Ginger Oil Market Synopsis:

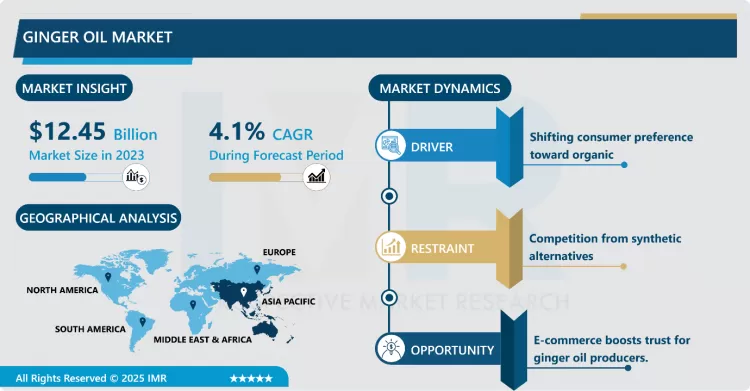

Ginger Oil Market Size Was Valued at USD 12.45 Billion in 2023 and is Projected to Reach USD 17.87 Billion by 2032, Growing at a CAGR of 4.1% From 2024-2032.

Ginger Essential Oil is extracted from the roots of Zingiber more commonly known as Ginger, through Steam Distillation. Ginger belongs to the family of Zingiberaceae and is native to Southeast Asia. It is also used as a home remedy to various medical conditions like, cough and cold, fever, sore throat, congestion, and viral fevers. Ginger is also rich in retinol, which helps in skin stimulation and tightening. Ginger is utilized in every culture, in every form. It is used to flavor drinks, make alcohol, candies, pickles, tea, etc.

Ginger essential oil is infused into various skin products however, it is most Potent in anti-aging creams and gels. The oil contains active ingredients that aid in Treating acne and blisters. Ginger is anti-inflammatory and has been used in making ointments and balm to relieve pain. The oil as an ingredient is useful in aromatherapy as it helps relieve stress, boosts confidence, and promotes relaxation, and concentration. Due to its several uses, ginger essential oil has been used for other purposes. The oil has an anti-bacterial nature, and ginger essential oil is a great ingredient in soaps, bathing products, and skin rejuvenators.

Ginger oil is used medicinally to cure many issues and digestive problems it lowers inflammation, reduces the discomfort of the bowel, eliminates toxins from the body, clears the respiratory tract, and increases the appetite. The ginger oil is also used in aromatherapy, it increases concentration, and confidence levels, and reduces the feeling of sadness, dizziness, and anxiety. Attributing such applications resulted in the growth of the ginger oil market in the forecasted period.

Ginger Oil Market Growth and Trend Analysis:

- Ginger Oil has a broad array of medicinal characteristics. It has antioxidant, anti-inflammatory, and antimicrobial properties. These properties make it essential in the treatment of various ailments, including digestive problems arthritis, and respiratory infections.

- For example, ginger oil can be used analytically to comfort joint pain associated with arthritis. It can also be taken internally to mitigate an upset stomach or improve digestion. In the respiratory system, ginger oil can help to relieve congestion and coughs.

- There is ongoing R&D in the pharmaceutical sector to further explore the potential of ginger oil. Scientists are studying its chemical composition and how it combines with the human body at the molecular level. This research could lead to the development of new drugs or therapies based on ginger oil.

- For instance, some research is focused on isolating specific compounds in ginger oil that may have more dominant medicinal effects. Pharmaceutical companies are also interested in developing ginger-based products in the form of capsules, tablets, or tinctures for easier consumption.

Shifting consumer preference toward organic

- In recent times, consumers are increasingly interested in natural and organic products. Ginger oil, being a natural extract, fits well into this trend. Consumers perceive natural products as being safer and healthier compared to synthetic alternatives. In the beauty and personal care industry, for example, ginger oil is being used in products such as shampoos, soaps, and lotions. The demand for organic ginger oil is particularly high among consumers who are concerned about the environment and their health. These consumers are willing to pay a premium price for products that are certified organic.

- Ginger has a unique flavor and aroma that is highly sought-after in the food and beverage industry. Ginger oil is used as a flavoring agent in a wide range of products, including soft drinks, teas, and confectionery. The trend towards more exotic and spicy flavors in food and beverages has further raised the demand for ginger oil. In the aromatherapy industry, ginger oil is valued for its warm and invigorating aroma. It is used in diffusers and massage oils to provide relaxation and stress relief.? This presents a promising market growth opportunity.

Competition from synthetic alternatives

- In some industries, ginger oil faces competition from synthetic alternatives. Synthetic flavorings and fragrances can be produced at a lower cost and may have a more consistent quality. However, they lack the natural and holistic benefits of ginger oil. To compete with synthetic alternatives, ginger oil producers need to highlight the unique properties of ginger oil, such as its natural origin and medicinal benefits.

E-commerce boosts trust for ginger oil producers.

- The rise of e-commerce has opened up new channels for selling ginger oil. Online platforms allow producers to reach a wider audience directly, bypassing traditional retail channels. This can lower the expenditure and increase profit margins. In addition, e-commerce platforms enable producers to provide more detailed information about their products, such as the production process, organic certification, and medicinal properties. This helps to build trust with consumers and can increase sales

Ginger Oil Market Segment Analysis:

Ginger Oil Market is segmented based on nature, application, end-users, and region

By Type, Organic segment is expected to dominate the market during the forecast period

- Organic food or products are grown without the use of synthetic chemicals, such as human-made pesticides and fertilizers, and do not contain genetically modified organisms (GMOs). Organic foods include fresh produce, meats, and dairy products as well as processed foods such as crackers, drinks, and frozen meals. The market for organic food has grown significantly with distinct production, processing, distribution, and retail systems.

- The numerous uses for ginger and its essential oil continue to draw the attention of many to it. Ginger for its used as a food ingredient which can be used in many forms whether it be fresh or dried or added as a tea flavouring. The oil is energizing and uplifting with a fresh, spicy, and woody aroma and has many uses as an enhancement for food flavorings or as a medical ingredient this is attributed to the dominance of organic segment.

By Application, Steam Distillation segment held the largest share in 2023

- Steam distillation is mostly used to produce many types of essential oil such as from ginger. The process is cheaper than other extraction processes. It will not use any solvent and can make it safer than other processes. To get the approximately pure essential oil from raw material, conventional extraction techniques like steam distillation are used. Steam distillation is unlikely solvent extraction.

- Steam distillation is the conventional method for extracting volatile Essential oil from plants. Steam distillation extracts approximately 93% of Essential oil, while the remaining 7% is obtained using other methods. Steam distillation is preferred for extracting Essential oil due to it is environmentally friendly, safe to operate, and easy to scale. Steam distillation is better at producing pure compounds and reducing impurities than the other methods as a result steam distillation held the largest share in the forecasted period.

Ginger Oil Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The diverse climate across the Asia Pacific region creates an optimal environment for cultivating a broad range of spices. India is the country with the highest number of spice varieties globally. In terms of spice export destinations, the United States tops the list, followed by Vietnam, China, the UAE, and Malaysia. India also holds the distinction of being both the largest producer and consumer of ginger globally, with nearly half of the global production originating from India.

- In the Asia Pacific region, India is the world’s largest spice producer. It is also the largest consumer and exporter of spices. The production of different spices has been growing rapidly over the last few years. Production in 2022-23 stood at 11.14 million tonnes compared to 11.12 million tonnes in 2021-22. During 2022-23, the export of spices from India stood at USD 3.73 billion from USD 3.46 billion in 2021-22.

- India is the largest exporter of spice and spice items. During 2023-24 the country exported spices worth USD 4.46 billion. In 2024-25 (until June 2024) India exported spices worth USD 1.09 billion.

- According to Volza's Ginger Oil export data of India, there are a total of 513 Ginger Oil Suppliers in India, exporting to 2,838 buyers globally. In the period from March 2023 to Feb 2024

From the above graph, it is seen that India dominated ginger oil suppliers in 2023, attributing to the country's overall production, India benefits from cost-effective labor, which reduces production costs, making its ginger oil competitive in global markets. The country has advanced processing facilities for essential oil extraction, supported by established companies like Mane Kancor, Synthite Industries, and AOS Products. These companies have built a reputation for producing high-quality oils at scale.

Ginger Oil Market Active Players:

- Aura Cacia (USA)

- Botanic Healthcare (India)

- Bulk Apothecary (USA)

- doTERRA (USA)

- Edens Garden (USA)

- Fraterworks (China)

- Gya Labs (USA)

- Healing Solutions (USA)

- HIQILI (China)

- Kukka Essential Oils (USA)

- LOTUSJOY (China)

- Mane Kancor Ingredients Ltd. (India)

- Mountain Rose Herbs (USA)

- Nature In Bottle (India)

- NOW Foods (USA)

- Other Active Players

- Ozone Naturals (India)

- Plant Therapy (USA)

- Young Living (USA)

- Zongle Therapeutics (USA)

- Other Active Players

Key Industry Developments in the Ginger Oil Market:

- In October 2023, the Jamaican government urged their farmers to embrace ginger cultivation to increase the demand for spice crops globally. The nation is witnessing a stage where the demand for all spices, especially ginger, is rising overseas. The increased demand makes it equivalent to “agricultural malpractice”, which is not even taken into consideration, stated Floyd Green, Agricultural Minister.

- In September 2023, d?TERRA announced the launch of several new essential oils and essential oil blends at their global convention and additions to their sleep and gut health systems. d?TERRA remains firm in its goal to provide high-quality products and sustainably sourced essential oils.

|

Ginger Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.1% |

Market Size in 2032: |

USD 17.87 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ginger Oil Market by By Nature (2018-2032)

4.1 Ginger Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed Ginger Oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed Ginger Oil

Chapter 5: Ginger Oil Market by By Application (2018-2032)

5.1 Ginger Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Conventional

Chapter 6: Ginger Oil Market by By End-User (2018-2032)

6.1 Ginger Oil Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Steam Distillation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Solvent Extraction

6.5 Cold Press Extraction

6.6 CO2 Supercritical Extraction

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ginger Oil Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AURA CACIA (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOTANIC HEALTHCARE (INDIA)

7.4 BULK APOTHECARY (USA)

7.5 DOTERRA (USA)

7.6 EDENS GARDEN (USA)

7.7 FRATERWORKS (CHINA)

7.8 GYA LABS (USA)

7.9 HEALING SOLUTIONS (USA)

7.10 HIQILI (CHINA)

7.11 KUKKA ESSENTIAL OILS (USA)

7.12 LOTUSJOY (CHINA)

7.13 MANE KANCOR INGREDIENTS LTD. (INDIA)

7.14 MOUNTAIN ROSE HERBS (USA)

7.15 NATURE IN BOTTLE (INDIA)

7.16 NOW FOODS (USA)

7.17 OZONE NATURALS (INDIA)

7.18 PLANT THERAPY (USA)

7.19 YOUNG LIVING (USA)

7.20 ZONGLE THERAPEUTICS (USA)

7.21 OTHER ACTIVE PLAYERS

Chapter 8: Global Ginger Oil Market By Region

8.1 Overview

8.2. North America Ginger Oil Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Nature

8.2.4.1 Processed Ginger Oil

8.2.4.2 Unprocessed Ginger Oil

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Organic

8.2.5.2 Conventional

8.2.6 Historic and Forecasted Market Size By By End-User

8.2.6.1 Steam Distillation

8.2.6.2 Solvent Extraction

8.2.6.3 Cold Press Extraction

8.2.6.4 CO2 Supercritical Extraction

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ginger Oil Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Nature

8.3.4.1 Processed Ginger Oil

8.3.4.2 Unprocessed Ginger Oil

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Organic

8.3.5.2 Conventional

8.3.6 Historic and Forecasted Market Size By By End-User

8.3.6.1 Steam Distillation

8.3.6.2 Solvent Extraction

8.3.6.3 Cold Press Extraction

8.3.6.4 CO2 Supercritical Extraction

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ginger Oil Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Nature

8.4.4.1 Processed Ginger Oil

8.4.4.2 Unprocessed Ginger Oil

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Organic

8.4.5.2 Conventional

8.4.6 Historic and Forecasted Market Size By By End-User

8.4.6.1 Steam Distillation

8.4.6.2 Solvent Extraction

8.4.6.3 Cold Press Extraction

8.4.6.4 CO2 Supercritical Extraction

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ginger Oil Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Nature

8.5.4.1 Processed Ginger Oil

8.5.4.2 Unprocessed Ginger Oil

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Organic

8.5.5.2 Conventional

8.5.6 Historic and Forecasted Market Size By By End-User

8.5.6.1 Steam Distillation

8.5.6.2 Solvent Extraction

8.5.6.3 Cold Press Extraction

8.5.6.4 CO2 Supercritical Extraction

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ginger Oil Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Nature

8.6.4.1 Processed Ginger Oil

8.6.4.2 Unprocessed Ginger Oil

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Organic

8.6.5.2 Conventional

8.6.6 Historic and Forecasted Market Size By By End-User

8.6.6.1 Steam Distillation

8.6.6.2 Solvent Extraction

8.6.6.3 Cold Press Extraction

8.6.6.4 CO2 Supercritical Extraction

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ginger Oil Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Nature

8.7.4.1 Processed Ginger Oil

8.7.4.2 Unprocessed Ginger Oil

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Organic

8.7.5.2 Conventional

8.7.6 Historic and Forecasted Market Size By By End-User

8.7.6.1 Steam Distillation

8.7.6.2 Solvent Extraction

8.7.6.3 Cold Press Extraction

8.7.6.4 CO2 Supercritical Extraction

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Ginger Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.1% |

Market Size in 2032: |

USD 17.87 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Ginger Oil Market research report is 2024-2032.

Aura Cacia (USA), Botanic Healthcare (India), Bulk Apothecary (USA), doTERRA (USA), Edens Garden (USA), Fraterworks (China), Gya Labs (USA), Healing Solutions (USA), HIQILI (China), Kukka Essential Oils (USA), LOTUSJOY (China), Mane Kancor Ingredients Ltd. (India), Mountain Rose Herbs (USA), Nature In Bottle (India), NOW Foods (USA), Ozone Naturals (India), Plant Therapy (USA), Young Living (USA), Zongle Therapeutics (USA), and Other Active Players.

The Ginger Oil Market is segmented into Type, Nature, Application, and Region. By Nature, the market is categorized into Organic and Conventional. By Method of Extraction, the market is categorized into Steam Distillation, Solvent Extraction, Cold Press Extraction, and CO2 Supercritical Extraction. By End-User, the market is categorized into Food & Beverage, Pharmaceutical, Personal Care, and Others. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia, Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ginger Essential Oil is extracted from the roots of Zingiber more commonly known as Ginger, through Steam Distillation. Ginger belongs to the family of Zingiberaceae and is native to Southeast Asia.

Ginger Oil Market Size Was Valued at USD 12.45 Billion in 2023 and is Projected to Reach USD 17.87 Billion by 2032, Growing at a CAGR of 4.1% From 2024-2032.