High Temperature Grease & Lubricants Market Synopsis:

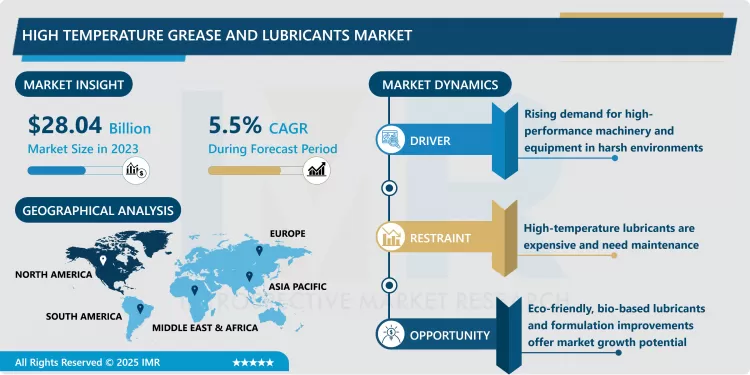

High Temperature Grease & Lubricants Market Size Was Valued at USD 28.04 Billion in 2023, and is Projected to Reach USD 42.71 Billion by 2032, Growing at a CAGR of 5.5% from 2024-2032.

The High Temperature Grease and Lubricants Market is expanding consistently because the requirement for high-performance lubricants in operations that face high thermal stress is moving upward. High-temperature greases and lubricants are commonly used in industry like automobile, air-plane, factory production line and energy production line due to high heat associated with them which affects the normal greases and lubricants. These presented specialty lubricants incorporate certain kinds of additives to effectively work under high temperature environments, to reduce friction and increase the durability of crucial parts.

The growth is also attributed to increased adoption of high temperature operational equipment and increased process complexity. Emerging technologies in cutting-edge high temperature lubricant, the synthesis of new effective lubricants, and others like synthetic oils and greases that have a longer thermostability are also fuelling growth in the high temperature lubricant market. Thus, continuing the trends towards higher efficiency and lower operating and maintenance expenses, there is a growing need for advanced materials for high temperature lubrication.

Thus, though there are highly important and promising market for high-temperature lubricants, there are some factors that are important and can be considered as crucial at the same time: a high cost of high-temperature lubricants, as well as the necessity of their correct application and utilization. But the industry prospects are that there is a trend towards the use of ecological lubricants, and the ever-growing demand from developing countries, where industrialization and the construction of infrastructure is actively developing. An exciting market with future prospects is high-temperature lubricants based on bio-popular and environmentally friendly products.

High Temperature Grease & Lubricants Market Trend Analysis:

Rising Demand for Synthetic and Bio-Based Lubricants

- Occasionally referred to as syn and bio lube, there is increasing demand for synthetic and bio based high temperature greases and lubricants as the world moves towards more sustainable and environmentally friendly materials. Synthetic lubricants tend to perform far better at high temperature levels as well as have better thermal characteristics than regular lubricants. On the same note, bio-based lubricants are also preferred and being widely used due to their biodegradability accompanied by less harm on the environment a factor that complements the increasing concern among consumers towards the use of environment friendly products. This trend is more and more observed in such sectors like automotive and manufacturing, where operational effectiveness and ecological sustainability are valued.

Technological Advancements in Lubricant Formulations

- This is because technological developments in the formulation of lubricant products are the key factor that defines the developments in the high temperature grease and lubricants market. There is a need to conduct research to discover new higher-performing lubricants to replace existing products in the market such as those with advanced sleeve and gear lubrication. Nanoscale technology and improved additives in lubricants are making it possible to develop products that can work in high temperatures and pressures and resist aggressive states. Most of these innovations not only enhance the durability of the used machinery, but also enhance efficiency in energy use as well as lowering the costs of production in some industries.

High Temperature Grease & Lubricants Market Segment Analysis:

High Temperature Grease & Lubricants Market Segmented on the basis of Type and Application, Distribution Channel, and Region.

By Type, Soap Thickener Segment is Expected to Dominate the Market During the Forecast Period

- Other similar classification of the high-temperature grease and lubricants is based on types that include soap thickener, non-soap thickener and high-temperature lubricants. Soap thickeners are the most popular and stable due to their cheap nature, in the high temperature grease and most favoured is the lithium. Polyurea and calcium sulfonate non-soap thickeners are slowly becoming admired for their performance in the extreme conditions of high-temperature and high-pressure environments, high oxidation and corrosion resistance. High-temperature lubricants are made up of oily and greasy products that do not thicken or lose their functionality when exposed to high temperatures; most of the high-temperature lubricants are used in automotive, aerospace and power industries among others. Every type has its benefits depending on the application and manufacturers pay much attention to research on how to enhance primary properties such as thermal resistance, mechanical load, and durability under hostile environment.

By Application, Industrial Segment Expected to Held the Largest Share

- The High Temperature Grease & Lubricants Market is widely used in manufacturing units and automobiles industries as the machinery’s and equipment’s are used at very high temperatures. Manufacturing industries, energy, and aerospace industries where high load, heavy structure, and high-temperature activities are present require high-temperature lubricants for heavy equipment, bearings, and gears. In automotive industry these lubricants play an important role to maintain and upgrade the durability of various parts of engines, transmission and exhaust as these parts work at high temperature. Thus, the timely development of high-temperature specialized greases and lubrication tools to meet the growing industries’ increasing expectations and performance and reliability requirements have further increased in both spheres.

High Temperature Grease & Lubricants Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to dominate the high-temperature grease and lubricants market due to several key factors, including technological advancements, the presence of major industrial players, and a high demand for these products in various industries. The region's robust industrial infrastructure, particularly in sectors like automotive, aerospace, manufacturing, and heavy machinery, drives the need for high-performance lubricants capable of withstanding extreme temperatures.

- The increasing use of electric vehicles (EVs) and the need for advanced lubrication solutions to meet the demands of high-efficiency motors and components further contribute to market growth. Moreover, North America has a well-established network of oil and gas, power generation, and chemical industries, where high-temperature greases and lubricants are essential to ensure smooth operation in high-stress environments.

- Additionally, the region benefits from strong research and development (R&D) capabilities, leading to the development of innovative, high-performance products tailored for specific applications. Government regulations promoting industrial efficiency and safety also drive the demand for these lubricants.

Active Key Players in the High Temperature Grease & Lubricants Market

- Exxon Mobil Corporation (U.S.)

- Shell plc (U.K.)

- Dow (U.S.)

- FUCHS (Germany)

- TotalEnergies (France)

- BP p.l.c. (U.K.)

- PETRONAS Lubricants International (Malaysia)

- The Lubrizol Corporation (U.S.)

- Chevron Corporation (U.S.)

- DuPont (U.S.)

- China Petroleum Corporation (China)

- NANDAN PETROCHEM LTD. (India)

- Maax Lubrication Pvt Ltd (India)

- Carl Bechem Lubricants India Private Limited (India)

- Equifit Technoart (India)

- Darshil Enterprise (India)

- T. S. Moly Lubricants, Inc. (U.S.), and other active players

Key Industry Development of High Temperature Grease & Lubricants Market:

In December 2024, Hot Shot’s Secret has launched its new 7000 Series Extreme Pressure Grease, featuring the 7460EP and 7150EP variants. These advanced lubricants are designed to provide superior performance under extreme pressure and high-temperature conditions, ensuring optimal protection for heavy-duty equipment. Ideal for automotive and industrial applications, the new grease improves efficiency, extends component lifespan, and reduces wear, making it a game-changer for demanding machinery and fleets.

|

Global High Temperature Grease & Lubricants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.04 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 42.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Temperature Grease & Lubricants Market by By Type (2018-2032)

4.1 High Temperature Grease & Lubricants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Soap Thickener

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Soap Thickener

4.5 High Temperature Lubricants

Chapter 5: High Temperature Grease & Lubricants Market by By Application (2018-2032)

5.1 High Temperature Grease & Lubricants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Automotive

Chapter 6: High Temperature Grease & Lubricants Market by By Distribution Channel (2018-2032)

6.1 High Temperature Grease & Lubricants Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Indirect

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 High Temperature Grease & Lubricants Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EXXON MOBIL CORPORATION (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SHELL PLC (U.K.)

7.4 DOW (U.S.)

7.5 FUCHS (GERMANY)

7.6 TOTALENERGIES (FRANCE)

7.7 BP P.L.C. (U.K.)

7.8 PETRONAS LUBRICANTS INTERNATIONAL (MALAYSIA)

7.9 THE LUBRIZOL CORPORATION (U.S.)

7.10 CHEVRON CORPORATION (U.S.)

7.11 DUPONT (U.S.)

7.12 CHINA PETROLEUM CORPORATION (CHINA)

7.13 NANDAN PETROCHEM LTD. (INDIA)

7.14 MAAX LUBRICATION PVT LTD (INDIA)

7.15 CARL BECHEM LUBRICANTS INDIA PRIVATE LIMITED (INDIA)

7.16 EQUIFIT TECHNOART (INDIA)

7.17 DARSHIL ENTERPRISE (INDIA)

7.18 T. S. MOLY LUBRICANTS INC. (U.S.)

7.19 OTHER ACTIVE PLAYERS.

Chapter 8: Global High Temperature Grease & Lubricants Market By Region

8.1 Overview

8.2. North America High Temperature Grease & Lubricants Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Soap Thickener

8.2.4.2 Non-Soap Thickener

8.2.4.3 High Temperature Lubricants

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Industrial

8.2.5.2 Automotive

8.2.6 Historic and Forecasted Market Size By By Distribution Channel

8.2.6.1 Direct

8.2.6.2 Indirect

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe High Temperature Grease & Lubricants Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Soap Thickener

8.3.4.2 Non-Soap Thickener

8.3.4.3 High Temperature Lubricants

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Industrial

8.3.5.2 Automotive

8.3.6 Historic and Forecasted Market Size By By Distribution Channel

8.3.6.1 Direct

8.3.6.2 Indirect

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe High Temperature Grease & Lubricants Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Soap Thickener

8.4.4.2 Non-Soap Thickener

8.4.4.3 High Temperature Lubricants

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Industrial

8.4.5.2 Automotive

8.4.6 Historic and Forecasted Market Size By By Distribution Channel

8.4.6.1 Direct

8.4.6.2 Indirect

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific High Temperature Grease & Lubricants Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Soap Thickener

8.5.4.2 Non-Soap Thickener

8.5.4.3 High Temperature Lubricants

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Industrial

8.5.5.2 Automotive

8.5.6 Historic and Forecasted Market Size By By Distribution Channel

8.5.6.1 Direct

8.5.6.2 Indirect

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa High Temperature Grease & Lubricants Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Soap Thickener

8.6.4.2 Non-Soap Thickener

8.6.4.3 High Temperature Lubricants

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Industrial

8.6.5.2 Automotive

8.6.6 Historic and Forecasted Market Size By By Distribution Channel

8.6.6.1 Direct

8.6.6.2 Indirect

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America High Temperature Grease & Lubricants Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Soap Thickener

8.7.4.2 Non-Soap Thickener

8.7.4.3 High Temperature Lubricants

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Industrial

8.7.5.2 Automotive

8.7.6 Historic and Forecasted Market Size By By Distribution Channel

8.7.6.1 Direct

8.7.6.2 Indirect

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global High Temperature Grease & Lubricants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.04 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 42.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the High Temperature Grease & Lubricants Market research report is 2024-2032.

Exxon Mobil Corporation (U.S.), Shell plc (U.K.), Dow (U.S.), FUCHS (Germany), TotalEnergies (France), BP p.l.c. (U.K.), PETRONAS Lubricants International (Malaysia), The Lubrizol Corporation (U.S.), Chevron Corporation (U.S.), DuPont (U.S.), China Petroleum Corporation (China), NANDAN PETROCHEM LTD. (India), Maax Lubrication Pvt Ltd (India), Carl Bechem Lubricants India Private Limited (India), Equifit Technoart (India), Darshil Enterprise (India), T. S. Moly Lubricants, Inc. (U.S.), and Other Active players.

The High Temperature Grease & Lubricants Market is segmented into Type, Application, Distribution Channel and region. By Type (Soap Thickener, Non-Soap Thickener, High Temperature Lubricants), Application (Industrial, Automotive). Distribution Channel (Direct, Indirect). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

High-temperature grease and lubricants are specialized lubricants designed to perform optimally in extreme temperature environments, typically above 150°C (302°F). These lubricants are formulated with advanced additives and base oils, such as synthetic or semi-synthetic compounds, that provide superior thermal stability, ensuring long-lasting performance even under high heat, pressure, and friction. They are used in industries such as automotive, aerospace, manufacturing, and energy, where machinery and engines operate in elevated temperatures. These lubricants help reduce wear and tear, prevent rust and corrosion, and maintain the efficiency and reliability of critical components, extending the service life of equipment and reducing maintenance costs.

High Temperature Grease & Lubricants Market Size Was Valued at USD 28.04 Billion in 2023, and is Projected to Reach USD 42.71 Billion by 2032, Growing at a CAGR of 5.5% from 2024-2032.