Hydrogen Infrastructure Market Synopsis:

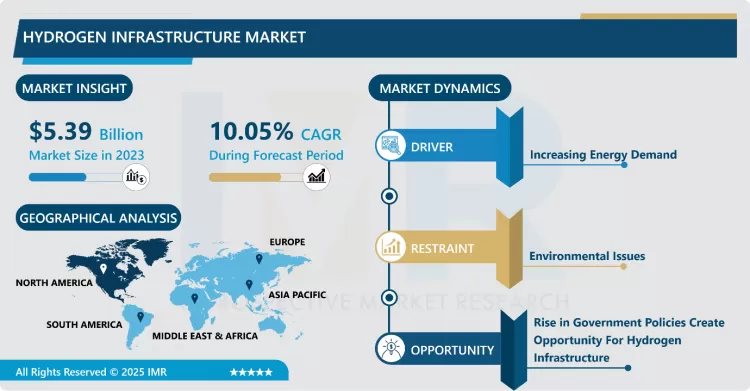

Hydrogen Infrastructure Market Size Was Valued at USD 5.39 Billion in 2023 and is Projected to Reach USD 12.76 Billion by 2032, Growing at a CAGR of 10.05% From 2024-2032.

Hydrogen infrastructure is a network of facilities in the supply and value chain, composed of hydrogen production from feed-stocks, transmission/distribution, fuelling stations, and storage. The stakeholders involved in building the infrastructure are the government, suppliers of feed-stocks, hydrogen producers, pipeline companies and tube trailers, distributors, hydrogen stations, and hydrogen storage companies. Each of these stakeholders is interconnected with each of the others but from a different technical as well as economic perspective.

The energy applications for Hydrogen Infrastructure include Production, Storage, Distribution, and Safety examine methodologies, new models, and innovative strategies for the optimization and optimal control of the hydrogen logistic chain, with a particular focus on a network of integrated facilities, sources of production, storage systems, infrastructures and the delivery process to the end users through hydrogen refueling stations.

According to the IEA, Global hydrogen demand reached more than 97 Mt in 2023 and is forecasted to reach almost 100 Mt in 2024. To meet this huge demand the development of hydrogen infrastructure is essential. Which includes storage solutions, increasing production capacity, enhancing transportation networks, and establishing refueling systems. These infrastructure developments are crucial in establishing a robust supply chain capable of supporting the growing demand across various industries.

Hydrogen Infrastructure Market Growth and Trend Analysis:

Growing Demand for Sustainable Solutions

- Global energy demands are escalating, driven by the confluence of demographic growth, economic development, and urban expansion. Projections indicate that with the global population expected to approach 9.7 billion by 2050, these factors will converge to amplify the imperative for increased energy production. Presently, approximately 80% of the world’s energy consumption is attributed to the use of fossil fuels, including natural gas, coal, and oil. Therefore, Hydrogen is forecasted to play a significant role in decarbonizing the sector by replacing fossil fuel-based hydrogen used in refining processes and offering a cleaner fuel option for transportation and power generation within the industry itself.

- The government is actively encouraging the development of the hydrogen infrastructure market to support the efficient production, storage, distribution, and utilization of hydrogen as a clean energy solution, for instance, in November 2024 The Ministry of New & Renewable Energy (MNRE) implemented an R&D Scheme under the National Green Hydrogen Mission (NGHM) to promote indigenous technology development. The scheme focuses on the efficient and cost-effective deployment of Green Hydrogen and its derivatives across the country, aiming to strengthen research and innovation capacity in India, the encouragement from the government and the advancement in the R&D of hydrogen infrastructure will boost the overall market during the forecast period.

High Costs Hinder Hydrogen Infrastructure Growth as a Clean Energy Source

- The initial cost of constructing a hydrogen infrastructure has been a significant barrier to the market's growth and general acceptance. Although hydrogen has a lot of potential as a clean, flexible energy source, its current cost issues prevent it from being expanded and prevent the development of a hydrogen economy.

- The process of creating hydrogen is expensive in itself. The two most popular processes for producing hydrogen are steam methane reforming (SMR) and electrolysis. SMR, which uses natural gas as a feedstock, is the most common and economical procedure at the moment. However, it continues to use fossil fuels and emits carbon dioxide, which restricts its sustainability.

Energize a Greener Future

- The gas and oil industry are grappling with a climate crisis triggered by carbon emissions. A ray of hope emerges from green hydrogen (GH2). The world is now pivoting towards zero-emission technology for decarbonization, digitalizing energy processes, and decentralizing energy through renewable energy sources. GH2, a distinct type of hydrogen that can be derived from various sources including natural gas, nuclear power, biogas, solar, and wind power, is leading this transition.

- Hydrogen has the potential to help with volatile output from renewables, like solar photovoltaics (PV) and wind, whose availability is not always well matched with demand. Hydrogen is one of the leading options for storing energy from renewables and looks promising to be the lowest-cost solution for storing electricity over weeks or even months.

- In January 2025, COPENHAGEN, Denmark Copenhagen Infrastructure Collaborated (CIP), through its Energy Transition Fund (CI ETF I), and Friesen Elektra Green Energy AG (Friesen Elektra) have initiated project Anker, a green hydrogen production facility in Sande, Germany. The project is scheduled to have an electrolysis capacity of 400 MW with plans to expand the capacity to 800 MW at a later stage.

Hydrogen Infrastructure Market Segment Analysis:

Hydrogen Infrastructure Market is segmented based on production, storage, delivery, and region

By Production, the steam methane reforming segment is expected to dominate the market during the forecast period

- Steam methane reforming is the most common and cost-effective method for hydrogen production, contributing about 50% of the world's hydrogen production. Steam methane reforming, or natural gas steam reforming, is currently the most widely used method of hydrogen production, with nearly half of the world's hydrogen coming from this source.

- The rising application of hydrogen in various industries is likely to be another driving factor for the growth of the steam methane reforming market. Hydrogen is produced using many resources such as natural gas, biomass, coal, and various other renewable and non-renewable energy sources. Natural gas is the main source of hydrogen production, and steam methane reformers using natural gas are utilized primarily for production. However, in recent years, the adoption of more recent technologies, such as electrolysis and pyrolysis production, has been encouraged.

By Storage, the compressed segment held the largest share in 2023

- Hydrogen storage is an important component in the hydrogen value chain to assure the security of supply during periods of lower production. Tank storage sites are expected at different scales at several locations, both onshore and offshore. Hydrogen storage by compression and liquefaction are mature and energy-intensive processes. Compressed hydrogen can be transported by either tube trailers (typically, up to 300 kg at 200 bar) or pipelines.

- Positive displacement (reciprocating piston, diaphragm/hydraulic/ionic, and screw compressors), where a certain volume of gas is captured, compressed by a gradual reduction within a control volume, and discharged at elevated pressure. Dynamic (centrifugal compressors), where kinetic energy (impeller velocity) is added to the incoming gas stream and, subsequently, converted into static energy (pressure).

- For instance, in May 2024, SIAD Macchine Impianti, a SIAD Group company, launched a 550-bar, oil-free, high-pressure hydrogen compressor, specifically designed to meet the needs of the transportation and hydrogen refueling station sectors. , the R&D is advancing the hydrogen infrastructure market.

Hydrogen Infrastructure Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region will play a significant key role as home to more than half of the global population, in developing the future of energy globally and determining the ability of the world to reach net zero emissions. The Asia Pacific region producing around 2,000 hydrogen kilotons as of 2023. In Asia-Pacific Region China is scaling up green hydrogen production significantly.

- Cooperation on the infrastructure that has accounted for the production, transport, and storage of green hydrogen. To support the growth of the green hydrogen market in Asia Pacific, Breakthrough Energy and the Green Hydrogen Organisation (GH2) have established the APAC Green Hydrogen Alliance which is bringing together finance, government, industry, and civil society to expand regional association to enable policy measures and financing incentives; boosting sustainable production, use and trade of green hydrogen; and to activate financing for green hydrogen projects?.

- For instance, in August 2024, The Indonesian Ministry of Energy and Mineral Resources and GH2 signed a Memorandum of Understanding to collaborate on implementing Indonesia’s national hydrogen strategy. The MoU includes four key areas of collaboration: policy and regulations; increasing market opportunities and investment; financing mechanisms and regional collaboration, notably through the Asia Pacific Green Hydrogen Alliance which was initiated by GH2 and Breakthrough Energy earlier this year.

- According to the IEA International Energy Agency, China and India Together accounted for 38% usage of global hydrogen demand in 2023, which influenced the Asia Pacific dominance in hydrogen usage.

- Policy supports and technological advancements have accelerated green hydrogen projects in China. From 10 projects in 2021, the number rose to over 90 in 2022 and more than 100 in 2023. In Q1 2024, an additional 83 projects with planned investments exceeding 82.5 Billion USD were recorded equivalent to about two-thirds of the global industry scale, which is currently around 125 billion US dollars. As a result, this is expected to put the Asia Pacific in a proper position to challenge other regions and be a forerunner in meeting the crude oil demands over the forecast period as the economic and industrial front expands its growth path steadily.

Hydrogen Infrastructure Market Active Players:

- ACWA Power (Saudi Arabia)

- Air Liquide (France)

- Air Products and Chemicals (United States)

- BP (United Kingdom)

- ENGIE (France)

- ENGIE Solutions (France)

- Equinor (Norway)

- Iberdrola (Spain)

- Linde (United Kingdom)

- MAN Energy Solutions (Germany)

- Mitsubishi Power (Japan)

- NEL Hydrogen (Norway)

- Other Active Players

- Plug Power (United States)

- Repsol (Spain)

- Shell (Netherlands)

- Siemens Energy (Germany)

- Thyssenkrupp (Germany)

- TotalEnergies (France)

- Woodside Energy (Australia)

- Other Active Key Players

Key Industry Developments in the Hydrogen Infrastructure Market:

- In December 202, TKIL Industries Pvt. Ltd. is expanding its business portfolio by entering the green hydrogen sector. The company has made a strategic investment in SoHHytec SA, a leading innovator in green hydrogen technology based in Lausanne, Switzerland. SoHHytec uses its advanced artificial photosynthesis technology to produce green hydrogen from renewable energy sources like solar and wind.

- In December 2024, JCB, HYCAP, and HydraB Group joined forces to launched HYKIT, a new joint venture focused on developing a range of hydrogen solutions, including distribution, storage, and refueling systems.

|

Hydrogen Infrastructure Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.05% |

Market Size in 2032: |

USD 12.76 Bn. |

|

Segments Covered: |

By Production |

|

|

|

By Storage |

|

||

|

By Delivery |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hydrogen Infrastructure Market by By Production (2018-2032)

4.1 Hydrogen Infrastructure Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Steam Methane Reforming

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Coal Gasification

4.5 Electrolysis

4.6 Others

Chapter 5: Hydrogen Infrastructure Market by By Storage (2018-2032)

5.1 Hydrogen Infrastructure Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Compression

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquefaction

5.5 Material Based

Chapter 6: Hydrogen Infrastructure Market by By Delivery (2018-2032)

6.1 Hydrogen Infrastructure Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Transportation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Refinery

6.5 Power Generation

6.6 Hydrogen Refueling Stations

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hydrogen Infrastructure Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACWA POWER (SAUDI ARABIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AIR LIQUIDE (FRANCE)

7.4 AIR PRODUCTS AND CHEMICALS (UNITED STATES)

7.5 BP (UNITED KINGDOM)

7.6 ENGIE (FRANCE)

7.7 ENGIE SOLUTIONS (FRANCE)

7.8 EQUINOR (NORWAY)

7.9 IBERDROLA (SPAIN)

7.10 LINDE (UNITED KINGDOM)

7.11 MAN ENERGY SOLUTIONS (GERMANY)

7.12 MITSUBISHI POWER (JAPAN)

7.13 NEL HYDROGEN (NORWAY)

7.14 PLUG POWER (UNITED STATES)

7.15 REPSOL (SPAIN)

7.16 SHELL (NETHERLANDS)

7.17 SIEMENS ENERGY (GERMANY)

7.18 THYSSENKRUPP (GERMANY)

7.19 TOTALENERGIES (FRANCE)

7.20 WOODSIDE ENERGY (AUSTRALIA)

7.21 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Hydrogen Infrastructure Market By Region

8.1 Overview

8.2. North America Hydrogen Infrastructure Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Production

8.2.4.1 Steam Methane Reforming

8.2.4.2 Coal Gasification

8.2.4.3 Electrolysis

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By By Storage

8.2.5.1 Compression

8.2.5.2 Liquefaction

8.2.5.3 Material Based

8.2.6 Historic and Forecasted Market Size By By Delivery

8.2.6.1 Transportation

8.2.6.2 Refinery

8.2.6.3 Power Generation

8.2.6.4 Hydrogen Refueling Stations

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hydrogen Infrastructure Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Production

8.3.4.1 Steam Methane Reforming

8.3.4.2 Coal Gasification

8.3.4.3 Electrolysis

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By By Storage

8.3.5.1 Compression

8.3.5.2 Liquefaction

8.3.5.3 Material Based

8.3.6 Historic and Forecasted Market Size By By Delivery

8.3.6.1 Transportation

8.3.6.2 Refinery

8.3.6.3 Power Generation

8.3.6.4 Hydrogen Refueling Stations

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hydrogen Infrastructure Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Production

8.4.4.1 Steam Methane Reforming

8.4.4.2 Coal Gasification

8.4.4.3 Electrolysis

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By By Storage

8.4.5.1 Compression

8.4.5.2 Liquefaction

8.4.5.3 Material Based

8.4.6 Historic and Forecasted Market Size By By Delivery

8.4.6.1 Transportation

8.4.6.2 Refinery

8.4.6.3 Power Generation

8.4.6.4 Hydrogen Refueling Stations

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hydrogen Infrastructure Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Production

8.5.4.1 Steam Methane Reforming

8.5.4.2 Coal Gasification

8.5.4.3 Electrolysis

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By By Storage

8.5.5.1 Compression

8.5.5.2 Liquefaction

8.5.5.3 Material Based

8.5.6 Historic and Forecasted Market Size By By Delivery

8.5.6.1 Transportation

8.5.6.2 Refinery

8.5.6.3 Power Generation

8.5.6.4 Hydrogen Refueling Stations

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hydrogen Infrastructure Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Production

8.6.4.1 Steam Methane Reforming

8.6.4.2 Coal Gasification

8.6.4.3 Electrolysis

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By By Storage

8.6.5.1 Compression

8.6.5.2 Liquefaction

8.6.5.3 Material Based

8.6.6 Historic and Forecasted Market Size By By Delivery

8.6.6.1 Transportation

8.6.6.2 Refinery

8.6.6.3 Power Generation

8.6.6.4 Hydrogen Refueling Stations

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hydrogen Infrastructure Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Production

8.7.4.1 Steam Methane Reforming

8.7.4.2 Coal Gasification

8.7.4.3 Electrolysis

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By By Storage

8.7.5.1 Compression

8.7.5.2 Liquefaction

8.7.5.3 Material Based

8.7.6 Historic and Forecasted Market Size By By Delivery

8.7.6.1 Transportation

8.7.6.2 Refinery

8.7.6.3 Power Generation

8.7.6.4 Hydrogen Refueling Stations

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Hydrogen Infrastructure Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.05% |

Market Size in 2032: |

USD 12.76 Bn. |

|

Segments Covered: |

By Production |

|

|

|

By Storage |

|

||

|

By Delivery |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

Hydrogen Infrastructure Market Size Was Valued at USD 5.39 Billion in 2023 and is Projected to Reach USD 12.76 Billion by 2032, Growing at a CAGR of 10% From 2024-2032.

ACWA Power (Saudi Arabia), Air Liquide (France), Air Products and Chemicals (United States), BP (United Kingdom), ENGIE (France), ENGIE Solutions (France), Equinor (Norway), Iberdrola (Spain), Linde (United Kingdom), MAN Energy Solutions (Germany), Mitsubishi Power (Japan), NEL Hydrogen (Norway), Plug Power (United States), Repsol (Spain), Shell (Netherlands), Siemens Energy (Germany), Thyssenkrupp (Germany), TotalEnergies (France), Woodside Energy (Australia), and Other Active Players.

The Hydrogen Infrastructure Market is segmented into Production, Storage, Delivery, and Region. By Production, the market is categorized into Steam Methane Reforming, Coal Gasification, Electrolysis, and Others. By Storage the market is categorized into Compression, Liquefaction, and Material Based. by Delivery the market is categorized into Transportation, Refinery, Power Generation, and Hydrogen Refueling Stations. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hydrogen infrastructure is a network of facilities in the supply and value chain, composed of hydrogen production from feed-stocks, transmission/distribution, fuelling stations, and storage.

Hydrogen Infrastructure Market Size Was Valued at USD 5.39 Billion in 2023 and is Projected to Reach USD 12.76 Billion by 2032, Growing at a CAGR of 10.05% From 2024-2032.