Gas Separation Membrane Market Synopsis:

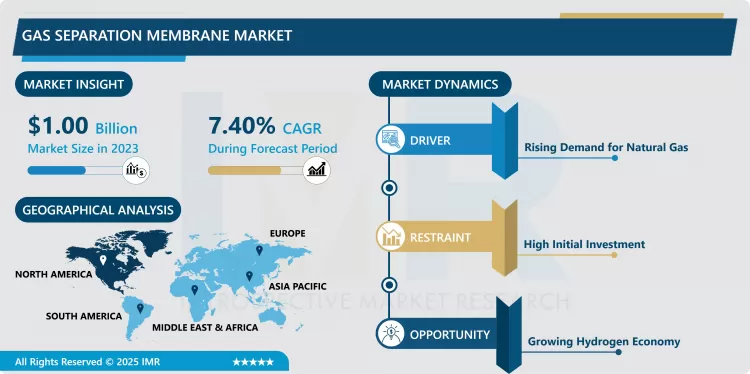

Gas Separation Membrane Market Size Was Valued at USD 1.00 Billion in 2023, and is Projected to Reach USD 1.90 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.

The gas separation membrane market includes the manufacture and employment of membranes that filter gaseous mixtures dependent upon their physical or chemical characteristics. These membranes are commonly employed in treatment of oil & gas, chemical processing industries and environmental care, to separate or purify any gaseous material such as nitrogen, oxygen, hydrogen and carbon dioxide from gaseous molecules. Its uses are crucial in such procedures as natural gas purification, carbon dioxide capture, and separation of gases in response to increasing industrial usage of efficient and economical gas separation techniques.

The key driver for the global gas separation membrane market is the pursuing demand for efficient and cost-effective gas separation during a range of applications across all industries. Membranes used in gas separation occur in several industrial processes that require the separation of gases like nitrogen, oxygen, carbon dioxide, and hydrogen are encouraging their use in industries like the oil & gas industry, chemical processing industries, power industries, and food and beverage industries. The advancement in environmental laws has also influenced industries to look for environmentally friendly, cost-effective and efficient separation techniques increasing demand for gas separation membranes. Among the significant benefits of membrane technology include utilization of lower energy to drive the process and the possibility to adapt to different conditions, skills that may help industries desiring to cut their emissions and expenses.

This remains backed by technology in market and innovations in membrane materials that are improving on effectiveness and durability of the gas separation membranes. Today there are several improved materials such as polymides, polysulfones and mixed matrix membranes (MMMs) which have greatly enhanced selectivity and permeability of gaseous separation. Furthermore, there is growing research and development spending in gas separation membranes and its novel application in new field like CCS and hydrogen economy. However there are hindrances to this method including fouling the membranes, high initial costs and competition from other separation techniques needed to be encountered. However, increasing awareness of the environmental impacts and increasing demand in the global market for cleaner fossil fuels, the growth of gas separation membranes in the market is expected to increase gradually over the years to come.

Gas Separation Membrane Market Trend Analysis:

Key Trends Driving Growth in the Gas Separation Membrane Market

- Environmental consideration and energy efficiency for separation of gasses are expected to be the most influential factors driving growth in the gas separation membrane market. Due to efforts towards efficient reduction of environmental footprints, the gas separation membranes are widely used in the carbon capture and storage systems. They are used as filters to remove carbon dioxide from industrial emissions: greenhouse gases which constitute a significant element in the strategy to combat climate change. This is further encouraged by environment conservation policies that continue to push industries to embrace more environmentally friendly technology hence making the gas separation membranes essential components in the drive towards low carbon economies.

- Besides CCS, the application of membrane technology is gradually increasing in the natural gas processing particularly in the removal of nitrogen from methane. This process is equally widely applied for upgrading of the natural gas since it increases the efficiency of its energy as well as the commercial value. In the global environment characterized by increase in demand for cleaner energy sources, use of natural gas and separation membranes for refining the gas and raising its purity standards is increasing. This is also fueled by government regulations that seek to reign in industrial carbon emissions through forcing industries to look for ways of enhancing energy use midst compliance with environmental laws. The regulatory demand and technical advancement are expected to enhance the growth of the gas separation membrane market.

Opportunity

Advancements in the Gas Separation Membrane Market

- One untapped market in the global gas separation membrane market is the increasing use of natural gas as a cleaner source of energy. As the world shifts its focus towards the reduction of carbon emissions, and the move towards use of green energy, natural gas has become the preferred energy source for firms wishing to err on the side of environmental responsibility. In this shift, gas separation membranes are used to selectively capture contaminants like carbon dioxide, hydrogen sulfide and other unlike components in the natural gas streams. Compared to other conventional separation techniques such as cryogenic distillation, membranes are more efficient in terms of energy and costs, which is in compliance with the increasing need for green technologies. This makes gas separation membranes especially desirable in areas that adhering to environmental standards is a total necessity; thus, creating many opportunities for market expansion.

- Finally, another advantage and key claim to fame for gas separation membranes is their flexibility as well as their capacity for expansion to fit an ever-growing need. These membranes can be employed as an easy retrofit strategy to existing gas processing systems hence no large investments to make. This comes back to the understanding that as consumers demand more purified natural gas in a number of areas rising from power production, chemical manufacturing, as well as transport means the need to apply enhanced membrane technologies will also go up. Majority of the industries would turn to invest in those companies, which spend more amount on research and development of membrane technology to enhance the efficiency and life cycle of the membrane because the changing demands of energy require efficient and sustainable membrane gas separation technologies. This provides a favorable condition for competition and development in the following years.

Gas Separation Membrane Market Segment Analysis:

Gas Separation Membrane Market is Segmented on the basis of Material Type, Construction Type, Application, End-use, and Region

By Material Type, Polymeric Membrane segment is expected to dominate the market during the forecast period

- Polymeric membranes are a fundamental of membrane separation technology since they are renowned for flexibility in membrane separation coupled with affordable costs. These membranes are prepared by organic polymers and thus represent a high level of permeability and selectivity to be used in various industries. They are mainly used in gas separation, water treatment, and in numerous industrial applications; the gases include oxygen and nitrogen. Used in applications such as oxygen and nitrogen separation, their advantage is that they are comparatively low energy and easy to manufacture at scale across a range of environments.

- Nonetheless, polymeric membranes come with some problems typical of mechanical self-sharpening including fouling and degradation issues over a decade of use. Membrane fouling is the build up of contaminants on the surface of the membrane, causing a decline in permeability and high pressure needed. Furthermore, the response of these polymeric materials to such conditions as exposure to aggressive chemical environment or high/low temperature can significantly deteriorate their selectivity and catalytic performance. To address these concerns, current works in development involve improving the stability and fouling resistance of polymeric membranes so that the membrane technologies can address the challenges characteristic of different industries in the future.

By End-use, Chemical segment expected to held the largest share

- Membrane separation technologies are crucial in driving the efficiency of several processes that occur in the chemical industry such as the purification of chemicals, recovery of solvents, and the separation of wanted product from unwanted product. These technologies take advantage of the fine porous structure of membranes in enabling the separation of particles by size charge or chemical reactivity, resulting in better and less energy intensive ways of production. Membrane processes allow for getting higher product purity which is important for meeting quality and regulatory requirements of chemical manufacturers.

- A major point for the interest towards membrane separation technologies is the lower energy consumption that the process requires compared to other conventional techniques for the separation of liquid mixtures like distillation or liquid-liquid extraction. The membrane technologies are known to provide heat energy and lower operating pressure than a conventional system making the overall energy and operating costs to be considerably low. Moreover they are small in size which makes them easy to install into manufacturing processes underway in factories. In summary, membranes exhibit high selectivity to improve the operation efficiency despite low permeation for most cases, and low waste emitted in the overall operation; hence the role of membrane separation in the chemical industry’s sustainability.

Gas Separation Membrane Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The major growth of the gas separation membrane market in North America is as a result of the strong oil & gas industry and the increasing need for technologies that allow for proper separation in demanding applications including natural gas processing and hydrogen recovery. Specifically, the United States occupies a leading position due to extensive petrochemical production; where new technologies of separation membranes will be useful in improving the performance. Natural gas processing is an essential component with the gas separation membranes used in purging of the high value gases like methane and hydrogen. Another factor is that hydrogen recovery by this membrane technology is relevant and significant when the demand rises for clean energy, and it is expected to drive the market even more in the region.

- As well, the growing concern to tackle environmental issues such as pollution and CO2 emissions in industries is driving the growth of the gas separation membranes in carbon capture from industrial emissions. These membranes have gained popularity due to regulations on emissions cutting on greenhouse gases and the use of carbon capture and storage (CCS). The pressures that require electricity industries in the U.S. and Canada to maintain high standards of safety and efficiency in energy processes have led to the application of more advanced gas separation systems. This trend shall help make the market to grow in the future to meet the increasing demand from the North American region that is highly inclined to the green energy and cleaner industrial practices.

Active Key Players in the Gas Separation Membrane Market:

- Air Products and Chemicals Inc.

- Air Liquide Advanced Separations LLC

- UBE Industries Ltd

- Schlumberger Ltd

- Fujifilm Manufacturing Europe B.V

- Parker-Hannifin Corporation

- Membrane Technology and Research Inc

- DIC Corporation

- Honeywell International (Honeywell UOP)

- Evonik Industries

- Mahler AGS

- Atlas Copco AB

- GENERON LLC

- GRASYS JSC

- GMT Membrantechnik GmbH, and Other Active Players.

|

Global Gas Separation Membrane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.00 Billion |

|

Forecast Period 2024-32 CAGR: |

7.40% |

Market Size in 2032: |

USD 1.90 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Construction Type |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gas Separation Membrane Market by By Material Type (2018-2032)

4.1 Gas Separation Membrane Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polymeric Membrane

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Inorganic Membrane

4.5 Metallic Membrane

Chapter 5: Gas Separation Membrane Market by By Construction Type (2018-2032)

5.1 Gas Separation Membrane Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hollow Fiber Module

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Spiral Wound Module

5.5 Plate & Frame Module

Chapter 6: Gas Separation Membrane Market by By Application (2018-2032)

6.1 Gas Separation Membrane Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Nitrogen Separation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Oxygen Separation

6.5 Acid gas Separation

6.6 Hydrogen Separation

6.7 Methane Separation

6.8 Carbon Dioxide Separation

6.9 Olefin - Paraffin Separation

Chapter 7: Gas Separation Membrane Market by By End-use (2018-2032)

7.1 Gas Separation Membrane Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Chemical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Petrochemical and Oil & Gas

7.5 Food and Beverages

7.6 Power Generation

7.7 Pharmaceutical

7.8 Pollution Control

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Gas Separation Membrane Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AIR PRODUCTS AND CHEMICALS INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AIR LIQUIDE ADVANCED SEPARATIONS LLC (FRANCE)

8.4 UBE INDUSTRIES LTD (JAPAN)

8.5 SCHLUMBERGER LTD (UNITED STATES)

8.6 FUJIFILM MANUFACTURING EUROPE B.V. (NETHERLANDS)

8.7 PARKER-HANNIFIN CORPORATION (UNITED STATES)

8.8 MEMBRANE TECHNOLOGY AND RESEARCH INC. (UNITED STATES)

8.9 DIC CORPORATION (JAPAN)

8.10 HONEYWELL INTERNATIONAL (HONEYWELL UOP) (UNITED STATES)

8.11 EVONIK INDUSTRIES (GERMANY)

8.12 MAHLER AGS (GERMANY)

8.13 ATLAS COPCO AB (SWEDEN)

8.14 GENERON LLC (UNITED STATES)

8.15 GRASYS JSC (RUSSIA)

8.16 GMT MEMBRANTECHNIK GMBH (GERMANY)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Gas Separation Membrane Market By Region

9.1 Overview

9.2. North America Gas Separation Membrane Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Material Type

9.2.4.1 Polymeric Membrane

9.2.4.2 Inorganic Membrane

9.2.4.3 Metallic Membrane

9.2.5 Historic and Forecasted Market Size By By Construction Type

9.2.5.1 Hollow Fiber Module

9.2.5.2 Spiral Wound Module

9.2.5.3 Plate & Frame Module

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Nitrogen Separation

9.2.6.2 Oxygen Separation

9.2.6.3 Acid gas Separation

9.2.6.4 Hydrogen Separation

9.2.6.5 Methane Separation

9.2.6.6 Carbon Dioxide Separation

9.2.6.7 Olefin - Paraffin Separation

9.2.7 Historic and Forecasted Market Size By By End-use

9.2.7.1 Chemical

9.2.7.2 Petrochemical and Oil & Gas

9.2.7.3 Food and Beverages

9.2.7.4 Power Generation

9.2.7.5 Pharmaceutical

9.2.7.6 Pollution Control

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Gas Separation Membrane Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Material Type

9.3.4.1 Polymeric Membrane

9.3.4.2 Inorganic Membrane

9.3.4.3 Metallic Membrane

9.3.5 Historic and Forecasted Market Size By By Construction Type

9.3.5.1 Hollow Fiber Module

9.3.5.2 Spiral Wound Module

9.3.5.3 Plate & Frame Module

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Nitrogen Separation

9.3.6.2 Oxygen Separation

9.3.6.3 Acid gas Separation

9.3.6.4 Hydrogen Separation

9.3.6.5 Methane Separation

9.3.6.6 Carbon Dioxide Separation

9.3.6.7 Olefin - Paraffin Separation

9.3.7 Historic and Forecasted Market Size By By End-use

9.3.7.1 Chemical

9.3.7.2 Petrochemical and Oil & Gas

9.3.7.3 Food and Beverages

9.3.7.4 Power Generation

9.3.7.5 Pharmaceutical

9.3.7.6 Pollution Control

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Gas Separation Membrane Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Material Type

9.4.4.1 Polymeric Membrane

9.4.4.2 Inorganic Membrane

9.4.4.3 Metallic Membrane

9.4.5 Historic and Forecasted Market Size By By Construction Type

9.4.5.1 Hollow Fiber Module

9.4.5.2 Spiral Wound Module

9.4.5.3 Plate & Frame Module

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Nitrogen Separation

9.4.6.2 Oxygen Separation

9.4.6.3 Acid gas Separation

9.4.6.4 Hydrogen Separation

9.4.6.5 Methane Separation

9.4.6.6 Carbon Dioxide Separation

9.4.6.7 Olefin - Paraffin Separation

9.4.7 Historic and Forecasted Market Size By By End-use

9.4.7.1 Chemical

9.4.7.2 Petrochemical and Oil & Gas

9.4.7.3 Food and Beverages

9.4.7.4 Power Generation

9.4.7.5 Pharmaceutical

9.4.7.6 Pollution Control

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Gas Separation Membrane Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Material Type

9.5.4.1 Polymeric Membrane

9.5.4.2 Inorganic Membrane

9.5.4.3 Metallic Membrane

9.5.5 Historic and Forecasted Market Size By By Construction Type

9.5.5.1 Hollow Fiber Module

9.5.5.2 Spiral Wound Module

9.5.5.3 Plate & Frame Module

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Nitrogen Separation

9.5.6.2 Oxygen Separation

9.5.6.3 Acid gas Separation

9.5.6.4 Hydrogen Separation

9.5.6.5 Methane Separation

9.5.6.6 Carbon Dioxide Separation

9.5.6.7 Olefin - Paraffin Separation

9.5.7 Historic and Forecasted Market Size By By End-use

9.5.7.1 Chemical

9.5.7.2 Petrochemical and Oil & Gas

9.5.7.3 Food and Beverages

9.5.7.4 Power Generation

9.5.7.5 Pharmaceutical

9.5.7.6 Pollution Control

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Gas Separation Membrane Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Material Type

9.6.4.1 Polymeric Membrane

9.6.4.2 Inorganic Membrane

9.6.4.3 Metallic Membrane

9.6.5 Historic and Forecasted Market Size By By Construction Type

9.6.5.1 Hollow Fiber Module

9.6.5.2 Spiral Wound Module

9.6.5.3 Plate & Frame Module

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Nitrogen Separation

9.6.6.2 Oxygen Separation

9.6.6.3 Acid gas Separation

9.6.6.4 Hydrogen Separation

9.6.6.5 Methane Separation

9.6.6.6 Carbon Dioxide Separation

9.6.6.7 Olefin - Paraffin Separation

9.6.7 Historic and Forecasted Market Size By By End-use

9.6.7.1 Chemical

9.6.7.2 Petrochemical and Oil & Gas

9.6.7.3 Food and Beverages

9.6.7.4 Power Generation

9.6.7.5 Pharmaceutical

9.6.7.6 Pollution Control

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Gas Separation Membrane Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Material Type

9.7.4.1 Polymeric Membrane

9.7.4.2 Inorganic Membrane

9.7.4.3 Metallic Membrane

9.7.5 Historic and Forecasted Market Size By By Construction Type

9.7.5.1 Hollow Fiber Module

9.7.5.2 Spiral Wound Module

9.7.5.3 Plate & Frame Module

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Nitrogen Separation

9.7.6.2 Oxygen Separation

9.7.6.3 Acid gas Separation

9.7.6.4 Hydrogen Separation

9.7.6.5 Methane Separation

9.7.6.6 Carbon Dioxide Separation

9.7.6.7 Olefin - Paraffin Separation

9.7.7 Historic and Forecasted Market Size By By End-use

9.7.7.1 Chemical

9.7.7.2 Petrochemical and Oil & Gas

9.7.7.3 Food and Beverages

9.7.7.4 Power Generation

9.7.7.5 Pharmaceutical

9.7.7.6 Pollution Control

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Gas Separation Membrane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.00 Billion |

|

Forecast Period 2024-32 CAGR: |

7.40% |

Market Size in 2032: |

USD 1.90 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Construction Type |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gas Separation Membrane Market research report is 2024-2032.

Air Products and Chemicals Inc., Air Liquide Advanced Separations LLC, UBE Industries Ltd, Schlumberger Ltd, Fujifilm Manufacturing Europe B.V, Parker-Hannifin Corporation, Membrane Technology and Research Inc, DIC Corporation, Honeywell International (Honeywell UOP), Evonik Industries, Mahler AGS, Atlas Copco AB, GENERON LLC, GRASYS JSC, GMT Membrantechnik GmbH, and Other Active Players.

The Gas Separation Membrane Market is segmented into By Material Type, By Construction Type, By Application, By End-use and region. By Material Type, the market is categorized into Polymeric Membrane, Inorganic Membrane and Metallic Membrane. By Construction Type, the market is categorized into Hollow Fiber Module, Spiral Wound Module and Plate & Frame Module. By Application, the market is categorized into Nitrogen Separation, Oxygen Separation, Acid gas Separation, Hydrogen Separation, Methane Separation, Carbon Dioxide Separation and Olefin - Paraffin Separation. By End-use, the market is categorized into Chemical, Petrochemical and Oil & Gas, Food and Beverages, Power Generation, Pharmaceutical, Pollution Control and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The gas separation membrane market involves the production and use of semi-permeable membranes that selectively separate gases based on their physical or chemical properties. These membranes are widely used in industries such as oil and gas, chemical processing, and environmental management to isolate or purify gases like nitrogen, oxygen, hydrogen, and carbon dioxide from gas mixtures. Their application is essential in processes like natural gas processing, carbon capture, and air separation, driven by growing industrial demand for energy-efficient and cost-effective gas separation technologies.

Gas Separation Membrane Market Size Was Valued at USD 1.00 Billion in 2023, and is Projected to Reach USD 1.90 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.