Home Medical Equipment Market Synopsis

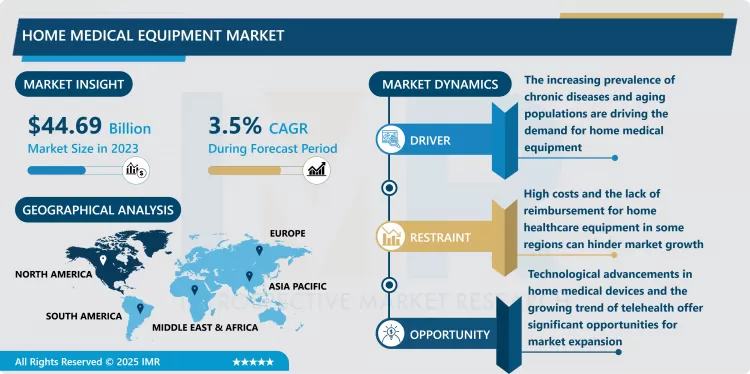

Home Medical Equipment Market Size Was Valued at USD 44.69 Billion in 2023, and is Projected to Reach USD 60.4 Billion by 2032, Growing at a CAGR of 3.5% from 2024-2032.

HME includes an extensive catalog of medical equipment which people require at their homes to monitor or treat their ailments or for recuperation, post a surgery or some health complication. This ranges from oxygen concentrators, wheel chairs, blood pressure machines, diabetes management machines, CPAP machines among others, mobility supports, among others. The increase of the aging population, increase in chronic diseases, increase in home care and use of medical equipment are some of the factors that have spurred Growth of HME market. Higher costs of medical care and continuation of options other than admission to a hospital have also helped advance home medical equipment.

Smart home technologies, remote and telemedicine in home healthcare environment are also factors that augment the growth of the HME market. Imagining, mobile devices will become smarter where patients get an opportunity to access healthcare solutions at homes through refined health care technologies. Also, advancing of the device and connected health solutions in the wearable medical devices improve the life of the patients and enable constant health monitoring that leads to the usage of HME products.

At a geographic level, the leading home medical equipment market is North America due to sufficient health facilities, more occurrences of chronic diseases, and an increasing number of geriatric populations. But the market is also expanding significantly in Asia-Pacific region due to enhancing health consciousness, better healthcare facilities and growing per capita income. New models of home-based care coupled with governmental support to develop home healthcare are also other factors that are likely to increase the demand for home medical equipment in the future years. A great deal of growth is expected within the market due to advancements in technology and increasing population.

Home Medical Equipment Market Trend Analysis:

Integration of Smart Technology in Home Medical Equipment

- The market for home medical equipment is fast transitioning toward smart home equipment market, having extended capabilities and improved usability. Smart blood pressure monitors, glucose meters, wearable health trackers and other similar devices are now incorporated connecting means to help physicians with patients’ real-time data collection from remote locations. This is enabled by IoT and telemedicine to allow proportional care management and thus; better health outcomes for patients. engaged patients and caregivers stand to gain from the ease of monitoring and tracking of health status data hence the increase in uptake of these technologies.

Growth in Demand for Respiratory Care Devices

- Oxygen generators, oxygen conserving devices, mechanical ventilators and Continuous Positive Airway Pressure (CPAP) devices are some of the most sought-after home health care’s devices. The increased usage of respiratory products like COPD, Asthma, and sleep apnea continue to drive the market for these products. The COVID-19 has also bolstered this trend because the respiratory care requires solution which can be possibly offered at home. Since patients are slowly trying to shift to home care, the need for convenient, easy to use and technologically enhanced respiratory support devices will still remain high.

Home Medical Equipment Market Segment Analysis:

Home Medical Equipment Market is Segmented on the basis of product type, end user, application, distribution channel, and region.

By Product Type, Monitoring Equipment Segment is Expected to Dominate the Market During the Forecast Period

- The home medical equipment market has many products that can be classified in many different types, which are all designed to serve specific healthcare needs. Supplementary equipment like blood pressure monitor, glucose meter and pulse oximeter help a person to keep tab on their vital statistics and control chronic disorders in the comfort of their own homes. Therapeutic equipment meaning equipment used in treatment; there is stem therapy; nebulizers, a respiratory and sleep disorder therapy that uses CPAP machines and oxygen concentrators. While home mobility equipment like wheelchairs, walkers and stairlifts provide the individuals with mobility limitation the ability to get around with ease. Care products such as grab bars, dressing aids, and bath chairs help clients with basic day to day activities and greatly enhance the quality of life of elderly and disabled patients. Finally, medical supplies, which include items such as wound care products, incontinence supplies and surgical dressings are important human wants which are used to address health issues at home. Both these product types are very useful in helping people sustain control of their health and minimize visits to the hospital.

By Application, Chronic Disease Management Segment Expected to held the Largest Share

- The home medical equipment market is also enjoying steady growth across diverse therapeutic area such as chronic disease, surgery, elderly and disabled. In chronic disease management, devices like blood pressure cuff, glucose meter, and home dialysis allow the patients with diabetes, hypertension, heart diseases and other ailments to control their health on their own. The use products such as surgical dressings, treatment aids, and pain management system that used in wound care, mobility assistance, and pain management support patient’s recovery after surgery at their homes. Hearing aids, mobility scooters, and home monitoring devices are faster becoming indispensable tools in the management of the elderly and critically important in their composite wellbeing. Furthermore, disability assistance devices such as wheel chair, artificial limb, and technical aids all improve the quality of life of the disabled and thus making these applications one of the key drivers of the home medical equipment market.

Home Medical Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis made North America is expected to hold top position in the home medical equipment market over the incoming forecast period majorly owing to the well-developed healthcare industry, higher expenditure on the healthcare sector, and increasing geriatric population. The region also experiences the expansion in demand for remote patient monitoring and telemedicine, which is fuelling the home care medical devices market. Moreover, the increasing incidence of chronic diseases including diabetes and other cardiovascular or respiratory diseases also brought into light more patients require home care solutions. Global electronics market giants along with persistent development and use of smart home medical equipment add value to North America to set it up as a market leader.

For Example:

Active Key Players in the Home Medical Equipment Market

- Hollister (USA)

- Hersill (Spain)

- GE Healthcare (USA)

- Cardinal Health (USA)

- Zimmer Biomet (USA)

- ResMed (Australia)

- Philips (Netherlands)

- Otsuka Pharmaceutical (Japan)

- Baxter International (USA)

- Invacare (USA)

- Smith & Nephew (UK)

- Fresenius Medical Care (Germany)

- 3M (USA)

- Drive DeVilbiss Healthcare (USA)

- Medtronic (Ireland), and other active players

Key Industry Dvelopments of Home Medical Equipment Market:

- In October 2024, WellSky, a global leader in health and community care technology, announced its acquisition of a prominent durable and home medical equipment provider. The acquisition strengthens WellSky’s position in delivering comprehensive solutions for home-based care. This strategic move aims to enhance care coordination and improve patient outcomes by integrating advanced technology and expanding service offerings in the home medical equipment market, fostering innovation in patient-centered care.

- In May 2024, Quipt Home Medical Corp. announced the filing of its final base shelf prospectus with securities regulators. This filing allows the company to offer and sell securities, including common shares, preferred shares, and debt securities, over a 25-month period. The prospectus provides the company with financial flexibility to support growth initiatives, acquisitions, and other strategic opportunities. The filing is part of Quipt's ongoing commitment to enhancing shareholder value.

|

Global Home Medical Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 44.69 Billion |

|

Forecast Period 2024-32 CAGR: |

3.5% |

Market Size in 2032: |

USD 60.4 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Home Medical Equipment Market by By Product Type (2018-2032)

4.1 Home Medical Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Monitoring Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Therapeutic Equipment

4.5 Home Mobility Equipment

4.6 Daily Living Aids

4.7 Medical Supplies

Chapter 5: Home Medical Equipment Market by By End User (2018-2032)

5.1 Home Medical Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Home Care

5.5 Nursing Homes

5.6 Rehabilitation Centers

Chapter 6: Home Medical Equipment Market by By Application (2018-2032)

6.1 Home Medical Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Chronic Disease Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Post-Surgical Care

6.5 Elderly Care

6.6 Disability Assistance

Chapter 7: Home Medical Equipment Market by By Distribution Channel (2018-2032)

7.1 Home Medical Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail Stores

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Online Stores

7.5 Direct Sales

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Home Medical Equipment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HOLLISTER (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HERSILL (SPAIN)

8.4 GE HEALTHCARE (USA)

8.5 CARDINAL HEALTH (USA)

8.6 ZIMMER BIOMET (USA)

8.7 RESMED (AUSTRALIA)

8.8 PHILIPS (NETHERLANDS)

8.9 OTSUKA PHARMACEUTICAL (JAPAN)

8.10 BAXTER INTERNATIONAL (USA)

8.11 INVACARE (USA)

8.12 SMITH & NEPHEW (UK)

8.13 FRESENIUS MEDICAL CARE (GERMANY)

8.14 3M (USA)

8.15 DRIVE DEVILBISS HEALTHCARE (USA)

8.16 MEDTRONIC (IRELAND)

8.17 OTHER ACTIVE PLAYERS.

Chapter 9: Global Home Medical Equipment Market By Region

9.1 Overview

9.2. North America Home Medical Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Monitoring Equipment

9.2.4.2 Therapeutic Equipment

9.2.4.3 Home Mobility Equipment

9.2.4.4 Daily Living Aids

9.2.4.5 Medical Supplies

9.2.5 Historic and Forecasted Market Size By By End User

9.2.5.1 Hospitals

9.2.5.2 Home Care

9.2.5.3 Nursing Homes

9.2.5.4 Rehabilitation Centers

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Chronic Disease Management

9.2.6.2 Post-Surgical Care

9.2.6.3 Elderly Care

9.2.6.4 Disability Assistance

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Retail Stores

9.2.7.2 Online Stores

9.2.7.3 Direct Sales

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Home Medical Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Monitoring Equipment

9.3.4.2 Therapeutic Equipment

9.3.4.3 Home Mobility Equipment

9.3.4.4 Daily Living Aids

9.3.4.5 Medical Supplies

9.3.5 Historic and Forecasted Market Size By By End User

9.3.5.1 Hospitals

9.3.5.2 Home Care

9.3.5.3 Nursing Homes

9.3.5.4 Rehabilitation Centers

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Chronic Disease Management

9.3.6.2 Post-Surgical Care

9.3.6.3 Elderly Care

9.3.6.4 Disability Assistance

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Retail Stores

9.3.7.2 Online Stores

9.3.7.3 Direct Sales

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Home Medical Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Monitoring Equipment

9.4.4.2 Therapeutic Equipment

9.4.4.3 Home Mobility Equipment

9.4.4.4 Daily Living Aids

9.4.4.5 Medical Supplies

9.4.5 Historic and Forecasted Market Size By By End User

9.4.5.1 Hospitals

9.4.5.2 Home Care

9.4.5.3 Nursing Homes

9.4.5.4 Rehabilitation Centers

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Chronic Disease Management

9.4.6.2 Post-Surgical Care

9.4.6.3 Elderly Care

9.4.6.4 Disability Assistance

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Retail Stores

9.4.7.2 Online Stores

9.4.7.3 Direct Sales

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Home Medical Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Monitoring Equipment

9.5.4.2 Therapeutic Equipment

9.5.4.3 Home Mobility Equipment

9.5.4.4 Daily Living Aids

9.5.4.5 Medical Supplies

9.5.5 Historic and Forecasted Market Size By By End User

9.5.5.1 Hospitals

9.5.5.2 Home Care

9.5.5.3 Nursing Homes

9.5.5.4 Rehabilitation Centers

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Chronic Disease Management

9.5.6.2 Post-Surgical Care

9.5.6.3 Elderly Care

9.5.6.4 Disability Assistance

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Retail Stores

9.5.7.2 Online Stores

9.5.7.3 Direct Sales

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Home Medical Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Monitoring Equipment

9.6.4.2 Therapeutic Equipment

9.6.4.3 Home Mobility Equipment

9.6.4.4 Daily Living Aids

9.6.4.5 Medical Supplies

9.6.5 Historic and Forecasted Market Size By By End User

9.6.5.1 Hospitals

9.6.5.2 Home Care

9.6.5.3 Nursing Homes

9.6.5.4 Rehabilitation Centers

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Chronic Disease Management

9.6.6.2 Post-Surgical Care

9.6.6.3 Elderly Care

9.6.6.4 Disability Assistance

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Retail Stores

9.6.7.2 Online Stores

9.6.7.3 Direct Sales

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Home Medical Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Monitoring Equipment

9.7.4.2 Therapeutic Equipment

9.7.4.3 Home Mobility Equipment

9.7.4.4 Daily Living Aids

9.7.4.5 Medical Supplies

9.7.5 Historic and Forecasted Market Size By By End User

9.7.5.1 Hospitals

9.7.5.2 Home Care

9.7.5.3 Nursing Homes

9.7.5.4 Rehabilitation Centers

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Chronic Disease Management

9.7.6.2 Post-Surgical Care

9.7.6.3 Elderly Care

9.7.6.4 Disability Assistance

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Retail Stores

9.7.7.2 Online Stores

9.7.7.3 Direct Sales

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Home Medical Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 44.69 Billion |

|

Forecast Period 2024-32 CAGR: |

3.5% |

Market Size in 2032: |

USD 60.4 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Home Medical Equipment Market research report is 2024-2032.

Hollister (USA), Hersill (Spain), GE Healthcare (USA), Cardinal Health (USA), Zimmer Biomet (USA), ResMed (Australia), Philips (Netherlands), Otsuka Pharmaceutical (Japan), Baxter International (USA), Invacare (USA), Smith & Nephew (UK), Fresenius Medical Care (Germany), 3M (USA), Drive DeVilbiss Healthcare (USA), Medtronic (Ireland), and other active players.

The Home Medical Equipment Market is segmented into Product Type, End User, Application, Distribution Channel, and region. By Product Type (Monitoring Equipment, Therapeutic Equipment, Home Mobility Equipment, Daily Living Aids, Medical Supplies), By End User (Hospitals, Home Care, Nursing Homes, Rehabilitation Centers), By Application (Chronic Disease Management, Post-Surgical Care, Elderly Care, Disability Assistance), By Distribution Channel (Retail Stores, Online Stores, Direct Sales). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Home medical equipment (HME) refers to the various medical devices and supplies designed for use in a home setting to support the treatment, monitoring, and management of medical conditions. These devices are intended to improve patients' quality of life, facilitate home-based care, and assist with recovery or disease management. Examples include oxygen therapy equipment, mobility aids (like wheelchairs and walkers), patient monitors, home dialysis machines, and ventilators. HME is typically prescribed by healthcare providers and is often used by individuals with chronic conditions, disabilities, or those recovering from surgery or injury, allowing them to receive care in the comfort of their home while reducing the need for hospital visits.

Home Medical Equipment Market Size Was Valued at USD 44.69 Billion in 2023, and is Projected to Reach USD 60.4 Billion by 2032, Growing at a CAGR of 3.5% from 2024-2032.