General Surgery Devices Market Synopsis:

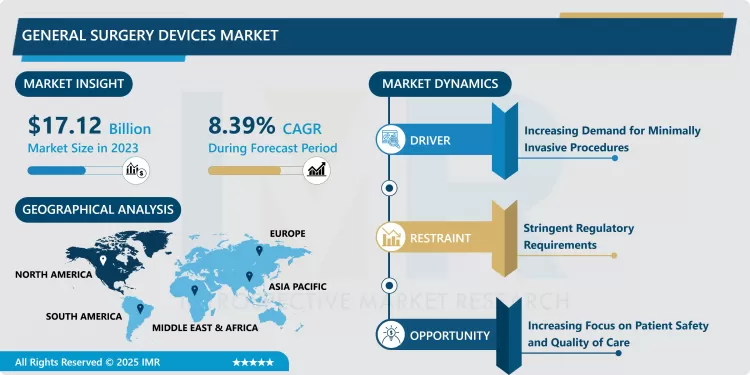

General Surgery Devices Market Size Was Valued at USD 17.12 Billion in 2023, and is Projected to Reach USD 35.36 Billion by 2032, Growing at a CAGR of 8.39% From 2024-2032.

General surgery devices refer to different instruments and machinery employed in the surgical treatment of diseases and other medical conditions. This market includes equipment for both open and minimal invasive procedures including the laparoscopic surgeries. Examples of surgical instruments are scalpels, scissors, forceps; surgical devices include staplers and electrosurgical devices and their accessories. The nature and importance of surgical interventions set them apart from other health-care services, so that the existing demand prescribes the nature of technological progress for this sector.

The significant growth in chronic diseases, including obesity, diabetes, and cardiovascular disorders required general surgery devices to perform surgical operation is the key factor of the General Surgery Devices Market. This again is an added strength for this demand because the geriatric population is increasing steadily and elders are more likely to be in need of a surgical operation. Further, improvements in such surgeries as laparoscopic surgeries have promoted patient’s well-being, and quick healing therefore subsequent high demand for such surgical devices.

One of the major factors is increased technology in surgical tools and equipment as well as Doctors. Enabling technologies in the highly emerging field of surgical innovations include; Robotic-assisted surgery, three-dimensional visualization, and smart attached surgical instruments. Most of these advancements not only enhance accuracy and speed but also reduce undesirable incidents and pain in the process of recovery for the patients. Patient dearth is increasingly becoming a major concern and hospital stays are being shortened, this catalyses the need for enhanced surgical devices.

General Surgery Devices Market Trend Analysis:

The growing adoption of minimally invasive surgical techniques.

- One of the main trends in the development of the General Surgery Devices Market is to increase the number of minimally invasive surgical procedures. All these procedures have many benefits which include; less trauma, less time taken to heal, and lesser risk of developing an infection. The increase in patient-centered care by healthcare providers is benefiting the development of these devices as the tag of minimally invasive surgeries gains popularity.

- Another one the trends identified in the context of development of new-generation surgical devices is the application of digital technologies, including artificial intelligence and augmented reality. These technologies increase efficiency in planning, decision making and practice simulation for surgeon. This is especially so, as the general healthcare industry continues to progress towards enhancing technology integration as part of the digital transformation framework; where the integration of these technologies in general surgery devices is expected to fuel the expansion of the market.

Healthcare infrastructure improves.

- The General Surgery Devices market has huge unexplored potential especially in the growing markets. Since the heath care facilities are likely to develop within the Asia/ Pacific and Latin American countries and as the surgical care becomes more accessible, the related equipment demand is likely to increase. These emerging markets are ideal for companies because they offer an increasing demand of optimal surgical solutions.

- In addition, the awareness on the patient and surgical outcomes continues to grow, which creates a chance for the manufacturers to design and launch new instruments and devices to improve surgical accuracy and reduce adverse effects. To fulfill the needs of practitioners and patients, investing in technology and innovating medical tools and equipment will give the opportunity to companies to develop and sell new products.

General Surgery Devices Market Segment Analysis:

General Surgery Devices Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Surgical Instruments segment is expected to dominate the market during the forecast period

- The General Surgery Devices Market can be categorized into three primary types: surgical tools, surgical gadgets, and related products. Surgical under important classification falls of a broad group known as surgical instruments; these are tools that play diverse purpose integral in surgery for instance the scissors, forceps, clamps and the scalpels among others: These are important tools of high precision. Surgical instruments can be defined as polished tools that are general in use in several surgeries, and they include the following; Electro surgical unit, stapler and robotic surgical system helps in making surgical operations safe as well as effective. Accessories include products that help in surgical operations like suture, the drape and the sterilizing solutions which are very vital in enhancing the best results in operations as well as maintaining sterile results throughout the operations. Altogether, the above-mentioned categories collectively provide a broad segmentation matrix for various products available in the general surgery devices market.

By Application, Laparoscopic Surgery segment expected to held the largest share

- Based on the type of surgery that the general surgery devices are used in, this market is further segmented to laparoscopic surgery, open surgery and robotic surgery. Laparoscopic surgery is a procedure that is gradually gaining popularity due to its benefits namely the need for small incisions and special equipment which means less pain, short recovery time and a general tendency towards adoption in many operations like cholecystectomy and herniorrhaphy. While on the other side traditional surgery which involves the creation of a large incision and requires the physical manipulation of tissue in the operation theatre is usually applied during operations that require broader exposure and frequently in cases of organ excision, major trauma surgery among others. Robotic surgery is an enhanced application for the implementation of robotic systems to improve the surgeons’ accuracy and control sophisticated movements with minimal invasions through an optimization of minimally invasive surgery to the well-being of patients. These applications demonstrate the continuing growth in surgical practices that are the focus of general surgery devices.

General Surgery Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest share in the General Surgery Devices Market and is expected to occupy nearly 40% of the market. Factors such as sound health care facilities, high health care expenditure and conducive research and development facility can explain this dominance. This need is primarily fueled by the fact that the region’s established hospitals and surgical centers are powered with surgical tool technologies for the manufacture of advanced surgical instruments.

- Furthermore, North American has the presence of major players they invest awareness in product progression and innovative technologies. Increasing familiarity with minimally invasive surgeries among both healthcare professionals and people also drives this market forward in the region. Therefore, North America is expected to continue to dominate the General Surgery Devices Market over the next several years.

Active Key Players in the General Surgery Devices Market:

- Medtronic (Ireland)

- Johnson & Johnson (United States)

- Boston Scientific (United States)

- Stryker Corporation (United States)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew (United Kingdom)

- Ethicon (part of Johnson & Johnson) (United States)

- Zimmer Biomet (United States)

- Abbott Laboratories (United States)

- Conmed Corporation (United States)

- Other Active Players

|

General Surgery Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.12 Billion |

|

Forecast Period 2024-32 CAGR: |

8.39 % |

Market Size in 2032: |

USD 35.36 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: General Surgery Devices Market by By Type (2018-2032)

4.1 General Surgery Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Surgical Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Surgical Devices

4.5 Accessories

Chapter 5: General Surgery Devices Market by By Application (2018-2032)

5.1 General Surgery Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laparoscopic Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Open Surgery

5.5 Robotic Surgery

5.6 End User

5.7 Hospitals

5.8 Ambulatory Surgical Centers

5.9 Specialty Clinics

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 General Surgery Devices Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MEDTRONIC (IRELAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 JOHNSON & JOHNSON (UNITED STATES)

6.4 BOSTON SCIENTIFIC (UNITED STATES)

6.5 STRYKER CORPORATION (UNITED STATES)

6.6 B. BRAUN MELSUNGEN AG (GERMANY)

6.7 SMITH & NEPHEW (UNITED KINGDOM)

6.8 ETHICON (UNITED STATES)

6.9 ZIMMER BIOMET (UNITED STATES)

6.10 ABBOTT LABORATORIES (UNITED STATES)

6.11 CONMED CORPORATION (UNITED STATES)

6.12 OTHER ACTIVE PLAYERS

Chapter 7: Global General Surgery Devices Market By Region

7.1 Overview

7.2. North America General Surgery Devices Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Surgical Instruments

7.2.4.2 Surgical Devices

7.2.4.3 Accessories

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Laparoscopic Surgery

7.2.5.2 Open Surgery

7.2.5.3 Robotic Surgery

7.2.5.4 End User

7.2.5.5 Hospitals

7.2.5.6 Ambulatory Surgical Centers

7.2.5.7 Specialty Clinics

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe General Surgery Devices Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Surgical Instruments

7.3.4.2 Surgical Devices

7.3.4.3 Accessories

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Laparoscopic Surgery

7.3.5.2 Open Surgery

7.3.5.3 Robotic Surgery

7.3.5.4 End User

7.3.5.5 Hospitals

7.3.5.6 Ambulatory Surgical Centers

7.3.5.7 Specialty Clinics

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe General Surgery Devices Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Surgical Instruments

7.4.4.2 Surgical Devices

7.4.4.3 Accessories

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Laparoscopic Surgery

7.4.5.2 Open Surgery

7.4.5.3 Robotic Surgery

7.4.5.4 End User

7.4.5.5 Hospitals

7.4.5.6 Ambulatory Surgical Centers

7.4.5.7 Specialty Clinics

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific General Surgery Devices Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Surgical Instruments

7.5.4.2 Surgical Devices

7.5.4.3 Accessories

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Laparoscopic Surgery

7.5.5.2 Open Surgery

7.5.5.3 Robotic Surgery

7.5.5.4 End User

7.5.5.5 Hospitals

7.5.5.6 Ambulatory Surgical Centers

7.5.5.7 Specialty Clinics

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa General Surgery Devices Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Surgical Instruments

7.6.4.2 Surgical Devices

7.6.4.3 Accessories

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Laparoscopic Surgery

7.6.5.2 Open Surgery

7.6.5.3 Robotic Surgery

7.6.5.4 End User

7.6.5.5 Hospitals

7.6.5.6 Ambulatory Surgical Centers

7.6.5.7 Specialty Clinics

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America General Surgery Devices Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Surgical Instruments

7.7.4.2 Surgical Devices

7.7.4.3 Accessories

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Laparoscopic Surgery

7.7.5.2 Open Surgery

7.7.5.3 Robotic Surgery

7.7.5.4 End User

7.7.5.5 Hospitals

7.7.5.6 Ambulatory Surgical Centers

7.7.5.7 Specialty Clinics

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

General Surgery Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.12 Billion |

|

Forecast Period 2024-32 CAGR: |

8.39 % |

Market Size in 2032: |

USD 35.36 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the General Surgery Devices Market research report is 2024-2032.

Medtronic (Ireland), Johnson & Johnson (United States), Boston Scientific (United States), Stryker Corporation (United States), B. Braun Melsungen AG (Germany), Smith & Nephew (United Kingdom), Ethicon (United States), Zimmer Biomet (United States), Abbott Laboratories (United States), Conmed Corporation (United States). and Other Active Players.

The General Surgery Devices Market is segmented by Product Type (Surgical Instruments, Surgical Devices, Accessories), Application (Laparoscopic Surgery, Open Surgery, Robotic Surgery), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

General surgery devices refer to different instruments and machinery employed in the surgical treatment of diseases and other medical conditions. This market includes equipment for both open and minimal invasive procedures including the laparoscopic surgeries. Examples of surgical instruments are scalpels, scissors, forceps; surgical devices include staplers and electrosurgical devices and their accessories. The nature and importance of surgical interventions set them apart from other health-care services, so that the existing demand prescribes the nature of technological progress for this sector.

General Surgery Devices Market Size Was Valued at USD 17.12 Billion in 2023, and is Projected to Reach USD 35.36 Billion by 2032, Growing at a CAGR of 8.39% From 2024-2032.