Global Gas Turbine Market Synopsis

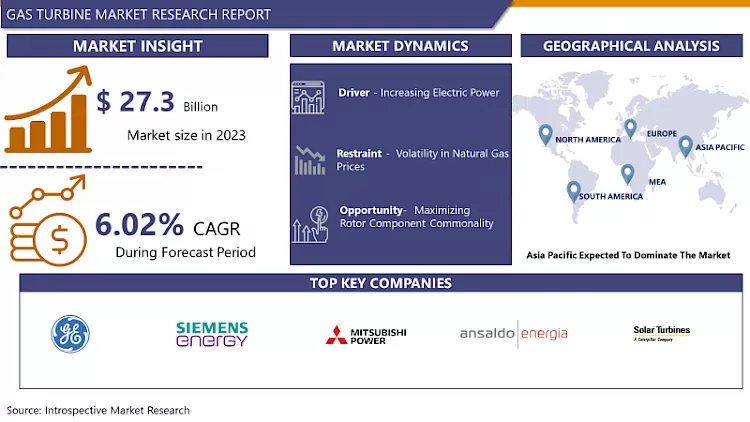

The Gas Turbine Market Was Valued at USD 27.3 Billion in 2023 and is Projected to Reach USD 46.2 Billion by 2032, Growing at a CAGR of 6.02% From 2024–2032.

A gas turbine is a type of internal combustion engine that converts chemical energy from fuel into mechanical energy. This mechanical energy is used to drive a generator, which then produces electrical energy. The gas turbine operates by compressing air, mixing it with fuel, and igniting the mixture to create high-temperature, high-pressure gas. This gas expands rapidly, driving a turbine that converts the energy into mechanical work.

- The gas turbine market is a vital component of the global power generation industry, driven by increasing demand for energy, particularly in emerging economies. Gas turbines are favored for their efficiency, reliability, and ability to use various fuels, including natural gas and liquid fuels. They are widely used in power plants, industrial applications, and even in the oil and gas sector for power generation and mechanical drive.

- In recent years, the market has seen a shift towards higher efficiency and lower emission technologies, driven by environmental regulations and the global push towards decarbonization. The adoption of combined-cycle power plants, where gas turbines are paired with steam turbines to maximize efficiency, is also on the rise. Major players in the market are continuously investing in research and development to innovate and improve turbine efficiency, reduce emissions, and extend operational life.

- However, the gas turbine market faces challenges such as competition from renewable energy sources and the volatility of natural gas prices. Despite these challenges, the market is expected to grow steadily, particularly in regions where natural gas is abundant and where there is a need for flexible, reliable power generation solutions. The Asia-Pacific region, in particular, is expected to see significant growth due to rising energy demand and ongoing infrastructure development.

Global Gas Turbine Market Trend Analysis

Increasing Electric Power

- For electric power generation, large central power plants that use steam or hydraulic turbines are expected to continue to predominate. The prospects appear bright, nonetheless, for medium-sized plants employing gas turbine engines in combination with steam turbines.

- Further use of gas turbine engines for peak power production is likely as well. These turbine engines also remain attractive for small and medium-sized, high-speed marine vessels and certain industrial applications. Gas turbines are used in the energy sector as propulsion and power generation technologies. Gas turbine technology remains important due to its flexibility in load demand, such as dynamical behavior, and the ability to work on different fuels with minor design changes.

- However, there would be no ambitious progress for gas turbines without reliable modeling and simulation. A simplified nonlinear model structure composed of s-domain transfer functions and nonlinear blocks represented by rate limiters, saturations, and look-up tables has been proposed.

- The model parameters have been optimized to fit real-world data. The verified model was then used to design a multiple PI/PD control to regulate the gas turbine via the inlet guide vane and fuel values. The aim is to raise and stabilize the compressor’s differential pressure or pressure ratio, as well as raise the set-point of the temperature exhausted from the combustion turbine; as a result, energy efficiency has been improved by an average of 237.16 MWh saving energy (or 8.96% reduction in fuel consumption) for a load range of 120 MW to 240 MW.

Maximizing Rotor Component Commonality

- The field of gas turbine technology increases in sophistication daily. Every manufacturer has a unique design philosophy. Primarily, design development work concentrates on improving the core of already established designs. The market entry of a new gas turbine model with a substantially different core represents a major capital investment and is usually only done if there is a substantial gap in the original equipment manufacturers (OEM's) product line that the specific OEM intends to cover.

- Several gas turbines have dual-frequency capability. Siemens SGT-200 Industrial Gas Turbine for Power Generation (ISO) 6.75MW (e) Power Generation Package is of light modular construction, 50Hz or 60Hz, and suitable for small power generation, especially in locations where the power-to-weight ratio is important, and a small footprint is required.

- The SGT-200 is available as a factory-assembled packaged power plant for utility and industrial power generation applications. It incorporates the gas turbine, gearbox, generator, and all systems mounted on a base. The package is available for either multi-point or three-point mounting for onshore or offshore use, as required.

Volatility in Natural Gas Prices

- Volatility in natural gas prices will hamper the market growth of gas turbines. Natural gas prices are affected by disruptions in the supply of natural gas. Geopolitics is an attention-seeking factor that causes unsureness regarding the availability or demand for gas. This can affect gas price volatility. Crushed rock gas exploitation has reduced the cost of gas in the U.S., but around the world, the value remains relatively high. In the Middle East region, most of the countries account for a significant share of natural gas reserves. It is a highly unstable region due to political and cultural issues.

Gas Turbine Market Segment Analysis

The global gas turbine market is segmented by capacity, application, design, technology, and end users. By design type, the aeroderivative segment is anticipated to dominate the market over the forecast period.

- The aeroderivative segment is dominated by growth during the forecast period. The design for aeroderivative gas turbines is based on aircraft engines or aviation gas turbines. Aeroderivative gas turbines weigh less, are easy to install, and are faster to start up compared to heavy-duty gas turbines.

- By TECHNOLOGY, the power generation segment dominated the growing market over the forecast period.

- The power generation segment is capturing the gas turbine market. Gas turbine power plants are widely used as medium-sized peak-load plants used to run intermittently during short durations of high-power demand on an electric system. They are also used as cogeneration plants for industrial plants with high heat loads and district heating schemes.

Global Gas Turbine Market: Regional Insights

Asia Pacific is expected to Dominate the Market over the Forecast period

- Asia Pacific, an energy transition in the region must be vital in its response to climate change. Asia-Pacific countries are at different levels of development and have uneven resource funding, with diverse geographical and technological capacities. The rising spending on technological developments and increasing investment in R&D activities, combined with the rising demand for electricity utilization from economies such as China and India, are driving regional industry growth.

- Additionally, the quick evolution of the electricity landscape in the region is projected to lead to increased demand for the industry. The rising number of enterprises undertaken by the regional government to encourage efficient ways of generating electricity.

Top Key Players of the Gas Turbine Market

- GE Power(U.S)

- Siemens Energy (Germany)

- Mitsubishi Power (Japan)

- Ansaldo Energia S.p.A (UAE)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Solar Turbines Inc. (U.S)

- Techno Strength Private Limited (India)

- Baker Hughes (U.S)

- Nanjing Turbine & Electric Machinery (China)

- Bharat Heavy Electricals Limited (India)

- Kawasaki Heavy Industries, Ltd. (Japan)

- John F Welch Technology Center (India)

- OPRA Turbines (Netherlands)

- MAN, Energy Solutions SE (Germany)

- Shanghai Electric Group Company Limited (China)

- Dongfang Electric Corporation (China)

- Doosan Energy Co., Ltd. (South Korea)

- Capstone Turbine Corporation (U.S)

- Centrax Gas Turbine (U.K)

- Solar Turbine International company (California)

Key Industry Developments in the Gas Turbine Market

- In April 2023, GE Gas Power acquired Nexus Controls from Baker Hughes, creating a new full-service control business line. With the addition of this leading aftermarket control system upgrade and field service capability, GE Gas Power, part of GE Vern ova, created a single, full-service controls business line responsible for further developing GE's proprietary Mark Vle control systems platform and the implementation of the On-Core system.

- In June 2024, TotalEnergies SE raised its global flexible power generation capacity to seven gigawatts (GW) gross by acquiring the 1.3 GW West Burton B gas-fired power plant in Nottinghamshire, England. The company completed a 100 percent stock acquisition of the plant's operator, West Burton Energy, from Washington-based EIG Global Energy Partners LLC. The transaction, valued at GBP 450 million ($573 million), was announced by the French energy giant in a statement. The deal, however, was pending approval from the relevant authorities at the time of the announcement.

- In January 2024, Bharat Forge recently acquired a 51% stake in the Indian arm of the Ukrainian firm Zorya-Mashproekt. Zorya's gas turbine power plants had been integral to all of India's destroyers and the Talwar-class frigates. The war in Ukraine prompted India to expedite its shift away from reliance on the Russian defense industry. This ongoing conflict had placed India in a Catch-22 situation, causing delays in the completion of the two remaining ships in the class. Bharat Forge's acquisition marked a significant step in reducing India's dependence on Russian defense technology amidst the challenges posed by the war.

|

Global Gas Turbine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market size in 2023: |

USD 27.3 Bn. |

|

Forecast Period 2024–32 CAGR: |

6.02% |

Market size in 2032: |

USD 46.2 Bn. |

|

Segments Covered: |

By Capacity Type |

|

|

|

By Application |

|

||

|

By Design |

|

||

|

By Technology |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key market restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gas Turbine Market by By Capacity Type (2018-2032)

4.1 Gas Turbine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Less Than 40 MW

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 40-120 MW

4.5 120-300 MWA

4.6 Above 300 MW

Chapter 5: Gas Turbine Market by By Application (2018-2032)

5.1 Gas Turbine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Power

5.5 Utility

Chapter 6: Gas Turbine Market by By Design (2018-2032)

6.1 Gas Turbine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Heavy-Duty

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aero-Derivative

Chapter 7: Gas Turbine Market by By Technology (2018-2032)

7.1 Gas Turbine Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Open Cycle

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Combined Cycle

Chapter 8: Gas Turbine Market by By End Users (2018-2032)

8.1 Gas Turbine Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Power Generation

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Oil & Gas

8.5 Marine

8.6 Aerospace

8.7 Process Plants

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Gas Turbine Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PEPSICO (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 NESTLÉ (SWITZERLAND)

9.4 MARICO (INDIA)

9.5 CALBEE (JAPAN)

9.6 BAGRRY INDIA PVT. LTD. (INDIA)

9.7 GENERAL MILLS INC. (USA)

9.8 KELLOGG CO. (USA)

9.9 B&G FOODS INC. (USA)

9.10 NATURE'S PATH FOODS (CANADA)

9.11 BOB’S RED MILL NATURAL FOODS (USA)

9.12 OTHER KEY PLAYERS

Chapter 10: Global Gas Turbine Market By Region

10.1 Overview

10.2. North America Gas Turbine Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Capacity Type

10.2.4.1 Less Than 40 MW

10.2.4.2 40-120 MW

10.2.4.3 120-300 MWA

10.2.4.4 Above 300 MW

10.2.5 Historic and Forecasted Market Size By By Application

10.2.5.1 Industrial

10.2.5.2 Power

10.2.5.3 Utility

10.2.6 Historic and Forecasted Market Size By By Design

10.2.6.1 Heavy-Duty

10.2.6.2 Aero-Derivative

10.2.7 Historic and Forecasted Market Size By By Technology

10.2.7.1 Open Cycle

10.2.7.2 Combined Cycle

10.2.8 Historic and Forecasted Market Size By By End Users

10.2.8.1 Power Generation

10.2.8.2 Oil & Gas

10.2.8.3 Marine

10.2.8.4 Aerospace

10.2.8.5 Process Plants

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Gas Turbine Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Capacity Type

10.3.4.1 Less Than 40 MW

10.3.4.2 40-120 MW

10.3.4.3 120-300 MWA

10.3.4.4 Above 300 MW

10.3.5 Historic and Forecasted Market Size By By Application

10.3.5.1 Industrial

10.3.5.2 Power

10.3.5.3 Utility

10.3.6 Historic and Forecasted Market Size By By Design

10.3.6.1 Heavy-Duty

10.3.6.2 Aero-Derivative

10.3.7 Historic and Forecasted Market Size By By Technology

10.3.7.1 Open Cycle

10.3.7.2 Combined Cycle

10.3.8 Historic and Forecasted Market Size By By End Users

10.3.8.1 Power Generation

10.3.8.2 Oil & Gas

10.3.8.3 Marine

10.3.8.4 Aerospace

10.3.8.5 Process Plants

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Gas Turbine Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Capacity Type

10.4.4.1 Less Than 40 MW

10.4.4.2 40-120 MW

10.4.4.3 120-300 MWA

10.4.4.4 Above 300 MW

10.4.5 Historic and Forecasted Market Size By By Application

10.4.5.1 Industrial

10.4.5.2 Power

10.4.5.3 Utility

10.4.6 Historic and Forecasted Market Size By By Design

10.4.6.1 Heavy-Duty

10.4.6.2 Aero-Derivative

10.4.7 Historic and Forecasted Market Size By By Technology

10.4.7.1 Open Cycle

10.4.7.2 Combined Cycle

10.4.8 Historic and Forecasted Market Size By By End Users

10.4.8.1 Power Generation

10.4.8.2 Oil & Gas

10.4.8.3 Marine

10.4.8.4 Aerospace

10.4.8.5 Process Plants

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Gas Turbine Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Capacity Type

10.5.4.1 Less Than 40 MW

10.5.4.2 40-120 MW

10.5.4.3 120-300 MWA

10.5.4.4 Above 300 MW

10.5.5 Historic and Forecasted Market Size By By Application

10.5.5.1 Industrial

10.5.5.2 Power

10.5.5.3 Utility

10.5.6 Historic and Forecasted Market Size By By Design

10.5.6.1 Heavy-Duty

10.5.6.2 Aero-Derivative

10.5.7 Historic and Forecasted Market Size By By Technology

10.5.7.1 Open Cycle

10.5.7.2 Combined Cycle

10.5.8 Historic and Forecasted Market Size By By End Users

10.5.8.1 Power Generation

10.5.8.2 Oil & Gas

10.5.8.3 Marine

10.5.8.4 Aerospace

10.5.8.5 Process Plants

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Gas Turbine Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Capacity Type

10.6.4.1 Less Than 40 MW

10.6.4.2 40-120 MW

10.6.4.3 120-300 MWA

10.6.4.4 Above 300 MW

10.6.5 Historic and Forecasted Market Size By By Application

10.6.5.1 Industrial

10.6.5.2 Power

10.6.5.3 Utility

10.6.6 Historic and Forecasted Market Size By By Design

10.6.6.1 Heavy-Duty

10.6.6.2 Aero-Derivative

10.6.7 Historic and Forecasted Market Size By By Technology

10.6.7.1 Open Cycle

10.6.7.2 Combined Cycle

10.6.8 Historic and Forecasted Market Size By By End Users

10.6.8.1 Power Generation

10.6.8.2 Oil & Gas

10.6.8.3 Marine

10.6.8.4 Aerospace

10.6.8.5 Process Plants

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Gas Turbine Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Capacity Type

10.7.4.1 Less Than 40 MW

10.7.4.2 40-120 MW

10.7.4.3 120-300 MWA

10.7.4.4 Above 300 MW

10.7.5 Historic and Forecasted Market Size By By Application

10.7.5.1 Industrial

10.7.5.2 Power

10.7.5.3 Utility

10.7.6 Historic and Forecasted Market Size By By Design

10.7.6.1 Heavy-Duty

10.7.6.2 Aero-Derivative

10.7.7 Historic and Forecasted Market Size By By Technology

10.7.7.1 Open Cycle

10.7.7.2 Combined Cycle

10.7.8 Historic and Forecasted Market Size By By End Users

10.7.8.1 Power Generation

10.7.8.2 Oil & Gas

10.7.8.3 Marine

10.7.8.4 Aerospace

10.7.8.5 Process Plants

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Gas Turbine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market size in 2023: |

USD 27.3 Bn. |

|

Forecast Period 2024–32 CAGR: |

6.02% |

Market size in 2032: |

USD 46.2 Bn. |

|

Segments Covered: |

By Capacity Type |

|

|

|

By Application |

|

||

|

By Design |

|

||

|

By Technology |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key market restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gas Turbine Market research report is 2024–2032.

GE Power (U.S), Siemens Energy (Germany), Mitsubishi Power (Japan), Ansaldo Energia S.p.A (UAE), Mitsubhishi Heavy Industries, Ltd. (Japan), Solar Turbines Inc. (U.S), Techno strength Private Limited (India), Baker Hughes (U.S), Nanjing Turbine & Electric Machinery (China), Bharat Heavy Electricals Limited (India), Kawasaki Heavy Industries, Ltd. (Japan), John F Welch Technology Center (India), OPRA Turbines (Netherlands), MAN, Energy Solutions SE (Germany), Shanghai Electric Group Company Limited (China), Dongfang Electric Corporation (China), Doosan Enerbility Co., Ltd. (South Korea), Capstone Turbine Corporation (U.S), Centrax Gas Turbine (U.K), Solar Turbine International Company (California), and Other major players.

The gas turbine market is segmented into capacity type, application, design, technology, end users, and region. By capacity type, the market is categorized into less than 40 MW, 40–120 MW, 120–300 MW, and above 300 MW. By application, the market is categorized into industrial, power, and utility. By design, the market is categorized into heavy-duty and aero-derivative. By technology, the market is categorized into open cycles and combined cycles. The end-user market is segmented into power generation, oil and gas, marine, aerospace, and process plants. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Russia, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A gas turbine is an internal combustion engine that transfers chemical energy in the form of rotational power into mechanical energy. Then, the major gas turbine manufacturers added another feature that drives the generator.

The Gas Turbine Market Was Valued at USD 27.3 Billion in 2023 and is Projected to Reach USD 46.2 Billion by 2032, Growing at a CAGR of 6.02% From 2024–2032.