Home Audio Equipment Market Synopsis

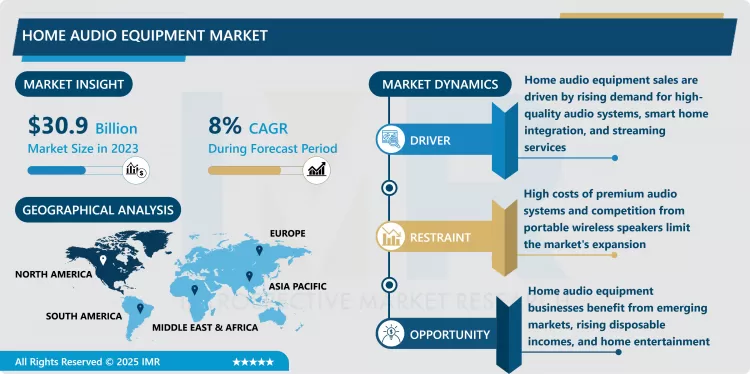

Home Audio Equipment Market Size Was Valued at USD 30.9 Billion in 2023, and is Projected to Reach USD 62.9 Billion by 2032, Growing at a CAGR of 8% from 2024-2032.

The home Audio equipment market has in the recent past undergone a considerable growth due to the enhanced customer demand for better home audio systems and the development of new technologies to enhance these systems. With the development of smart homes and the constantly expanding repertoire of options for home entertainment like streaming services, home theaters, etc., customers increasingly choose high-quality sound systems for home. headphone, soundbars, home theatre systems, smart speakers and other wireless audio devices have become important home appliances thus driving demand for the market.

The improvement of technologies, such as wireless, Bluetooth, Wi-Fi, and voice, and assistants can also credit for the increase in appreciation of home audio equipment. Consumers are focusing more and more on those systems that offer advanced simplicity, high-definition sound quality and interoperability with other smart home devices. In addition, with implementation of VR and especially growing popularity of gaming, the demand for better quality audio is increasing which requires the companies to continue to innovate.

However, as in many growing markets, some issues – for example, high costs of the products and the difficulty of installation of some systems – may still limit the market’s expansion. However, two opportunities have included the improving accessibility of such equipment because they are becoming cheaper and more use of the internet in purchasing of these McCoy et al. (2012). This can be seen as disposable income increases especially in the emerging economies and the overall home audio equipment industry has potential to grow more to reach different levels of customers for firms.

Home Audio Equipment Market Trend Analysis:

Rise of Smart Audio Devices

- Smart audio devices refer to wireless speakers and voice-controlled speakers and are evidently on an upward growth trajectory currently as home audio equipment. As more consumers incorporate smart home features, they also want voice speakers that are compatible with other home automation systems including lighting, heating, or security. Gadgets such as Amazon Echo, Google Nest Audio, Apple HomePod since they are equipped with brain interfaces and equally multiple connectivity modes are among the intelligent home audio technologies. This trend forces companies to create more feature comprehensive products that can meet demands for comfort, the ability to control connected home appliances, and other home devices.

Demand for Immersive and High-Quality Sound Systems

- Because the entertainment systems seem to form a very integral part of people’s lives at home or wherever they reside, the consumers are developing a desire for systems that provide superior quality sound. The customers are no longer content with ordinary audio accessories and desire much better-quality sound for various purposes as for instance watching a movie, gaming, or listening to music. This trend is leading to advancements in audio technology like Dolby Atmos, and 3D sound systems that give the listeners the ultimate experience. As technology improves more options for higher quality products are introduced and different price points for new sound systems are introduced, the home audio market is projected to stay on this growing trend.

Home Audio Equipment Market Segment Analysis:

Home Audio Equipment Market is Segmented on the basis of technology, distribution channel, and regions.

By Technology, Wired Segment is Expected to Dominate the Market During the Forecast Period

- The wired and wireless options represent the splitting of the separated technologies of the Home Audio Equipment Market that reflect the customer’s requirements. Cabled audio peripherals continue to enjoy their usage among music lovers and people who want optimum performance in the absence of complications associated with wireless technology. These systems are known to provide dependable and stable sound reproduction, nowadays quite popular in-home theatre and much professional sound applications. On the other hand, portable or wireless audio devices are becoming popular due to these reasons; convenience and versatility and integration with the smart home technology solutions. One of the key customer trends influencing modern home audio systems is the availability of wireless speakers and sound transmitting technologies like Bluetooth and Wi-Fi that allow people to connect, control, and move around their speakers and sound systems. That is why the factor indicating that the market will grow, as well as developments in streaming, can be noted as the factor in the trend of wireless technology.

By Distribution Channel, Online Segment Expected to Held the Largest Share

- The Home Audio Equipment Market is classified based on sales channel type as Internet sales and offline sales. The wired section is rapidly expanding because it is easier to surf, order, and compare various products sitting at home. These e-commerce stores include Amazon.com, BestBuy online store, and specialized audio equipment websites and home audio systems provide consumers with options, features, and descriptions of home audio systems complete with customer reviews and affordable prices. However, the offline segment still holds value for those individuals who wish to touch and feel before they buy and get consultation on what product to purchase from home theatre shops. Extended self-materiel stores such as electronics stores and showrooms for instance are likely to maintain customer appeal with personalized service in addition to touching and feeling the client’s abode to directly have firsthand experience of the value of their sound quality before buying them. Both are important for delivering the different consumer preferences, though online sales are taking over the market in the increasing use of technology.

Home Audio Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is anticipated to hold the largest share within the Home Audio Equipment Market during the forecast period due to the high disposable income in the region, high absorption of the latest technologies and high customer demand for improved quality home audio systems. The acculturation theory is evident because the USA is populated by many patients, IT literate consumers who are willing to invest in sophisticated home theatre systems. Further, the increased awareness of smart home technology, the rising trend in the adoption of streaming services and the love for enjoying powerful sound at home are key factors that have led to the expansion of the home audio equipment market in the region. High connection demand, high performance audio devices, consumers’ preference shift towards innovative products and differentiation strategies of manufacturers have made North America as the leading market.

Active Key Players in the Home Audio Equipment Market

- Akai Electric Co (Japan)

- Audio Partnership Plc (UK)

- Bose Corporation (USA)

- Dolby Laboratories Inc. (USA)

- DTS Inc. (USA)

- JVC Kenwood Holdings Inc. (Japan)

- Koninklijke Philips Electronics NV (Netherlands)

- LG Electronics Inc (South Korea)

- Panasonic Corporation (Japan)

- Sanyo Electric Co. Ltd. (Japan)

- Nakamichi Corporation (Japan)

- Onkyo Corporation (Japan)

- Pioneer Corporation (Japan)

- Sharp Corporation (Japan)

- Sony Corporation (Japan)

- Samsung Electronics (South Korea)

- Vistron Audio Equipment (Taiwan)

- Harman International Industries (USA)

- Intex (India)

- Niles Audio (USA)

- Philips (Netherlands)

- Qualcomm Technologies (USA)

- Acoustic Research, Inc. (USA)

- Altec Lansing (USA)

- Boston Acoustics (USA)

- Voxx International (USA), and other active players

Key industry Developments of Global Home Audio Equipment Market:

- In November 2024, Fasetto, Inc., a leader in technology IP solutions, introduced AUDIO Cu, a groundbreaking home audio solution that delivers high-quality sound using existing power lines. Launched on November 12, 2024, this innovative system eliminates the need for traditional speaker wiring, offering seamless connectivity and superior audio performance. Designed to revolutionize home audio experiences, AUDIO Cu showcases Fasetto's commitment to cutting-edge technology and user-centric innovation.

- In July 2024, HARMAN's JBL unveiled its latest home theater solutions, blending advanced audio technologies with sleek designs to transform the entertainment experience. The new lineup features immersive sound systems with enhanced connectivity, catering to movie enthusiasts and audiophiles alike. With a focus on delivering cinema-quality audio at home, JBL's offerings promise unmatched clarity, deep bass, and seamless integration, setting a new standard in home entertainment.

|

Global Home Audio Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.9 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 62.9 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Home Audio Equipment Market by By Technology (2018-2032)

4.1 Home Audio Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wired

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wireless

Chapter 5: Home Audio Equipment Market by By Distribution Channel (2018-2032)

5.1 Home Audio Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Home Audio Equipment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AKAI ELECTRIC CO (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AUDIO PARTNERSHIP PLC (UK)

6.4 BOSE CORPORATION (USA)

6.5 DOLBY LABORATORIES INC. (USA)

6.6 DTS INC. (USA)

6.7 JVC KENWOOD HOLDINGS INC. (JAPAN)

6.8 KONINKLIJKE PHILIPS ELECTRONICS NV (NETHERLANDS)

6.9 LG ELECTRONICS INC (SOUTH KOREA)

6.10 PANASONIC CORPORATION (JAPAN)

6.11 SANYO ELECTRIC CO. LTD. (JAPAN)

6.12 NAKAMICHI CORPORATION (JAPAN)

6.13 ONKYO CORPORATION (JAPAN)

6.14 PIONEER CORPORATION (JAPAN)

6.15 SHARP CORPORATION (JAPAN)

6.16 SONY CORPORATION (JAPAN)

6.17 SAMSUNG ELECTRONICS (SOUTH KOREA)

6.18 VISTRON AUDIO EQUIPMENT (TAIWAN)

6.19 HARMAN INTERNATIONAL INDUSTRIES (USA)

6.20 INTEX (INDIA)

6.21 NILES AUDIO (USA)

6.22 PHILIPS (NETHERLANDS)

6.23 QUALCOMM TECHNOLOGIES (USA)

6.24 ACOUSTIC RESEARCH INC. (USA)

6.25 ALTEC LANSING (USA)

6.26 BOSTON ACOUSTICS (USA)

6.27 VOXX INTERNATIONAL (USA)

6.28 OTHER ACTIVE PLAYERS.

Chapter 7: Global Home Audio Equipment Market By Region

7.1 Overview

7.2. North America Home Audio Equipment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Technology

7.2.4.1 Wired

7.2.4.2 Wireless

7.2.5 Historic and Forecasted Market Size By By Distribution Channel

7.2.5.1 Online

7.2.5.2 Offline

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Home Audio Equipment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Technology

7.3.4.1 Wired

7.3.4.2 Wireless

7.3.5 Historic and Forecasted Market Size By By Distribution Channel

7.3.5.1 Online

7.3.5.2 Offline

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Home Audio Equipment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Technology

7.4.4.1 Wired

7.4.4.2 Wireless

7.4.5 Historic and Forecasted Market Size By By Distribution Channel

7.4.5.1 Online

7.4.5.2 Offline

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Home Audio Equipment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Technology

7.5.4.1 Wired

7.5.4.2 Wireless

7.5.5 Historic and Forecasted Market Size By By Distribution Channel

7.5.5.1 Online

7.5.5.2 Offline

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Home Audio Equipment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Technology

7.6.4.1 Wired

7.6.4.2 Wireless

7.6.5 Historic and Forecasted Market Size By By Distribution Channel

7.6.5.1 Online

7.6.5.2 Offline

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Home Audio Equipment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Technology

7.7.4.1 Wired

7.7.4.2 Wireless

7.7.5 Historic and Forecasted Market Size By By Distribution Channel

7.7.5.1 Online

7.7.5.2 Offline

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Home Audio Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.9 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 62.9 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Home Audio Equipment Market research report is 2024-2032.

Akai Electric Co (Japan), Audio Partnership Plc (UK), Bose Corporation (USA), Dolby Laboratories Inc. (USA), DTS Inc. (USA), JVC Kenwood Holdings Inc. (Japan), Koninklijke Philips Electronics NV (Netherlands), LG Electronics Inc (South Korea), Panasonic Corporation (Japan), Sanyo Electric Co. Ltd. (Japan), Nakamichi Corporation (Japan), Onkyo Corporation (Japan), Pioneer Corporation (Japan), Sharp Corporation (Japan), Sony Corporation (Japan), Samsung Electronics (South Korea), Vistron Audio Equipment (Taiwan), Harman International Industries (USA), Intex (India), Niles Audio (USA), Philips (Netherlands), Qualcomm Technologies (USA), Acoustic Research, Inc. (USA), Altec Lansing (USA), Boston Acoustics (USA), Voxx International (USA), and other active players.

The Home Audio Equipment Market is segmented into By Technology, By Distribution Channel and region. By Technology (Wired, Wireless), By Distribution Channel (Online, Offline). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Home audio equipment refers to a range of audio devices designed for personal or home entertainment use, providing high-quality sound and immersive listening experiences. This includes products like speakers, soundbars, amplifiers, receivers, home theater systems, and wireless audio solutions, often integrated with advanced technologies such as Bluetooth, Wi-Fi, and smart connectivity features. These devices are used for various applications such as music listening, movie watching, gaming, and smart home audio systems. With the rise of streaming services and the increasing demand for enhanced audio experiences, home audio equipment has evolved to offer more compact, versatile, and high-performance options for consumers.

Home Audio Equipment Market Size Was Valued at USD 30.9 Billion in 2023, and is Projected to Reach USD 62.9 Billion by 2032, Growing at a CAGR of 8% from 2024-2032.