Grooming Products Market Synopsis

Grooming Products Market Size Was Valued at USD 219.25 Billion in 2023 and is Projected to Reach USD 446.38 Billion by 2032, Growing at a CAGR of 8.22% From 2024-2032.

Grooming products are personal care items that improve hygiene, appearance, and well-being. They include skincare, hair care solutions, oral hygiene aids, fragrances, shaving tools, and cosmetics. These products cater to various needs, from cleansing to styling, and are tailored to individual preferences. They help maintain personal grooming routines, promote self-confidence, and foster a positive self-image, contributing to overall health and confidence.

- Grooming products are essential items designed to improve personal appearance and hygiene, catering to both men and women of all ages. They offer numerous advantages, including improved cleanliness, boosted self-confidence, and overall well-being. The demand for grooming products has grown due to societal norms, increased emphasis on self-care, and product innovation.

- Grooming products, such as soaps, shampoos, and dental care products, help maintain cleanliness, reduce infection risk, and promote better health. They often contain skincare benefits like moisturizers and antioxidants, contributing to healthier skin. Regular grooming rituals can instill discipline, self-esteem, and confidence, empowering individuals to present their best selves to the world.

- The demand for grooming products has grown significantly due to shifting consumer preferences and lifestyle trends. Millennials and Generation Z prioritize self-care and personal grooming, leading to a demand for premium products with quality ingredients and sustainability. The rise of social media and influencer culture has further fueled interest in grooming.

- The market trend in grooming products reflects a growing interest in natural and organic formulations, with brands incorporating botanical extracts, essential oils, and eco-friendly packaging to cater to this demand. In conclusion, grooming products offer numerous advantages, including improved hygiene, enhanced self-confidence, and better overall well-being.

Grooming Products Market Trend Analysis

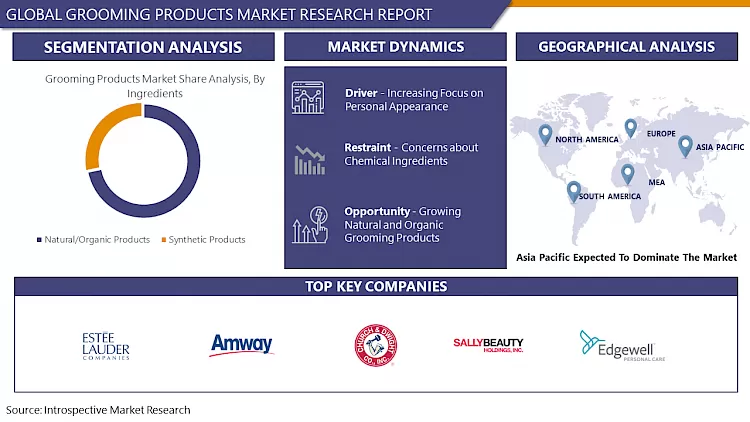

Increasing Focus on Personal Appearance

- The grooming products market is experiencing a surge in popularity due to the growing emphasis on personal appearance. This shift is driven by the rise of social media and digital platforms, where celebrities and influencers showcase their grooming routines and endorse products, influencing millions of followers to adopt similar practices. The concept of self-care has also gained prominence, prompting individuals to prioritize their physical well-being and appearance. Grooming routines are now considered essential components of self-care, contributing to mental health and overall wellness.

- Consumers are seeking grooming products that not only improve their appearance but also provide a sense of relaxation and indulgence. Moreover, societal norms and expectations surrounding personal appearance are evolving, placing greater emphasis on grooming and presentation. This pressure drives demand for grooming products that help individuals maintain a certain level of grooming and physical attractiveness, thereby driving the demand for innovative and effective grooming solutions. The growing focus on personal appearance, driven by social media influence, the self-care movement, and evolving societal norms, is expected to continue driving the grooming products market.

Growing Natural and Organic Grooming Products

- The demand for natural and organic grooming products is on the rise due to increasing consumer awareness of health and wellness. Consumers are seeking alternatives free from harsh chemicals, parabens, sulfates, and synthetic fragrances. Natural and organic grooming products are made from plant-based ingredients, botanical extracts, and essential oils, which are gentler on the skin and less likely to cause irritation or adverse reactions. These products often undergo minimal processing to preserve their integrity and maximize efficacy.

- Another driving factor is environmental sustainability, with consumers choosing eco-friendly and cruelty-free grooming products. Natural and organic grooming products are often produced using sustainable farming practices, renewable resources, and biodegradable packaging materials, reducing their environmental footprint. Brands that prioritize sustainability and transparency can appeal to environmentally conscious consumers and differentiate themselves in the market.

- The natural and organic grooming products market offers opportunities for innovation and differentiation. Brands can develop unique formulations featuring exotic botanicals, adaptogens, and superfoods, catering to niche segments of the market. By leveraging the growing consumer interest in wellness-oriented grooming solutions, brands can capitalize on this trend and expand their product offerings to meet evolving consumer needs and preferences.

Grooming Products Market Segment Analysis:

Grooming Products Market Segmented on the basis of Type, Gender, Ingredients, Price Range, Distribution Channel.

By Type, Skin Care Products segment is expected to dominate the market during the forecast period

- The skin care products segment dominates the grooming products market due to factors such as increasing consumer awareness of the importance of maintaining healthy skin, technological advancements in skincare formulations and ingredients, and the influence of social media and digital platforms. Skincare has become more prioritized due to factors like pollution, stress, and aging, leading to a surge in demand for products like cleansers, moisturizers, serums, and masks.

- Advancements in skincare formulations and ingredients, such as encapsulation and nanotechnology, have also contributed to the market's popularity. Natural and organic ingredients appeal to consumers seeking safer alternatives. Social media influencers and skincare enthusiasts share tips, reviews, and tutorials, influencing consumer purchasing decisions and driving demand for skincare products. Demographic trends, such as an aging population and increasing disposable incomes, also contribute to the market's dominance.

- Older consumers prioritize anti-aging and corrective skincare products, while younger demographics seek preventive measures and personalized solutions. Rising disposable incomes enable consumers to invest in premium and luxury skincare products, driving market growth and revenue expansion. As consumers continue to prioritize skin health and seek effective skincare solutions, the demand for innovative and high-quality skincare products is expected to remain strong, sustaining the segment's dominance in the market.

By Ingredients, Natural/Organic Products segment is expected to dominate the market during the forecast period

- The natural/organic products segment is expected to dominate the grooming products market due to shifting consumer preferences and industry trends. Increased health and wellness awareness has driven demand for natural and organic grooming products, as consumers are more discerning about ingredients and seek products free from harmful chemicals, artificial additives, and synthetic fragrances. These products are derived from plant-based sources, botanical extracts, and essential oils, perceived as safer, gentler, and less likely to cause adverse reactions or skin irritations.

- Sustainability and environmental consciousness are also driving the popularity of natural and organic grooming products. These products often utilize sustainable farming practices, renewable resources, and biodegradable packaging materials, aligning with consumers' sustainability goals and values. Brands that prioritize sustainability and ethical sourcing can capitalize on this trend, attracting environmentally conscious consumers and gaining a competitive edge in the market.

- The natural/organic products segment also offers opportunities for innovation and differentiation, as brands can develop unique formulations featuring exotic botanicals, adaptogens, and superfoods, catering to diverse consumer preferences and niche market segments. By embracing natural and organic ingredients, brands can tap into a growing market of health-conscious consumers, reinforce their brand values, and foster trust and loyalty among their customer base.

Grooming Products Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to dominate the grooming products market due to its rapidly expanding population, rising disposable incomes, changing lifestyles, diverse product offerings, and expanding e-commerce landscape. The younger population, particularly in countries like China, India, Indonesia, and Japan, is more inclined towards personal grooming and beauty products, driving market growth. Rising disposable incomes in the region have led to increased consumer spending on grooming products, as economies continue to grow and urbanize.

- Current lifestyles and cultural norms in the Asia Pacific region have led to a greater emphasis on appearance and grooming, driven by urbanization, globalization, and social media influence. The region is home to a diverse array of beauty and personal care brands, catering to a wide range of consumer preferences and price points.

- The expansion of e-commerce and digital platforms in the Asia Pacific region has significantly contributed to the accessibility and availability of grooming products. Online retail channels provide convenience and a broader selection of products, facilitating market growth and expansion. As these trends continue, the Asia Pacific region is likely to maintain its prominent position in the grooming products market for the foreseeable future.

Grooming Products Market Top Key Players:

- Procter & Gamble Company (Us)

- Johnson & Johnson (Us)

- Colgate-Palmolive Company (Us)

- The Estée Lauder Companies Inc. (Us)

- Coty Inc. (Us)

- Revlon, Inc. (Us)

- Mary Kay Inc. (Us)

- Amway Corporation (Us)

- Church & Dwight Co., Inc. (Us)

- Edgewell Personal Care Company (Us)

- Burt's Bees (Us)

- Kimberly-Clark Corporation (Us)

- Sally Beauty Holdings, Inc. (Us)

- Unilever (Uk)

- Avon Products, Inc. (Uk)

- The Body Shop International Limited (Uk)

- Pz Cussons Plc (Uk)

- Beiersdorf Ag (Germany)

- Henkel Ag & Co. Kgaa (Germany)

- L'oréal S.A. (France)

- Oriflame Cosmetics Ag (Switzerland)

- Shiseido Company, Limited (Japan)

- Kao Corporation (Japan)

- The Himalaya Drug Company (India)

- Natura &Co Holdings S.A. (Brazil), and Other Major Players.

Key Industry Developments in the Grooming Products Market:

- In May 2023, Scent Beauty Inc., a leading global e-commerce company, announced an expanded partnership with Stetson, a renowned American men's cologne brand. This collaboration will see the launch of Stetson's comprehensive range of men's grooming products on Scent Beauty's platform, catering specifically to customers in the Western region of America. Stetson's offerings include an array of grooming essentials such as body sprays, hair and body washes, beard moisturizers, and more.

- In November 2022, MANSCAPED, a prominent global manufacturer of men's grooming products, unveiled its latest venture at Tesco's physical retail outlets across Europe. This strategic move marks the introduction of MANSCAPED's premium grooming tools and formulations to a wider audience in Europe, facilitating the brand's expansion efforts in the region.

|

Global Grooming Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 219.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.22 % |

Market Size in 2032: |

USD 446.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Gender |

|

||

|

By Ingredients |

|

||

|

By Price Range |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Grooming Products Market by By Type (2018-2032)

4.1 Grooming Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hair Care Products

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Skin Care Products

4.5 Oral Care Products

4.6 Bath and Shower Products

4.7 Fragrances

4.8 Shaving and Hair Removal Products

Chapter 5: Grooming Products Market by By Gender (2018-2032)

5.1 Grooming Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Men

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Women

5.5 Unisex

Chapter 6: Grooming Products Market by By Ingredients (2018-2032)

6.1 Grooming Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Natural/Organic Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Synthetic Products

Chapter 7: Grooming Products Market by By Price Range (2018-2032)

7.1 Grooming Products Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Mass Market Products

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Premium/Luxury Products

Chapter 8: Grooming Products Market by By Distribution Channel (2018-2032)

8.1 Grooming Products Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarkets/Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Convenience Stores

8.5 Specialty Stores

8.6 Online Retail

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Grooming Products Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PROCTER & GAMBLE COMPANY (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 JOHNSON & JOHNSON (US)

9.4 COLGATE-PALMOLIVE COMPANY (US)

9.5 THE ESTÉE LAUDER COMPANIES INC. (US)

9.6 COTY INC. (US)

9.7 REVLON INC. (US)

9.8 MARY KAY INC. (US)

9.9 AMWAY CORPORATION (US)

9.10 CHURCH & DWIGHT COINC. (US)

9.11 EDGEWELL PERSONAL CARE COMPANY (US)

9.12 BURT'S BEES (US)

9.13 KIMBERLY-CLARK CORPORATION (US)

9.14 SALLY BEAUTY HOLDINGS INC. (US)

9.15 UNILEVER (UK)

9.16 AVON PRODUCTS INC. (UK)

9.17 THE BODY SHOP INTERNATIONAL LIMITED (UK)

9.18 PZ CUSSONS PLC (UK)

9.19 BEIERSDORF AG (GERMANY)

9.20 HENKEL AG & CO. KGAA (GERMANY)

9.21 L'ORÉAL S.A. (FRANCE)

9.22 ORIFLAME COSMETICS AG (SWITZERLAND)

9.23 SHISEIDO COMPANY

9.24 LIMITED (JAPAN)

9.25 KAO CORPORATION (JAPAN)

9.26 THE HIMALAYA DRUG COMPANY (INDIA)

9.27 NATURA &CO HOLDINGS S.A. (BRAZIL)

9.28

Chapter 10: Global Grooming Products Market By Region

10.1 Overview

10.2. North America Grooming Products Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Hair Care Products

10.2.4.2 Skin Care Products

10.2.4.3 Oral Care Products

10.2.4.4 Bath and Shower Products

10.2.4.5 Fragrances

10.2.4.6 Shaving and Hair Removal Products

10.2.5 Historic and Forecasted Market Size By By Gender

10.2.5.1 Men

10.2.5.2 Women

10.2.5.3 Unisex

10.2.6 Historic and Forecasted Market Size By By Ingredients

10.2.6.1 Natural/Organic Products

10.2.6.2 Synthetic Products

10.2.7 Historic and Forecasted Market Size By By Price Range

10.2.7.1 Mass Market Products

10.2.7.2 Premium/Luxury Products

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Supermarkets/Hypermarkets

10.2.8.2 Convenience Stores

10.2.8.3 Specialty Stores

10.2.8.4 Online Retail

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Grooming Products Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Hair Care Products

10.3.4.2 Skin Care Products

10.3.4.3 Oral Care Products

10.3.4.4 Bath and Shower Products

10.3.4.5 Fragrances

10.3.4.6 Shaving and Hair Removal Products

10.3.5 Historic and Forecasted Market Size By By Gender

10.3.5.1 Men

10.3.5.2 Women

10.3.5.3 Unisex

10.3.6 Historic and Forecasted Market Size By By Ingredients

10.3.6.1 Natural/Organic Products

10.3.6.2 Synthetic Products

10.3.7 Historic and Forecasted Market Size By By Price Range

10.3.7.1 Mass Market Products

10.3.7.2 Premium/Luxury Products

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Supermarkets/Hypermarkets

10.3.8.2 Convenience Stores

10.3.8.3 Specialty Stores

10.3.8.4 Online Retail

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Grooming Products Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Hair Care Products

10.4.4.2 Skin Care Products

10.4.4.3 Oral Care Products

10.4.4.4 Bath and Shower Products

10.4.4.5 Fragrances

10.4.4.6 Shaving and Hair Removal Products

10.4.5 Historic and Forecasted Market Size By By Gender

10.4.5.1 Men

10.4.5.2 Women

10.4.5.3 Unisex

10.4.6 Historic and Forecasted Market Size By By Ingredients

10.4.6.1 Natural/Organic Products

10.4.6.2 Synthetic Products

10.4.7 Historic and Forecasted Market Size By By Price Range

10.4.7.1 Mass Market Products

10.4.7.2 Premium/Luxury Products

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Supermarkets/Hypermarkets

10.4.8.2 Convenience Stores

10.4.8.3 Specialty Stores

10.4.8.4 Online Retail

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Grooming Products Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Hair Care Products

10.5.4.2 Skin Care Products

10.5.4.3 Oral Care Products

10.5.4.4 Bath and Shower Products

10.5.4.5 Fragrances

10.5.4.6 Shaving and Hair Removal Products

10.5.5 Historic and Forecasted Market Size By By Gender

10.5.5.1 Men

10.5.5.2 Women

10.5.5.3 Unisex

10.5.6 Historic and Forecasted Market Size By By Ingredients

10.5.6.1 Natural/Organic Products

10.5.6.2 Synthetic Products

10.5.7 Historic and Forecasted Market Size By By Price Range

10.5.7.1 Mass Market Products

10.5.7.2 Premium/Luxury Products

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Supermarkets/Hypermarkets

10.5.8.2 Convenience Stores

10.5.8.3 Specialty Stores

10.5.8.4 Online Retail

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Grooming Products Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Hair Care Products

10.6.4.2 Skin Care Products

10.6.4.3 Oral Care Products

10.6.4.4 Bath and Shower Products

10.6.4.5 Fragrances

10.6.4.6 Shaving and Hair Removal Products

10.6.5 Historic and Forecasted Market Size By By Gender

10.6.5.1 Men

10.6.5.2 Women

10.6.5.3 Unisex

10.6.6 Historic and Forecasted Market Size By By Ingredients

10.6.6.1 Natural/Organic Products

10.6.6.2 Synthetic Products

10.6.7 Historic and Forecasted Market Size By By Price Range

10.6.7.1 Mass Market Products

10.6.7.2 Premium/Luxury Products

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Supermarkets/Hypermarkets

10.6.8.2 Convenience Stores

10.6.8.3 Specialty Stores

10.6.8.4 Online Retail

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Grooming Products Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Hair Care Products

10.7.4.2 Skin Care Products

10.7.4.3 Oral Care Products

10.7.4.4 Bath and Shower Products

10.7.4.5 Fragrances

10.7.4.6 Shaving and Hair Removal Products

10.7.5 Historic and Forecasted Market Size By By Gender

10.7.5.1 Men

10.7.5.2 Women

10.7.5.3 Unisex

10.7.6 Historic and Forecasted Market Size By By Ingredients

10.7.6.1 Natural/Organic Products

10.7.6.2 Synthetic Products

10.7.7 Historic and Forecasted Market Size By By Price Range

10.7.7.1 Mass Market Products

10.7.7.2 Premium/Luxury Products

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Supermarkets/Hypermarkets

10.7.8.2 Convenience Stores

10.7.8.3 Specialty Stores

10.7.8.4 Online Retail

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Grooming Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 219.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.22 % |

Market Size in 2032: |

USD 446.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Gender |

|

||

|

By Ingredients |

|

||

|

By Price Range |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Grooming Products Market research report is 2024-2032.

Procter & Gamble Company (Us), Johnson & Johnson (Us), Colgate-Palmolive Company (Us), The Estée Lauder Companies Inc. (Us), Coty Inc. (Us), Revlon, Inc. (Us), Mary Kay Inc. (Us), Amway Corporation (Us), Church & Dwight Co., Inc. (Us), Edgewell Personal Care Company (Us), Burt's Bees (Us), Kimberly-Clark Corporation (Us), Sally Beauty Holdings, Inc. (Us), Unilever (Uk), Avon Products, Inc. (Uk), The Body Shop International Limited (Uk), Pz Cussons Plc (Uk), Beiersdorf Ag (Germany), Henkel Ag & Co. Kgaa (Germany), L'oréal S.A. (France), Oriflame Cosmetics Ag (Switzerland), Shiseido Company, Limited (Japan), Kao Corporation (Japan), The Himalaya Drug Company (India), Natura &Co Holdings S.A. (Brazil), and Other Major Players.

The Grooming Products Market is segmented into Type, Gender, Ingredients, Price Range, Distribution Channel, and region. By Type, the market is categorized into Hair Care Products, Skin Care Products, Oral Care Products, Bath and Shower Products, Fragrances, Shaving and Hair Removal Products. By Gender, the market is categorized into Men, Women, and Unisex. By Ingredients, the market is categorized into Natural/Organic Products and Synthetic Products. By Price Range, the market is categorized into Mass Market Products and premium/Luxury Products. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Grooming products are personal care items that improve hygiene, appearance, and well-being. They include skincare, hair care solutions, oral hygiene aids, fragrances, shaving tools, and cosmetics. These products cater to various needs, from cleansing to styling, and are tailored to individual preferences. They help maintain personal grooming routines, promote self-confidence, and foster a positive self-image, contributing to overall health and confidence.

Grooming Products Market Size Was Valued at USD 219.25 Billion in 2023 and is Projected to Reach USD 446.38 Billion by 2032, Growing at a CAGR of 8.22% From 2024-2032.