Automotive Load Floor Market Synopsis

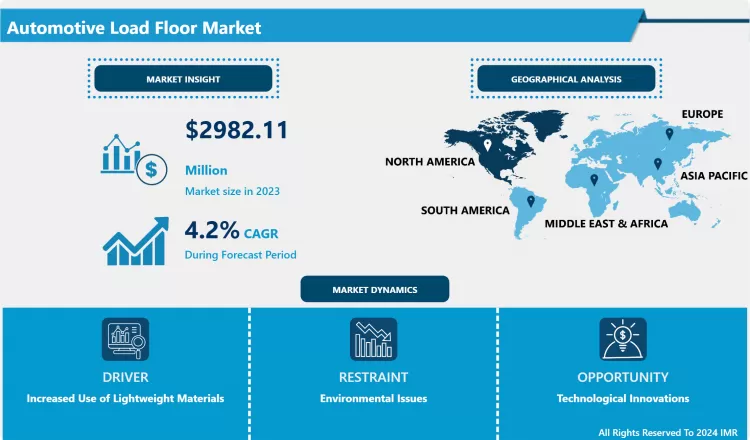

Automotive Load Floor Market Size Was Valued at USD 2982.11 Million in 2023, and is Projected to Reach USD 4318.50 Million by 2032, Growing at a CAGR of 4.2% From 2024-2032.

An automotive load floor is a panel that's installed in a vehicle to carry cargo and baggage. They are often found in the rear cargo area of a vehicle.

- Increased global vehicle manufacturing has resulted in higher demand for car parts such as load floors. This trend is driven by the increased demand for both traditional and electric vehicles. Advancements in materials and manufacturing technology are enhancing the functionality and efficiency of load floors.

- Market growth is being fueled by growing demand for spacious and versatile load floors in SUVs and crossovers. Consumers prioritize comfort, convenience, and cargo space, prompting automakers to design load floors that are more flexible and easier to use. Improvements in load floor design also prioritize safety and durability, aiming to enhance crash protection and structural integrity in vehicle design.

- The automotive sector is moving towards sustainability, affecting load floor materials and manufacturing processes. Unique design requirements are being brought to the load floor market by electric vehicles. Environmentally friendly materials and procedures are on the rise, in line with larger movements towards minimizing environmental harm and opening up fresh market prospects.

Automotive Load Floor Market Trend Analysis

Increased Use of Lightweight Materials

- The use of lightweight materials in vehicles enhances fuel efficiency and decreases emissions. Automakers utilize them in order to comply with more stringent regulations regarding fuel efficiency and emissions. Vehicles that are lighter demonstrate improved performance, particularly in terms of handling and acceleration. Decreasing weight is crucial in order to increase the range of electric vehicles. Utilizing lightweight materials in components increases battery efficiency in Electric Vehicles (EVs), enabling them to achieve longer travel distances on one charge, attracting potential customers.

- Innovations in materials technology, like carbon fibre, aluminium alloys, and high-strength polymers, enable the use of lightweight materials in automotive uses. Although they may have a higher initial price, improvements in manufacturing and larger production quantities are reducing expenses. Consumers are showing a growing desire for vehicles that offer better fuel efficiency and performance, prompting car manufacturers to use lighter materials to appeal to environmentally-conscious and performance-driven customers.

- Automakers are putting money into lightweight materials in order to meet stringent government regulations on vehicle emissions and fuel consumption while also improving the durability and lifespan of their vehicles. High-strength composites, an advanced material, can withstand harsh conditions and resist corrosion, thereby prolonging the lifespan of load floors. Lightweight materials also allow for creative design solutions, like intricate shapes and structures, enhancing the functionality and appearance of vehicle load floors.

Opportunity

Technological Innovations

- The strength, durability, and functionality of load floors are improved by new materials and technologies, resulting in improved performance and longevity. Carbon fibre and advanced composites enable vehicles to be lighter, enhancing fuel efficiency and performance. Technological progress allows for adaptable and modular load floor systems that can be customized to cater to various consumer requirements, enhancing the flexibility of vehicles by providing more storage space and specific storage options.

- Intelligent features such as sensors, automated adjustments, and connectivity options have the ability to improve the functionality of the load floor by adapting to cargo requirements and tracking weight. Vehicles are made safer with enhanced safety features like strengthened structures and surfaces that reduce slipping. Eco-friendly materials such as recycled or bio-based polymers lessen environmental harm, attracting environmentally aware customers and matching worldwide movements towards environmental accountability.

- Using technological developments to increase cost effectiveness can lower the price of high-quality load floors. Innovation has the potential to improve user experience by incorporating user-friendly elements such as surfaces that are easy to clean and designs that are ergonomic. Businesses that are at the forefront of technological advancements can have a competitive edge by offering innovative features and top-quality load areas, which can help them attract a wider customer base and set themselves apart from other brands in the market.

Automotive Load Floor Market Segment Analysis:

Automotive Load Floor Market is Segmented based on Material Type, Operation, Sales Channel, Application, Vehicle Type, And Region.

By material Type, the polypropylene Segment Is Expected to Dominate the Market During the Forecast Period

- Polypropylene (PP) used in the automotive sector provides lightweight characteristics, which help decrease vehicle weight for better fuel efficiency and handling. It is resilient and sturdy, capable of enduring daily wear and tear and heavyweights in vehicle load floors, demonstrating outstanding impact resistance and strength.

- Polypropylene is a budget-friendly option for manufacturers as it helps lower production expenses without compromising quality. Additionally, it offers strong protection against chemicals, oils, and moisture, which helps extend the lifespan and diminish the maintenance requirements of load floors.

- The versatility of manufacturing polypropylene allows for a variety of load floor designs, promoting creativity. The fact that it can be recycled fits in with the automotive sector's emphasis on sustainability, attracting manufacturers who want to improve their eco-friendly image. Furthermore, polypropylene's ability to reduce noise and vibrations helps create a quieter and more pleasant driving atmosphere, ultimately improving overall comfort.

By Distribution channel, aftermarket Segment Held the Largest Share In 2023

- As vehicles get older, the need for replacement and upgraded parts such as load floors increases. The aftermarket sector fulfills this demands by offering customization and improvement choices for car owners seeking to preserve or enhance their vehicles' performance and look, with distinct designs not always provided by original manufacturers.

- Vehicle owners looking to replace load floors may find aftermarket parts to be a more budget-friendly option compared to OEM parts. The aftermarket sector provides a variety of load floor products to meet the varying preferences of customers. The expansion of online shopping has simplified the acquisition of aftermarket components, enabling customers to easily compare and buy items such as load floors, which has in turn driven up the demand for aftermarket products.

- Aftermarket load floors have advanced in both quality and innovation, now offering products that are on par with OEM parts. DIY lovers favour aftermarket choices designed for simple installation and customization. Variations in vehicle ownership and repair methods at a regional level impact the growth of the aftermarket industry.

Automotive Load Floor Market Regional Insights:

North is Expected to Dominate the Market Over the Forecast Period

- Increased demand for advanced load floor solutions has been driven by the growth in vehicle production in North America, particularly in the US and Mexico. Customers are seeking cars with increased storage capacity and flexible functions such as adjustable load areas and creative storage options, leading to market growth.

- In North America, the market is growing due to advancements in technology such as lightweight composites and modular designs on load floors. Robust economic expansion in the area results in higher sales and manufacturing of vehicles, which boosts the need for parts such as load floors and drives investments in cutting-edge automotive technologies.

- North American laws for cars encourage safer and more effective vehicle parts. Adhering to regulations results in improved load floor layouts. Businesses allocate resources to research and development in order to advance load floor technology and stimulate market expansion. There is a strong emphasis on sustainability, specifically using eco-friendly materials for load floors to attract environmentally conscious customers.

Automotive Load Floor Market Active Players

- Adient plc (Ireland)

- Magna International Inc. (Canada)

- Lear Corporation (USA)

- Faurecia (France)

- Johnson Controls International plc (Ireland)

- Plastic Omnium (France)

- Valeo (France)

- Gestamp Automoción (Spain)

- Brose Fahrzeugteile GmbH & Co. KG (Germany)

- Harman International (a Samsung company) (USA)

- Delphi Technologies (UK)

- Toyota Boshoku Corporation (Japan)

- TS Tech Co., Ltd. (Japan)

- SABIC (Saudi Arabia)

- Continental AG (Germany)

- Rieter Automotive (Switzerland)

- Nifco Inc. (Kawasaki, Kanagawa, Japan)

- Calsonic Kansei Corporation (Japan)

- Yanfeng Automotive Interiors (China)

- Hella GmbH & Co. KGaA (Germany)

- Hyundai Dymos Inc. (South Korea)

- Magna Steyr (Austria)

- Daimler AG (Germany)

- Ford Motor Company (USA)

- General Motors (GM) (USA)

|

Global Automotive Load Floor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2982.11 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.2 % |

Market Size in 2032: |

USD 4318.50 Mn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Operation |

|

||

|

By Sales Channel |

|

||

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Load Floor Market by By Material Type (2018-2032)

4.1 Automotive Load Floor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardboard

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fluted Polypropylene

4.5 Honeycomb Polypropylene

4.6 Composites

4.7 Twin Sheet

4.8 Natural Fiber & wooden

Chapter 5: Automotive Load Floor Market by By Operation (2018-2032)

5.1 Automotive Load Floor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fixed

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sliding

Chapter 6: Automotive Load Floor Market by By Sales Channel (2018-2032)

6.1 Automotive Load Floor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Original Equipment Manufacturer (OEM)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aftermarket

Chapter 7: Automotive Load Floor Market by By Application (2018-2032)

7.1 Automotive Load Floor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Interior Systems

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cargo Systems

7.5 Load Floor Systems

Chapter 8: Automotive Load Floor Market by By Vehicle Type (2018-2032)

8.1 Automotive Load Floor Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Compact

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Mid-Sized

8.5 Luxury

8.6 SUV

8.7 LCV

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Load Floor Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ADIENT PLC (IRELAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MAGNA INTERNATIONAL INC. (CANADA)

9.4 LEAR CORPORATION (USA)

9.5 FAURECIA (FRANCE)

9.6 JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

9.7 PLASTIC OMNIUM (FRANCE)

9.8 VALEO (FRANCE)

9.9 GESTAMP AUTOMOCIÓN (SPAIN)

9.10 BROSE FAHRZEUGTEILE GMBH & CO. KG (GERMANY)

9.11 HARMAN INTERNATIONAL (A SAMSUNG COMPANY) (USA)

9.12 DELPHI TECHNOLOGIES (UK)

9.13 TOYOTA BOSHOKU CORPORATION (JAPAN)

9.14 TS TECH COLTD. (JAPAN)

9.15 SABIC (SAUDI ARABIA)

9.16 CONTINENTAL AG (GERMANY)

9.17 RIETER AUTOMOTIVE (SWITZERLAND)

9.18 NIFCO INC. (KAWASAKI

9.19 KANAGAWA

9.20 JAPAN)

9.21 CALSONIC KANSEI CORPORATION (JAPAN)

9.22 YANFENG AUTOMOTIVE INTERIORS (CHINA)

9.23 HELLA GMBH & CO. KGAA (GERMANY)

9.24 HYUNDAI DYMOS INC. (SOUTH KOREA)

9.25 MAGNA STEYR (AUSTRIA)

9.26 DAIMLER AG (GERMANY)

9.27 FORD MOTOR COMPANY (USA)

9.28 GENERAL MOTORS (GM) (USA)

9.29

Chapter 10: Global Automotive Load Floor Market By Region

10.1 Overview

10.2. North America Automotive Load Floor Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Material Type

10.2.4.1 Hardboard

10.2.4.2 Fluted Polypropylene

10.2.4.3 Honeycomb Polypropylene

10.2.4.4 Composites

10.2.4.5 Twin Sheet

10.2.4.6 Natural Fiber & wooden

10.2.5 Historic and Forecasted Market Size By By Operation

10.2.5.1 Fixed

10.2.5.2 Sliding

10.2.6 Historic and Forecasted Market Size By By Sales Channel

10.2.6.1 Original Equipment Manufacturer (OEM)

10.2.6.2 Aftermarket

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Interior Systems

10.2.7.2 Cargo Systems

10.2.7.3 Load Floor Systems

10.2.8 Historic and Forecasted Market Size By By Vehicle Type

10.2.8.1 Compact

10.2.8.2 Mid-Sized

10.2.8.3 Luxury

10.2.8.4 SUV

10.2.8.5 LCV

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Load Floor Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Material Type

10.3.4.1 Hardboard

10.3.4.2 Fluted Polypropylene

10.3.4.3 Honeycomb Polypropylene

10.3.4.4 Composites

10.3.4.5 Twin Sheet

10.3.4.6 Natural Fiber & wooden

10.3.5 Historic and Forecasted Market Size By By Operation

10.3.5.1 Fixed

10.3.5.2 Sliding

10.3.6 Historic and Forecasted Market Size By By Sales Channel

10.3.6.1 Original Equipment Manufacturer (OEM)

10.3.6.2 Aftermarket

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Interior Systems

10.3.7.2 Cargo Systems

10.3.7.3 Load Floor Systems

10.3.8 Historic and Forecasted Market Size By By Vehicle Type

10.3.8.1 Compact

10.3.8.2 Mid-Sized

10.3.8.3 Luxury

10.3.8.4 SUV

10.3.8.5 LCV

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Load Floor Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Material Type

10.4.4.1 Hardboard

10.4.4.2 Fluted Polypropylene

10.4.4.3 Honeycomb Polypropylene

10.4.4.4 Composites

10.4.4.5 Twin Sheet

10.4.4.6 Natural Fiber & wooden

10.4.5 Historic and Forecasted Market Size By By Operation

10.4.5.1 Fixed

10.4.5.2 Sliding

10.4.6 Historic and Forecasted Market Size By By Sales Channel

10.4.6.1 Original Equipment Manufacturer (OEM)

10.4.6.2 Aftermarket

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Interior Systems

10.4.7.2 Cargo Systems

10.4.7.3 Load Floor Systems

10.4.8 Historic and Forecasted Market Size By By Vehicle Type

10.4.8.1 Compact

10.4.8.2 Mid-Sized

10.4.8.3 Luxury

10.4.8.4 SUV

10.4.8.5 LCV

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Load Floor Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Material Type

10.5.4.1 Hardboard

10.5.4.2 Fluted Polypropylene

10.5.4.3 Honeycomb Polypropylene

10.5.4.4 Composites

10.5.4.5 Twin Sheet

10.5.4.6 Natural Fiber & wooden

10.5.5 Historic and Forecasted Market Size By By Operation

10.5.5.1 Fixed

10.5.5.2 Sliding

10.5.6 Historic and Forecasted Market Size By By Sales Channel

10.5.6.1 Original Equipment Manufacturer (OEM)

10.5.6.2 Aftermarket

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Interior Systems

10.5.7.2 Cargo Systems

10.5.7.3 Load Floor Systems

10.5.8 Historic and Forecasted Market Size By By Vehicle Type

10.5.8.1 Compact

10.5.8.2 Mid-Sized

10.5.8.3 Luxury

10.5.8.4 SUV

10.5.8.5 LCV

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Load Floor Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Material Type

10.6.4.1 Hardboard

10.6.4.2 Fluted Polypropylene

10.6.4.3 Honeycomb Polypropylene

10.6.4.4 Composites

10.6.4.5 Twin Sheet

10.6.4.6 Natural Fiber & wooden

10.6.5 Historic and Forecasted Market Size By By Operation

10.6.5.1 Fixed

10.6.5.2 Sliding

10.6.6 Historic and Forecasted Market Size By By Sales Channel

10.6.6.1 Original Equipment Manufacturer (OEM)

10.6.6.2 Aftermarket

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Interior Systems

10.6.7.2 Cargo Systems

10.6.7.3 Load Floor Systems

10.6.8 Historic and Forecasted Market Size By By Vehicle Type

10.6.8.1 Compact

10.6.8.2 Mid-Sized

10.6.8.3 Luxury

10.6.8.4 SUV

10.6.8.5 LCV

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Load Floor Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Material Type

10.7.4.1 Hardboard

10.7.4.2 Fluted Polypropylene

10.7.4.3 Honeycomb Polypropylene

10.7.4.4 Composites

10.7.4.5 Twin Sheet

10.7.4.6 Natural Fiber & wooden

10.7.5 Historic and Forecasted Market Size By By Operation

10.7.5.1 Fixed

10.7.5.2 Sliding

10.7.6 Historic and Forecasted Market Size By By Sales Channel

10.7.6.1 Original Equipment Manufacturer (OEM)

10.7.6.2 Aftermarket

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Interior Systems

10.7.7.2 Cargo Systems

10.7.7.3 Load Floor Systems

10.7.8 Historic and Forecasted Market Size By By Vehicle Type

10.7.8.1 Compact

10.7.8.2 Mid-Sized

10.7.8.3 Luxury

10.7.8.4 SUV

10.7.8.5 LCV

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Automotive Load Floor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2982.11 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.2 % |

Market Size in 2032: |

USD 4318.50 Mn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Operation |

|

||

|

By Sales Channel |

|

||

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Load Floor Market research report is 2024-2032.

Adient plc (Ireland), Magna International Inc. (Canada), Lear Corporation (USA), Faurecia (France), Johnson Controls International plc (Ireland), Plastic Omnium (France), Valeo (France), Gestamp Automoción (Spain), Brose Fahrzeugteile GmbH & Co. KG (Germany), Harman International (a Samsung company) (USA), Delphi Technologies (UK), Toyota Boshoku Corporation (Japan), TS Tech Co., Ltd. (Japan), SABIC (Saudi Arabia), Continental AG (Germany), Rieter Automotive (Switzerland), Nifco Inc. (Kawasaki, Kanagawa, Japan), Calsonic Kansei Corporation (Japan), Yanfeng Automotive Interiors (China), Hella GmbH & Co. KGaA (Germany), Hyundai Dymos Inc. (South Korea), Magna Steyr (Austria), Daimler AG (Germany), Ford Motor Company (USA), General Motors (GM) (USA) and Other Active Players.

The Automotive Load Floor Market is segmented into Material Type, Operation, Sales Channel, Application, Vehicle Type, and region. By Material Type, the market is categorized into Hardboard, Fluted Polypropylene, Honeycomb Polypropylene, Composites, Twin Sheet, And Natural Fiber & wooden. By Operation, the market is categorized into Fixed, Sliding. By Sales Channel, the market is categorized into Original Equipment Manufacturer (OEM), Aftermarket. By Application, the market is categorized into Interior Systems, Cargo Systems, Load Floor Systems. By Vehicle Type, The Market Is Categorized Into Compact, Mid-Sized, Luxury, SUV, LCV, And Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An automotive load floor is a panel that's installed in a vehicle to carry cargo and baggage. They are often found in the rear cargo area of a vehicle.

Automotive Load Floor Market Size Was Valued at USD 2982.11 Million in 2023, and is Projected to Reach USD 4318.50 Million by 2032, Growing at a CAGR of 4.2% From 2024-2032.