High End Cellomics Market Synopsis

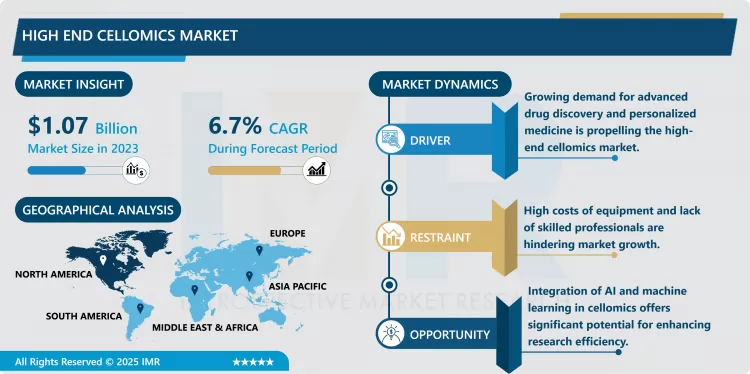

High End Cellomics Market Size Was Valued at USD 1.07 Billion in 2023, and is Projected to Reach USD 1.68 Billion by 2032, Growing at a CAGR of 6.7% from 2024-2032.

The growth of High-End Cellomics Market has been triggered by growth in need of higher cellular imaging techniques in analysis, drug development, and diagnosis. Cell imaging, or visualization of cells and cellular processes applying the use of latest generation microscopes, is a critical component of elucidating various cellular processes and genetic disorders as well as drug target discovery. It is fueled by the developing demand for highly accurate screening instruments in pharmaceutical applications and diagnostics. Based on trends of emergence of personalized medicine and the increase in chronic diseases, need for advanced cellomics solutions is expected to gather more pace in the near future.

Development of cell imaging systems, particularly the use of AI and ML in the analysis of the resulting data, has greatly improved those of cellomics tools. These innovations allow for quicker and more precise examination of cellular communication and activity which will continue to progress in oncology, neurology and immunology. Cellomics technologies available today capture higher magnification, higher complexity due to multiplexing, and the ability to handle large numbers of cells to study complex biological processes in depth. This development in technology has placed the market in a Preferred position to serve academic and commercial research entities such as the biotech and the pharma industries.

The market has problems linked with higher costs of developed cellomics platforms that compromises enskill for number of research institutions and developing countries. Instead of high costs, an increasing number of technology developers and academic institutions join to deliver affordable solutions and promote innovations. Moreover, cellomics technologies for the non-invasive diagnosis that provides growth opportunity for the industry are also factored in. Considering advanced applications of cellomics in disease diagnosis and treatment, the market is anticipated to rise constantly during the period analyzed.

High End Cellomics Market Trend Analysis:

Integration of Artificial Intelligence in Cellular Analysis

- Highly integrated solutions and AI/ML technologies for cell analysis is one of the significant trends defining the further dynamics of the High-End Cellomics Market. Algorithms which are driven through A.I. helps in the analysis of image, patterns, and concludes in efficient analysis time in comparison to extensive human labour. These new developments prove especially helpful especially in HTS and multiparameter cellular Signaling, giving researchers more important knowledge on disease processes and drugs. This trend is propelling development and making the cellomics alternative more effective and available for pharmaceutical and academicians.

Rising Adoption of Multiplexing Technologies

- Another emerging trend in cellomics is multiplexing technologies to analyse multiple biomarkers per assay simultaneously. This capability is certainly useful in unraveling complex cellular signaling processes and the molecular cross talk essential in functions like oncology and immunology. Cellomics systems integrated with multiplexing capabilities are the most advanced solutions that allow researchers organize complex and accurate experiments, their usage is increasing in drug discovery, personalized medicine, diagnostic tools. This trend is expected to be further fuelled by the increasing focus on multi-dimensional cellular analysis.

High End Cellomics Market Segment Analysis:

High End Cellomics Market is Segmented on the basis of Product Type, Application, Technology, End User, and Region

By Product Type, Instruments segment is expected to dominate the market during the forecast period

- The high-end cellomics market segmented on the basis of product type including instruments, reagents & consumables, software & service exhibits dissimilar growth trends across these categories. Consumables, especially imaging systems and high-throughput screening platforms characteristic for advanced cellular analysisution constituted the overarching product type in the market. Chemicals and reagents as well as other consumables like stains, specific labelled probes and any assay kit, are repeat purchase items because they are core necessities in carrying out any experiments. On the other hand, software & service segment is showing signs of growth due to high demand of advanced methodical tools for data interpretation and professional serving’s for dealing with huge sets of data collected during cellomics researches. This segmentation emphasizes that dependency signifies the market’s potential to provide means for different kinds of research and diagnostics in academic, clinical, and pharmaceutical settings.

By Application, Drug discovery segment expected to held the largest share

- The High-End Cellomics Market has numerous uses across some of the most particular segments of biomedical sciences and healthcare industry such as, drug discovery, cancer research, Neuroscience, stem cell research & regenerative medicine, and pharmacogenomics. A vast array of fine cellomics technologies offers opportunities in high throughput screening and quantitative measurement of cellular effects to potential drug entities. In this context, they help to investigate properties of tumors and the interactions cellular surroundings to find new target for therapies. Neuroscience goes cellomics of neural network and investigates neurodegenerative diseases. Oncology, stem cell research and regenerative medicine can advance from improved cellomics by providing insight into the handling and method of reprogramming stem cells for treatment usage. Furthermore, due to the paradigm change of personalized medicine the use of cellomics in patient and disease specific cellular analysis for optimizing the right therapy. Such diverse applications demonstrate the increasing significance of sophisticated cellomics for the development of current healthcare and life sciences.

High End Cellomics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to continue to be the largest market for High-End Cellomics during the forecast period. It has a robust research infrastructure, which has made a tremendous investment in Biotechnology and Pharmaceutical R & D as well as an early adopter of emerging technologies. The ongoing participation of major industry players and adequate support from government and private organizations for life sciences research adds to the growth of the market. Further, the higher incidence of chronic and lifestyle diseases across the region has also led to the need for higher end cellular imaging tools to support drug development and personalized medicine programs. Such favorable structure helps North America to take a significant share in the high-end cellomics market among global competitors.

Active Key Players in the High End Cellomics Market:

- Thermo Fisher Scientific (USA)

- Danaher (USA)

- PerkinElmer (USA)

- BD (Becton, Dickinson and Company) (USA)

- Bio-Rad Laboratories (USA)

- Agilent Technologies (USA)

- Illumina (USA)

- Luminex (USA)

- Merck KGaA (Germany)

- GE Healthcare (USA)

- Bruker (USA)

- NanoString Technologies (USA)

- 10x Genomics (USA)

- Fluidigm (USA)

- Celsee (USA)

- Berkeley Lights (USA)

- Miltenyi Biotec (Germany)

- Bionano Genomics (USA)

- Bio-Techne (USA)

- Sphere Fluidics (United Kingdom)

- Other Active Players

Key Industry Developments in in the High End Cellomics Market:

- In November 2024, Scale Biosciences a leader in scalable single-cell analysis solutions, and Revvity’s (NYSE: RVTY) BioLegend business, a renowned provider of biological reagents and tools, announced the launch of the groundbreaking TotalSeq™ Phenocyte™ single-cell protein profiling solution. Designed to enhance immunology and oncology research, this innovative solution simplifies the identification and characterization of rare cell subtypes in complex samples at the single-cell level. It integrates Scale Biosciences' proprietary Quantum Barcoding technology platform with BioLegend's TotalSeq™ antibody conjugates.

- In July 2024, Hong Kong Science and Technology Parks Corporation (HKSTP) congratulated its partner company, Cellomics Holdings Limited, for securing a strategic equity investment from the Taiping Hong Kong Insurance Innovation and Technology Venture Fund (Taiping HK I&T Fund), managed by China Taiping Insurance Group Co., Ltd. (China Taiping). This investment marked a significant milestone for Cellomics, strengthening its position in the biotechnology sector. This collaboration aimed to enhance innovation and technology-driven solutions within the insurance industry, aligning with shared growth objectives.

|

Global High End Cellomics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.07 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 1.68 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High End Cellomics Market by By Product Type (2018-2032)

4.1 High End Cellomics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Reagents and Consumables

4.5 Software & Services

Chapter 5: High End Cellomics Market by By Application (2018-2032)

5.1 High End Cellomics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drug discovery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cancer Research

5.5 Neuroscience

5.6 Stem Cell Research and Regenerative Medicine

5.7 Personalized Medicine

5.8 Others

Chapter 6: High End Cellomics Market by By Technology (2018-2032)

6.1 High End Cellomics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Microscopy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Flow Cytometry

6.5 Single-cell Genomics

6.6 Mass Spectrometry

6.7 Next Generation Sequencing

6.8 Others

Chapter 7: High End Cellomics Market by By End User (2018-2032)

7.1 High End Cellomics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Biotechnology & Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Hospitals & Diagnostic Laboratories

7.5 Contract Research Organizations

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 High End Cellomics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THERMO FISHER SCIENTIFIC (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DANAHER (USA)

8.4 PERKINELMER (USA)

8.5 BD (BECTON

8.6 DICKINSON AND COMPANY) (USA)

8.7 BIO-RAD LABORATORIES (USA)

8.8 AGILENT TECHNOLOGIES (USA)

8.9 ILLUMINA (USA)

8.10 LUMINEX (USA)

8.11 MERCK KGAA (GERMANY)

8.12 GE HEALTHCARE (USA)

8.13 BRUKER (USA)

8.14 NANOSTRING TECHNOLOGIES (USA)

8.15 10X GENOMICS (USA)

8.16 FLUIDIGM (USA)

8.17 CELSEE (USA)

8.18 BERKELEY LIGHTS (USA)

8.19 MILTENYI BIOTEC (GERMANY)

8.20 BIONANO GENOMICS (USA)

8.21 BIO-TECHNE (USA)

8.22 SPHERE FLUIDICS (UNITED KINGDOM)

8.23 OTHER ACTIVE PLAYERS.

Chapter 9: Global High End Cellomics Market By Region

9.1 Overview

9.2. North America High End Cellomics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Instruments

9.2.4.2 Reagents and Consumables

9.2.4.3 Software & Services

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Drug discovery

9.2.5.2 Cancer Research

9.2.5.3 Neuroscience

9.2.5.4 Stem Cell Research and Regenerative Medicine

9.2.5.5 Personalized Medicine

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size By By Technology

9.2.6.1 Microscopy

9.2.6.2 Flow Cytometry

9.2.6.3 Single-cell Genomics

9.2.6.4 Mass Spectrometry

9.2.6.5 Next Generation Sequencing

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Biotechnology & Pharmaceutical Companies

9.2.7.2 Hospitals & Diagnostic Laboratories

9.2.7.3 Contract Research Organizations

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe High End Cellomics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Instruments

9.3.4.2 Reagents and Consumables

9.3.4.3 Software & Services

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Drug discovery

9.3.5.2 Cancer Research

9.3.5.3 Neuroscience

9.3.5.4 Stem Cell Research and Regenerative Medicine

9.3.5.5 Personalized Medicine

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size By By Technology

9.3.6.1 Microscopy

9.3.6.2 Flow Cytometry

9.3.6.3 Single-cell Genomics

9.3.6.4 Mass Spectrometry

9.3.6.5 Next Generation Sequencing

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Biotechnology & Pharmaceutical Companies

9.3.7.2 Hospitals & Diagnostic Laboratories

9.3.7.3 Contract Research Organizations

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe High End Cellomics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Instruments

9.4.4.2 Reagents and Consumables

9.4.4.3 Software & Services

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Drug discovery

9.4.5.2 Cancer Research

9.4.5.3 Neuroscience

9.4.5.4 Stem Cell Research and Regenerative Medicine

9.4.5.5 Personalized Medicine

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size By By Technology

9.4.6.1 Microscopy

9.4.6.2 Flow Cytometry

9.4.6.3 Single-cell Genomics

9.4.6.4 Mass Spectrometry

9.4.6.5 Next Generation Sequencing

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Biotechnology & Pharmaceutical Companies

9.4.7.2 Hospitals & Diagnostic Laboratories

9.4.7.3 Contract Research Organizations

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific High End Cellomics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Instruments

9.5.4.2 Reagents and Consumables

9.5.4.3 Software & Services

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Drug discovery

9.5.5.2 Cancer Research

9.5.5.3 Neuroscience

9.5.5.4 Stem Cell Research and Regenerative Medicine

9.5.5.5 Personalized Medicine

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size By By Technology

9.5.6.1 Microscopy

9.5.6.2 Flow Cytometry

9.5.6.3 Single-cell Genomics

9.5.6.4 Mass Spectrometry

9.5.6.5 Next Generation Sequencing

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Biotechnology & Pharmaceutical Companies

9.5.7.2 Hospitals & Diagnostic Laboratories

9.5.7.3 Contract Research Organizations

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa High End Cellomics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Instruments

9.6.4.2 Reagents and Consumables

9.6.4.3 Software & Services

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Drug discovery

9.6.5.2 Cancer Research

9.6.5.3 Neuroscience

9.6.5.4 Stem Cell Research and Regenerative Medicine

9.6.5.5 Personalized Medicine

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size By By Technology

9.6.6.1 Microscopy

9.6.6.2 Flow Cytometry

9.6.6.3 Single-cell Genomics

9.6.6.4 Mass Spectrometry

9.6.6.5 Next Generation Sequencing

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Biotechnology & Pharmaceutical Companies

9.6.7.2 Hospitals & Diagnostic Laboratories

9.6.7.3 Contract Research Organizations

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America High End Cellomics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Instruments

9.7.4.2 Reagents and Consumables

9.7.4.3 Software & Services

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Drug discovery

9.7.5.2 Cancer Research

9.7.5.3 Neuroscience

9.7.5.4 Stem Cell Research and Regenerative Medicine

9.7.5.5 Personalized Medicine

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size By By Technology

9.7.6.1 Microscopy

9.7.6.2 Flow Cytometry

9.7.6.3 Single-cell Genomics

9.7.6.4 Mass Spectrometry

9.7.6.5 Next Generation Sequencing

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Biotechnology & Pharmaceutical Companies

9.7.7.2 Hospitals & Diagnostic Laboratories

9.7.7.3 Contract Research Organizations

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global High End Cellomics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.07 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 1.68 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the High End Cellomics Market research report is 2024-2032.

Thermo Fisher Scientific (USA), Danaher (USA), PerkinElmer (USA), BD (Becton, Dickinson and Company) (USA), Bio-Rad Laboratories (USA), Agilent Technologies (USA), Illumina (USA), Luminex (USA), Merck KGaA (Germany), GE Healthcare (USA), Bruker (USA), NanoString Technologies (USA), 10x Genomics (USA), Fluidigm (USA), Celsee (USA), Berkeley Lights (USA), Miltenyi Biotec (Germany), Bionano Genomics (USA), Bio-Techne (USA), Sphere Fluidics (United Kingdom), and Other Active Players

The High End Cellomics Market is segmented into By Product Type, Application, By Technology, By End User and region. By Product Type (Instruments, Reagents and Consumables, and Software & Services), By Application (Drug discovery, Cancer Research, Neuroscience, Stem Cell Research and Regenerative Medicine, Personalized Medicine, and Others), By Technology (Microscopy, Flow Cytometry, Single-cell Genomics, Mass Spectrometry, Next Generation Sequencing, and Others), By End User (Biotechnology & Pharmaceutical Companies, Hospitals & Diagnostic Laboratories, Contract Research Organizations, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

High-end cellomics refers to the advanced study and analysis of cellular structures, functions, and interactions at a high resolution using sophisticated tools and technologies. It integrates disciplines such as cell biology, bioinformatics, and high-throughput screening to enable detailed examination of cellular behaviors in health and disease. This field employs cutting-edge methodologies, including automated microscopy, flow cytometry, and single-cell analysis, to generate comprehensive data for applications in drug discovery, personalized medicine, s-end cellomics plays a critical role in advancing our understanding of cellular mechanisms, providing insights that drive innovation in biomedical research and therapeutic development.

High End Cellomics Market Size Was Valued at USD 1.07 Billion in 2023, and is Projected to Reach USD 1.68 Billion by 2032, Growing at a CAGR of 6.7% from 2024-2032.