High Speed Engine Market Synopsis:

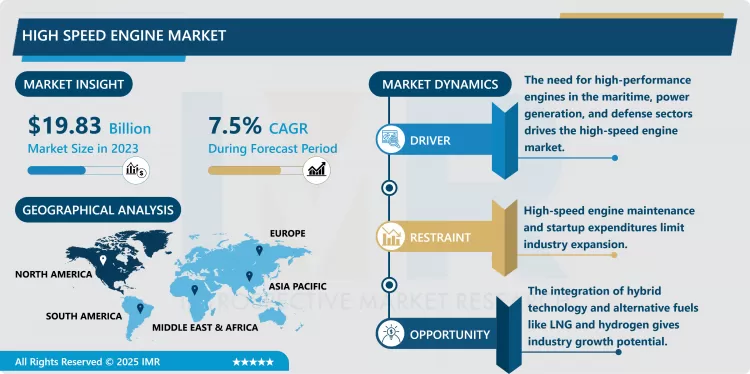

High Speed Engine Market Size Was Valued at USD 19.83 Billion in 2023, and is Projected to Reach USD 33.27 Billion by 2032, Growing at a CAGR of 7.5% from 2024-2032.

The High-Speed Engine Market here used focuses on the particular part of engines which typically works at more than 1000 RPM speeds. These engines are used broadly in the marine, power generation, railway and defense sectors owing to their high performance, compact size and high efficiency. As energy management systems continue to emerge as critical solutions in operations across markets, increased speeds of an engine have become critical in almost all industries.

The market is growing at a considerable pace as high-speed engines are being increasingly used in marine vessels service as aboard engine for driving propellers as well as for auxiliary power, and in industrial and commercial applications as backup power source in case of main power supply failure. Substantial growth in the following aspects like, improved functionality and features like fuel efficiency and low emission are also strengthening the market demand. The larger shipping and logistics market and the growing defense budgets across different countries also form part of the market growth trend.

For example, challenges include the reduced emissions regulation and the high initial price of high-speed engines are hampering the market growth. Nevertheless, the continually increasing use of other fuels and hybrids in high-speed engines remains promising for growth. Furthermore, the increasing use of materials that are built specifically for high-speed engines and the coming up of a smart monitoring platform in the market is also likely to propel changes to the high-speed engine market and make it more sustainable over the given point of time.

High Speed Engine Market Trend Analysis:

Growing Adoption of Hybrid and Alternative Fuel Engines

- The high-speed engine industry is gradually leaning towards hybrids and low-carbon sources of power because of standard emission controls and tougher regulatory policies around the globe. Modularity with the blending of the conventional technologies with electric technologies has seen uptake in various industries particularly the marine and transportation industries. Also,, an emerging engine that uses LNG and hydrogen is rapidly transforming the transport sector by eliminating polluting fuels while improving efficiency and power.

Increasing Focus on Digitalization and Smart Engine Management

- Both digitalization and integration of smart engine management systems are disrupting the high-speed engine market. Smart sensors, IoT, and AI provide the foundation in the current industry for continuous measurement and analytics, prognosis, and optimisation of operations. These innovations are especially valuable for industries such as power generation and marine, where time losses and inefficiencies are translated into major losses. Thus, creating new intelligent engines is considered by manufacturers as a higher priority, because these engines can provide better reliability and convenient interface.

High Speed Engine Market Segment Analysis:

High Speed Engine Market is Segmented on the basis of Engine Type, End-use Industry, Power Rating, Speed, and Region

By Engine Type, Gas Turbine segment is expected to dominate the market during the forecast period

- The high-speed engine market is divided by engine type such as gas turbines, steam turbines, hydraulic turbines, reciprocating engines and others. Gas turbines are employed wherever high speed, high efficiency and reliability is required for example in power generation, aviation and in marine sectors. While steam turbines are mainly employed in power stations and industries with approximately high performance in large-scale power production. Hydraulic turbines are widely useful in hydroelectric power stations to generate renewable power effectively. Reciprocating engines are popular in transportation and backup power applications owing to their capabilities for flexibility and high-power levels. The “others” category includes a number of specific engine kinds ideal for specific markets or purposes in numerous industries. Both types of engines meet unique needs and each play a large role towards the development of the overall high-speed engines market, thanks to technological evolution and global need for energy efficiency.

By End-use Industry, Power Generation segment expected to held the largest share

- The high-speed engine based on market segmentation of the end use industries covering power generation, marine, oil & gas, process industry, aviation, metal manufacturing and other application. In power generation, high-speed engines have gained preference as Standby power and efficient energy producer. The marine industry depends on these engines for main and auxiliary applications, whereas in oil & gas, they are used to drive drilling and offshore assets. Chemicals and food processing industries are prime examples of process industry where high speed engines are used for operating machineries and systems. In aviation, they drive lesser aircrafts and also, the ground support utilities. Metal manufacturing involves general use of high-speed engines needed for several equipment operations which in turn enhances high efficiency in production. All these industries converge to append value and benefit from high-speed engines which are reliable and compact in their different applications.

High Speed Engine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The high-speed engine market in North America is likely to exhibit the strongest growth over the next decade based on the large investment in sectors including marine, power, and defense that requires the use of high-speed tools. Infrastructure in the region is already developed with the existence of strict regulatory practices that urge the development of efficient and sustainable solutions such as high-speed engines. Furthermore, the North America region consists of key market players, new innovation, and growing trends of renewable energy, and hybrid propulsion system to sustain the market in the forecasted period.

Active Key Players in the High-Speed Engine Market:

- GE (USA)

- Siemens (Germany)

- Rolls-Royce (UK)

- Kawasaki Heavy Industries (Japan)

- MAN Energy Solutions (Germany)

- Wartsila (Finland)

- Mitsubishi Heavy Industries (Japan)

- Harbin Turbine Company (China)

- Solar Turbines (USA)

- Ansaldo Energia (Italy)

- Other Active Players

Key Industry Developments in the High-Speed Engine Market:

- In December 2024, Enso Group's Enso Oils & Lubricants became the official distributor for G-Energy, a high-tech engine oil brand, in India. The partnership was announced during a client conference held in Mumbai on Monday, coinciding with G-Energy's launch in the Indian market. The event gathered representatives from the automotive and industrial sectors, including Vaibhav Maloo, MD of Enso Group; Rajesh Nagar, CEO of Enso Oils & Lubricants; and senior officials from Gazpromneft-Lubricants Ltd. Maloo highlighted G-Energy's high standards and customization potential for India.

- In December 2024, Bergen Engines, a global leader in medium-speed engine manufacturing and power solutions, announced a strategic partnership with ioCurrents, a pioneer in maritime data analytics. The collaboration integrated ioCurrents' advanced MarineInsight™ platform into Bergen Engines’ offerings for new builds, repowers, and overhauls. This initiative aimed to enhance vessel performance by utilizing real-time data analytics and artificial intelligence, driving efficiency, sustainability, and smarter fleet management for marine and industrial applications. The partnership marked a significant step forward in maritime innovation.

|

Global High-Speed Engine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.83 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 33.27 Billion |

|

Segments Covered: |

By Engine Type |

|

|

|

By End-use Industry |

|

||

|

By Power Rating |

|

||

|

By Speed |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Speed Engine Market by By Engine Type (2018-2032)

4.1 High Speed Engine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gas Turbine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Steam Turbine

4.5 Hydraulic Turbine

4.6 Reciprocating Engine

4.7 Others

Chapter 5: High Speed Engine Market by By End-use Industry (2018-2032)

5.1 High Speed Engine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Power Generation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Marine

5.5 Oil & Gas

5.6 Process Industry

5.7 Aviation

5.8 Metal Manufacturing

5.9 Others

Chapter 6: High Speed Engine Market by By Power Rating (2018-2032)

6.1 High Speed Engine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 500 kW – 1 MW

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 1 MW – 10 MW

6.5 10 MW – 50 MW

6.6 50 MW – 100 MW

6.7 100 MW – 200 MW

6.8 Above 200 MW

Chapter 7: High Speed Engine Market by By Speed (2018-2032)

7.1 High Speed Engine Market Snapshot and Growth Engine

7.2 Market Overview

7.3 1

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 000 rpm – 5

7.5 000 rpm

7.6 5

7.7 000 rpm – 10

7.8 000 rpm

7.9 10

7.10 000 rpm – 15

7.11 000 rpm

7.12 Above 15

7.13 000 rpm

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 High Speed Engine Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GE (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SIEMENS (GERMANY)

8.4 ROLLS-ROYCE (UK)

8.5 KAWASAKI HEAVY INDUSTRIES (JAPAN)

8.6 MAN ENERGY SOLUTIONS (GERMANY)

8.7 WARTSILA (FINLAND)

8.8 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

8.9 HARBIN TURBINE COMPANY (CHINA)

8.10 SOLAR TURBINES (USA)

8.11 ANSALDO ENERGIA (ITALY)

8.12 OTHER ACTIVE PLAYERS.

Chapter 9: Global High Speed Engine Market By Region

9.1 Overview

9.2. North America High Speed Engine Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Engine Type

9.2.4.1 Gas Turbine

9.2.4.2 Steam Turbine

9.2.4.3 Hydraulic Turbine

9.2.4.4 Reciprocating Engine

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size By By End-use Industry

9.2.5.1 Power Generation

9.2.5.2 Marine

9.2.5.3 Oil & Gas

9.2.5.4 Process Industry

9.2.5.5 Aviation

9.2.5.6 Metal Manufacturing

9.2.5.7 Others

9.2.6 Historic and Forecasted Market Size By By Power Rating

9.2.6.1 500 kW – 1 MW

9.2.6.2 1 MW – 10 MW

9.2.6.3 10 MW – 50 MW

9.2.6.4 50 MW – 100 MW

9.2.6.5 100 MW – 200 MW

9.2.6.6 Above 200 MW

9.2.7 Historic and Forecasted Market Size By By Speed

9.2.7.1 1

9.2.7.2 000 rpm – 5

9.2.7.3 000 rpm

9.2.7.4 5

9.2.7.5 000 rpm – 10

9.2.7.6 000 rpm

9.2.7.7 10

9.2.7.8 000 rpm – 15

9.2.7.9 000 rpm

9.2.7.10 Above 15

9.2.7.11 000 rpm

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe High Speed Engine Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Engine Type

9.3.4.1 Gas Turbine

9.3.4.2 Steam Turbine

9.3.4.3 Hydraulic Turbine

9.3.4.4 Reciprocating Engine

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size By By End-use Industry

9.3.5.1 Power Generation

9.3.5.2 Marine

9.3.5.3 Oil & Gas

9.3.5.4 Process Industry

9.3.5.5 Aviation

9.3.5.6 Metal Manufacturing

9.3.5.7 Others

9.3.6 Historic and Forecasted Market Size By By Power Rating

9.3.6.1 500 kW – 1 MW

9.3.6.2 1 MW – 10 MW

9.3.6.3 10 MW – 50 MW

9.3.6.4 50 MW – 100 MW

9.3.6.5 100 MW – 200 MW

9.3.6.6 Above 200 MW

9.3.7 Historic and Forecasted Market Size By By Speed

9.3.7.1 1

9.3.7.2 000 rpm – 5

9.3.7.3 000 rpm

9.3.7.4 5

9.3.7.5 000 rpm – 10

9.3.7.6 000 rpm

9.3.7.7 10

9.3.7.8 000 rpm – 15

9.3.7.9 000 rpm

9.3.7.10 Above 15

9.3.7.11 000 rpm

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe High Speed Engine Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Engine Type

9.4.4.1 Gas Turbine

9.4.4.2 Steam Turbine

9.4.4.3 Hydraulic Turbine

9.4.4.4 Reciprocating Engine

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size By By End-use Industry

9.4.5.1 Power Generation

9.4.5.2 Marine

9.4.5.3 Oil & Gas

9.4.5.4 Process Industry

9.4.5.5 Aviation

9.4.5.6 Metal Manufacturing

9.4.5.7 Others

9.4.6 Historic and Forecasted Market Size By By Power Rating

9.4.6.1 500 kW – 1 MW

9.4.6.2 1 MW – 10 MW

9.4.6.3 10 MW – 50 MW

9.4.6.4 50 MW – 100 MW

9.4.6.5 100 MW – 200 MW

9.4.6.6 Above 200 MW

9.4.7 Historic and Forecasted Market Size By By Speed

9.4.7.1 1

9.4.7.2 000 rpm – 5

9.4.7.3 000 rpm

9.4.7.4 5

9.4.7.5 000 rpm – 10

9.4.7.6 000 rpm

9.4.7.7 10

9.4.7.8 000 rpm – 15

9.4.7.9 000 rpm

9.4.7.10 Above 15

9.4.7.11 000 rpm

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific High Speed Engine Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Engine Type

9.5.4.1 Gas Turbine

9.5.4.2 Steam Turbine

9.5.4.3 Hydraulic Turbine

9.5.4.4 Reciprocating Engine

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size By By End-use Industry

9.5.5.1 Power Generation

9.5.5.2 Marine

9.5.5.3 Oil & Gas

9.5.5.4 Process Industry

9.5.5.5 Aviation

9.5.5.6 Metal Manufacturing

9.5.5.7 Others

9.5.6 Historic and Forecasted Market Size By By Power Rating

9.5.6.1 500 kW – 1 MW

9.5.6.2 1 MW – 10 MW

9.5.6.3 10 MW – 50 MW

9.5.6.4 50 MW – 100 MW

9.5.6.5 100 MW – 200 MW

9.5.6.6 Above 200 MW

9.5.7 Historic and Forecasted Market Size By By Speed

9.5.7.1 1

9.5.7.2 000 rpm – 5

9.5.7.3 000 rpm

9.5.7.4 5

9.5.7.5 000 rpm – 10

9.5.7.6 000 rpm

9.5.7.7 10

9.5.7.8 000 rpm – 15

9.5.7.9 000 rpm

9.5.7.10 Above 15

9.5.7.11 000 rpm

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa High Speed Engine Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Engine Type

9.6.4.1 Gas Turbine

9.6.4.2 Steam Turbine

9.6.4.3 Hydraulic Turbine

9.6.4.4 Reciprocating Engine

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size By By End-use Industry

9.6.5.1 Power Generation

9.6.5.2 Marine

9.6.5.3 Oil & Gas

9.6.5.4 Process Industry

9.6.5.5 Aviation

9.6.5.6 Metal Manufacturing

9.6.5.7 Others

9.6.6 Historic and Forecasted Market Size By By Power Rating

9.6.6.1 500 kW – 1 MW

9.6.6.2 1 MW – 10 MW

9.6.6.3 10 MW – 50 MW

9.6.6.4 50 MW – 100 MW

9.6.6.5 100 MW – 200 MW

9.6.6.6 Above 200 MW

9.6.7 Historic and Forecasted Market Size By By Speed

9.6.7.1 1

9.6.7.2 000 rpm – 5

9.6.7.3 000 rpm

9.6.7.4 5

9.6.7.5 000 rpm – 10

9.6.7.6 000 rpm

9.6.7.7 10

9.6.7.8 000 rpm – 15

9.6.7.9 000 rpm

9.6.7.10 Above 15

9.6.7.11 000 rpm

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America High Speed Engine Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Engine Type

9.7.4.1 Gas Turbine

9.7.4.2 Steam Turbine

9.7.4.3 Hydraulic Turbine

9.7.4.4 Reciprocating Engine

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size By By End-use Industry

9.7.5.1 Power Generation

9.7.5.2 Marine

9.7.5.3 Oil & Gas

9.7.5.4 Process Industry

9.7.5.5 Aviation

9.7.5.6 Metal Manufacturing

9.7.5.7 Others

9.7.6 Historic and Forecasted Market Size By By Power Rating

9.7.6.1 500 kW – 1 MW

9.7.6.2 1 MW – 10 MW

9.7.6.3 10 MW – 50 MW

9.7.6.4 50 MW – 100 MW

9.7.6.5 100 MW – 200 MW

9.7.6.6 Above 200 MW

9.7.7 Historic and Forecasted Market Size By By Speed

9.7.7.1 1

9.7.7.2 000 rpm – 5

9.7.7.3 000 rpm

9.7.7.4 5

9.7.7.5 000 rpm – 10

9.7.7.6 000 rpm

9.7.7.7 10

9.7.7.8 000 rpm – 15

9.7.7.9 000 rpm

9.7.7.10 Above 15

9.7.7.11 000 rpm

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global High-Speed Engine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.83 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 33.27 Billion |

|

Segments Covered: |

By Engine Type |

|

|

|

By End-use Industry |

|

||

|

By Power Rating |

|

||

|

By Speed |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the High-Speed Engine Market research report is 2024-2032.

GE (USA), Siemens (Germany), Rolls-Royce (UK), Kawasaki Heavy Industries (Japan), MAN Energy Solutions (Germany), Wartsila (Finland), Mitsubishi Heavy Industries (Japan), Harbin Turbine Company (China), Solar Turbines (USA), Ansaldo Energia (Italy), and Other Active Players.

The High-Speed Engine Market is segmented into By Engine Type, By End-use Industry, By Power Rating, By Speed and region. By Engine Type (Gas Turbine, Steam Turbine, Hydraulic Turbine, Reciprocating Engine, and Others), By End-use Industry (Power Generation, Marine, Oil & Gas, Process Industry, Aviation, Metal Manufacturing, and Others), By Power Rating (500 kW – 1 MW, 1 MW – 10 MW, 10 MW – 50 MW, 50 MW – 100 MW, 100 MW – 200 MW, Above 200 MW), By Speed (1,000 rpm – 5,000 rpm, 5,000 rpm – 10,000 rpm, 10,000 rpm – 15,000 rpm, and Above 15,000 rpm). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A high-speed engine is a type of internal combustion engine designed to operate at high revolutions per minute (RPM), typically exceeding 1,000 RPM, to deliver superior performance and efficiency. These engines are characterized by their compact design, high power output, and ability to maintain high speeds over extended periods. High-speed engines are commonly used in applications requiring fast acceleration and reliable operation, such as in marine propulsion, power generation, rail transport, and defense. They are also favored for their ability to handle high stress and provide rapid power delivery, making them essential for industries where performance and reliability are critical.

High Speed Engine Market Size Was Valued at USD 19.83 Billion in 2023, and is Projected to Reach USD 33.27 Billion by 2032, Growing at a CAGR of 7.5% from 2024-2032.