as well as identify elements that are part of nuclear material, which may be applied in unlawful acts. There is therefore no better time to apply this than now post the increase in global insecurity. Also, the compactness and portability of gamma-ray spectrometers an improvement have made them ideal for use in dangerous environments due to flexibility in handling and convection.

The market is also getting support from the improving interest for research and development efforts in academic and industrial settings. Gamma ray spectroscopy for R &D facilitate in increasing the knowledge of nuclear process and contribute in the creation of technology in numerous areas of science. Such trends, combined with a growing demand for efficient, high-accuracy radiation measurement, should continue to propel the market forward in the foreseeable future.

Gamma Ray Spectroscopy Market Trend Analysis:

Portable Gamma-Ray Spectrometers Gain Traction

- One of the biggest trends in the gamma-ray spectroscopy market is an increasing need for portable gamma-ray spectrometers. These instruments have grown popular due to their capability and portability offering very high performance in small terminations. The portable spectrometers are most beneficial in the areas where immediate identification on the site is desirable including monitoring, nuclear energy, and defense. This flexibility is multiplied by capabilities to identify gamma radiation in real time, making portable units the medium of choice over benchtop systems.

- As many advances in the developments of sensors, portable gamma-ray spectrometers can now be much more effective and sensitive to a broad range of radioactive substances. The devices have become extensively employed in various sectors where they are sought for radiation detection in the industrial industries and the scanning of detectable radioactive materials in areas of homeland security. These devices also come as portable hence minimizing the formation and building of most elaborate laboratory hence cheaper and faster analysis. This trend is expected to continue, exciting focus will be directed towards size, weight and accuracy in portable models in view of the continuously emerging industry standards.

Expansion in Nuclear Medicine Applications

- The most prominent market prospects for gamma-ray spectroscopy are associated with the growing application of the technology in nuclear medicine. Nuclear medicine consists of: the use of radioactive substances for imaging and therapy of diseases, such as cancer. Gamma-ray spectroscopy is primarily used to determine properties of radioactive substances, thus, they can be used safely in medicine.

- In conjunction with the rising global instability and utilization of nuclear medicine for diagnosing and treating cancer, the significance of sensitive gamma-ray detection devices becomes increasingly important. This makes gamma-ray spectroscopy helpful to healthcare providers in checking the radiation levels of the medical isotopes, and comparing them with relevant standard specifications before use. The advance in personalized medicine and molecular therapies also brings a possibility of expanding the function of gamma-ray spectroscopy in medical applications, improving the accuracy and efficacy of nuclear medicine interventions.

Gamma Ray Spectroscopy Market Segment Analysis:

Gamma Ray Spectroscopy Market Segmented on the basis of type, application and end user.

By Product Type, Portable Gamma-Ray Spectrometers segment is expected to dominate the market during the forecast period

- Gamma-ray spectrometers are purchased in portable, bench-top and handheld forms. The device includes a portable gamma ray spectrometer which can be used in the field because of its portability suitable for situ radiation measurement in environmental, nuclear inspection, and security areas. Such devices have become popular because of their portability and flexibility in use in risky situations.

- The benchtop gamma-ray spectrometers have higher resolution, and are employed in laboratories where huge analysis is called for. They are preferred especially in research and development facilities because their means are very accurate. Portable gamma-ray detectors are slightly less portable than handheld machines but provide slightly better accuracy as well. They are currently being deployed in industries and security services for fast radiation scans serving the purpose of being fast and accurate at the same time.

By Application, Environmental Monitoring segment expected to held the largest share

- Gamma-ray spectroscopy has uses in virtually every type of industry and area, for example; environmental analysis, nuclear medicine, industrial and mining, research and development, and national security. Gamma-ray spectroscopy also plays a major role in recognition of environmental radioactivity of air, water and soil to help safeguard the people and save environment. This application is expanding as more attention has to be paid to the changes in radiation levels in ecosystems around NPPs and after tragedies.

- Gamma-ray spectroscopy is widely used in nuclear medicine not only for diagnostic radiation but also for radiation treatment. You’ll be able to keep track of the safety and efficacy of radiopharmaceuticals utilizing in medical processes, thus bringing more positive impact to the patient. Moreover, in homeland security gamma-ray spectroscopy can be employed in detection of unauthorized atomic radioactive materials for instance in Control at the border and airport for non-compliance of nuclear dangers.

Gamma Ray Spectroscopy Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the highest market share in gamma-ray spectroscopy market because of its technological, investment, demand in various industry and high research activities. The current leading country is the United States of America since gamma-ray spectrometers are widely used in power generation, healthcare and safety. The nuclear power plant and medical centers already established within the region also persistently drive the need for accurate radiation measuring devices.

- Lack of focusing on security and environmental safety is also hindering market growth in North America, but the respective concerns’ emergence also pushes the market to the forefront. The government of the United States and private industries both spend a lot of money in the radiation detection technologies leading to great market development. Furthermore, the growing concern for homeland security and detection of radioactive materials to prevent terrorisms is creating the market for portable and handheld gamma-ray spectrometer in the Global Market, where North America continued to dominate the global Market.

Active Key Players in the Gamma Ray Spectroscopy Market:

- Thermo Fisher Scientific (United States)

- Canberra Industries, Inc. (United States)

- ORTEC (United States)

- EG & G Technical Services, Inc. (United States)

- SEIKO Instruments Inc. (Japan)

- Kromek Group PLC (United Kingdom)

- Antech Instruments Inc. (United States)

- AmRay (United Kingdom)

- Mirion Technologies (United States)

- Pajarito Powder LLC (United States)

- Berthold Technologies (Germany)

- Tracerco (United Kingdom)

- Other Active Players

Key Industry Developments in the Gamma Ray Spectroscopy Market:

- In October 2023, A major discovery was made by the U.S. Naval Research Laboratory (NRL) and the international Fermi Large Area Telescope Collaboration. Approximately 300 gamma-ray pulsars were identified and included in their Third Catalog of Gamma Ray Pulsars. This accomplishment comes 15 years after the 2008 launch of Fermi, during which time the count of gamma-ray pulsars that are known to exist has increased from less than 10 to about 300.

|

Global Gamma Ray Spectroscopy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 802.13 Million |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 1,525.05 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Detector Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gamma Ray Spectroscopy Market by By Product Type (2018-2032)

4.1 Gamma Ray Spectroscopy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Portable Gamma-Ray Spectrometers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Benchtop Gamma-Ray Spectrometers

4.5 Handheld Gamma-Ray Spectrometers

Chapter 5: Gamma Ray Spectroscopy Market by By Detector Type (2018-2032)

5.1 Gamma Ray Spectroscopy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Scintillation Detectors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Semiconductor Detectors

Chapter 6: Gamma Ray Spectroscopy Market by By Application (2018-2032)

6.1 Gamma Ray Spectroscopy Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Environmental Monitoring

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Nuclear Medicine

6.5 Industrial & Mining

6.6 Research & Development

6.7 Homeland Security

Chapter 7: Gamma Ray Spectroscopy Market by By End User (2018-2032)

7.1 Gamma Ray Spectroscopy Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals & Healthcare Facilities

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Research Institutions

7.5 Industrial Companies

7.6 Government & Defense Organizations

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Gamma Ray Spectroscopy Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THERMO FISHER SCIENTIFIC (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CANBERRA INDUSTRIES INC. (UNITED STATES)

8.4 ORTEC (UNITED STATES)

8.5 EG & G TECHNICAL SERVICES INC. (UNITED STATES)

8.6 SEIKO INSTRUMENTS INC. (JAPAN)

8.7 KROMEK GROUP PLC (UNITED KINGDOM)

8.8 ANTECH INSTRUMENTS INC. (UNITED STATES)

8.9 AMRAY (UNITED KINGDOM)

8.10 MIRION TECHNOLOGIES (UNITED STATES)

8.11 PAJARITO POWDER LLC (UNITED STATES)

8.12 BERTHOLD TECHNOLOGIES (GERMANY)

8.13 TRACERCO (UNITED KINGDOM)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Gamma Ray Spectroscopy Market By Region

9.1 Overview

9.2. North America Gamma Ray Spectroscopy Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Portable Gamma-Ray Spectrometers

9.2.4.2 Benchtop Gamma-Ray Spectrometers

9.2.4.3 Handheld Gamma-Ray Spectrometers

9.2.5 Historic and Forecasted Market Size By By Detector Type

9.2.5.1 Scintillation Detectors

9.2.5.2 Semiconductor Detectors

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Environmental Monitoring

9.2.6.2 Nuclear Medicine

9.2.6.3 Industrial & Mining

9.2.6.4 Research & Development

9.2.6.5 Homeland Security

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Hospitals & Healthcare Facilities

9.2.7.2 Research Institutions

9.2.7.3 Industrial Companies

9.2.7.4 Government & Defense Organizations

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Gamma Ray Spectroscopy Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Portable Gamma-Ray Spectrometers

9.3.4.2 Benchtop Gamma-Ray Spectrometers

9.3.4.3 Handheld Gamma-Ray Spectrometers

9.3.5 Historic and Forecasted Market Size By By Detector Type

9.3.5.1 Scintillation Detectors

9.3.5.2 Semiconductor Detectors

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Environmental Monitoring

9.3.6.2 Nuclear Medicine

9.3.6.3 Industrial & Mining

9.3.6.4 Research & Development

9.3.6.5 Homeland Security

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Hospitals & Healthcare Facilities

9.3.7.2 Research Institutions

9.3.7.3 Industrial Companies

9.3.7.4 Government & Defense Organizations

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Gamma Ray Spectroscopy Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Portable Gamma-Ray Spectrometers

9.4.4.2 Benchtop Gamma-Ray Spectrometers

9.4.4.3 Handheld Gamma-Ray Spectrometers

9.4.5 Historic and Forecasted Market Size By By Detector Type

9.4.5.1 Scintillation Detectors

9.4.5.2 Semiconductor Detectors

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Environmental Monitoring

9.4.6.2 Nuclear Medicine

9.4.6.3 Industrial & Mining

9.4.6.4 Research & Development

9.4.6.5 Homeland Security

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Hospitals & Healthcare Facilities

9.4.7.2 Research Institutions

9.4.7.3 Industrial Companies

9.4.7.4 Government & Defense Organizations

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Gamma Ray Spectroscopy Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Portable Gamma-Ray Spectrometers

9.5.4.2 Benchtop Gamma-Ray Spectrometers

9.5.4.3 Handheld Gamma-Ray Spectrometers

9.5.5 Historic and Forecasted Market Size By By Detector Type

9.5.5.1 Scintillation Detectors

9.5.5.2 Semiconductor Detectors

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Environmental Monitoring

9.5.6.2 Nuclear Medicine

9.5.6.3 Industrial & Mining

9.5.6.4 Research & Development

9.5.6.5 Homeland Security

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Hospitals & Healthcare Facilities

9.5.7.2 Research Institutions

9.5.7.3 Industrial Companies

9.5.7.4 Government & Defense Organizations

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Gamma Ray Spectroscopy Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Portable Gamma-Ray Spectrometers

9.6.4.2 Benchtop Gamma-Ray Spectrometers

9.6.4.3 Handheld Gamma-Ray Spectrometers

9.6.5 Historic and Forecasted Market Size By By Detector Type

9.6.5.1 Scintillation Detectors

9.6.5.2 Semiconductor Detectors

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Environmental Monitoring

9.6.6.2 Nuclear Medicine

9.6.6.3 Industrial & Mining

9.6.6.4 Research & Development

9.6.6.5 Homeland Security

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Hospitals & Healthcare Facilities

9.6.7.2 Research Institutions

9.6.7.3 Industrial Companies

9.6.7.4 Government & Defense Organizations

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Gamma Ray Spectroscopy Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Portable Gamma-Ray Spectrometers

9.7.4.2 Benchtop Gamma-Ray Spectrometers

9.7.4.3 Handheld Gamma-Ray Spectrometers

9.7.5 Historic and Forecasted Market Size By By Detector Type

9.7.5.1 Scintillation Detectors

9.7.5.2 Semiconductor Detectors

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Environmental Monitoring

9.7.6.2 Nuclear Medicine

9.7.6.3 Industrial & Mining

9.7.6.4 Research & Development

9.7.6.5 Homeland Security

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Hospitals & Healthcare Facilities

9.7.7.2 Research Institutions

9.7.7.3 Industrial Companies

9.7.7.4 Government & Defense Organizations

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Gamma Ray Spectroscopy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 802.13 Million |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 1,525.05 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Detector Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gamma Ray Spectroscopy Market research report is 2024-2032.

Thermo Fisher Scientific (United States), Canberra Industries, Inc. (United States), ORTEC (United States), EG & G Technical Services, Inc. (United States), SEIKO Instruments Inc. (Japan), Kromek Group PLC (United Kingdom), Antech Instruments Inc. (United States), AmRay (United Kingdom), Mirion Technologies (United States), Pajarito Powder LLC (United States), Berthold Technologies (Germany), Tracerco (United Kingdom), and Other Active Players.

The Gamma Ray Spectroscopy Market is segmented into Product Type, Detector Type, Application, End User and region. By Product Type, the market is categorized into Portable Gamma-Ray Spectrometers, Benchtop Gamma-Ray Spectrometers, Handheld Gamma-Ray Spectrometers. By Detector Type, the market is categorized into Scintillation Detectors, Semiconductor Detectors. By Application, the market is categorized into Environmental Monitoring, Nuclear Medicine, Industrial & Mining, Research & Development, Homeland Security. By End User, the market is categorized into Hospitals & Healthcare Facilities, Research Institutions, Industrial Companies, Government & Defense Organizations. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Gamma-ray spectroscopy is a method in which energy and intensity of gamma-ray emissions of any material substance can be determined. More commonly this method is used in different fields to determine and assess the concentration of radionuclides within the sample. As for the analysis of gamma rays for understanding the composition/structure of the material applied in environmental monitoring, nuclear medicine, and homeland security it is vital.

Gamma Ray Spectroscopy Market Size Was Valued at USD 802.13 Million in 2023, and is Projected to Reach USD 1,525.05 Million by 2032, Growing at a CAGR of 7.4% From 2024-2032.