Industrial Radiography Market Synopsis:

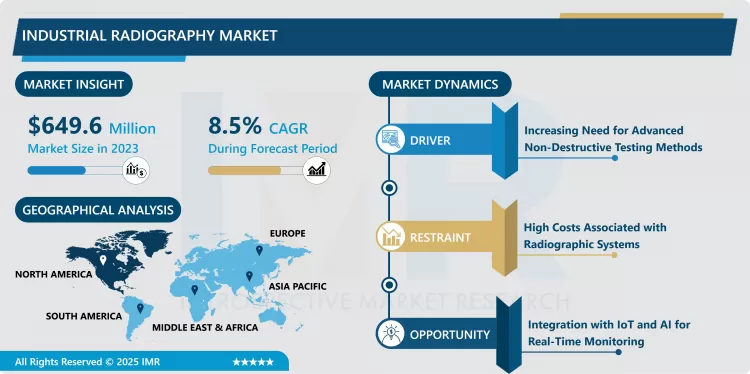

Industrial Radiography Market Size Was Valued at USD 649.6 Million in 2023, and is Projected to Reach USD 1,353.67 Million by 2032, Growing at a CAGR of 8.5 % From 2024-2032.

This report categorizes the Industrial Radiography market based on equipment, technology, services, and applications used by industrial QA/QC and Non-Destructive Testing (NDT) industries involved in aerospace, automotive, energy, construction, and manufacturing fields. Industrial radiography employed techniques of radiographic inspection implemented X- and ?-rays for diagnosing the inside of material, details, and compound structures without dangerous impact on the inspected object, ensuring its quality, further use, and compliance with the requirements of some industries.

At the same time, the global Industrial Radiography Market is growing rather actively as it responds to the need for using more effective non-destructive testing methods in the most critical industries – aerospace and energy. From these findings it can be seen that: As the market needs quality and accurate inspection services, there has been enhancement in the radiographic equipment through the use of digital radiography systems that are fast and produce clear images. Since its establishment, governments, and regulatory agencies worldwide have been directed towards establishing high-quality quality standards and safety specific to industrial radiography systems that foster demand.

Today companies are employing industrial radiography to ascertain the reliability of such parts as well as their inability to fail during operation, particularly in cases where such failure can lead to disastrous consequences. As the developing world economies industrialize their economies and global infrastructure development and upgrade is on the rise, there is a growing demand for smart efficient inspection technologies. Industrial radiography has also had its field of application extended with the appearance of IoT and AI in systems where constant monitoring and probable failure forecasts are feasible.

Industrial Radiography Market Trend Analysis:

Adoption of Digital Radiography Systems on the Rise

- One of the key factors presently stimulating the Industrial Radiography Market is the transition process from Traditional Films Industrial Systems to Digital Industrial Radiography Systems. Digital radiography has several benefits: Higher quality is achieved due to objectification and the time taken for processing is reduced, images can be saved in a digital form and conveyance can also take place as well. These systems have been characteristic of low rates of interruption on production cycles in numerous industries, for example, aerospace industries, automobile industries as well as the oil and gas industries. As a result, when portable digital radiography devices have been developed, they are even applicable more in field testing requiring flexibility in the testing processes.

Growing Applications in Emerging Markets

- Industries in Asia-Pacific, Latin America, and Middle Eastern countries hold a good potential for development in the Industrial Radiography Market. The region's industrialization rate has also increased at a faster rate and there is also a growing interest evident in the infrastructure development in these areas, there is equally high demand for advanced inspection and test solutions. The oil & gas, automotive, and construction industries in these regions are moving towards bettering operation safety and productivity, which is positive for industrial radiography solutions. New manufacturing centers and the expansion of the existing manufacturing centers also push the requirement for radiographic inspections.

Industrial Radiography Market Segment Analysis:

The Industrial Radiography Market is Segmented on the basis of component, technology, End-user, and region.

By Component, Hardware segment is expected to dominate the market during the forecast period

- Of the two segments, the Hardware and Software segments, the former holds a higher market share throughout the forecast period of the Industrial Radiography Market. The inclusion of such products as X-ray machines, gamma-ray sources, or detectors when conducting radiographic inspections constitutes this segment. Since the minimum image quality is defined according to the need to connect with the client, high equipment requirements have also evolved in the modern process of radiographic designing. Applications are investing in reliable and mobile equipment to improve reviews and reduce costs hence why the hardware segment of the business will have the biggest market.

By Technology, the Digital radiography segment expected to held the largest share

- The digital radiography segment is anticipated to represent the highest market share due to a wide range of advantages offered over use of film-based systems. X-ray digital radiography provide images nearly immediately, the images are high resolution and easy to store and transfer making this process indispensable to present-day nondestructive testing. Today’s new digital radiography systems have been backed up with artificial intelligence and machine learning making their diagnosis even more accurate needed for sectors like aerospace, automotive, and health care. The purchase of DR systems has been rising yearly, and this is owing to the fact; that industries never cease to develop quality and effectiveness.

Industrial Radiography Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the most potential in the Industrial Radiography Market as they have stable growth in industrial market and ensure safety and Quality. The largest portion is the United States; the aerospace, defense, and automotive industries characteristic for the USA utilize radiographic technologies in production tests or protection measures. Digital radiography systems are used most intensively in this area, primarily because more than half of the companies have well-equipped production shops and invested significantly in research work.

- Canada is also one of the customers in this regard for instance in the energy and construction industry; integrity of vital structures calls for radiographic inspection. ,The high level of regulation in North America coupled with increasing trend of acceptance of non-intrusive examination across the region has also contributed towards the consolidation of leadership of the region in the market. For any time businesses in the area develop and begin incorporating smart solutions into their industrial processes, it will necessitate the development of novel and improved industrial radiography applications.

Active Key Players in the Industrial Radiography Market

- 3DX-Ray Ltd (United Kingdom)

- Anritsu Corporation (Japan)

- Baker Hughes Company (United States)

- Canon Inc. (Japan)

- COMET Group (Switzerland)

- FUJIFILM Corporation (Japan)

- General Electric (United States)

- Hamamatsu Photonics K.K. (Japan)

- Hitachi Ltd. (Japan)

- Mettler-Toledo International Inc. (United States)

- Nikon Corporation (Japan)

- Shimadzu Corporation (Japan)

- Smiths Group PLC (United Kingdom)

- Teledyne Technologies Incorporated (United States)

- Thermo Fisher Scientific Inc. (United States)

- Other Active Players

Key Industry Developments in Industrial Radiography Market

- In October 2024, The Board of Radiation and Isotope Technology (BRIT), under the Department of Atomic Energy (DAE), unveiled India’s first indigenously developed Industrial Radiography Device, ROTEX-I. Designed to hold 2.40 TBq (65 Ci) of Iridium-192, ROTEX-I is poised to revolutionize non-destructive testing (NDT) in industries such as chemical, energy, defense, nuclear, and aerospace. The launch event at BRIT’s Navi Mumbai headquarters was graced by Dr. Ajit Kumar Mohanty, Atomic Energy Commission Chairman, and DAE scientists and industry leaders.

|

Industrial Radiography Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 649.6 Million |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 1,353.67 Million |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Radiography Market by By Component (2018-2032)

4.1 Industrial Radiography Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

Chapter 5: Industrial Radiography Market by By Technology (2018-2032)

5.1 Industrial Radiography Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Film Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Digital

Chapter 6: Industrial Radiography Market by By End User (2018-2032)

6.1 Industrial Radiography Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Oil & Gas

6.5 Consumer Electronics

6.6 Aerospace & defence

6.7 Manufacturing

6.8 Power Generation

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industrial Radiography Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTRAZENECA (UK)

7.4 BAYER AG (GERMANY)

7.5 BRISTOL-MYERS SQUIBB (USA)

7.6 CHUGAI PHARMACEUTICAL CO. LTD. (JAPAN)

7.7 DAIICHI SANKYO COMPANY (JAPAN)

7.8 DR. REDDY'S LABORATORIES (INDIA)

7.9 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

7.10 GLAXOSMITHKLINE PLC (UK)

7.11 JOHNSON & JOHNSON (USA)

7.12 MERCK & CO. INC. (USA)

7.13 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

7.14 PFIZER INC. (USA)

7.15 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

7.16 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Industrial Radiography Market By Region

8.1 Overview

8.2. North America Industrial Radiography Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 Film Based

8.2.5.2 Digital

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Automotive

8.2.6.2 Oil & Gas

8.2.6.3 Consumer Electronics

8.2.6.4 Aerospace & defence

8.2.6.5 Manufacturing

8.2.6.6 Power Generation

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industrial Radiography Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 Film Based

8.3.5.2 Digital

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Automotive

8.3.6.2 Oil & Gas

8.3.6.3 Consumer Electronics

8.3.6.4 Aerospace & defence

8.3.6.5 Manufacturing

8.3.6.6 Power Generation

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industrial Radiography Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 Film Based

8.4.5.2 Digital

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Automotive

8.4.6.2 Oil & Gas

8.4.6.3 Consumer Electronics

8.4.6.4 Aerospace & defence

8.4.6.5 Manufacturing

8.4.6.6 Power Generation

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industrial Radiography Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 Film Based

8.5.5.2 Digital

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Automotive

8.5.6.2 Oil & Gas

8.5.6.3 Consumer Electronics

8.5.6.4 Aerospace & defence

8.5.6.5 Manufacturing

8.5.6.6 Power Generation

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industrial Radiography Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 Film Based

8.6.5.2 Digital

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Automotive

8.6.6.2 Oil & Gas

8.6.6.3 Consumer Electronics

8.6.6.4 Aerospace & defence

8.6.6.5 Manufacturing

8.6.6.6 Power Generation

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industrial Radiography Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 Film Based

8.7.5.2 Digital

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Automotive

8.7.6.2 Oil & Gas

8.7.6.3 Consumer Electronics

8.7.6.4 Aerospace & defence

8.7.6.5 Manufacturing

8.7.6.6 Power Generation

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Industrial Radiography Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 649.6 Million |

|

Forecast Period 2024-32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 1,353.67 Million |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Industrial Radiography Market research report is 2024-2032.

3DX-Ray Ltd (United Kingdom), Anritsu Corporation (Japan), Baker Hughes Company (United States), Canon Inc. (Japan), COMET Group (Switzerland), FUJIFILM Corporation (Japan), General Electric (United States), Hamamatsu Photonics K.K. (Japan), Hitachi Ltd. (Japan), Mettler-Toledo International Inc. (United States), Nikon Corporation (Japan), Shimadzu Corporation (Japan), Smiths Group PLC (United Kingdom), Teledyne Technologies Incorporated (United States), Thermo Fisher Scientific Inc. (United States), Other Active Players.

The Industrial Radiography Market is segmented into Component, Technology, End User, and region. By Component, the market is categorized into Hardware and software. By Technology, the market is categorized into film-based based, Digital. By End User, the market is categorized into Automotive, Oil & Gas, Consumer Electronics, Aerospace & Defense, Manufacturing, Power Generation, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

This report categorizes the Industrial Radiography market based on equipment, technology, services, and applications used by industrial QA/QC and Non-Destructive Testing (NDT) industries involved in aerospace, automotive, energy, construction, and manufacturing fields. Industrial radiography employed techniques of radiographic inspection implemented X- and ?-rays for diagnosing the inside of material, details, and compound structures without dangerous impact on the inspected object, ensuring its quality, further use, and compliance with the requirements of some industries.

Industrial Radiography Market Size Was Valued at USD 649.6 Million in 2023, and is Projected to Reach USD 1,353.67 Million by 2032, Growing at a CAGR of 8.5 % From 2024-2032.